Summary:

- Mastercard has consistently produced positive annual earnings growth throughout its history.

- Since its IPO in 2007, MA stock has risen by over 11,600%.

- The company’s Q4 results showed strong growth, with revenue up 13% and diluted EPS up 20% on an adjusted basis.

jbk_photography

When it comes to compounding earnings, dividends, and ultimately, shareholder wealth, it doesn’t get much better than Mastercard Incorporated (NYSE:MA).

The stock posted earnings this morning, pushing shares to a new all-time high.

This compounder has produced positive annual earnings growth during 16 out of its 17 years as a public company.

What’s even more amazing is that Mastercard produced double-digit growth in each of those 16 positive growth years.

The only year that Mastercard failed to grow its earnings was 2020 when the world shut down during the COVID-19 pandemic.

If it wasn’t for that once-in-a-century biological event, then it’s reasonable to assume that MA would have maintained its perfect double-digit annual growth streak.

And this reliable double-digit growth is exactly why MA has outperformed over the long term.

Since its 2007 IPO, MA shares are up by more than 11,600%.

During the last 5 and 10-year periods, MA’s share price has risen by 118% and 483%, respectively. Both of those results beat the S&P 500’s price returns of 81% and 174%.

Since it began trading, MA’s annual dividend has increased from $0.05/share to $2.64/share. That represents a 26.3% dividend growth CAGR over the last 17 years.

MA went public at $39.00/share. In 2014, MA underwent a 10-1 split. Therefore, looking at a split-adjusted IPO price, someone who was fortunate enough to buy it on its opening day of trading and disciplined enough to hold until today would be looking at a yield on cost of nearly 70%.

All of these figures point to why Mastercard is a perfect example of the powerful compounding potential that blue chip dividend growers can produce over the long term.

Honestly, the only problem when it comes to Mastercard shares is finding time to buy shares at a discount.

Because of the immense quality of this company, it trades at a steep premium to the market.

With that in mind, I wanted to take a closer look at MA’s Q4 results before updating my fair value estimate on the stock to see whether or not Mastercard is a reasonable buy or not with shares hitting new 52-week (and all-time record) highs.

Mastercard Q4/Full Year Results

Mastercard reported Q4 results before the bell today and its strong growth trajectory remains intact.

Mastercard’s revenue rose by 13% on an adjusted basis during Q4 to $6.5 billion.

This beat analyst estimates for the quarter by $20m.

During Q4, MA’s diluted EPS rose by 20% on an adjusted basis to $3.18.

This beat analyst estimates by $0.10/share.

These two results pushed the company’s full-year top and bottom-line growth figures up to 13% and 15%, respectively.

I love Mastercard’s business model so much because it essentially operates as a part of a duopoly – alongside rival Visa Inc. (V) – as a global tollbooth for the digital payments industry.

Oftentimes, investors think of Mastercard as a credit card; however, this company doesn’t make money by loaning money to clients and charging interest. Instead, it makes money by charging small fees every time that someone makes a transaction on its global payments network.

Every time that a Mastercard is swiped (or used digitally) there is a credit card processing fee involved.

MA’s partners (usually big banks or other financial institutions that actually issue the credit cards and provide the credit) collect the largest portion of these fees via interchange fees, however, they’re also taking on the largest risk with regard to consumer credit.

Mastercard’s portion of the take is called an assessment fee and MA’s 2023 assessment fee was, “0.13% for transactions under $1,000; 0.14% for transactions over $1,000”.

