Summary:

- After turning bullish on the stock earlier this year, Mastercard is now among the best performers within its peer group.

- MA stock is now fairly priced and industry tailwinds are likely to subside which will put pressure on future returns.

- Investors should also keep a close eye on the company’s overall debt level and its implications for the ongoing capital allocation policy.

Thomas Cooper

Mastercard Incorporated (NYSE:MA) is so far one of the best-performing companies in the electronic payments space after I turned bullish on the stock earlier in January.

As the company follows on its strategy and continues to capitalize on recent industry tailwinds, it is in a good position to remain as one of the best-performing stocks in the peer group, but future expected returns are likely to come down.

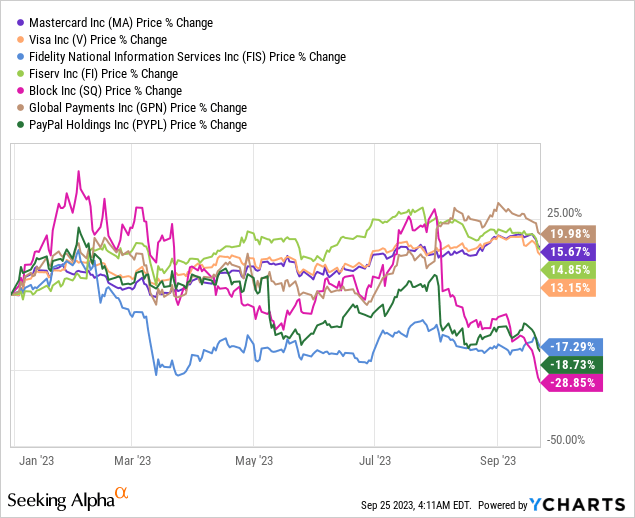

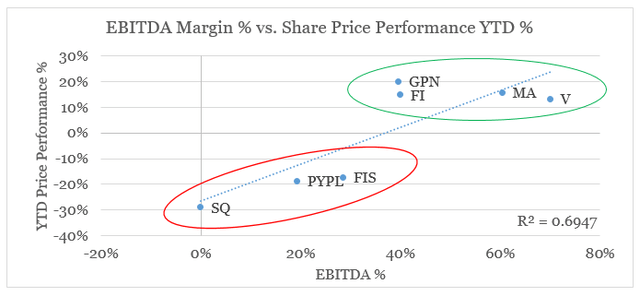

As we look at the graph above, there are two distinct groups of stocks of winners and losers. A closer look at the two groups reveals some important characteristics of what market participants are currently looking for.

In addition to MA, Visa (NYSE:V) and Fiserv (NYSE:FI) – two companies that I have covered extensively here on Seeking Alpha (see here and here), are also among the winners on year-to-date basis.

When it comes to the losers, I recently turned bullish on PayPal (NASDAQ:PYPL) and Fidelity National Information Services (NYSE:FIS), but the troubled business model of Block (NYSE:SQ) is unlikely to deliver meaningful results for shareholders.

The Characteristics Of A Winner

After this brief overview, it is worth mentioning that as monetary conditions continue to normalize profitability becomes one of the most important drivers of share price returns and in that regard Mastercard is among the absolute leaders.

prepared by the author, using data from Seeking Alpha

Capital allocation is another key area to focus on as the pivot in monetary conditions brings recent large M&A deals under scrutiny.

This is yet another area where Mastercard shines as the company’s recent acquisitions have been highly complementary to its core business model. For the 2020-22 period, MA focused on mid-sized deals in the fields of payments services, digital identity, banking with the acquisitions of Dynamic Yield ,the Corporate Services business of Nets Denmark, Ekata and Finicity.

In 2022, 2021 and 2020, the Company acquired several businesses for total consideration of $0.3 billion, $4.7 billion and $1.1 billion, respectively, representing both cash and contingent consideration.

Source: Mastercard 2022 10-K SEC Filing

This helped the company solidify its existing competitive advantages of its network, instead of expanding into adjacent service offerings the same way as FIS and Block did.

Record Business Performance

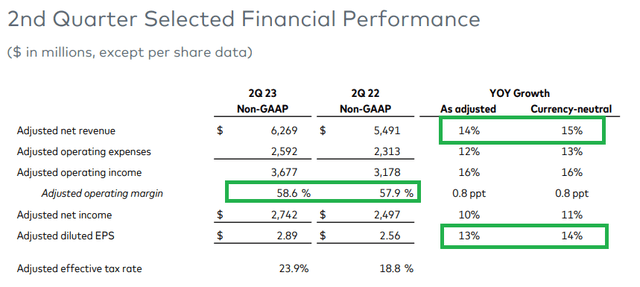

So far in 2023, Mastercard continues to ride the wave of recent industry tailwinds. During the most recent quarter, net revenue and earnings per share continued growing in the teens, while operating profitability reached one of its highest levels since Mastercard’s IPO In 2006.

