Summary:

- Mastercard is well-positioned to capture market share in emerging markets and new payment technologies, benefiting from the global shift to digital payments.

- The company’s strong moat, driven by brand, network effect, and economies of scale, supports long-term growth.

- Value-added services revenue offers higher margins and diversification, enhancing Mastercard’s long-term growth potential.

- Despite being richly valued, Mastercard’s long-term free cash flow growth opportunity makes it an attractive long-term buy with potential for market outperformance.

jir

Investment Thesis

Mastercard Incorporated (NYSE:MA) is winning in new markets and new verticals and benefits from the transition from cash to digital payments throughout the globe. With a long runway for global digital payments growth and increasing demand for its value-added service (VAS) solutions, the company has plenty of room to reward shareholders. I believe Mastercard is well-positioned to capture a larger share of this market.

Mastercard’s brand, network effect, and economies of scope and scale provide the company with a powerful moat. As customers increasingly turn to VAS solutions, they are more likely to rely on Mastercard for payments. The greater the scope (variety of solutions) that Mastercard provides, the cheaper it becomes on a unit-cost basis to provide solutions to its customers. The larger the network becomes, the wider the margins.

I don’t see any reason to think MA’s free cash flow growth trajectory will change significantly, making the stock roughly fairly valued using a discounted cash flow model. I consider this stock a DCF breaker, one that has the potential to outgrow the terminal rates in any rational DCF model. This is why the stock often appears to be overvalued yet continues to trade at a premium for many years, still delivering solid returns for shareholders. If it truly is a DCF breaker, it’s likely undervalued intrinsically from a free cash flow perspective. I rate MA a buy.

Introduction: Mastercard’s Growth Opportunity

Mastercard CEO, President & Director, Michael Miebach spoke about MA’s simple but effective growth strategy. The company looks to put its investments into stronger markets with more cash generation potential and into its value-added services portfolio. Emerging market growth and VAS revenue growth are the two most important elements of my investment thesis. In this article, I will focus on the big picture for MA and how I see the company continuing to grow for a long period of time on the strength of these opportunities.

With emerging markets still largely relying on cash transactions, the digital payments trend will provide a long-term growth opportunity for MA. MA seeks to accelerate the shift from cash and checks to digital payments, taking advantage of underpenetrated markets and new verticals. Being involved in the transactions opens the opportunity to add other verticals, promoting more transactions. These other verticals are where I believe sustained revenue growth and the potential for further margin expansion will come from.

Let’s get into the basics for VAS revenue and emerging markets, MA’s main growth opportunities.

Value-Added Services

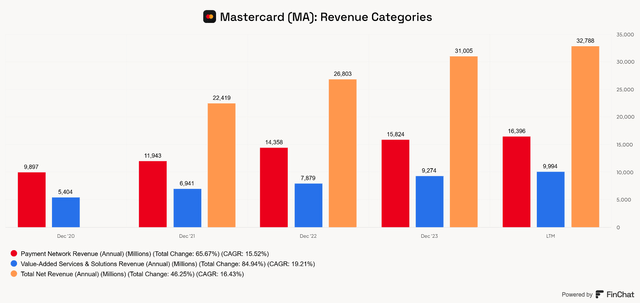

Mastercard divides its revenue into two categories: Payment Network Revenue and Value-Added Services & Solutions (VAS) Revenue. Despite impressive growth in payment network revenue (15.5% CAGR since 2020), VAS revenue appears to be the most tantalizing opportunity. VAS revenue has grown at a 19.2% CAGR since then.

Mastercard’s Value-Added Services & Solutions growth has outpaced its Payment Network Revenue growth (FinChat)

VAS encompasses solutions for cybersecurity, fraud prevention, data analytics, and consulting. VAS revenues tend to be subscription-based and recurring, delivering higher margin opportunities for Mastercard than its payment network category. This category continues to diversify the company from being a payments-only provider, lessening the risk of potential legal impacts that appear to be weighing on both Visa Inc. (V) and MA. VAS is also an important component of MA’s global growth strategy.

What Are Value-Added Services?

