Summary:

- Mastercard’s global payment network should continue to drive strong results well into the future.

- The company’s winning position in fintech – and expansion into China – should continue to entrench network advantages, despite regulatory risks.

- With a strong growth profile and excellent margins, MA is a ‘premium’ company.

- While nominally ‘expensive’, we think that shares are reasonably priced, and today’s buyers can participate 100% in the company’s future growth.

- We rate MA a ‘Buy’.

shaun

Mastercard (NYSE:MA) is one of the largest financial companies in the world, with more than $450 billion in market cap as of writing.

With a robust growth profile, terrific profit margins, and strong momentum in shares, it’s clear that the company is on a roll.

While some may see the company as nominally ‘expensive’, we think MA’s shares are fairly valued, and stand to see continued upside as both top and bottom-line results continue to push forward.

Today, we’ll dive into the company’s recent results, macro trends, and future potential to ultimately explain why we think, despite the premium-looking valuation, shares are likely to see continued, steady upside.

In our eyes, this could make MA the perfect choice for high-quality, GARP-focused investors.

Sound good?

Let’s jump in.

Financials

Let’s start by taking a look at MA’s financials.

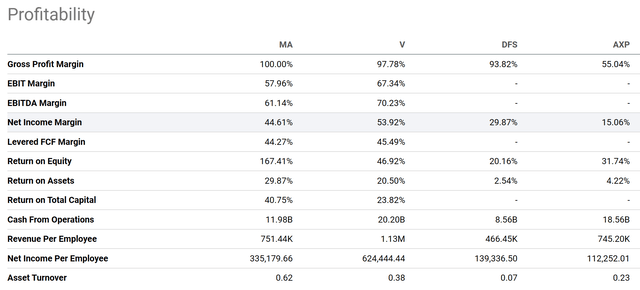

Right off the bat, it’s clear that MA operates in an uncompetitive market. With only Visa (V) as a true competitor – and Discover (DFS) and American Express (AXP) as distant peers, MA’s margin profile is absolutely incredible:

Sporting net income margins of 44%+, the company is well positioned to continue investing in itself to maintain its competitive moat. It’s also indicative of the pricing power and market position that both MA and V have, respectively.

As Jeff Bezos is fond of saying – ‘Your margin is my opportunity’. However, given the dynamics of the market and MA’s strong network effect, it is clear that there’s no real room for competitors to chip away at MA’s moat.

Building a global payment network is no easy task, and MA’s historical investments in doing so are now bearing fruit, both in terms of financial visibility and pricing power.

As a global payment network, MA’s results should theoretically grow in line with global GDP and payment processing volumes.

However, as the company introduces more value-added services on top of their strong card offering, as well as management’s continued effort to juice margins from their main line of business, it is clear that MA’s growth profile is strong.

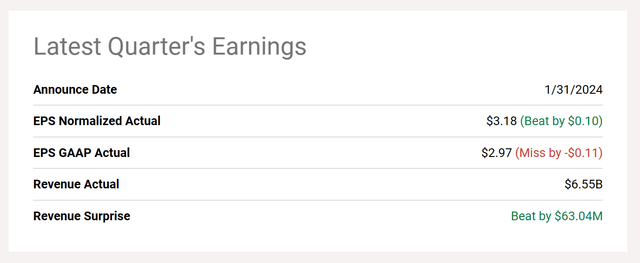

Recently, the company has been doing well, and in Q4 the company was able to beat on both EPS and revenue:

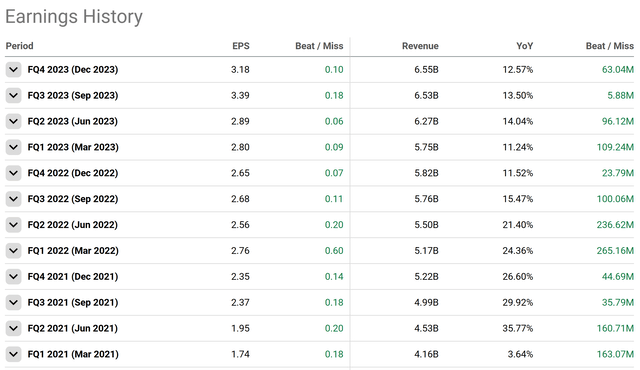

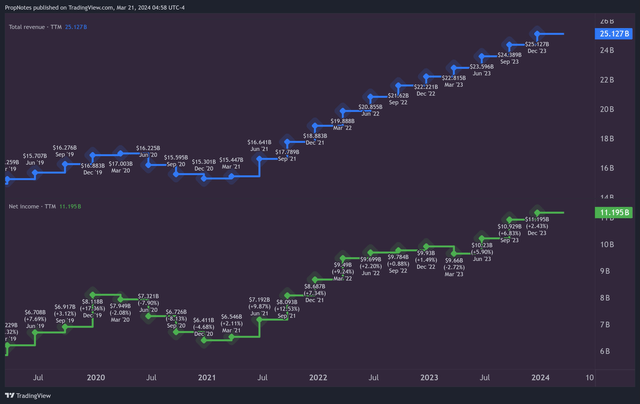

This success dovetails off of a very long track record of beating estimates, as the company has done for the last string of quarters:

It’s clear to see from both the rate of change metrics, as well as the nominal results, that MA’s business is highly performing, and the company’s future financials have a high degree of visibility.

Zooming out, you can see how top line revenue and bottom-line profits have grown over time:

As things progress, we expect that this growth should continue apace, due to the aforementioned moat & network advantages.

MA’s pushes into Fintech and China should also continue to drive results.

As MA pointed out on their recent earnings call, MA is the preferred partner for fintech startup companies, with over 80% market share of key names in the space:

We’re also winning in fintechs, co-brands and public sector partners. When it comes to fintechs, Mastercard is a partner of choice. In fact, Mastercard serves over 80% of the top digital payment and neobank fintechs on the CNBC Global Fintech list. This quarter, Starling Bank, one of the largest fintechs in the UK renewed their partnership with Mastercard.

Similarly, in China, MA’s recent JV application just cleared regulatory hurdles, and the company now stands ready to begin processing payments:

We are thrilled that our joint venture in China has released formal approval to commence domestic bankcard clearing. Believe that we will be uniquely positioned to provide Chinese consumers with an exceptional payment experience using a single card that’s optimized for both domestic and cross-border spend.

This is a strong proposition for Chinese customers, as MA branded cards will have a seamless cross-border spending experience, which can’t be said for more regional networks like Union Pay, which see a very high level of spend, but only a fraction of a percentage of that spend outside of the Chinese Mainland.

These continued incremental improvements to MA’s business represent the company’s strategy – entrenchment and monetization.

Value

But how much is MA worth?

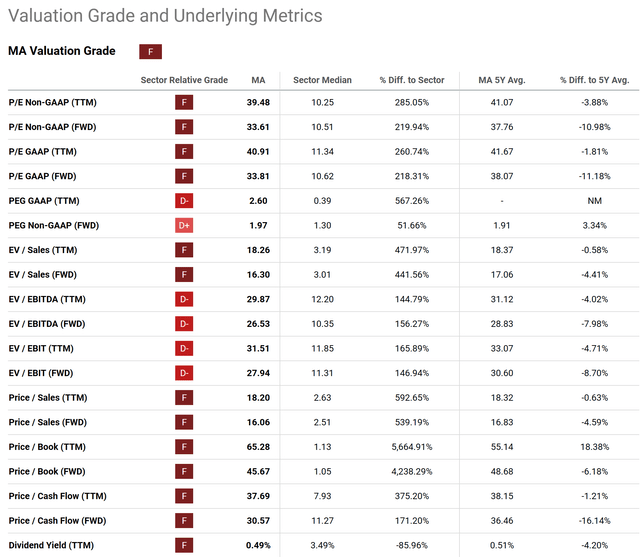

Right now, many see MA’s stock as overly expensive, which is corroborated by Seeking Alpha’s Quant Rating system, which gives MA stock an ‘F’ in the Value department:

However, look closer, and you’ll see that MA’s valuation is actually being compared with banks and other financial institutions, which often see a much lower multiple due to the inherent risk in those businesses.

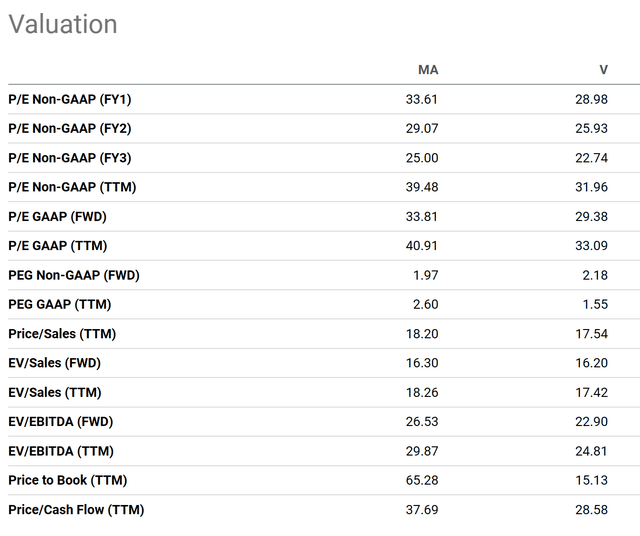

When compared to both itself, and Visa, historically, MA’s valuation appears to be much more reasonable.