Mastercard Investor Presentation

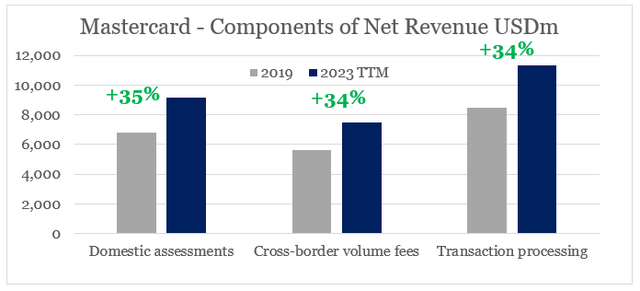

Different areas of the business remained strong with revenues in all segments up significantly since 2019 (pre-pandemic) even after we account for the double digit inflation in recent years.

prepared by the author, using data from SEC Filings

Mastercard also continues with notable overseas client wins with UniCredit in Italy, Deutsche Bank’s credit and debit cards in Germany and some important developments in the United Kingdom:

These wins build on our prior success in the U.K., where there are now 16 million NatWest Debit Mastercards live in market. When combined with the Santander and First Direct migrations, approximately 27 million debit cards have now shifted to Mastercard across these 3 portfolios in the U.K.

Source: Mastercard Q2 2023 Earnings Transcript

Don’t Expect Too Much

As exciting as everything said so far sounds, investors should not forget that all good news are already priced-in the stock.

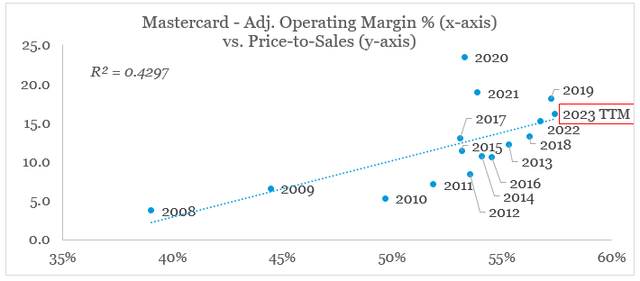

On the graph below, we could see Mastercard’s adjusted operating margin plotted on the x-axis against the company’s price-to-sales multiple on the y-axis. Based on that, it is fair to say that the current sales multiple of 16 times already reflects the recent margin improvements.

prepared by the author, using data from SEC Filings and Seeking Alpha

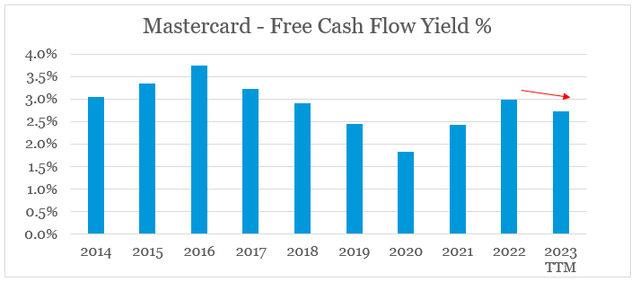

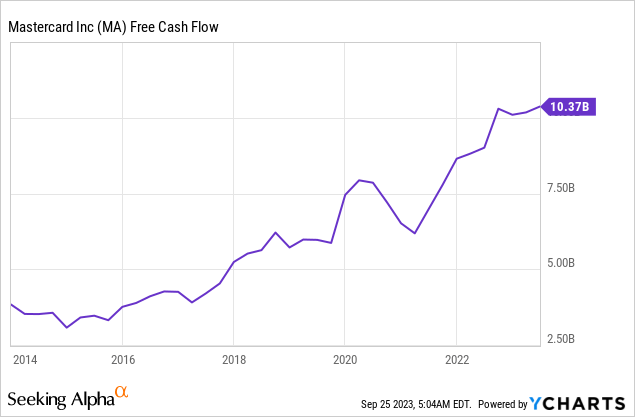

At present, MA’s free cash flow yield stands at 2.7%, which is below the historical average and is hardly an attractive entry level for buying the stock.

prepared by the author, using data from SEC Filings and Seeking Alpha

With high margins already being priced in and free cash flow yield being well-below the current Treasury Yields, Mastercard is also facing the probability of industry tailwinds turning into headwinds over the coming year.

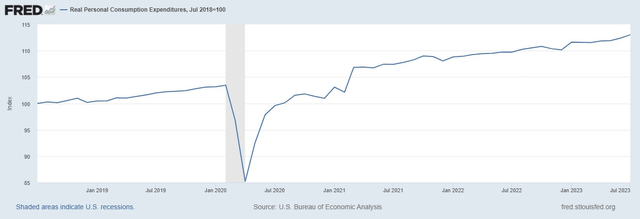

Most importantly, the risk of a recession has not gone away with the Conference Board Leading Economic Index (LEI) making new lows on a year-on-year basis. Even if we are still in for a soft landing, this could derail current strength in consumer spending which is of crucial importance for Mastercard’s growth and record-high margins.

