Summary:

- Mastercard’s recent financial performance and double-digit revenue growth in a challenging environment indicate a bullish outlook.

- MA is well-positioned for growth due to favorable secular tailwinds, which I believe will outweigh near-term challenges.

- Upgrading the stock rating from “Hold” to “Buy” as Mastercard demonstrates resilience and strong profitability metrics.

Wirestock/iStock Editorial via Getty Images

Investment thesis

My last analysis about Mastercard (NYSE:MA), which I shared in early March, was neutral. Since then, MA stock price has increased by slightly above 6%, suitable for three months. Though the stock underperformed the broad market, so I believe that the neutral rating was fair.

Seeking Alpha

Today I would like to update my analysis based on recent developments and recalculated valuation to explain why I upgrade the rating for the stock from “Hold” to “Buy”.

Recent developments

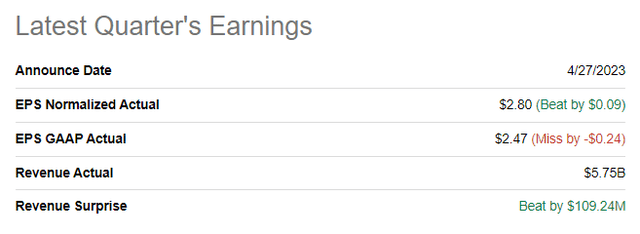

The company released its latest quarterly earnings on April 27, delivering a beat in revenue and adjusted EPS.

The topline demonstrated 11.24% YoY growth, with a 15% increase in currency-neutral revenue, indicating solid resilience in the challenging environment. Mastercard’s business is seasonal, with the holiday quarter being far more robust than others, so sequential comparisons do not make sense. Gross dollar volume increased 15% YoY to $2.11 trillion with spending volume continuing to improve in nearly all categories, which is also impressive given the harsh environment.

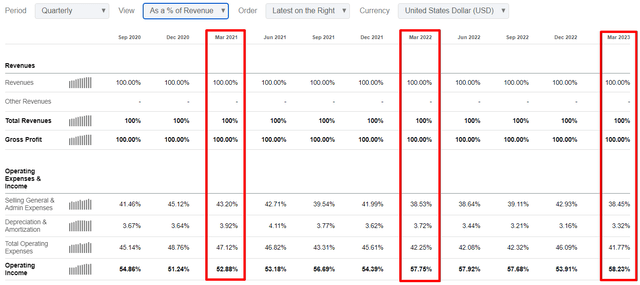

Another sign of resilience is that the company expanded its operating margin by almost 50 basis points, essential in the current inflationary environment. Though most of the improvement came from the optimized amortization line, the SG&A to revenue ratio also moderated slightly. Compared to Q1 FY 2021, all metrics improved substantially, indicating that management has been navigating the challenging environment exceptionally.

Mastercard delivered improved financial performance due to tailwinds that outweighed challenges. The higher spending included a further rebound in cross-border transactions as international travel restrictions continued to ease. Stephen Biggar from Argus Research expects spending volume to continue to improve in nearly all categories, however, at a slower pace than in 2022 as higher interest rates take their toll on the global economy.

But MA does not focus only on its traditional business. The company is expanding its presence in the crypto industry in order not to miss technological disruptions to the digital payments industry. According to recent news, the company plans to expand its crypto card program with more partners. This is a positive sign for potential investors since the company strives to keep up with the changing technological environment. It is a sign of the management’s long-term mindset, which is good for me as a long-term investor.

The company’s balance sheet is in good shape with sound liquidity ratios. The leverage is high but the company’s stellar profitability allows it to service its debt with very strong interest coverage metrics. Moreover, the company historically has been implementing capital allocation with relatively substantial leverage. But this capital allocation proved to be effective given the massive shareholders’ value growth delivered by the company over the last decade.

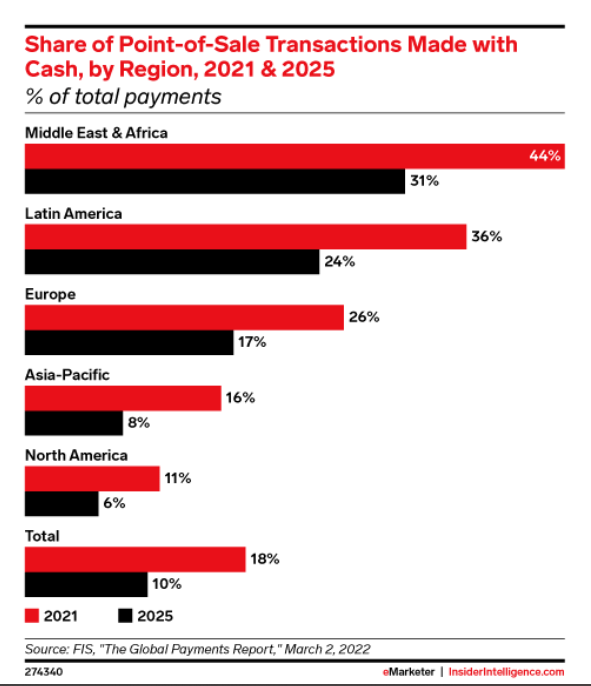

Mastercard’s secular success story will be long due to a favorable secular shift from cash to credit cards. According to eMarketer, there is still plenty of room to shift transactions from cash to cashless.

eMarketer

The secular shift to e-commerce and the security and convenience of cards will fuel long-term growth for Mastercard.

