Summary:

- Since my previous article, shares of Mastercard have returned nearly quadruple that of the S&P 500 index.

- The payment processor’s net revenue and adjusted diluted EPS climbed higher in the second quarter.

- Mastercard possesses an A+ credit rating from S&P on a stable outlook.

- The stock looks to be trading at a 6% discount to fair value.

- Mastercard could be positioned to deliver 30%+ cumulative total returns through 2026.

A woman pays for her coffee using the payment card reader at a coffee shop. MoMo Productions

In recent years, I have put much more emphasis on investing in growth-oriented stocks than in the past. Since I am 27 years old, this only makes sense. After all, I have plenty of time to let compounding work its magic.

Throughout this year, my weighting with capital deployment has been about 40% to 45% value/income and 55% to 60% growth. For my investment objectives and time frame, I’m fairly pleased with my capital deployment strategy this year and envision it continuing into 2025.

My value/income buys have included Realty Income (O) and Enterprise Products Partners (EPD). The more prominent growth buys in my portfolio as of late include Meta Platforms (META) and Mastercard (NYSE:MA) (NEOE:MA:CA).

Today, I’m going to be focusing on the latter of my growth buys as of late. When I last covered Mastercard with a buy rating in June, I appreciated its top-notch growth prospects. I also liked the A-rated balance sheet. Best of all, shares appeared to be moderately undervalued.

After sharing its second-quarter results, I am comfortably reaffirming my buy rating on MA. This is because the company has ample growth opportunities via emerging markets and recent consumer trends. Shares aren’t quite the value they were three months ago, but they’re still a modest value here.

Growth Opportunities Abound

Mastercard Q2 2024 Earnings Press Release

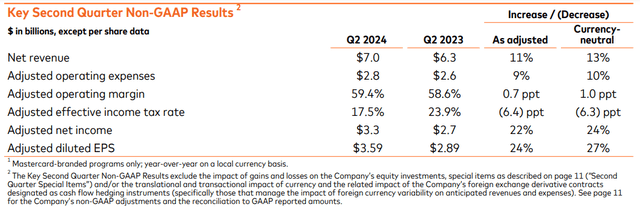

Heading into the second quarter, MA posted 14 consecutive quarters of double beats (net revenue and adjusted diluted EPS). After releasing its second-quarter results on July 31st, the company extended this streak to 15 consecutive quarters.

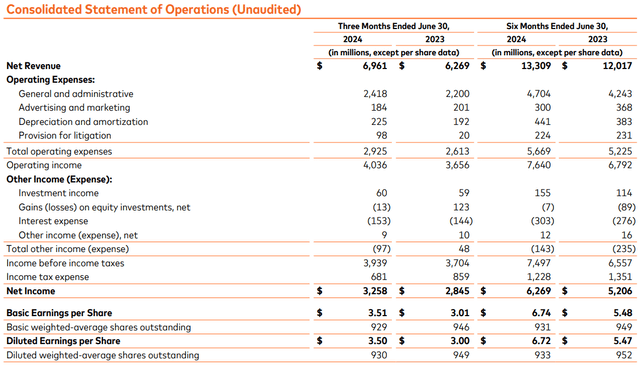

MA’s net revenue surged 11% higher year-over-year to $7 billion during the second quarter. This was $110 million greater than Seeking Alpha’s analyst consensus for the quarter.

Once again, MA received a boost from more merchants wanting a piece of the network’s multi-trillion-dollar purchasing power pie. Coupled with higher adoption rates of debit and credit cards in developing markets, this pushed the total cardholder base 9% higher to almost 3.1 billion in the quarter.

