Summary:

- Mastercard is an operating margins champion, delivering stellar top-line growth with a strong tailwind represented by a secular shift to electronic payments.

- I consider current valuation fair since multiples are below the company’s historical averages but I do not see that possible recession priced in.

- The company is well-positioned to continue to benefit from favorable secular trend, but short-term challenges in the macroenvironment might undermine the stock price.

jbk_photography

Investment thesis

I like Mastercard’s (NYSE:MA) long-term stellar financial performance and the company’s management’s striving toward innovation and expansion of shareholder value, but in the short term there is very much uncertainty regarding developed economies’ Central Banks’ further interest rates tightening which directly impact consumer spending. Since the company’s financial performance depends heavily on consumer spending and Gross Dollar Volumes, I am neutral on the stock in the short run.

Company information

Mastercard is a technology company in the global payments industry, which connects consumers, financial institutions, businesses, and other organizations worldwide by enabling electronic payments instead of cash and cheques.

Mastercard has just one reportable segment which is “Payment Solutions”. The company disaggregates its revenue by geographic markets into two categories: “U.S.” and “Other countries”. According to company’s latest 10-K filing:

Revenue generated in the U.S. was approximately 33% of net revenue in 2022, 32% in 2021 and 33% in 2020. No individual country, other than the U.S., generated more than 10% of net revenue in those periods. Mastercard did not have any individual customer that generated greater than 10% of net revenue in 2022, 2021 or 2020.

Financials

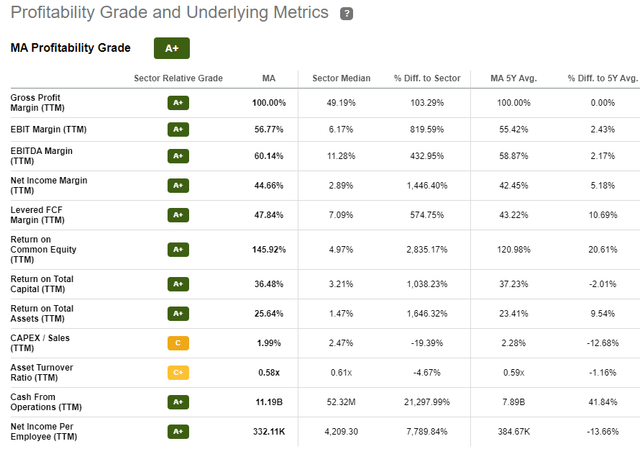

The company is an absolute profitability rockstar if compared to industry median ratios. It is also important to mention that MA continues to further improve its wide margins – currently, most profitability ratios are higher than the company’s 5-year averages.

Seeking Alpha

If we zoom out and look at the company’s performance in the last 10 years – MA delivered stellar topline growth at a 10.3% CAGR together with an operating margin within the 53-57% range. The company is paying dividends consistently with hikes in the last 11 consecutive years, though the dividend yield is low comprising less than 1%. Apart from dividends, MA returns money to shareholders via buybacks which comprised a cumulative $48 billion in the last 10 years.

On January 26, Mastercard reported adjusted 4Q2022 operating earnings of $2.65 per share, up from $2.35 a year earlier and above the consensus of $2.58. Revenue increased 12%, delivering a slight topline surprise compared to consensus expectations. It is important to note that spending trends softened in 4Q. Gross Dollar Volume [GDV] rose 8% in 4Q compared to 11% growth in 3Q. It is highly likely that increasing Central Banks’ interest rates across all developed economies will continue to further put pressure on consumer spending in 2023. From longer-term perspective, I see that MA is well-positioned to continue benefit from secular trend in payments industry which are definitely favorable for the company since more spending moves online.

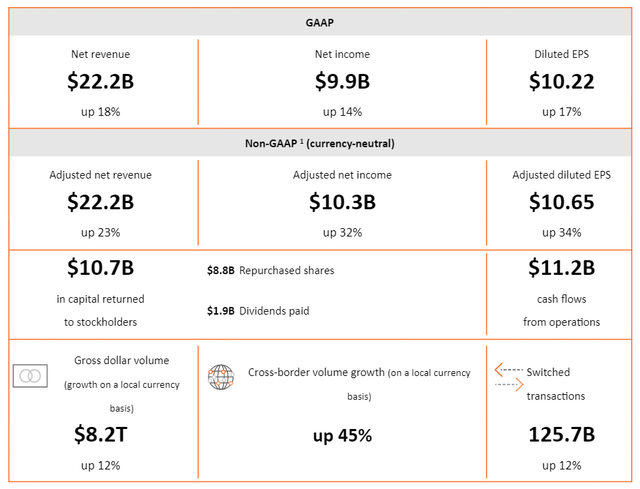

Mastercard had a very strong full FY2022 with double-digit percentage growth across the board. The company was well-positioned to absorb resilient consumer spending in FY2022.

