Summary:

- Mastercard’s Q4 and full-year 2023 results show strong growth in revenues and solid margin expansion.

- Key drivers remain Mastercard’s GDV and switched transactions growth, along with great performance by their value-added services.

- I think the recent rally in share prices has eliminated most of the upside for 2024, making the stock fairly valued in a base-case or overvalued in a bear-case scenario.

- Mastercard still faces competition from Visa and ESG, risks related to regulatory governance and cybersecurity threats.

- Hold rating issued.

jbk_photography

Investment Thesis

Mastercard (NYSE:MA) continues to produce excellent results amidst a difficult macro environment highlighting the influence the firm holds in today’s business landscape.

Full year 2023 results saw the firm continuing to generate real earnings from sustained GDV and switched transactions growth while the firm’s value-added services also exhibited excellent YoY expansion.

However, the firm’s growth rate has slowed relative to previous years with a recent rally in shares seemingly wiping out any potential upside left in the stock for 2024.

My IV calculations reveal shares are fairly valued given a base-case outlook for 2024 and overvalued by around 21% should revenue growth slow as the year progresses.

I therefore rate Mastercard a Hold at present time. While I still love the company, I do not love the valuation and believe insufficient margin of safety exists for investors.

Company Background

Mastercard Investor Relations

Mastercard is an American payment processing enterprise operating in what has essentially become a duopoly with Visa (V). The business is a global staple in payment transactions with Mastercard now serving over 210 countries and 150 currencies.

Their principal products and services include payment processing between banks, merchants and credit unions and the provision of credit, debit and prepaid card infrastructure.

Mastercard’s primary revenue streams arise continue to arise from their global payment network and the transaction fees the company charges from transactions occurring on their networks.

The last decade has presented Mastercard with multiple challenges in the form of cryptocurrencies and rapid-pay solutions significant changing the way consumers want to make digital payments in their day-to-day lives.

However, the established, secure and trusted business Mastercard has built for themselves over the past 50 years might make it difficult for any other companies and alternative payment methods to truly become formidable competitors.

Q4 & Full Year 2023 Analysis

Mastercard posted strong performance in Q4 and FY23 across its key metrics, reflecting its consistent ability to extract significant profits thanks to their diversified business model and innovative value-added services growth.

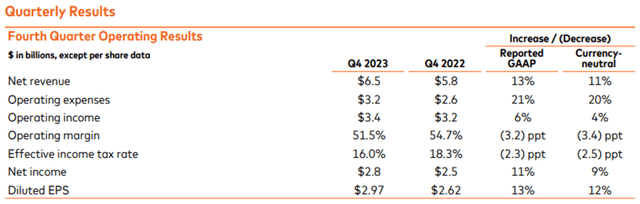

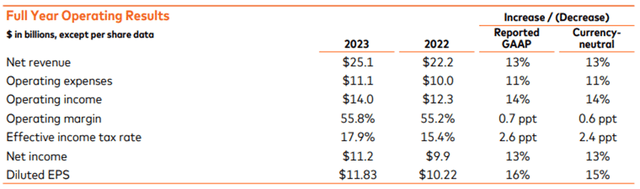

MA FY23 Q4 Press Release

For the fourth quarter of 2023, Mastercard reported net revenues of $6.5 billion, an increase of 13% year-over-year. Operating income of $3.4 billion, an increase of just 6% year-over-year.

The firm’s operating margin for the final quarter fell to 51.5%, down 3.2 percentage points YoY.

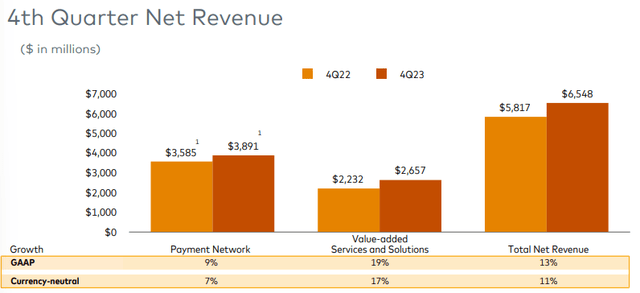

MA FY23 Q4 Presentation

The key growth drivers were Mastercard’s value-added services and solutions such as their buy-now-pay-later (BNPL) service and the payments security solutions offered by the firm.

