Summary:

- Focusing on high dividend growth over a high starting yield can lead to higher returns in the long run.

- Mastercard and Visa operate in an oligopoly and have wide moats, very profitable businesses with mid-double-digit EPS growth expectations, making them attractive investments.

- Both companies offer low dividend yields but have double-digit dividend growth rates that are expected to continue eventually compounding.

- While high-quality businesses are rarely on sale, both Mastercard and Visa are currently trading at a discount to their 5-year averages.

- I like both companies, but let me show you why I think one will deliver superior returns over the other.

fcafotodigital

As a decade-long dividend growth investor, I always enjoy writing about wide-moat dividend growth companies that are reshaping the way we live and have long growth potential ahead of them because they operate in growing markets.

Yet, as I am ‘only’ in my 30s, I always prefer high dividend growth over high starting yield in most cases. That is why I never look at the dividend yield as a starting criterion for my investments, and I am open to investing in a company with, let’s say, a 1% dividend yield.

The reason for that is simple: compounding.

If you have a long enough investing time horizon ahead of you, the starting yield does not matter because you probably going to reinvest the dividends anyway.

Consider that investing in a company with as low as a 1% dividend, which grows its dividend at 15% annually given the business performs well, can grow into a 14.8% yield on cost after 20 years.

That well outperforms a business with a 5% starting yield, which grows its dividend only at 3% rate annually, where the yield on cost at the end of the same duration would be 8.8%.

| Starting Yield | DGR | Yield on Cost After 10 Years | After 20 Years | |

| Scenario 1 | 1.0% | 15.0% | 3.5% | 14.8% |

| Scenario 2 | 5.0% | 3.0% | 6.5% | 8.8% |

Of course, it’s important to acknowledge that if the company doesn’t sustain its growth, the yield at the end may be lower.

The concept is clear: focusing on growth rather than immediate yield can significantly enhance your returns in the long run.

While it is definitely not easy to identify businesses that will achieve such robust dividend growth alongside capital appreciation, let me give you some examples:

- Broadcom’s (AVGO) yield on cost after 10 years: 40.7%

- Microsoft’s (MSFT) 8.2%

- Home Depot’s (HD) 10.4%

- AbbVie’s (ABBV) 11.8%

Your choice ultimately depends on your time horizon and investment objectives. For me, I prioritize quality and outlook over chasing yield. Mastercard Inc. (NYSE:MA) and Visa Inc. (NYSE:V) both stand out due to their superior quality and promising future, making them two of my all-time favorites in my dividend growth portfolio.

Let me show you why I think their durable and non-cyclical business models are great, as they operate in an oligopoly, and why I think one of them is a better investment at today’s price.

Wide Moat & High Profitability

Mastercard and Visa run what I’d describe as a fairly straightforward yet sophisticated operation, acting as intermediaries between customers making electronic payments and the businesses accepting them.

When your bank issues you a Mastercard or Visa card, you’re empowered to use it for purchases. Upon your payment, the network provider ensures the safe transfer of your money from your bank account to the merchant’s account.

Here’s the intriguing part: both companies profit by taking a small cut from each transaction, resembling what I term a “toll system.” For instance, when you spend $100 at a grocery store using your debit or credit card, the card issuer pockets $0.30 from that transaction.

Though different transactions at various places involve varying fees, this essentially explains the fundamental business model for both companies.

Consider this: the more cards and money flowing through the system, the more advantageous it becomes for the network operators.

Why?

Because as the volume of cards and money in circulation increases, there are more transactions and potentially larger volumes.

Now, consider that in the past decade, measures like quantitative easing have caused the M2 supply in the US to surge by a staggering 90%. While this alone won’t directly increase network’s operators’ revenue, it serves as a clear indicator of the significant opportunity awaiting both Mastercard and Visa in this growing financial market.

Given the industry’s high barriers to entry due to regulations, only three companies globally handle a whopping 97% of all credit card transactions: Visa, Union Pay, and Mastercard. Although Union Pay doesn’t disclose its transaction volumes, a clear picture emerges with the other card issuers:

- In 2022, Visa processed $5.83 trillion in U.S. transactions, securing its position as the country’s largest card processor by purchase volume (with a 61.0% market share).

