Summary:

- Mastercard is a strong long-term investment with multiple growth drivers.

- Increasing the number of transactions, raising fees, and capturing new payment flows are key drivers of top-line growth.

- Mastercard has significant operating leverage and the potential for margin expansion.

shaun

From my point of view, Mastercard (NYSE:MA) is one of the best companies you can include in your long-term portfolio. Many people think it is overvalued or that, due to their size and dominant market position, they will find it very difficult to sustain double-digit top-line growth for many years. In my opinion, this is not the case, and in this article, I will try to explain all the levers that this company has to continue growing over the next decade, which I can already tell you are not few.

We will also see how this increase in the top line should translate into an even greater increase in the bottom line. This company has been experiencing significant operating leverage for many years, which, in my opinion, should continue in the coming years. Finally, I will attempt to explain why, under my scrutiny, despite the valuations often seeming very demanding. this may be justified.

Before starting, I would like to make a clarification and that is that in this article I am specifically going to talk about Mastercard, but practically everything mentioned can also be applied to Visa (V). Their businesses are the same and the same tailwinds and benefits of the sector can be applied to both. Although it is true that there are certain differences between the two that we will also discuss in detail when appropriate.

Top line growth drivers

1. Increasing the Number of Transactions

The most obvious growth avenue is to continue increasing the number of processed payments. This is driven by several macro-trends that discourage the use of cash and promote credit card usage. One significant factor is the digitization of the economy. The world is becoming increasingly digital, which directly benefits Mastercard as cash is not an option when making online purchases.

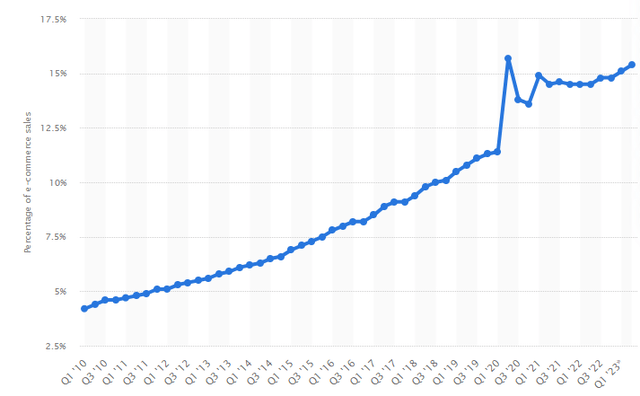

In the US, 16% of all retail commerce is conducted online. This trend is also observed in most developed and developing countries. To put this into perspective, in September 2023, total retail sales in the US were $705 billion, with approximately $170 billion being transacted online.

E-commerce as share of total U.S. retail sales (Statista)

Additionally, even non-online commerce is becoming increasingly digital, as people find it more convenient and secure to use cards or mobile apps rather than carrying cash. Analyses suggest that the total number of digital transactions in Europe will grow more by more than 10% annually until 2027.

Furthermore, whether we like it or not, governments are discouraging the use of cash. With the premise of preventing fraud and the underground economy, cash transaction limits are increasingly lower, and large cash transactions are more closely monitored. Although this may not be liked by many, it is clearly a tailwind for digital payment networks.

2. Increasing Transaction Volume

Beyond the number of transactions, increasing the transaction volume is another avenue to boost revenues. These companies earn a portion of their commission as a percentage of the total transaction amount. In other words, in larger transactions, their commissions are higher. In this regard, these companies benefit from inflation since their costs are insignificant and not closely tied to inflation. However, it’s important to note that high inflation might come with reduced consumption and interest rate hikes, which could indirectly impact Mastercard .