Mastercard 10-K

Consensus estimates say that both revenue and EPS will continue to demonstrate stellar double-digit growth in the next 3 years which is good for investors. For the full FY 2023, the management projects, on a currency-neutral basis, that revenue will grow at the high end of a double-digit pace, excluding extraordinary items. Operating expenses are expected by management to grow at a high end of single-digit rate.

The company’s balance sheet looks strong, but it is worth mentioning that as of December 2022 reporting, the company’s current ratio is at its lowest point in the last 10 years. Current ratio is 1.17 at the moment while 10-year average is 1.56. I would also like to emphasize that financial leverage increased during the same period from -$6,260 billion to $6,986 billion.

Valuation

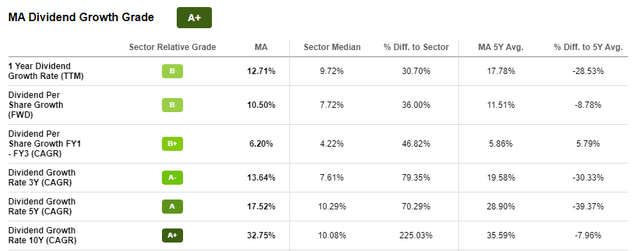

For valuation of MA I could have used a Dividend Discount Model [DDM] like I usually do, but with this company I do not see it as a viable option. First of all, not to mislead the reader, let me emphasize that the company paid dividends for 15 consecutive years and increased them in the last 11 years in a row. To go further, the company is a rockstar in dividend growth with a 10 year CAGR of 32.75%.

Seeking Alpha

So, I cannot implement DDM here, because dividend growth rate is way higher than the company’s required rate of return, since Gurufocus estimates company’s WACC at below 11%, so when I incorporate dividend growth rate and WACC into formula it turns out with negative value of stock price which does not make any sense.

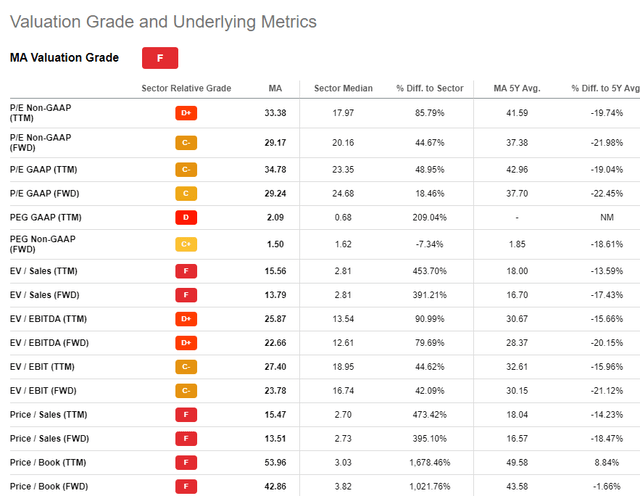

Then, let’s go to Seeking Alpha Valuation Grades section to get an understanding about how the company’s multiples compare to industry medians.

Seeking Alpha

We can see that all of the company’s multiples across the board are by far higher than sector median. I think that the market values MA stock at a substantial premium due to the company’s strong P&L growth with high and expanding operating margins.