- As America’s second-largest card processor by purchase volume, Mastercard handled $2.18 trillion in U.S. transactions during 2022 (accounting for a 25.5% market share).

- American Express (AXP) saw consumers charging $1.08 trillion to their cards (capturing an 11.3% market share).

To put it in perspective, about 183.9 million Americans (which makes up 70% of U.S. adults) hold at least one credit card account in their name.

These figures clearly highlight Visa’s dominant position in the US market, leading significantly in transaction volume.

However, the global landscape tells a slightly different story where Union Pay emerges as the largest network provider, commanding a 40% market share. Visa follows in second place with 34%, and Mastercard trails with a 23% market share.

Understanding these market shares is crucial because “size matters” in this industry.

Firstly, the incentive to switch from Visa to Mastercard and vice versa is minimal when both offer similar fees and closely monitor each other’s moves. Meaning if you gain a market share, it is likely to stay that way.

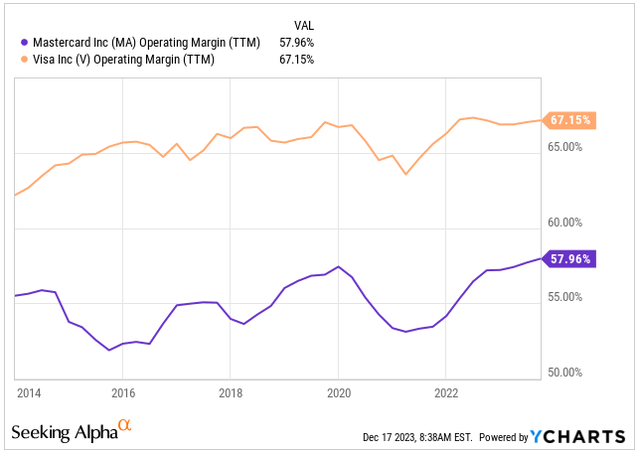

Secondly, size impacts operating costs. Having a larger market share or more active credit cards doesn’t necessarily mean higher operating costs due to increased SG&A. In fact, it’s the opposite. The larger the network operator, the lower the costs per transaction which directly influences profitability. Visa, for instance, has an industry-leading operating margin of 67.15% compared to Mastercard’s 57.96%, largely influenced by this economy of scale.

Operating Margin (Seeking Alpha)

Dividends & Buybacks

Some investors argue that Mastercard’s 0.55% dividend yield and Visa’s 0.81% yield aren’t enticing for dividend growth investors.

I beg to differ.

While these yields are indeed low and might disappoint those seeking immediate income, the real potency of their dividends lies in their growth potential and compounding, potentially transforming these modest yields into substantial income streams down the line.

Remember, in the realm of dividend growth investing, roughly 70% of the total return comes from stock appreciation, while the remaining 30% comes from dividends.

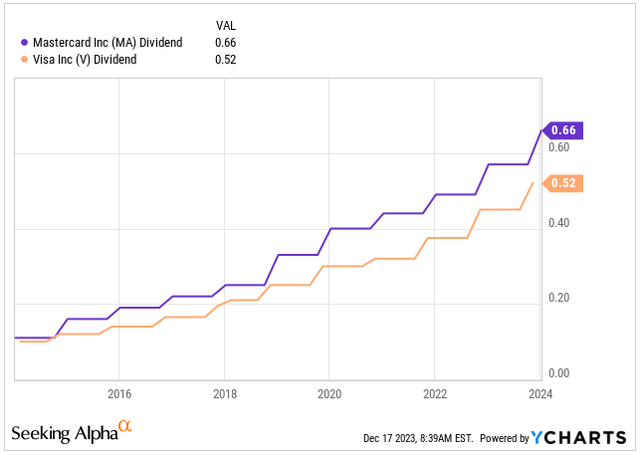

- Mastercard, currently paying a $0.66 dividend with a 0.55% yield. Its five-year dividend growth rate stands at an impressive 17.9%, resulting in a yield on cost of 3.2% for investors who bought in a decade ago.

- Visa, offering a $0.52 dividend with a 0.81% yield, boasts a five-year growth rate of 16.3%, translating to a 3.9% yield on cost for investors from a decade ago.

Moreover, both companies announced a 16% dividend increase by the end of 2023.

