Summary:

- McDonald’s value meal promotion extension aims to attract cost-conscious consumers, leveraging its mobile app’s success.

- Despite a recent earnings miss, McDonald’s management provided solid guidance, with expectations of mid-to-high 40% operating margins and a 90% free cash flow conversion rate.

- I see shares as being fully valued with technical resistance at $300, and while it deserves a premium valuation, its EPS growth potential is modest, cementing my hold rating.

- Key risks include weaker global macro conditions, higher inflation, a stronger US dollar, and competition from other fast-food chains and weight loss drugs.

M. Suhail

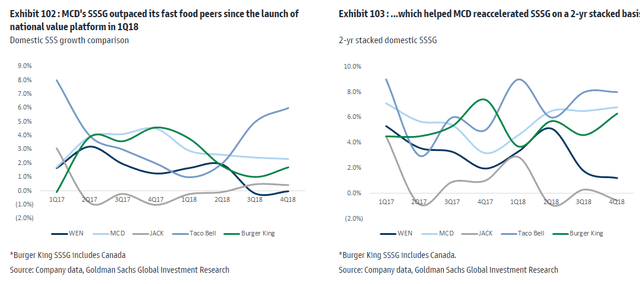

McDonald???s (NYSE:MCD) is doubling down on its value meal promotion. The $5 meal deal was an apparent success to draw in cost-conscious consumers as inflation, while slowing, remains uncomfortably high for households. The team at Goldman Sachs recently put out a note rehashing MCD???s playbook from 2018, when it embarked on a similar value focus.

The results were successful, resulting in stronger same-store sales growth (particularly compared to its fast-food competitors). The campaign also improved top-line readings on its two-year stack.

This time around, investors have taken a bullish stance on the meal deal initiative. What may be different today, however, is that McDonald???s has greater penetration with its mobile app, which has generally led to more frequent purchases by many of its users; digital sales now account for more than 40% of its top market sales with 166 million members.

I have a hold rating on MCD, though. I see the stock as fully valued while its chart shows resistance at a key level.

Historical Perspectives: Strong Sales Growth in 2018 After A Value Promo Push

Back in July, the $213 billion market cap Consumer Staples company reported a weak set of quarterly results. Q2 non-GAAP EPS of $2.97 fell shy of the Wall Street consensus outlook for $3.07 of per-share earnings. McDonald???s also missed modestly on the top line, with revenue of $6.5 billion, flat from the same period a year earlier, and below the street’s target of $6.63 billion.

Its global comparable-store sales fell 1% with decreases in all of its segments, highlighted by a ???0.7% dip in US revenue; The sell-side had forecast a 1% rise in comp-store sales. Negative guest counts hurt domestically, while geopolitical events overseas weighed on the International segment. A strong dollar during the second quarter was likely a negative factor, too, though recent weakness in the greenback could turn into a tailwind for the upcoming report.

But its management team issued pretty decent guidance ??? the Chicago-based multinational sees (as of the July report) full-year operating margins in the mid-to-high 40% range with a free cash flow conversion rate of around 90%. While the Q2 numbers fell short of estimates, the stock rallied by almost 4% in the session that followed, perhaps as investors eyed stronger potential profits from better guest counts given the $5 meal deal campaign.