I really like the diagram above as it clearly illustrates just how well balance Mastercard’s overall revenues are. I think these high levels of diversification should allow the firm to generate relatively solid results even amidst a recessionary macroeconomic environment.

While the 13% GAAP YoY growth in revenues is excellent to see, the rapid 21% increase in operating expenses led overall operating income and margins to contract in Q4 FY23 relative to the same period in FY22.

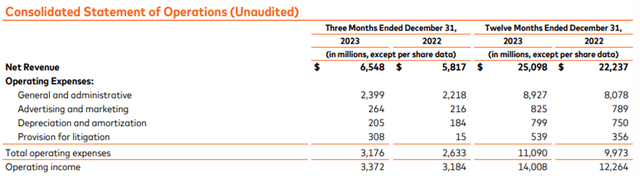

MA FY23 Q4 Press Release

However, significant one-off costs impacted the Q4 results with provisions for litigation driving up operating expenses. Without these negative impacts, operating expenses only increased 10%.

Mastercard generated net income of $2.8 billion, or $2.97 per diluted share, an increase of 11% and 13% YoY respectively.

Switched transactions were mainly to thank with the metric being up in Q4 by 12% thanks to gross dollar volume (GDV) growth of 10% and cross-border volumes increasing a healthy 18%.

Such solid growth in transactions illustrated just how resilient consumers and corporations remained throughout 2023 despite a worsening macroeconomic environment pressuring discretionary spending.

MA FY23 Q4 Press Release

For the full year of 2023, Mastercard reported excellent net revenues of $25.1 billion, an increase of 13% year-over-year which as a growth rate is down 3pp compared to FY21-FY22.

Operating income of $14 billion represented an increase of 14% YoY, and the firm’s operating margin of expanded further to 55.8% versus 55.2% in FY22.

Net income grew 13% YoY to an excellent $11.2 billion, or $11.83 per diluted share. The great operating margin expansion and bottom-line growth illustrates just how well placed Mastercard is within the payments business.

Much like rivals Visa, Mastercard is such a critical element of the daily lives of billions of people and organizations that the firm can essentially benefit from any increase in payments traffic and translate this growth into profits.

MA FY23 Q4 Press Release

Furthermore, the solid 12% growth in full-year GDV to $9.0 trillion was complemented by 18% revenue growth in the firm’s value-added services and solutions.

Mastercard’s significant investment into the scaling of their fraud and security solutions as well as the growth of their consulting, marketing and loyalty services should help the firm diversify their revenues slightly and become less directly reliant on GDV and total switched transactions growth in the future.

FY23 also saw Mastercard return significant capital to shareholders through the form of 23.8 million share repurchases and over $2.2 billion being paid out in dividends.

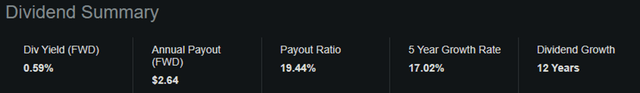

Seeking Alpha | MA | Dividend

The current dividend payout FWD is $2.64 with a ratio of 19.44% which I believe is sustainable given the firm’s massive unlevered FCF.

Mastercard also has an excellent 12-year dividend growth streak which when combined with consistent share repurchases illustrates just how important it is to management to keep rewarding shareholders in the company.

These overall great quantitative results were accompanied by solid qualitative wins for the firm with Mastercard managing to sign a third U.S. regulated bank debit portfolio flip to their network within the TTM.

Such momentum in deal making is critical to Mastercard remaining competitive versus Visa with the firm pouring significant resources towards deepening its partnerships with customer banks and fintechs.