Versus the last 5 years, MA is actually trading below long-term averages, as you can see above.

And, while more expensive on both a P/E and Cash Flow basis vs. Visa, the company sports a lower Forward PEG:

This PEG is because of the company’s superior growth profile, as AOE and sales are expected to grow at ~17% and ~12.5% respectively, which outpaces MA’s main rivals:

www.propnotes.co

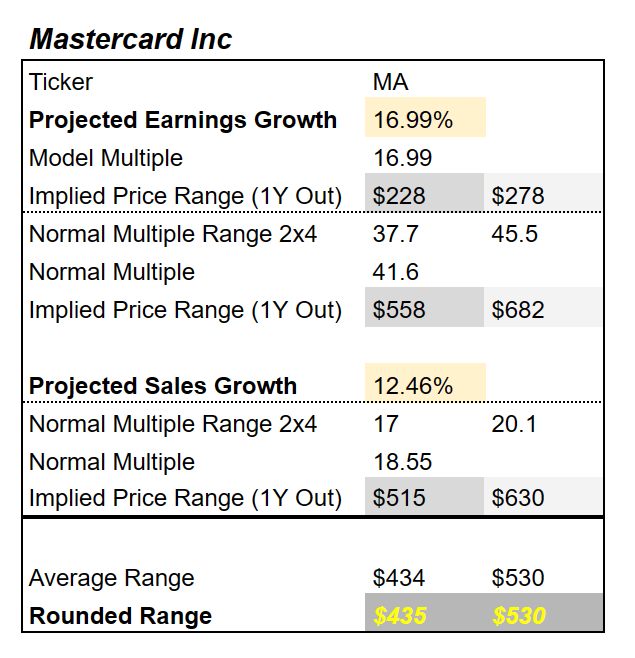

When backing out these growth rates, we get a Fair Value range somewhere in the $435 – $530 zone, which is right in line with where shares are trading as of writing (yesterday’s close was $488/share).

This model uses 3 inputs – a historical PE = G formula which is common for stocks that sport an AOE rate of more than 15%, as well as a blended average of historical earnings and sales multiples for MA going back 5 years.

When combined, MA looks comfortably situated, right within our estimates.

However, while you may think that a lack of valuation ‘edge’ provides a poor entry point into the stock, we prefer to think of this as a fantastic company at a reasonable price.

Sure, you’re not positioning yourself to earn significant multiple appreciation in the stock, but you are positioning yourself to participate fully alongside the company’s EPS growth.

Projected at 17% annualized over the next few years, it’s hard to argue that this is an unattractive proposition, especially in light of a market that appears expensive, on the whole.

Plus, with MA’s business model and network advantages, it would appear that both the company’s long-term results, as well as MA’s premium valuation, should remain consistent over time.

Risks

There are some risks to this thesis.

For the most part, MA appears insulated from a ‘race to the bottom’ style competition vs. Visa and other payment networks. However, that does mean that the company has earned regulators’ ire, and a bill, called the ‘Credit Card Competition Act‘ has recently picked up steam in Congress:

If enacted, the law would amend the Electronic Fund Transfer Act to require credit card-issuing banks to offer a minimum of two networks for merchants processing electronic credit card transactions. It would prohibit Visa and Mastercard from being those with the largest market share of cards today.

Clearly, this represents a threat to MA’s domestic processing business. With exclusivity agreements with issuing banks under threat, it could invite a scramble in the industry, and engender a race to the bottom on fees. This could destroy margins.

Right now, the bill appears stalled, and MA and other card networks are said to be vigorously lobbying against the bill.

However, it remains a serious risk going forward.

Other risks include slowing growth as MA’s end markets may come under saturation. This would likely hurt the company’s P/S and P/E multiples, and thus cause losses to shareholders.

This doesn’t appear likely, but it’s also something to consider when looking at an investment.

Summary

All in all, we believe that MA is a ‘Buy’.

The company’s strong growth and margin profile, powered by a strong moat and network advantages, cement that.

And, while shares could appear expensive to some investors, we prefer to think of the company, which is the very definition of ‘premium’, as ‘reasonably priced’.

Thus, our ‘Buy’ rating.

If you’re a GARP or ‘Compounder’ focused investor, MA could be an excellent option for your portfolio.

Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.