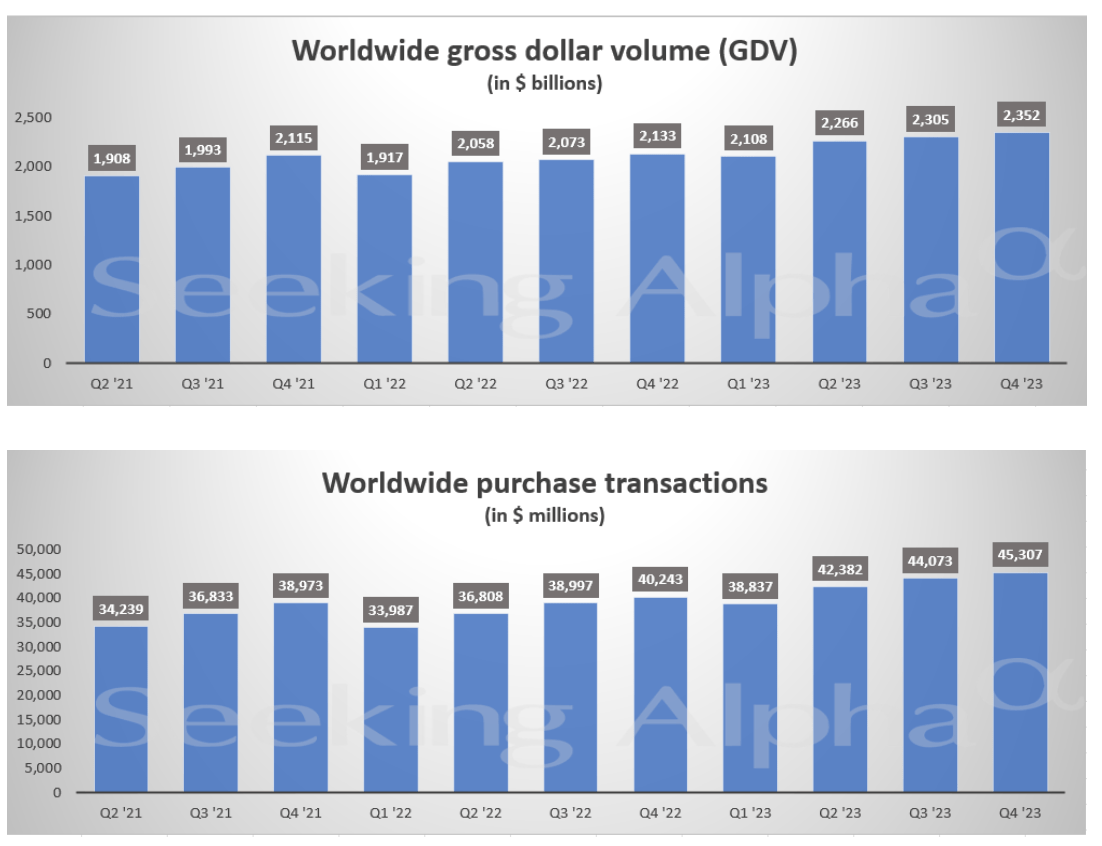

That might not sound like much, but it adds up when we’re talking about $2.3 trillion worth of transactions in a quarter.

Seeking Alpha

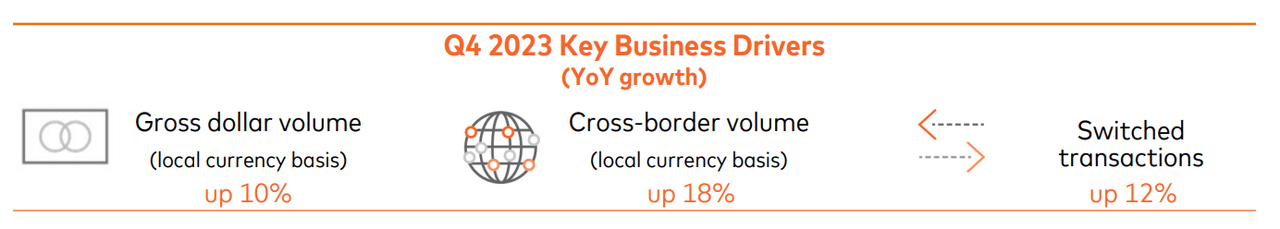

As you can see here, gross dollar volumes rose by 10% on its network during Q4.

MA Q4 Report

Cross-border volumes (which typically generate higher fees/margins for the company) were up by 18%.

During Q4, MA’s operating expenses rose by 21%. However, management noted that excluding one-time items, MA’s expenses grew by ~10%. And that’s great news because this company’s profits are so high because, over the years, MA has made a habit of growing revenues at a rate that exceeds its capex.

During Q4, MA’s operating margin came in at 58%.

That was down slightly from its 58.8% figure a year ago; however, you’re not going to hear me complain about a company posting double-digit sales growth while generating 58% margins.