Valuation update

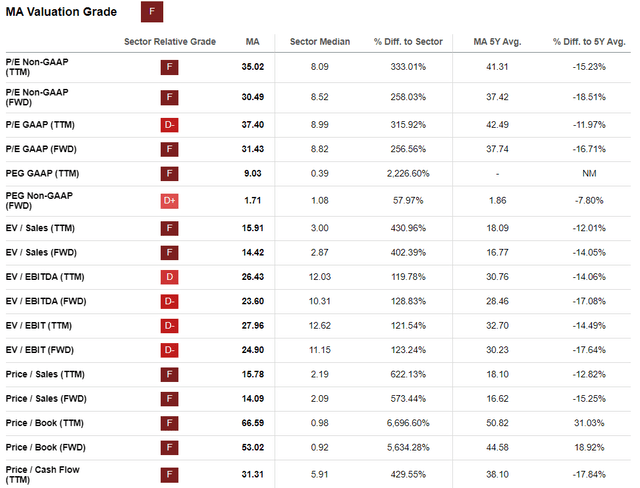

The last time I used multiples analysis for valuation, I concluded that the stock had a double-digit upside potential. Let me look at updated multiples and compare them to historical 5-year averages.

As you can see from the above table by Seeking Alpha Quant, the stock trades at multiples significantly below 5-year averages almost across the whole board. For me, it is a clear sign of undervaluation. Let me emphasize and explain why I do not look at the overall poor “F” valuation grade. If you compare Mastercard’s multiples and sector median, you can see that MA stock might look significantly overvalued, given multiple-fold differences in valuation ratios. But Mastercard, together with Visa (V), is an undisputable leader in the industry with immense profitability. Therefore, a substantial premium to Mastercard’s stock price is fair, so I ignore multiples compared to the sector median.

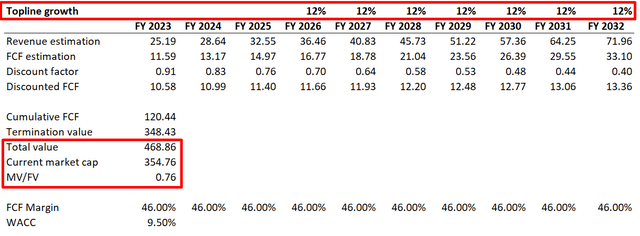

To cross-check multiples analysis, I would also like to simulate discounted cash flow [DCF] model. I use 9.5% for the discount rate, at about the midpoint of the range provided by valueinvesting.io. I have revenue consensus estimates up to FY 2025, and for the years beyond, I expect revenue to sustain a 12% CAGR. Mastercard’s excellent profitability gives me a high conviction that the company will be able to maintain a 46% FCF ex-SBC margin over the next decade.

As you can see from the above calculations, the upside potential looks very attractive, given the fair business value of about $470 billion. It is substantially higher than the current $355 billion market cap.

Overall, I believe that Mastercard stock is very attractively valued, especially given the low level of uncertainty regarding the reliability of the underlying assumptions.

Risks update

I shared my first article about Mastercard stock on March 1. So, it was a couple of weeks before the Silicon Valley Bank failure. Since then several other regional banks have also halted their operations. The credit crunch risk is elevated given all this news. On the other hand, clients did not lose their money thanks to bailouts, and the panic in the stock market only affected the banking industry, especially regional banks. But the credit environment might tighten more which will highly likely adversely affect overall spending. As I mentioned earlier, the company benefits from long-term secular tailwinds, but I have to emphasize that Mastercard’s financials are closely tied to short-term trends in consumer spending.

Geopolitical tensions which we see nowadays, also pose additional risks to Mastercard’s performance. The company generates a significant portion of revenue from cross-border transactions, which means the company is sensitive to changes in regulations and volatility in foreign exchange rates. Dominating the global credit cards market together with Visa also means elevated antitrust risks together with potential penalties for these two giants.

Bottom line

To sum up, I believe that Mastercard’s solid financial performance and double-digit revenue growth in the challenging environment is a clear bullish sign. The company has stellar profitability metrics and demonstrates apparent resilience in the current turmoil. Mastercard is well-positioned to remain on its growth trajectory fueled by favorable secular tailwinds. I upgrade the stock rating from “Hold” to “Buy” since the company looks bulletproof to storms.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.