Nevertheless, I want to note that while Mastercard did show solid growth in Q4 and 2023 as a whole, the firm’s expansion slowed compared to years prior. While this is to be expected given the slowing macroeconomic environment and natural ebbs and flows of the business cycle, it must be considered with particular importance when analyzing the valuation of Mastercard shares.

Valuation – Q4 FY23 Update

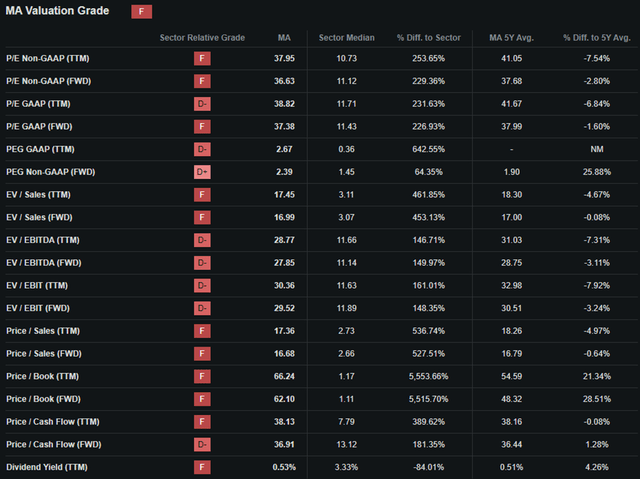

Seeking Alpha | MA | Valuation

Seeking Alpha’s Quant has assigned Mastercard with an “F” Valuation rating. While the underlying multiples appear quite elevated, it is relatively surprising to me to see such a poor letter grade rating for the firm.

Mastercard is currently trading at a P/E GAAP TTM ratio of 38.82x which actually represents a 7% decrease relative to their running 5Y average.

While the 5Y ratio does of course include a period of time in the near zero interest rate environment, it is still important to consider the historically lower P/E ratio for Mastercard.

I believe investors may beginning to price-in some slowdown in Mastercard’s top and bottom-line growth as fears of a more recessionary business environment set in for 2024.

Mastercard also has a P/CF ratio TTM of 38.13x and an EV/Sales TTM of 17.45x. Both of these relatively high ratios illustrate that the markets still have significant growth priced-in for Mastercard which while not over surprising, suggests to me that the current share price leaves little room for potentially slowing growth in the coming year.

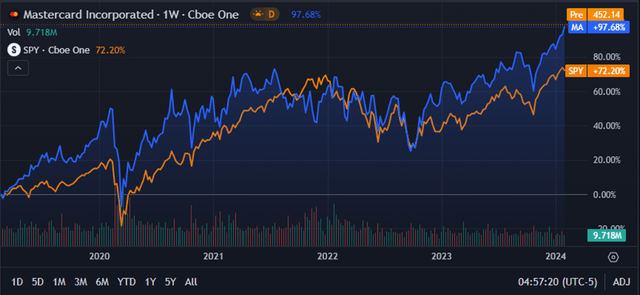

Seeking Alpha | MA | 5Y Advanced Chart

From an absolute perspective, Mastercard stock has outperformed the S&P 500 tracking SPY (SPY) index by over 20% earning investors massive returns as shares reach all time high valuations in early 2024.

Seeking Alpha | MA | 3M Advanced Chart

While this performance is at least partially warranted by the excellent fiscal performance achieved by Mastercard over the last five years, I would like to highlight the huge rally that has occurred over the last three months.

This rally has come on the heels of Mastercard’s slowing growth rates and almost flatline expansion in operating margins. While Mastercard is by no means generating poor earnings reports, I believe this recent 20% increase in share price may be unwarranted from a pure valuation perspective.