Where Is Capital Being Allocated?

Lastly, investors should be laser focused on Mastercard’s capital allocation process which so far has delivered outstanding results.

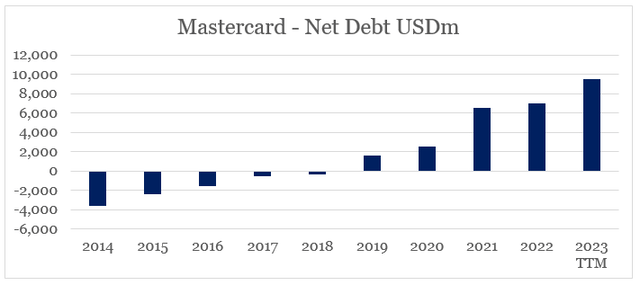

Having said that, however, the company was off for a good start with negative net debt figure in fiscal year 2014, but this has slowly changed to the current situation of having net debt at nearly $10bn.

prepared by the author, using SEC Filings

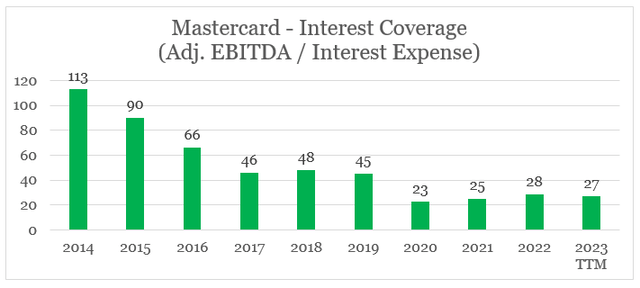

Although this is not a problem on itself, it represents a major shift in recent years. It also greatly diminishes the company’s ability to expand through higher leverage as interest coverage declined.

prepared by the author, using SEC Filings

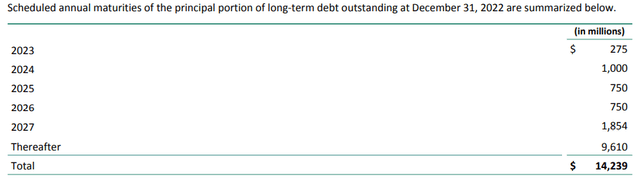

Of course, an interest coverage ratio of nearly 30 times is hardly a problem, but we should not forget that this comes at times of record high margins. Moreover, the interest expense for the past 12-month period sits at around $520m, which makes the amounts of long-term debt due in 2024 onward (see below) significant and they will also be renegotiated at much higher rates.

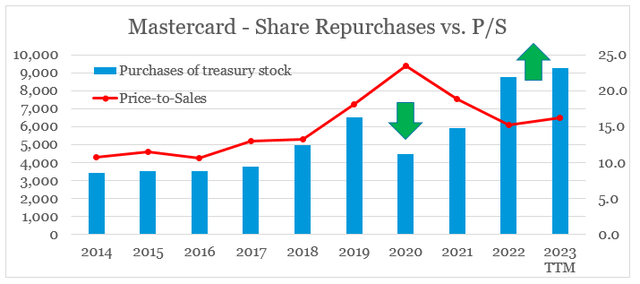

Apart from the recent acquisitions, the majority of this debt load has been used to reward shareholders. To put things into perspective, for the past 12-month period, the amount of share buybacks stands at around $9.3bn, which is significant when compared to the company’s current free cash flow.

To give Mastercard’s management credit, there has been some timing involved with these buybacks. For example, during the 2020-21 period, when the price-to-sales multiple was significantly elevated, MA’s management has reduced the amount for share repurchases. Consequently, in 2022-23 we are now observing the reverse happening which is good news for shareholders.

prepared by the author, using data from SEC Filings and Seeking Alpha

Having said that, the current capital allocation process needs to change as interest rates remain higher for longer and macroeconomic tailwinds are under threat. Moreover, the increased debt level of Mastercard is now threatening to significantly reduce the company’s ability to repurchase shares which will be very painful in event of a major market downturn.

Conclusion

In spite of certain red flags, Mastercard remains as one of the best-positioned stocks in the sector to outperform its peers. Nevertheless, it is important for MA shareholders to keep a close eye on the company’s capital allocation process and to take into account the risk of an economic slowdown.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

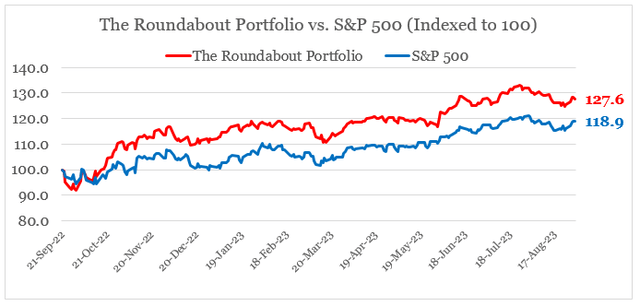

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.