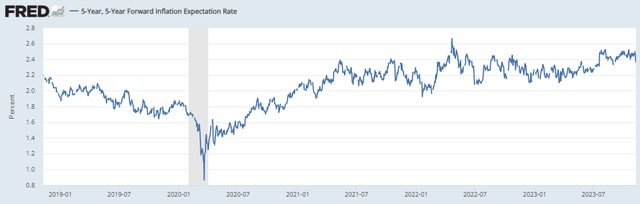

However, in the long term, the over indebtedness of governments in developed economies will make it impossible for central banks to maintain positive real interest rates. This will impact currency devaluation, and the likelihood of high inflation persisting is significant. This does not necessarily mean we will frequently see inflation rates like those of the past two years, but it will be challenging to approach deflation. In fact, if we consider the current market inflation expectations, they hover around 2.5%. Mastercard will benefit from this trend by increasing transaction volumes and, thus, the basis on which to charge their fees.

3. Raising Fees

Another strategy to boost revenues in the coming years would involve increasing the fees imposed on banks and merchants for transactions. Given their currently low fees, even a slight fee hike could lead to a significant upswing in revenue. However, the feasibility of continuing to raise intermediary fees is questionable, as merchants are likely to resist such increases and may exert pressure on regulators to impose limitations, like what has occurred with bank fees in Europe. This has the potential to impact Mastercard in the future, so I do not anticipate any growth in this percentage in the long term. In fact, maintaining the current status quo would be viewed as a positive outcome.

4. Capturing New Payment Flows

Payment flows refer to the movement of money between different entities in a commercial transaction. These flows represent payments made for goods, services, or any other form of economic value exchange. Payment flows can involve two parties: a payer and a recipient. These entities can be individuals, businesses, or organizations. So far, we’ve discussed C2B (Consumer to Business) payments, but the money circulating in the economy goes far beyond this flow alone.

As I see it, the greatest growth opportunity for Mastercard (and also for Visa) right now lies in the B2B (Business to Business) market. This refers to transactions between two companies or organizations, including governments, in which case they are called B2G (Business to Government). Currently, Visa and MasterCard dominate the B2C market for a reason: in this market, the user experience in payments is crucial. The simpler it is to pay at a business, the more likely the customer is to make a purchase and return in the future. Credit card solutions greatly facilitated this, hence their widespread popularity.

However, in B2B and B2G transactions, the user experience is much less relevant, which is why such archaic transaction methods are still in use. Most of these transactions are still conducted through high-fee bank transfers that can take several days. Surprisingly, some transactions are still carried out using bank checks.

In this regard, Mastercard are beginning to offer solutions for the B2B market with cheaper, faster, and more secure transactions. It’s important to note that Visa and Mastercard are practically the only companies with the reputation and scale to offer truly effective solutions to customers, perhaps alongside American Express. In some countries, there are local networks facilitating these transactions, posing strong competition. However, on an international level, no one has a network as extensive, secure, and reliable as theirs.

Gaining market share in this sector is not insignificant. Consider that, according to Mastercard itself, this market globally could be about $125 trillion with forecasts of double-digit growth at least until 2030. Obviously, Mastercard cannot achieve a market share like that in the B2C market. Still, simply by capturing a significant percentage in the long term, the total volume processed by payment networks can grow significantly, leading to substantial fees applied to their usage.

5. Value Added Services

This category is difficult to define as it encompasses various types of services that these two companies offer to their clients. Among them, we find cybersecurity and intelligence services that help protect users’ data and transactions; data and consulting services that provide analysis and information to enhance business decisions and performance; processing and connection services that facilitate the exchange of information and access to other payment networks; and other products and services that complement the aforementioned solutions or target specific customer segments, such as digital services, prepaid services, or advisory services.

Visa and Mastercard are also the best positioned in this market due to the scale of their networks. No one has more data than them by a wide margin, so the value they can provide to their customers is enormous at a relatively low cost for them. In this sense, we could view Visa and Mastercard as technology consulting firms focused on the financial sector, virtually without competition in the services and data they offer.