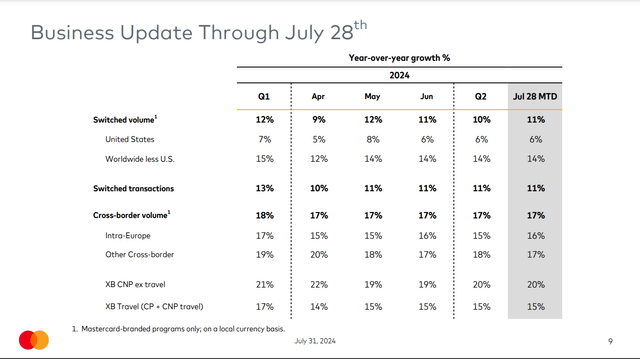

Along with healthy consumer spending, that resulted in a 10% rise in gross dollar volumes during the second quarter. Switched transactions grew by 12% for the quarter.

Consumers continued to travel in the second quarter. This helped MA’s cross-border volume to jump by 18% for the quarter.

Moving to the bottom line, the company’s adjusted diluted EPS soared 24.2% over the year-ago period to $3.59 during the second quarter. Adjusting for unfavorable foreign currency translation to the tune of 3%, currency-neutral adjusted diluted EPS growth would have been an even more robust 27%. MA’s adjusted diluted EPS beat the Seeking Alpha analyst consensus by $0.08 in the quarter.

This was powered by disciplined cost management. That caused the company’s non-GAAP net profit margin to expand by 430 basis points to 48% for the second quarter. This accounts for how adjusted diluted EPS growth greatly exceeded net revenue growth during the quarter.

Mastercard Q2 2024 Earnings Presentation

Looking at the near term, MA’s fundamentals outlook remains admirable. The company’s July 28 month-to-date switched volume, switched transactions, and cross-border volumes remained steady.

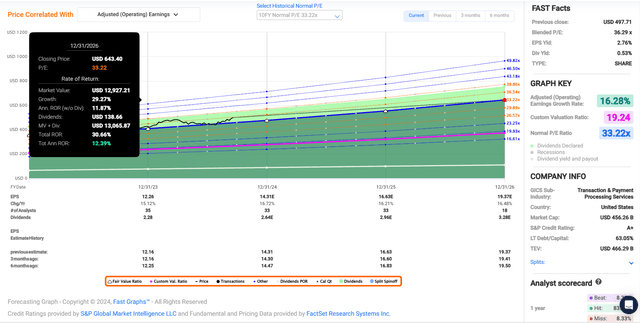

Each was in line with Q2 figures. This is why the FAST Graphs analyst consensus for 2024 projects that adjusted diluted EPS will increase by 16.7% to $14.31.

Beyond this year, MA has a couple of material tailwinds. For one, there’s the added transaction volume from the likes of Uber Eats and a shift from cable subscriptions to multiple streaming services. Because MA is paid fixed cents for each transaction that it completes and the dollar volumes that it processes, these elements push net revenue upward over time.

Secondly, emerging markets like the continent of Africa represent an immense opportunity. 1.4 billion people living on the continent and 90% of transactions are completed in cash per CEO Michael Miebach’s remarks during the Goldman Sachs Technology Conference. As economic development progresses, adoption rates of alternative payments should improve.

Africa isn’t the only opportunity, either. Miebach also pointed to developed economies in Europe like Italy and Germany, the digitization opportunity in Japan, and Brazil’s high levels of digitalization.

This is why the FAST Graphs analyst consensus is projecting a 16.2% growth rate in adjusted diluted EPS in 2025 to $16.63. For 2026, another 16.5% growth to $19.37 in adjusted diluted EPS is being predicted.

Mastercard Q2 2024 Earnings Press Release

MA is also a financial juggernaut. As of June 30, 2024, the company had $8.2 billion in net debt. Stacked up to $16.2 billion in annualized EBITDA through the first six months of 2024, this is a leverage ratio of 0.5.

MA’s interest coverage ratio in the first half of the year was also excellent, registering at 51.7. This justifies the A+ credit rating from S&P on a stable outlook according to The Zen Research Terminal (unless otherwise sourced or hyperlinked, all details in this subhead were according to Mastercard’s Q2 2024 Earnings Press Release, Mastercard’s Q2 2024 Earnings Presentation, Mastercard’s Q2 2024 Operational Performance Data, and Mastercard’s Q2 2024 10-Q Filing).