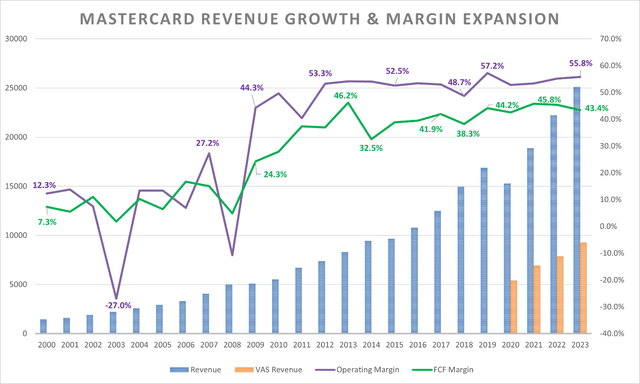

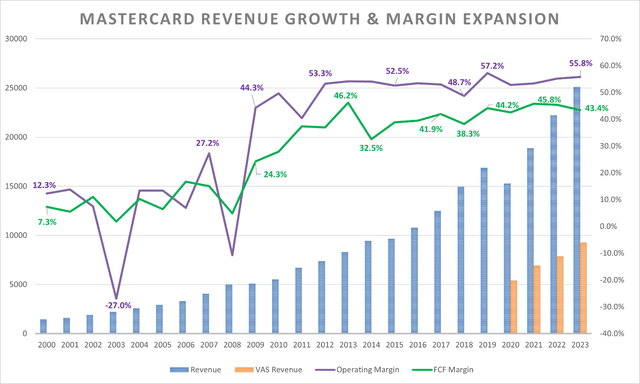

Before going further, let’s discuss the basics of VAS solutions. MA’s VAS solutions are a suite of products designed to enhance the core benefits of its payment systems and are fairly wide-ranging. VAS solutions weren’t originally a part of MA when it IPO’d in 2006. The 2009 acquisition of Orbiscom helped MA diversify away from being a payments-only provider, positioning the company to benefit from the growing shift towards e-commerce and digital payments. It also acquired Orbiscom’s technology platform, which appears to have kicked off MA’s incredible period of margin expansion coming out of the global financial crisis. The Orbiscom acquisition allowed the company to innovate in areas like virtual cards, prepaid cards, and spending control systems.

Below is a chart showing MA’s expansion in operating margin (purple line), free cash flow margin (green line), total revenue (blue bar), and VAS revenue (orange bar) since it started being reported separately in 2020. Notice that margins expanded significantly after the Orbiscom acquisition. Some of this was likely due to normalization coming out of a recession, and some was likely due to adding new verticals and higher margin revenue. We will come back to this chart soon.

Mastercard’s Expanding Margins (Author-generated, data from SEC filings)

MA’s Cyber and Intelligence Solutions provides multi-layered protection against fraud and cyber-attacks for both Mastercard and non-Mastercard products, helping financial institutions prevent fraud and protect assets. The “Prevent” layer protects against attacks on infrastructure, devices, and data, with technology live EMV chips and contactless payment technology. Its “identify” layer helps merchants and banks improve authenticity during payment processes, utilizing biometrics and behavioral data online. The “Detect” layer helps stop fraud and cyber-attacks once they are detected. MA’s “Experience” layer improves the security and speed of transactions, encompassing digital payments. The “Network” layer extends its services across all of Mastercard’s payment rails. MA leverages AI and data analytics to help its customers secure their digital assets across these layers to acquire insights and develop business strategies for customers looking for more.

With its Data and Services Solutions, MA helps customers leverage data and monitor KPIs to develop insights to improve decision-making and conduct business experiments. It provides consulting services to help customers use analytical insights to make better business decisions and improve business output, and enables the use of payment patterns recognition and insights to enable smaller businesses access to greater business capabilities, such as marketing solutions and merchant loyalty and rewards programs that can be personalized for each merchant to help drive customer engagement and improve business outcomes.

Additionally, Processing and Gateway Solutions offer secure e-commerce and mobile payment platforms, while Open Banking and Digital Identity platforms allow third parties to access and manage consumer financial data securely.

How This Helps Mastercard Grow

VAS can drive further margin expansion and revenue growth for Mastercard by adding new service verticals, diversifying revenue streams, enhancing customer engagement, and supporting global expansion. By offering premium services in cybersecurity, data analytics, and marketing, MA has reduced its reliance on core payment processing revenue and positioned itself for growth in emerging global markets and new and evolving financial areas such as open banking and digital identity. Integrating tailored solutions for fraud prevention, customer insights, and loyalty programs can deepen client relationships and make its payment network even stickier. In a time of payments disruption, innovation and adaptation is critical for a legacy payments company like Mastercard.

My investment thesis in MA has much to do with the company’s global growth strategy. VAS solutions appear to be a key part of the global growth thesis in Mastercard, as security and authentication may be more important in emerging markets with developing payment infrastructure. The rise of cybersecurity and fraud in MA’s established markets is an issue but will likely be an even greater issue to overcome in emerging markets. Rather than relying on others to be the solution, MA has created and now manages these solutions for its customers. This should help support global growth and strengthen MA’s network effect and economies of scope. Each added layer of solutions can be more profitable as part of the greater network than on its own. I believe that MA has a significant advantage over upstarts and even new payment technologies. Any disruption can likely be repelled before it scales MA’s moat. Any disruption that takes hold may just become part of MA’s business model.