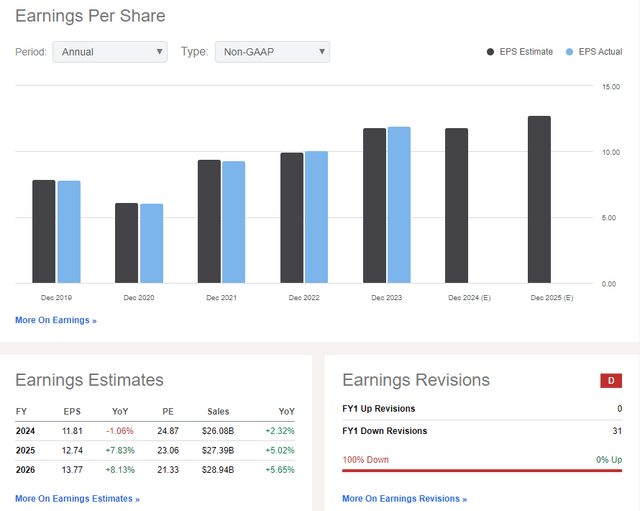

Indeed, it was the best earnings reaction in at least the last three years, according to data from Option Research & Technology Services (ORATS). Still, there has been a slew of negative EPS forecast changes in the last 90 days. For the upcoming Q3 report, the options market prices in a 3% swing with EPS forecast to come in at $3.18.

Key risks include weaker global macro conditions, higher-than-expected labor cost growth, a stronger US dollar, and heightened competition as other fast-food chains put forward value meal bundles. Weaker sales could come about amid the proliferation of GLP-1 weight loss drugs from the likes of Eli Lilly (LLY) and Novo Nordisk (NVO).

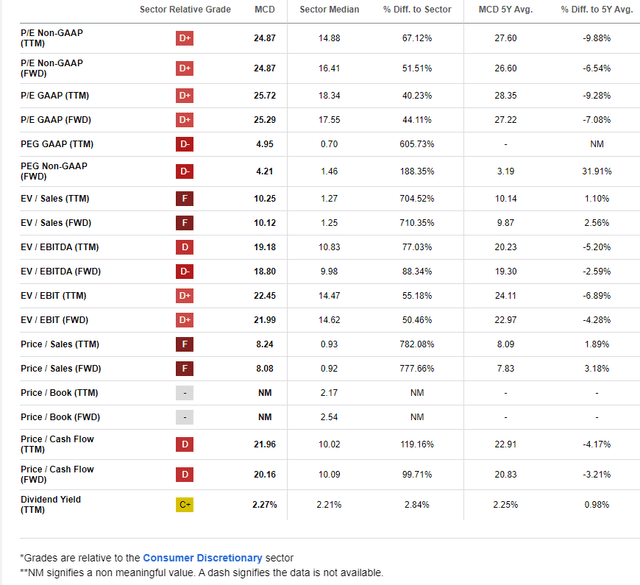

On the earnings outlook, MCD operating EPS is seen dropping modestly this year, but per-share earnings are expected to rise by nearly 8% in the out year with that pace persisting into 2026. Sales growth is seen in the low-to-mid single digits. Its earnings multiple is thus elevated in the mid-$20s and the firm???s free cash flow yield is somewhat low at 3.3% today.

McDonald’s: Revenue, Earnings, EPS Revision Trends

On valuation, given the modest EPS growth rate, a mid-20s P/E is arguably rich. That???s a PEG ratio above 4 ??? significantly above both the sector median and MCD???s own premium-PEG history. If we grant MCD 8% EPS growth and assign a PEG of 2.7, between MCD???s recent average and the sector median, then the applicable P/E would be about 22.

Assuming non-GAAP EPS of $12.50 over the next 12 months and using the 22x multiple, then shares should trade near $275, making shares slightly overvalued. MCD also sells close to its historical price-to-sales ratio.

MCD: Premium Valuation Metrics

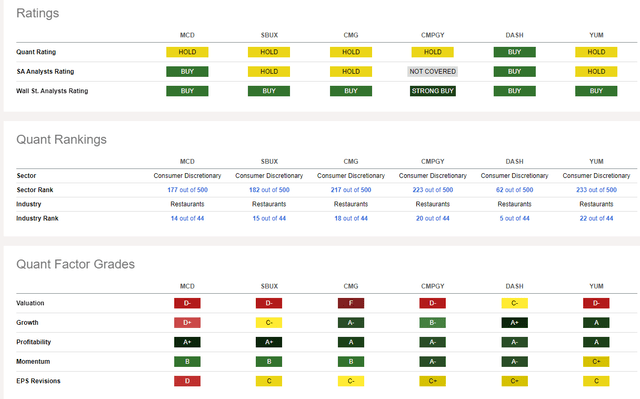

Compared to its peers, MCD features a weak valuation rating, though its pristine brand presence and healthy balance sheet warrant a premium valuation to the broad market.