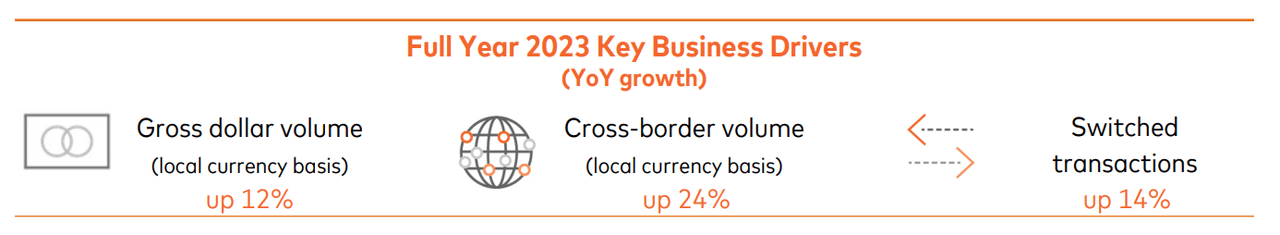

For the full year, MA’s top line continued to grow at a pace that exceeded operating expenses. Its revenues rose by 13% and its operating expenses rose by 11%.

As you can see below, for the full year, the gross dollar volume flowing through MA’s global payment network grew by 12% and cross-border volumes continued to recover from their COVID-related disruption.

MA Q4 Report

In short, all of MA’s operating metrics are rising (which shouldn’t be a surprise to investors who are aware of this company’s long-term trajectories).

And all of this positive top/bottom line has allowed management to generously return cash to shareholders.

During its Q4 report, MA noted that it returned $11.2 billion to shareholders during the full year in 2023 ($9.0b in buybacks and $2.2b in dividends).

Furthermore, in December 2023 MA raised its dividend by 15.8%.

Its Board of Directors also approved a new $11b buyback program.

Looking ahead, analysts expect to see MA’s double-digit growth continue.

Right now, the consensus EPS growth estimate for Mastercard in both 2024 and 2025 is 18%.

With this in mind, I still find MA’s relatively low 0.59% dividend yield very attractive.

If MA continues to compound its dividend at a 15% annual clip, then it will double every 4.8 years.

These attractive fundamental growth prospects point towards ongoing double-digit dividend growth in 2024 as well (in my humble opinion).

I expect to see MA raise its dividend by another 15%+ in 2024, making this an easy stock for me to hold.

Actually, I believe that MA has what it takes to compound its dividend at a double-digit rate for the next 5-10 years (at least) and therefore, these low-yielding shares have what it takes to play a significant role in my passive income stream far into the future.

MA Stock Valuation

But, the question remains, is now a good time to buy more MA?

I’ve owned shares of this company for years, and it’s one that I’d be happy to accumulate more of as a core holding in the high-dividend growth segment of my portfolio.

But, when putting new savings to work, I don’t want to overpay for stocks (no matter how high their quality scores are).

Right now, MA shares are trading with a 31.5x forward-earnings multiple (using the current 2024 analyst consensus EPS estimate of $14.32/share).

I’m a bit more bullish on MA’s 2024 prospects and expect to see full-year earnings come in above consensus at ~$14.50/share.

After all, MA has beaten Wall Street’s bottom-line consensus during 19 out of the last 20 quarters.

But, my estimate only reduced the forward P/E ratio down to 31.1x.

