Summary:

- Mastercard has a stable business but remains expensive at this time.

- Their growth potential does not warrant a multiple as high as the market is giving it.

- There are some long-term threats to the business.

- Investors may want to remain neutral on this name until a better opportunity to buy shares presents itself.

jbk_photography

Thesis

Mastercard (NYSE:MA) is a high quality business and the market is giving it a high multiple. Given the market environment we are currently in, this multiple does not seem justified by its growth prospects. There are some risks to the company’s strong moat that the market is not pricing in. We believe that investors may want to remain neutral on this name until a better opportunity to buy shares presents itself.

Low Prospects for Growth

In their most recently reported quarter Mastercard reported a revenue increase of 15% and a net income increase of 14%. These are solid numbers given the macro environment. It’s difficult to see how Mastercard can continue this level of growth in the future, mainly because merchants are beginning to push back on interchange fees. With Mastercard being unable to increase their interchange rates it removes a growth lever for the business. They may also be forced to lower the fees they take on transactions which would lead to margin compression.

Mastercard is currently in a stage where total nominal transaction value is the main factor that determines their revenue and earnings. The business is strong but has captured all of the market that it can realistically achieve and they are unable to further increase interchange rates. Mastercard is a stable and predictable business, but relying on spend growth can have some risks associated with it.

Long-Term Risks

The market is assuming that Mastercard has a rock solid moat but there are some potential threats on the horizon.

Legislative scrutiny is a major threat to both Mastercard and Visa (V). As more merchants criticize the companies for the amount of each transaction they take, legislative pressure grows stronger. Regulators seem to dislike the major card networks and will likely take more steps against them over the course of this decade. This should reduce the premium that the card networks are given by the market.

Crypto payment networks are a threat to the major card networks as they seek to completely circumvent their payment system and often completely circumvent traditional financial institutions. I’ve never been a fan of crypto, however it is undeniably a threat to the card networks.

Buy now pay later payment options have been become more popular in recent years. BNPL companies help people to spend money now and then pay for the purchase in installments through their bank account. This sidesteps the card networks entirely. While this concept has been tried in the past and doesn’t seem to be that great of a business model, any potential reduction in transaction volume due to a shift in societal preferences is a risk to Mastercard.

Margin compression is a major risk and could come from many sources. The two biggest sources of potential margin compression are regulatory scrutiny and competitive pressures. If governments around the world begin to take action against the card networks, they may be forced to lower fee rates. If retailers and consumers have a plethora of options to choose from, the card networks may need to make themselves more enticing through lower fees or increased incentives. This would more than likely lead to margin compression over the long-term.

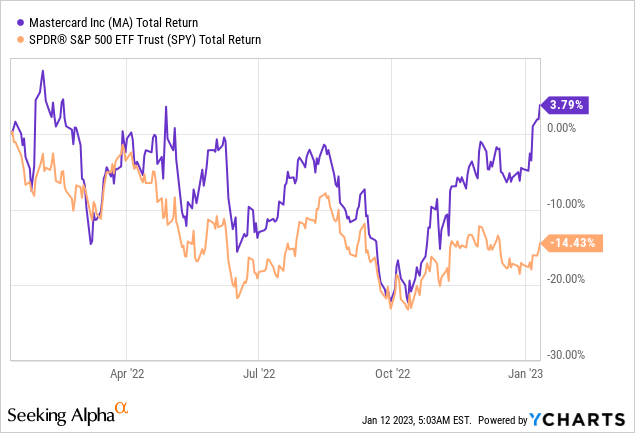

Price Action

Mastercard has performed wonderfully over the past year and is actually in the green. Even though we do not view Mastercard explicitly as a “buy”, we view the business as being a solid component of a diversified portfolio and investors can feel comfortable holding the stock. We just don’t see it as a good time to be adding shares given the current premium to the market and high availability of better opportunities.

Valuation

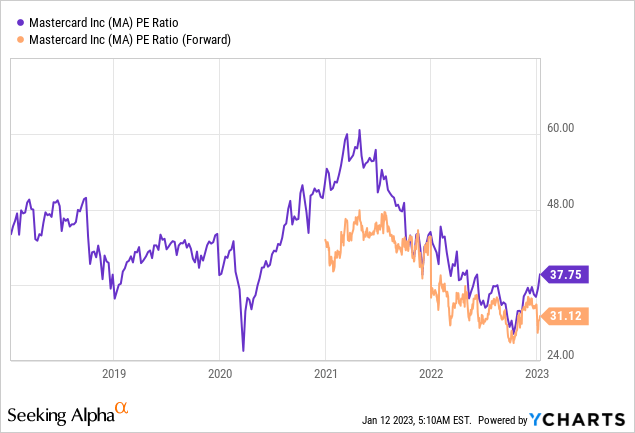

Mastercard currently trades at a trailing PE of 37.75 and a forward PE of 31.12. This doesn’t look expensive relative to recent history, however the risks to Mastercard’s business are greater than they used to be.

Given the S&P 500 is trading at a PE of 20.65 we believe that Mastercard is currently overvalued. Their growth potential and risk profile does not justify a multiple that is almost double that of the market. We believe that Mastercard should trade at only a 50% premium for the following reasons.

1. Mastercard is a stable business and should be given a premium multiple.

2. Investors should also be wary of the potential for lower growth and increased amount of risk going forward.

Taking these two statements into consideration leads us to conclude that the risk/reward is unfavorable at this time but current owners of the shares should do decently well.

Risks to Neutral Thesis

Since our thesis is neutral there are risks to the upside and downside.

As far as upside potential is concerned, it’s possible that Mastercard finds a way to diversify their business or meaningfully improve their revenue growth and margins with the current model. This would mean that Mastercard’s moat is stronger than we anticipated and they would outperform our expectations.

Some downside risks are that Mastercard’s business deteriorates and they can’t handle the immense pressure from regulators and competition. If Mastercard is unable to maintain their moat and high margins then investors will no longer be willing to give them a premium multiple.

Key Takeaway

Mastercard is a solid business but we would not be looking to add shares at this time. The current valuation is pricing in high expectations but Mastercard may not be able to meet those expectations going forward. This is definitely a name that investors would do well to keep on their watch list and look to buy shares when the risk/reward becomes more attractive.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.