Summary:

- On the recent Investor Day, McDonald’s management shared its plans to accelerate new restaurant openings.

- McDonald’s is executing well focusing on menu enhancements, value offerings, and growing digital channels, and this new restaurant opening plan should further add to sales growth.

- Margin outlook is also attractive and the valuation is lower than the historical average.

hanohiki/iStock Editorial via Getty Images

Investment Thesis

McDonald’s Corporation’s stock (NYSE:MCD) is up slightly since our previous coverage in August. The company has seen several positive developments since our last coverage including better-than-expected earnings and recently communicated plans to accelerate new restaurant openings (shared on investor day). We continue to see good growth prospects for the company driven by consumer trade downs in an inflationary environment, the company’s execution in terms of core menu enhancement, and growing digital channels and plans to accelerate new restaurant openings.

On the margin front, the company should benefit from moderating inflation, lower franchise assistance costs, productivity gains, and improving execution. So the company’s revenue and margin growth prospects remain encouraging. Furthermore, the company’s valuation is also favorable with the stock trading below the historical average P/E multiple. This favorable valuation along with good growth prospects makes the company a buy.

Revenue Analysis and Outlook

In my previous article, I discussed McDonald’s good growth prospects ahead, benefiting from price increases, good demand for takeaway and quick-service restaurants (OSR), value offerings, and growing digital channels. Since then, the company has reported earnings for its third quarter of 2023, and similar dynamics were seen there as well.

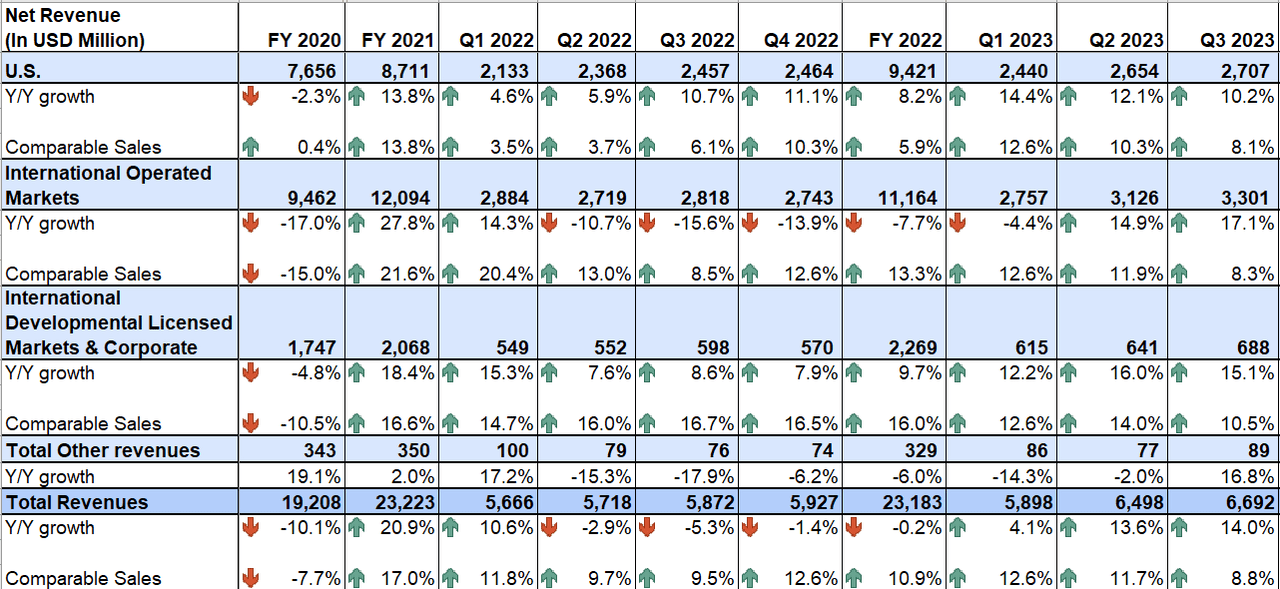

In the third quarter of 2023, the company’s revenue growth saw an increase in average check growth due to the carryover benefit of price increases taken earlier in the year. In addition, good consumer traction as a result of effective marketing campaigns and strength in digital platforms also helped the company’s sales. This resulted in a 14% YoY increase in sales to $6.69 billion, while on a constant currency basis, sales increased by 11% YoY. On a same-store sales basis, global comparable sales increased by 8.8% YoY. The increase in comparable sales reflected a 10.5% YoY same-store sales growth in the International Developmental Licensed Markets & Corporate segment, an 8.3% YoY same-store sales growth in the International operated Markets, and an 8.1% YoY same-store sales increase in the U.S.