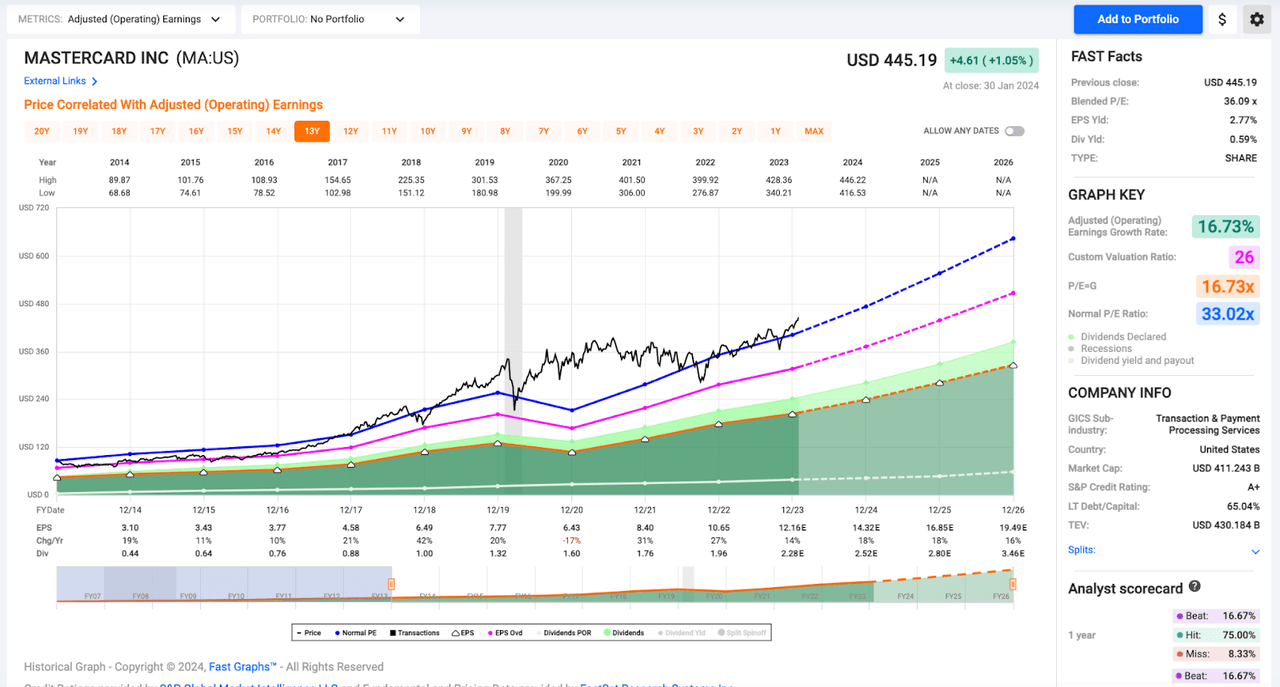

That represents a premium to MA’s long-term average P/E of 29x; however, it’s a discount relative to MA’s 10-year average P/E of 33x.

MA’s forward-looking growth rates in the 18% area are above the company’s 10-year EPS growth CAGR of 16.7%, so to me, there’s an argument to be made that MA should trade at a premium to that 33x multiple as opposed to a discount.

However, even though MA’s historical growth has been incredibly reliable, there are no guarantees when talking about the future and therefore, I always discount forward estimates to account for speculative risks that are inherently involved with making projections.

To me, a 30-31x multiple is a fine price to pay for a company of Mastercard’s caliber with nearly 20% annual EPS growth expectations attached.

That represents a fair value range of $435.00-$449.50.

Therefore, with shares currently trading for $449.42, they’re still below the upper end of my new fair value range.

At these levels, I don’t believe that MA offers much in the way of a margin of safety, but I’d still be willing to buy shares.

Looking at the chart below you’ll see the blue line (representing MA’s 10-year average P/E of 33x) and a custom pink line that I added (representing the 26x level, which has served as strong support for shares throughout the last decade).

FAST Graphs

MA shares have largely hugged that 33x level since mid-2021 and if that trend continues throughout 2023, consensus estimates are pointing towards a $475 share price by the end of this year (implying an upside potential of 6% or so with dividends factored in).

For shares to dip down to that pink support line, they’d have to fall 17% or so to the $375 area.

I’m not going to hold my breath while I wait for that sort of sell-off to occur; however, that’s the point where I’d feel comfortable “backing up the truck” as they say because I believe the risk/reward proposition would point towards ~20% upside potential.

Conclusion

At all-time highs I don’t believe that MA offers outsized short-term total return prospects; however, I’d be happy to buy shares here because of MA’s ongoing long-term growth potential.

Although I only see mid-single digit upside potential over the next 12 months or so from today’s price point, looking out over the next 3-5 years, ongoing fundamental growth points towards a double-digit total return CAGR.

That will likely beat the market over that period of time and therefore, despite its recent rally (MA is up 5% during 2024 thus far), this stock is still on my current watch list and would become a high conviction add for me during any near-term dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CME, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, ECL, ELV, ENB, ESS, FRT, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, MA, MAIN, MCD, MCO, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.