VAS revenue has a greater potential to scale with lower infrastructure costs, giving it higher margins than payments revenue. Looking back, we can see that margins took off following the acquisition of Orbiscom. Though the rapid expansion phase of margins appears to be over, looking at the long-term history of MA’s financials, we see that the operating margin has expanded in recent years. VAS revenue increased from 35.3% of net revenue in 2020 to 37.8% in the TTM period. As this becomes a higher percentage of total revenue, MA may be able to expand margins a little more.

Mastercard’s Expanding Margins (Author-generated, data from SEC filings)

Global Growth Opportunity

According to Grand View Research, the global digital payment market could grow at a CAGR of 21.1% from 2024 to 2030. The key drivers of this trend are the increasing use of smartphones, expanded access to the internet, and increasing adoption of cashless transactions, and because governments worldwide are encouraging the use of digital payment methods, something frequently mentioned by MA management. The COVID-19 pandemic has accelerated the shift to digital payments.

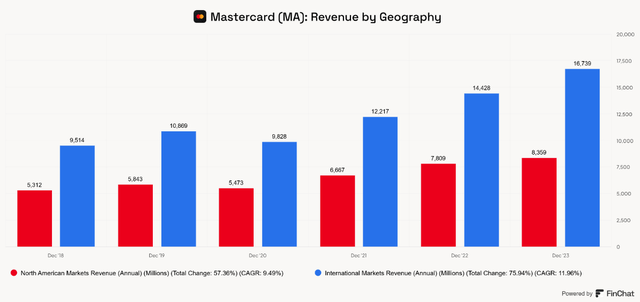

Established markets are where MA is currently winning, and emerging markets are where the big opportunity lies. By partnering with banks, governments, and mobile wallets, MA can reach unbanked people and capture payment and transaction volume as these populations transition from cash to digital payments. We already covered how the VAS solutions help MA make inroads into these markets. MA also makes inroads into emerging payment technology and solutions by investing in fintech partnerships, crypto and blockchain technology, B2B payments, and real-time payments. Investing in stronger markets has worked extremely well for Mastercard. The chart below shows the strength of MA’s international or global growth strategy.

Mastercard revenue by geography shows international growth (FinChat)

MA has grown its International market revenue at a 12.0% CAGR since 2018. This outpaces North American growth by 1.5% annually. With the rise of the global middle class and more technology-connected emerging markets, MA has billions of potential customers still using cash as an exclusive or primary means of payment. During the Goldman Sachs Technology conference, Miebach touted MA’s switching rates, saying the company improved from 55% to nearly 66%, showing that it is successfully penetrating these new markets. He also pointed out something every investor should know about MA. The opportunity for digital payments growth is much larger than global transaction growth or PCE growth because most global transactions still occur in cash; as MA helps shift more and more of these transactions to digital payments, it will take advantage of a market growth rate much higher than GDP or PCE growth.

As an example of MA’s opportunity, Miebach mentioned Africa during the conference. Africa has a population of 1.4 billion people, and 90% of transactions occur in cash. To varying degrees, this opportunity also exists in Asia, Central and South America, and Europe, providing the company with a long-term growth opportunity that modeling cash flows is almost a fruitless effort. On the one hand, the company is somewhat predictable; on the other, no one knows how long the company can continue to grow free cash flows at higher rates than global GDP. This creates an interesting asymmetric opportunity for investors. I’m not talking asymmetric like buying NVIDIA Corporation (NVDA) or Monster Beverage Corporation (MNST) twenty years ago, but perhaps decades-long market-beating performance with relatively low risk.

Risks

MA is dependent on the willingness of consumers to spend money. Recessions are a major risk to the business model, albeit a temporary risk. This is the biggest risk today. The Fed has initiated a rate-cutting cycle, lowering the Federal Funds Rate (FFR) by 50 basis points on September 18, 2024. This might be bullish in the immediate term, but stocks often fall in the aftermath of the initiation of rate cuts, at least until the cutting cycle slows or ends. Additionally, the increase in spending coming out of the COVID-19 pandemic might eventually normalize or be in that process now. Credit card balances have increased and consumers might pull back on spending if pessimism prevails in the economy.

Competition risk is not a major concern for me. There is plenty of room for both MA and V to continue dominating the market. Disruptive payment technologies are both a risk and an opportunity for MA’s market growth potential. As new technology arrives, MA appears to be successfully finding ways to capture market share.