What we don???t see, however, is high long-term EPS growth potential, but with consistent free cash flow and reliable profitability trends, the stock is high-quality. EPS revisions have been decidedly negative in the past 90 days, though, despite robust share-price momentum.

Competitor Analysis

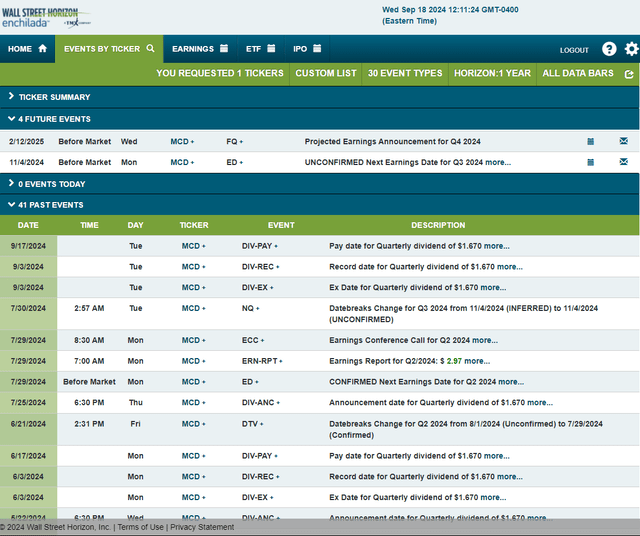

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of Monday, November 4 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

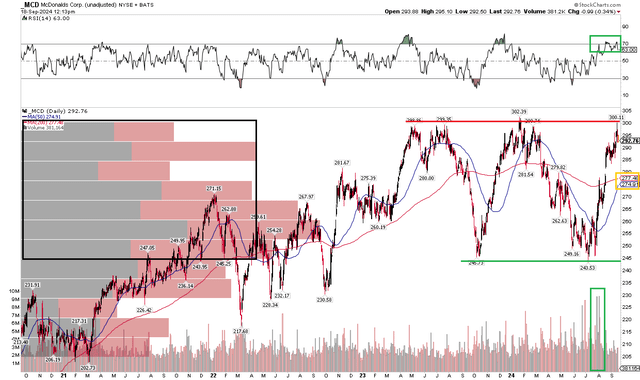

The Technical Take

With a premium valuation and optimism around its value-meal bundle and recent relative strength in the defensive Consumer Staples sector, MCD is right near its all-time high. Notice in the chart below that shares continue to meet selling pressure around the $300 mark. That???s where MCD pulled back from during the middle of 2023, in Q1 of this year, and just a few days ago. If we see a breakout through that spot, then an upside measured move price objective to about $365 would be in play based on the height of the current trading range. Support is seen between $243 and $246.

Also take a look at the long-term 200-day moving average ??? it’s about to cross above the shorter-term 50-day moving average in what would be a golden cross pattern. You might hear about that on financial TV in the coming weeks. But the 200dma is merely flat in its slope, suggesting that there???s an ongoing battle between the bulls and bears. With a high amount of volume by price under today???s stock level, there should be a decent amount of support on pullbacks.

Overall, MCD???s chart suggests a hold with resistance apparent at $300 and support down in the mid-$200s.

MCD: Persistent Trading Range, Upside Breakout Would Target $365, Flat 200dma

The Bottom Line

I have a hold rating on MCD. I see the stock as deserving of a premium valuation multiple, but it???s certainly not a bargain in light of current EPS growth expectations. The technicals, meanwhile, are likewise lukewarm with key resistance in play ahead of earnings next month.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.