MCD’s Historical Revenue (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering revenue growth as it benefits from acceleration in store openings, good demand for affordable food options in an inflationary environment, value meal offerings and menu enhancement, growing digital platforms, and carryover benefits of recent price increases.

On its recent investor day, the company shared its encouraging new unit opening plans with a target to reach 50,000 restaurant counts by FY27. The company’s total units increased from 37,241 at the end of FY2017 to 40,275 at the end of FY22. The company accelerated in unit opening this year and has guided for 1500 net new restaurant openings (~1900 gross) in FY23. This pace is expected to accelerate further in the coming years and, by FY2027, the company is planning to open 900 gross units in the U.S., 1900 gross units in the International Operated Markets, and 7000 gross units (with over half in China) in International Development Licensed Market to meet management targets which bodes well for revenue growth. In addition to these new McDonald’s restaurant opening plans, the company is also testing CosMc’s restaurant for its coffee offerings and plans to open 10 test stores in 1H24. If successful it can be a meaningful long-term driver for sales as coffee is a big market.

In addition to encouraging new store opening plans, the company is also seeing strength in same-restaurant sales as it benefits from consumer trade down in an inflationary environment.

Despite tight consumer budgets, the QSR industry seems to be doing well in an inflationary environment due to its affordable food options. In an inflationary environment, consumers tend to look for affordable alternatives for dining out and this leads to trade-downs from full-service restaurants to quick-service restaurants. MCD being the QSR giant is benefiting from this trend of changing consumer preferences.

Moving forward, the macroeconomic environment is expected to remain challenging as inflation while moderating, is still high, making consumers more cautious about their spending choices. This situation is expected to benefit the demand for a budget-friendly QSR industry and this should continue to help the company in delivering sales growth moving forward.

In addition to demand trends, the company is also actively focusing on providing value offerings to attract more consumers to the brand. As I mentioned in my previous article, the company, in the first quarter of 2023, MCD introduced the McSmart menu in Germany, refreshing its value bundles to offer smaller, more affordable meal options for customers focused on value and budget considerations. This initiative contributed to Germany achieving its highest-ever sales in the second and third quarters of 2023. The success prompted the expansion of this offering to the UK market, resulting in increased customer traffic during the quarter. The strategy of presenting smaller, budget-friendly bundles featuring core menu favorites, along with the introduction of new permanent value offerings, is getting adopted in various markets and gaining good traction which should continue to help sales.

Furthermore, the company is also focused on menu enhancements to keep providing more compelling value meals to customers. These enhancements are helping the company increase its market share. A good example is the McCrispy Chicken Sandwich, which, after its initial launch in 2022, has become a $1 billion brand across multiple markets. MCD recently introduced McCrispy in Australia and, according to management, it is showing promising early results, boosting chicken category sales and bringing renewed attention to the chicken portfolio. Similarly, in the U.K., fresh variations of global favorites, such as the McCrispy Deluxe, were introduced in the third quarter alongside the McCrispy and the McSpicy, further increasing traction around chicken offerings. These ongoing improvements, especially in chicken items, should continue to enhance market share and drive sales growth.

Additionally, the company is also focused on driving guest traffic through digital platforms. Throughout the year, MCD has launched various promotional and value offerings through its digital app which is helping in increasing customer engagement. For example, the company extended its McSmart menu strategy to its digital app, introducing a Your Remix Your Deal campaign exclusively in the app within the German market. This initiative enabled customers to create their customized small bundles. In addition to affordability, the promotion provided the desired personalization for customers, leading to a boost in customer engagement, which was reflected in the addition of an extra 1 million 90-day active loyalty members in the third quarter in the German market.

Moreover, the company reintroduced its MONOPOLY game, a promotional game, on its digital application globally, enhancing customer engagement. The initiative began in Australia, where MONOPOLY contributed to a rise in digital sales for the quarter, driven by increased app registrations and higher game-piece redemptions. Other markets also benefited from this game, as the promotion led to significant increases in both app downloads and registrations.