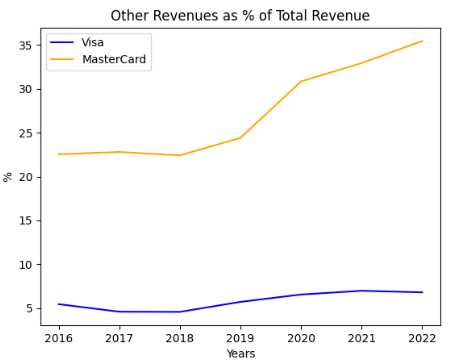

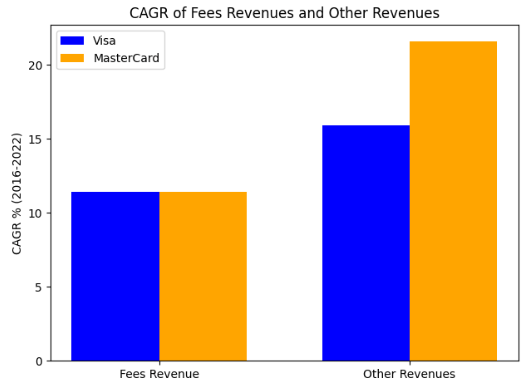

These additional services that both companies offer are a good way to diversify from their main business and have enormous Total Addressable Markets (TAMs) for significant growth over many years. In this regard, Mastercard is well ahead of Visa both in total and relative terms. For Mastercard , these services account for 35% of revenues, while for Visa, it’s only 9%. Furthermore, while Visa has been growing these services at a compounded annual rate of 16% since 2016, Mastercard has achieved a growth rate of 22%. As seen in the second graph, the extra-sales growth for Mastercard in recent years compared to Visa has precisely come from these services, as revenues from network fees have grown exactly at the same pace for both.

Self-made Self-made

Operating leverage should continue to widen margins.

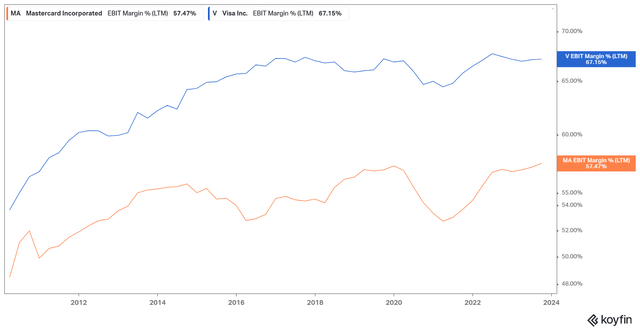

The margins with which these two companies operate are simply spectacular and among the best in the entire market. Visa’s operating margin has already reached 67%, while Mastercard is at 57%. The difference between the two stems from the scale and the origin of their sales. Visa has a larger network, and most of its revenue comes from usage fees for its network. On the other hand, Mastercard has a slightly smaller network, and a higher percentage of its sales come from value-added services, which necessarily have lower margins than revenue from the use of its network.

Although it may seem complicated considering the incredible margins that Mastercard already operate with, I believe these margin should continue to expand in the future for two reasons.

Firstly, as we have seen, the volume processed should continue to increase in the long term by 5-10%. The marginal cost of processing an additional transaction for Mastercard is practically zero, as all the necessary infrastructure is already in place and operating at less than maximum capacity. Therefore, the operating costs associated with transaction processing should increase at a slower rate than the revenue from network usage fees, resulting in improved margins.

On the other hand, value-added services, as they gain scale over time, should also improve their efficiency, and contribute to margin expansion. It is unrealistic to expect this part of the business to reach the margins of network usage fees, but it has significant potential to contribute to the operational leverage of both companies in the long term.

Regulation is the only real risk.

From my perspective, the long-term risks Mastercard are practically negligible, except for one: regulation. Some people view local networks as a significant risk, although I don’t see them as such. While it’s true that money transacted through these networks represents a missed opportunity for Mastercard , in Western countries, it’s highly unlikely for them to lose dominance due to low incentives to create local networks. These countries are allies of the United States, and the complexity of such a shift would be substantial.

In countries like Russia or China, it does seem challenging for Mastercard to gain a significant market share in the local market, as these nations are unlikely to accept an-American company managing all their transactions.