Fair Value Is Now Above $530 A Share

In the last three months, shares of MA have rallied 11% versus the 3% returns of the S&P 500 index (SP500) in that time. Despite this rally, I think shares could have room to run higher yet.

MA’s current-year P/E ratio of 35.1 is slightly elevated versus its 10-year normal P/E ratio of 33.2 per FAST Graphs. However, it’s worth noting that 2024 is just about over. So, the forward P/E ratio is arguably more appropriate here. This is just 30.1, which is under the 10-year normal P/E ratio.

In the years ahead, I believe that the 10-year normal P/E ratio remains a rational fair value for MA. The company’s 16.3% annual forward adjusted diluted EPS growth outlook is in line with its 10-year average of 16.5%. This suggests that its growth story remains intact.

In a few days, the calendar year 2024 will be 73% complete. This means that just 27% of my adjusted diluted EPS input is based on the 2024 analyst consensus, with the remainder being based on 2025. This yields a forward 12-month adjusted diluted EPS input of $16.01.

Using a fair value multiple of 33.2, I arrive at a fair value of $532 a share. Against the $501 share price (as of September 17th, 2024), this is equivalent to a 6% discount to fair value. If MA meets growth expectations and reverts to fair value, it could generate 31% cumulative total returns by the end of 2026.

Dividend Growth Potential Remains Exceptionally High

The Dividend Kings’ Zen Research Terminal

MA’s 0.5% dividend yield is modest in comparison to the financial sector’s median forward dividend yield of 3.2%. This explains the F grade from Seeking Alpha’s Quant System for overall dividend yield.

In other words, this is a compounding play about future dividend growth. And man, does MA deliver in this aspect.

The company’s EPS payout ratio is poised to register in the high teens in 2024. This is roughly just a third of the 60% EPS payout ratio that rating agencies like to see, according to The Dividend Kings’ Zen Research Terminal. That rightfully earns an A+ grade for overall dividend safety with the Quant System.

This also puts MA in a great position to extend its 12-year dividend growth streak. That itself is much better than the sector median of 2.2 years. This justifies the B+ grade from the Quant System for overall dividend consistency.

In the last five years, MA’s quarterly dividend per share has doubled to the current rate of $0.66. This is good enough for an approximately 15% compound annual growth rate, which is almost three times the sector median of ~6%.

In my view, I’d be surprised if MA doesn’t keep delivering 15% annual dividend growth in the next five to 10 years. The payout ratio has room to expand, earnings growth potential is comfortably in the double-digits, and the balance sheet is enviable.

Risks To Consider

MA is a world-class business. This doesn’t change the fact that it still faces risks, however.

As I alluded to in my prior article, MA’s continued success depends on maintaining its trusted brand image. A variety of events could undermine this trust and damage the company’s fundamentals. That includes the potential for a major cyber breach. This could compromise loads of data and lead to sizable legal settlements against the company.

Just as the news pointed to in June, MA and Visa’s (V) swipe fee settlement with merchants was rejected by U.S. District Judge Margo Brodie. This means that the parties will need to return to the negotiation table. If something can’t be worked out soon to the satisfaction of the National Retail Federation, this could end up going to trial.

That could cause the stock to underperform in the near term. The settlement could end up being more unfavorable than was initially expected. This could have at least some negative impact on MA’s growth forecast.

Finally, there is an outside chance of a global economic recession. If this happened, MA’s growth would be temporarily contained.

Summary: A Must-Own In My Portfolio

MA comprises 1.7% of my portfolio and is my 14th-biggest holding. It’s not hard to understand why my portfolio weight is twice the S&P 500 index weighting of almost 0.9%, either.

MA has emerging markets and consumer trends working in its favor. This supports annual adjusted diluted EPS growth potential in the teens for the foreseeable future. Not to mention that MA is a financial fortress. The valuation is what puts the buy case over the top. MA is a classic wonderful business for a fair/slightly discounted valuation. Thus, I’m maintaining my buy rating here.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of MA, O, EPD, META, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.