The Value Corner

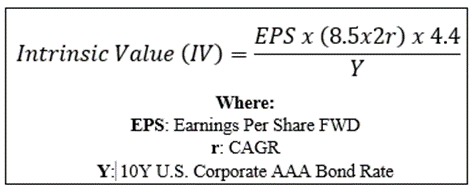

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Let’s start with a base-case valuation using Mastercard’s current share price of $449.23, my conservative 2024 EPS estimate of $14.20, a realistic “r” value of 0.13 (13%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $482.

This represents just a 7% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.09 (9%) to reflect a stress-test scenario where Mastercard struggles to grow revenues as a recession result in a slowdown in corporate and consumer spending, shares are valued at around $371 representing a 21% overvaluation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe Mastercard is trading at what should be considered a fair valuation at best and a real overvaluation given a bear case.

In the short term (3-12 months), essentially anything could happen to Mastercard’s stock price. While the solid future growth prospects are alluring to many, any negative short-term catalyst could result in a sudden drop in share prices especially given the growth already priced in to share prices.

In the long-term (2-10 years), I still see Mastercard as playing second fiddle to Visa. Nevertheless, the firm should be able to continue growing substantially by exploiting their exposure to emerging markets and economies.

Mastercard’s expansion into value-added services could also allow the firm to further expand their operating margin by offering highly profitable auxiliary service to their clients.

Mastercard’s Risk Profile

Mastercard still faces real competitive risk from Visa along with some ESG threats arising from regulatory governance and cybersecurity threats.

Mastercard faces intense competition from other payment networks, such as Visa, American Express (AXP), and Discover (DFS), as well as from new entrants and disruptors, such as fintechs, digital wallets, cryptocurrencies, and alternative payment methods.

The constantly changing consumer tastes and preferences when it comes to making digital transactions means Mastercard must continue to innovate their product offering to keep-up with the rapidly diversifying payments industry.

Visa’s expansion into quick-pay solutions with Visa Cash App along with the firm’s rapid expansion into the crypto realm must be countered by Mastercard in order for the firm to remain relevant and influential within the space.

From an ESG perspective, Mastercard faces some real threats related to the regulatory governance and cybersecurity threats.

Mastercard is subject to complex and evolving laws and regulations in different jurisdictions that govern its business activities, such as data privacy and security, anti-money laundering, consumer protection, interchange fees, taxation, and competition.

Any changes or violations of these laws and regulations could adversely affect Mastercard’s reputation, operations, and financial results.

Mastercard is currently involved in several lawsuits and investigations related to its interchange fees and network rules in various jurisdictions such as the U.K., U.S. and Brazil. Such legal quarrels could prove costly to Mastercard’s reputation and business operations.

Finally, Mastercard faces real cybersecurity risk due to the massive amounts of sensitive data the company holds from customers, merchants and partners. Any break in their security infrastructure could lead to huge data leaks that could ruin Mastercard’s reputation and business.

While the firm is leading the way in payments security, the firm simply cannot afford a data leak.

Despite these real ESG threats, I believe Mastercard would still make for a solid ESG conscious investment pick given the hypothetical nature of most of these concerns.

Of course, opinions may vary and I urge you to conduct research of your own into Mastercard’s ESG risk profile should these matters be of particular importance to you.

Summary

Mastercard’s Q4 and full year 2023 results saw the firm exhibit excellent rates of both top and bottom-line growth thanks to solid expansion in GDV and switched transactions.

While the company did see their growth slow relative to previous years, the overall resilience and ability for Mastercard to expand their business despite a significantly worsened macro environment illustrates just how integral the firm is to the global economy’s function.

Nevertheless, a recent rally in share prices has in my opinion eliminated much of any upside potential that may have existed in the stock for 2024. My base and bear case intrinsic value calculations reveled that the firm is trading at a fair valuation given expected growth for 2024 and a real overvaluation should a slowdown in growth occur for the firm.

Given the lack of margin of safety, I must rate Mastercard a Hold at present time.

While I will absolutely not be selling my stake in the firm given their massive long-term growth prospects, I find the current pricing levels to offer insufficient upside to begin building a further position in the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.