However, as we’ve seen, for international transactions, there is no rival beyond bank transfers, and this market is enormous and yet to be substantially penetrated by Visa and Mastercard. Additionally, we’ve observed how economic growth, inflation, digital commerce, and the disincentive to use cash will be growth drivers for many years, perhaps even decades, without relying on expanding into new geographies.

Nevertheless, there is a real risk to the thesis: Central Bank Digital Currencies (CBDCs). The issue with CBDCs is not whether they will come into existence (which I consider almost certain) but how they will impact the business of Mastercard. It is a complete unknown how this new form of money will flow through the economy and whether intermediaries like them will still be needed.

From my perspective, replacing the infrastructure that Visa and Mastercard have been building for over 50 years will be very challenging. It is likely that central banks will continue to trust them to move this new type of money, considering that most money today is already digital. Mastercard probably already have the capability to facilitate the movement of this money through the economy, avoiding central banks having to create this costly infrastructure from scratch.

Nevertheless, I emphasize that it is unknown how this new form of money will function, and it poses a significant potential risk to Mastercard (and obviously for Visa), and even other industry players like PayPal. I don’t believe there is a need to panic sell or dismiss it as potential investment, but it is something that should be considered and closely monitored when investing in the sector.

We could discuss other risks, such as potential recessions slowing down consumption, but these are short to medium-term risks that do not impact my long-term view. Another risk could be competition, but I believe this risk is also very low. No one has the scale to build a network and be truly efficient. To give you an idea, Google and Apple, two of the world’s largest technology companies, have chosen to collaborate with Visa and Mastercard to enter the digital payment sector rather than compete with them. If these tech giants cannot compete with them, who else can?

The only real competition for Mastercard is Visa itself, but we have already seen how the TAM for both is huge and it is impossible for one of the two to take over the monopoly of the sector. From my point of view, both will most likely continue to grow at similar rates and dominate the market for many more years, so I wouldn’t worry too much about competition from Visa.

Valuation and Conclusions

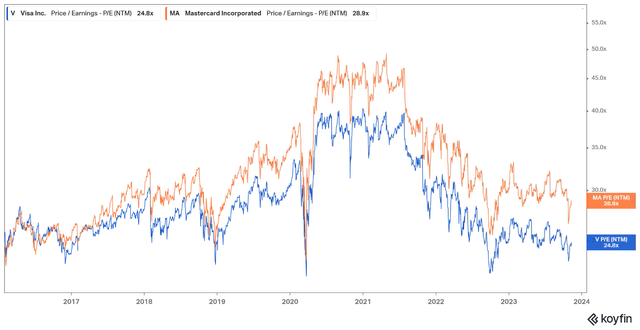

If we look at historical valuations, we can see that Mastercard always tends to trade at a higher valuation than Visa. This, for me, is due to its greater growth in value-added services, which, as we have seen, have allowed Mastercard to have a better performance in its top line in recent years.

For me, this valuation gap is because Mastercard is more diversified and is a little closer to being a technology consultancy than Visa. However, this gap right now seems a bit exaggerated to me. I don’t think there’s going to be too much difference in the performance of the two in the long run, but I do think Mastercard can do a little better. Still, these better forecasts are already included in the price we pay for them.

I estimate that Mastercard can grow its EPS at a compound 14-17% per annum over the next 5 years from ~12% in sales and some operating leverage which is somewhat like current market estimates. With almost no major long-term competition or industry risk (not counting CBDC’s, which we’ve already discussed), Mastercard seems to me to be one of the safest growth companies you can add to your portfolio.

Perhaps the historical valuations seem very high, being 32x for Mastercard . However, just as there is a lot of talk about “Cheap for a reason”, I think there is such a thing as “Expensive for a reason”. Mastercard is a company of extreme quality and have a giant TAM to continue growing ahead. That’s why I feel comfortable paying for its valuations that would be very demanding for other companies. Considering everything discussed in this article and the fact that the current valuation is one of the lowest in a decade, I am going to assign a “Buy” rating to the Mastercard stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.