Valuation

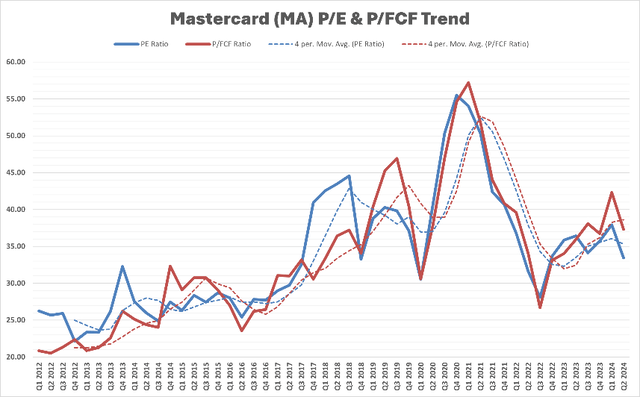

On the surface, Mastercard trades at a ridiculous premium. But when you realize that MA isn’t a bank or a finance company; it’s a tech company that does payments and consulting work, the valuation appears more reasonable. When you consider the company’s moat, growth trajectory, and long-term tailwinds, it almost looks attractive. As margins have increased over the years, the P/E and P/FCF multiples have expanded into the mid to upper thirties. In recent periods, the multiples have contracted into recent historical ranges.

Mastercard’s P/E and P/FCF multiple (Author-generated, data from SEC filings)

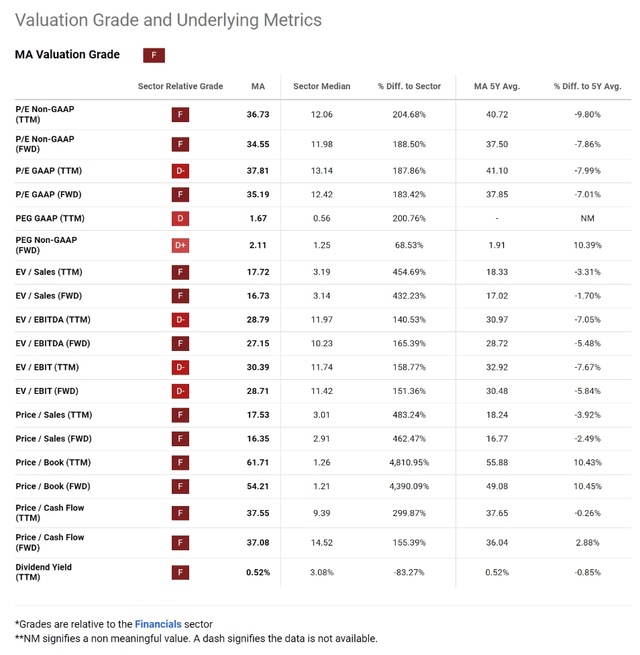

According to Seeking Alpha’s Valuation page, MA trades at a TTM P/E of 37.8 and a P/Cash Flow of 37.6 and receives an F grade. However, it’s important to note that MA is considered to be in the financials sector by Seeking Alpha, meaning that this valuation grade is not a great comparison.

MA Valuation (Seeking Alpha – Valuation)

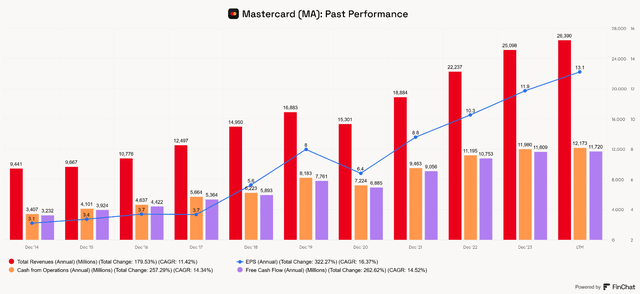

Cash Flows

Mastercard has grown revenue at an 11.4% CAGR and free cash flow at 14.5% CAGR since 2014. For my base case in my DCF model, I will use 14.5% as the estimated FCF growth rate.