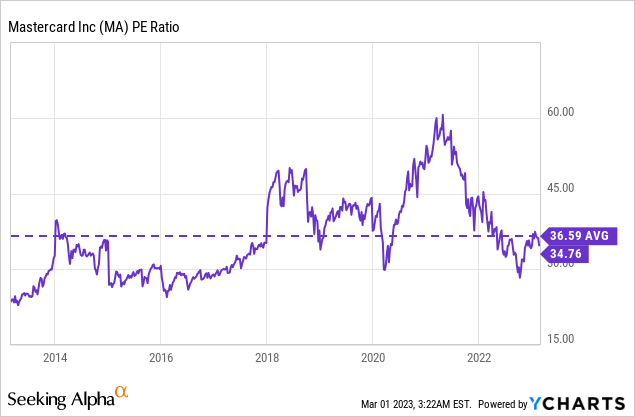

So, to get an understanding on whether MA stock is fairly valued at the moment we should better refer to company’s historical average ratios. If we look at company’s P/E ratio of last 10 years the average multiple is 36.59, so we can say that current stock price is fair (to slightly undervalued) if compared to historical multiples.

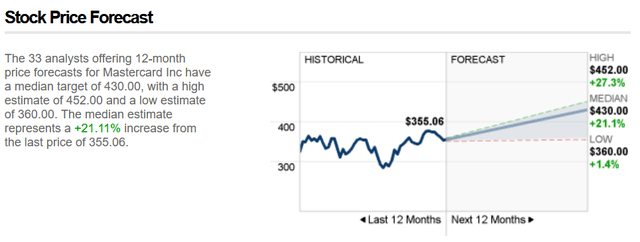

It is also worth to review what investment banks forecast as 12-month target price of MA stock. Company’s median target price is estimated at $430 representing an upside potential of about 21% with low end of target price range of $360 per share. Since the stock is currently traded at about $355 per share here we can conclude that top investment bank analysts see little probability of further price downside.

CNN Business

Investment banks analytics forecast an upside potential of almost 21%, but I see high uncertainty level here because MA has been historically trading with premium in comparison to industry median multiples due to the uniqueness of this company (together with Visa (V)): very large market share and premium operating profit margins. I think that in the current macroenvironment, a company’s “uniqueness premium” heavily depends on metrics that are out of the company’s control: Fed rates, consumer spending, and recession if rates go too high with spending heading rapidly in the opposite direction.

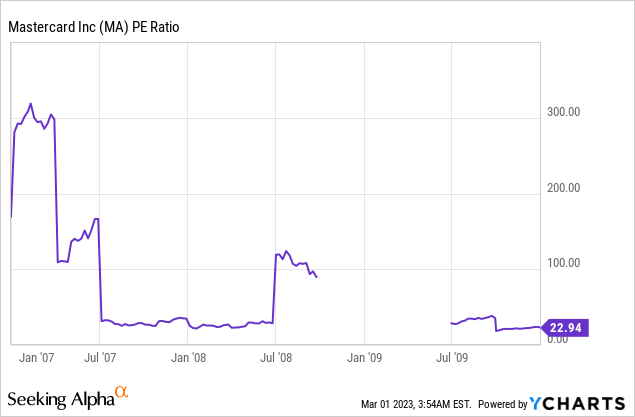

Let’s refer to MA P/E multiple during Global Financial Crisis [GFC] when company’s price-to-earnings ratio shrunk to as low as 22.94.

To conclude, if we assume no recession in the nearest future, I believe that MA stock is fairly valued with double-digit percentage upside potential. But there is high level of uncertainty because MA business depends heavily on general health of developed markets economy.

Risks to consider

As I mentioned above, MA business operations significantly depend on the GDV which is directly affected by overall economic activity dynamics together with consumer spending. I see next months as very uncertain because every day we get mixed data. On the one hand, labor market is still being strong with unemployment rate close to historical minimum. On the other hand, we all see headlines informing us about mass layoffs in several large companies, which will definitely hit consumer spending in the long run. Inflation is not as hot as it was a year ago, but it is still by far not close to Fed’s target levels.

I also consider as a risk increased geopolitical tensions between largest countries. For example, the company suspended its operations in Russia in early March 2022, due to the Russian invasion in Ukraine. Surely, Russia was not the largest market for MA, but still suspension of operations adversely affects financials.

And the third major risk that I see is regulation of company’s operations. According to Argus Research, Mastercard and Visa together hold about 77% of total U.S. credit volume, so activities of both companies will be scrutinised heavily by the government.

Bottom line

Wrapping up the above analysis of potential risks and rewards, I see Mastercard business as a growth machine that is a strong buy if you implement the “Buy and Hold” investment strategy for several years ahead. But, in the short term of nearest months, I prefer to be Neutral on MA stock since there is a big potential headwind which can adversely affect stock price.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.