In terms of dividend health, both companies maintain a payout ratio of around 20%, indicating robust health in this aspect as expected.

Dividend per Share (Seeking Alpha)

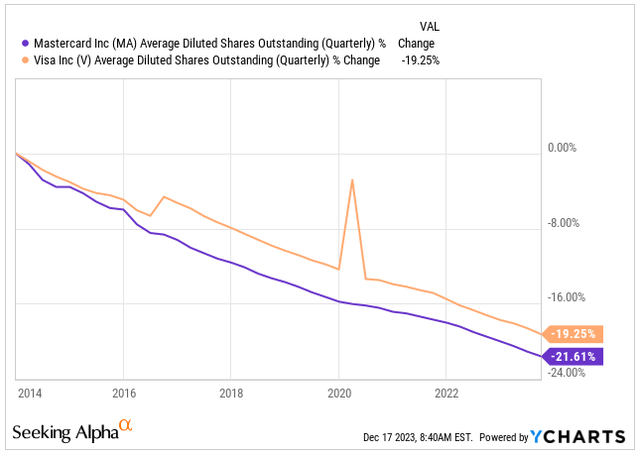

Mastercard and Visa have been actively repurchasing their shares, a strategic move that appears particularly prudent given the decline in their stock prices during 2022.

In the past decade, Mastercard has repurchased a significant 21.6% of its outstanding shares. They recently announced another substantial buyback program in December, totaling $11 billion on top of the remaining $3.5 billion from the previous program. At today’s stock price, this indicates an additional potential repurchase of 3.7% of shares.

Visa has executed a comparable strategy, repurchasing 19.3% of shares over the last decade. They unveiled a new buyback program worth $25 billion in October, representing about 4.8% of outstanding shares at current prices. This suggests that Visa’s buyback program is slightly more aggressive than Mastercard’s.

Shares Outstanding (Seeking Alpha)

Valuation

Valuation-wise, both companies are trading at a premium. This is one reason why both Mastercard and Visa receive an F grade from Seeking Alpha Valuation Grading.

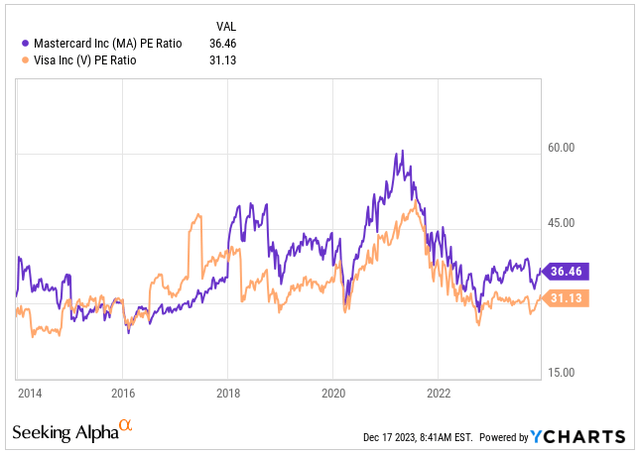

The financial sector’s median PE stands at 9.95x, significantly lower than Mastercard’s 36.5x and Visa’s 31.1x. This difference mainly stems from the sector’s inclusion of insurance companies, holding firms, and other highly cyclical financial businesses.

But here’s the catch: The two network providers are not your typical financial company. I see them more as a tech-financial entity. Both are trading at a considerable discount compared to their 5-year averages.

| PE Ratio | 5-Year | Var. | FWD PE | 5-Year | Var. | |

| Mastercard | 36.5x | 41.0x | -11% | 35.2x | 37.8x | -7% |

| Visa | 31.1x | 34.1x | -9% | 26.5x | 31.1x | -15% |

While both companies are currently trading at a discount to their 5-year averages, Visa is trading at a significantly cheaper valuation than Mastercard. Visa’s average discount to its last 5-year fair price is currently 12%, while Mastercard’s is 9%. It’s not a significant difference, but considering Visa is trading at a lower valuation, there is more margin of safety.