Mastercard Past Financials (FinChat)

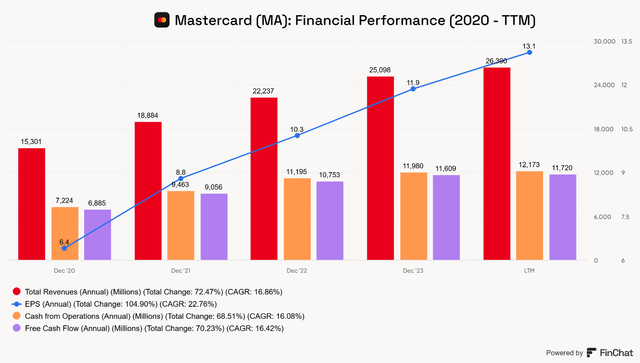

The company has experienced even better growth since the pandemic. Growing revenue at a 16.9% CAGR and free cash flow at a 16.4% CAGR. I will use 16.4% as my DCF bull case growth rate for free cash flow.

Mastercard Financials 2020-TTM (FinChat)

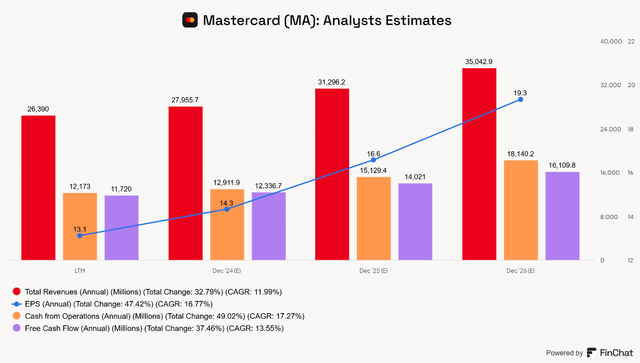

Analysts estimate free cash flow to grow at a CAGR of 13.6% over the next three fiscal years, but it’s important to note that OCF is expected to grow at a 17.3% CAGR. Let’s assume that the economy is shaky, and growth rates come down. I will use a 12% FCF CAGR for my DCF bear case, which is more bearish than analysts, reflecting conservatism and risk of recession and decreased consumer spending.

Analysts Consensus Forward Estimates – Mastercard (FinChat)

Mastercard’s Discounted Cash Flow Model

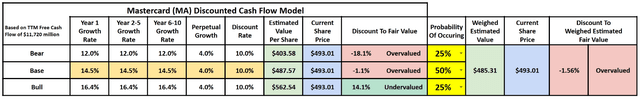

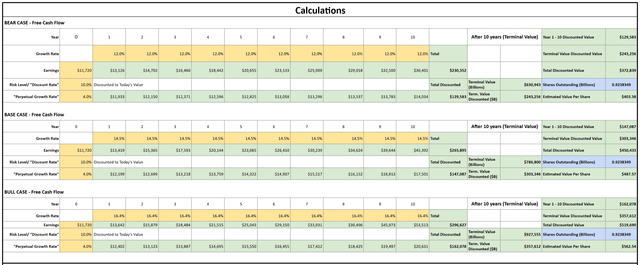

In my model, I am using MA’s TTM free cash flow of $11.72 billion as my base to build off; a 10.0% discount (hurdle) rate, and a 4.0% terminal or perpetual growth rate after the initial ten-year period. I already outlined how emerging market growth could help MA sustain free cash flow growth for a long time and how VAS revenue could help MA expand free cash flow margin. Therefore, I believe that a 4.0% terminal rate is warranted and potentially conservative. I weighted the base case to a 50% probability of occurrence and the bear and bull cases to 25% each.

Mastercard Discounted Cash Flow Model (Author-Generated DCF Model)

Based on the above assumptions, MA is slightly overvalued, but only by roughly 2%. The asymmetric part of my investment thesis is that Mastercard could grow free cash flows at a rate higher than 4% annually, well beyond the initial ten-year period. If this happens, the stock could be significantly undervalued in the base case scenario and an absolute steal in the bull scenario. If this happens, it could also be fairly valued even in the bearish growth scenario.

DCF Calculations (Author-generated DCF Calculations)

Conclusion

Mastercard is well-positioned to capture significant market share in emerging markets and newer payment technologies, and its moat appears strong enough to protect its significant advantage in its current markets. After building a diversified revenue stream the company has expanded margins dramatically since a key acquisition in 2009 that helped change the company’s trajectory. Though MA is already well-optimized for free cash flow generation and holds a 43.4% FCF margin, further expansion is still possible as VAS revenue grows and takes on a larger percentage of total revenue.

If Mastercard is a true DCF breaker from here and capitalizes on the extremely long potential for global digital payments and related services growth, the stock may be a great buy at today’s prices. Even at the current valuation of roughly 38x P/E and FCF, the asymmetric upside potential makes Mastercard an attractive long-term buy, with room for market outperformance in both bullish and bearish scenarios. I rate the stock as a buy and would rate it a strong buy if the price falls another 10% to 15% without the investment thesis being challenged.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, NVDA, V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.