Across MCD’s top 6 markets, digital sales accounted for over 40% of system-wide sales, nearly reaching $9 billion for the third quarter. The company now has over 57 million 90-day active members, up ~10% sequentially, across these top markets, contributing to the continued growth of the digital channel. Furthermore, these active members are also helping the company with consumer insights regarding their changing preferences, food choices, and no. of visits. This should help the company in providing tailored value propositions to customers and also help MCD prepare for sudden changes in consumer demand moving forward.

In addition to these factors, the company’s sales growth should also benefit from the carryover impact of price increases taken earlier this month. Overall, I remain optimistic about the company’s revenue growth prospects ahead.

Margin Analysis and Outlook

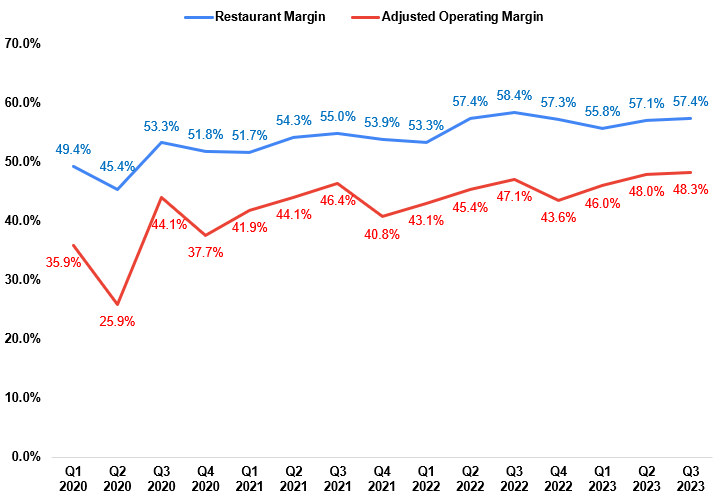

In the third quarter of 2023, the restaurant margins continued to face pressure from inflationary food and labor costs. However, the company’s asset-light business model helped partially offset these inflationary headwinds as the majority of the company’s profit is contributed through its franchises. In addition, MCD also saw benefits from sales leverage, price increases, and improved execution. All these benefits combined resulted in a 120 bps YoY increase in the adjusted operating margin to 48.3%.

MCD’s Historical Restaurant Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, I believe the restaurant-level margins as well as the company’s operating margin should improve in the coming quarters. The cost of major raw materials like flour, chicken, beef, and cheese are off from their peak levels and have begun to moderate. This should result in favorable year-over-year cost comparison moving into the next year, and help margin growth. Moreover, as inflation moderates, the franchise’s cash flow and profitability should also improve. This implies that the company should normalize its costs associated with assisting franchises in managing their cash flows in an inflationary environment. So, I expect lower costs (as compared to fiscal 2023) related to franchise assistance should help operating margin growth in the coming year.

In addition, the company is also focused on improving the execution and productivity of day-to-day operations. MCD is working to make the digital ordering process to help restaurant staff track orders more accurately using location data. Employees at the restaurant can begin preparing orders ahead of customer arrival, ensuring that the food is fresh and ready for pickup, thereby increasing the service. This boosts productivity in restaurants. These efforts, according to management, led to a reduction in service time in the third quarter. The company plans to continue identifying ways and investing in productivity to improve its restaurant operations in the coming year, further enhancing execution. Moreover, employee turnover has gone down compared to the previous year, suggesting that new hiring and training costs should also go back to normal in the coming year. This should also improve the productivity of existing staff as they become familiar with their day-to-day tasks. So, I am optimistic about the restaurant level as well as the company’s operating margins ahead.

Valuation and Conclusion

McDonald’s is currently trading at 22.92x FY24 consensus EPS estimate of $12.51, which is below the historical 5-year average forward P/E of 26.86x. I believe the company has good growth prospects as it accelerates its new unit openings. The company also continues to benefit from demand trends favoring the QSR industry in an inflationary environment. In addition good consumer traction to its value offering, growing digital channels, moderating inflation, and improving execution should also contribute to the overall growth of the company in the coming year. Moreover, the company also offers a 2.34% forward dividend yield, which together with lower-than-historical valuation and good growth prospects, makes the company a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.