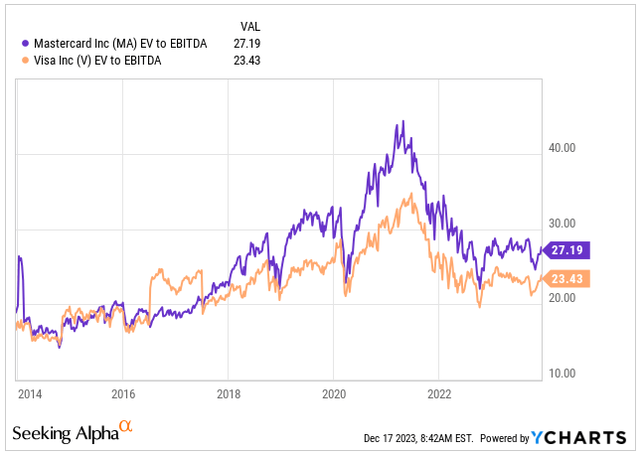

Further confirmation comes from the EV/EBITDA, where Visa is trading 13.8% cheaper compared to Mastercard.

While the current PE ratios and EV/EBITDA overlook growth, Visa’s Forward PE ratio stands 17.7% lower than that of Mastercard’s.

Part of this discrepancy lies in Mastercard boasting a stronger growth profile:

- Mastercard anticipates an average annualized EPS growth of 14.3% over the next 5 years,

- Visa forecasts a slightly lower average annualized EPS growth at 13.4%.

However, I don’t believe this approximately 1% disparity in EPS growth justifies Mastercard trading at such a significantly more expensive valuation compared to Visa.

Considering this, if Visa returns to trade closer to its historical average valuation, around 30x its forward earnings, which I think is perfectly fair and doable, I anticipate potential stock appreciation of about 14% annually over the next 4 years from today’s price of $258, without factoring in the dividend.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 |

| Revenue (b) | $ 35.9 | $ 39.6 | $ 43.9 | $ 47.7 |

| Revenue Growth | 9.9% | 10.5% | 10.7% | 8.7% |

| EPS | $ 9.9 | $ 11.2 | $ 12.8 | $ 14.5 |

| EPS Growth | 12.7% | 13.0% | 14.3% | 13.7% |

| Forward PE | 30.0 | 30.0 | 30.0 | 30.0 |

| Stock Price | $ 297 | $ 335 | $ 383 | $ 436 |

Assuming that Mastercard’s growth profile edges slightly ahead of Visa’s, resulting in slightly more robust EPS growth, I still find Mastercard’s 5-year average forward PE ratio of 37.8x unjustifiable. Consequently, I’m adjusting the valuation target to 33x its earnings. Even at this revised level, it would still indicate a substantial stock appreciation from today’s price of $418, around 13.1% annually.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 |

| Revenue (b) | $ 28.1 | $ 31.7 | $ 35.0 | $ 38.2 |

| Revenue Growth | 12.3% | 13.0% | 10.3% | 9.1% |

| EPS | $ 14.2 | $ 16.1 | $ 18.6 | $ 20.7 |

| EPS Growth | 16.9% | 13.4% | 15.5% | 11.3% |

| Forward PE | 33.0 | 33.0 | 33.0 | 33.0 |

| Stock Price | $ 418 | $ 531 | $ 614 | $ 683 |

While both network providers are solid choices for a dividend growth portfolio, I’m skeptical of Mastercard’s premium valuation compared to Visa, especially when the EPS growth isn’t significantly higher.

Given this perspective, I lean more toward recommending Visa. I believe it will offer more dependable returns moving forward, primarily driven by EPS growth rather than multiple expansions.

Takeaway

Mastercard and Visa are two businesses operating within an oligopoly, boasting wide moats and internationally recognizable brands.

Both companies command a substantial market share, not only within the US but also globally. As the M2 supply increases, it indicates expanding markets for these two juggernauts.

Visa stands as the more profitable business owing to its sheer size and lower per transaction costs. Conversely, Mastercard exhibits stronger dividend growth and slightly better EPS growth expectations.

However, despite Mastercard’s expected 14.3% EPS growth surpassing Visa’s 13.4%, the 17.7% disparity in Forward PE ratio doesn’t appear justified.

Given this, while I appreciate both businesses, my preference leans towards Visa over Mastercard purely based on valuation and a higher margin of safety. I anticipate this choice might lead to marginally superior returns over the next four years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.