Summary:

- The company experienced strong double-digit growth across all regions and expects to continue taking share through the balance of 2023.

- The company is focused on expanding its margin by leveraging its franchise model to enhance its company-level operating margins.

- Investors have high growth expectations for restaurant stocks.

- Its high valuation may not be tenable if inflation slows down, but investors seeking to hedge against inflation risk may consider investing in McDonald’s stock when the stock pulls back.

yaoinlove/iStock Editorial via Getty Images

Company Profile

McDonald’s Corporation (NYSE:MCD) is a well-known and globally recognized fast-food restaurant chain. In 115 countries, it operates 40,535 restaurants under a franchise system (2,118 company-operated restaurants).

Key Takeaways from Q1 2023 Earnings

Expand margin by leveraging its franchise model

The company grew total revenues by 8% const currency. Its global comparable sales increased by 12.6%. Systemwide sales increased by 13% const currency. Operating Income increased by 14% const currency.

The company grew strong double digits across all regions. The growth was balanced between check and guest count, according to the management, with two-thirds from the check and a third from the guest count. The company saw a slight decrease in units per transaction and some resistance to pricing. The company stated that the first quarter benefited from lapping Omicron and favorable weather in January. The company expected to continue the momentum and take market shares through the balance of 2023.

Its company-operated restaurant’s revenue declined by 3% in the quarter and related operating expenses declined by 2%. This indicated a decline in operating margin in the quarter. Its company-level margin was slightly below expectations despite strong top-line results due to higher-than-anticipated inflation levels.

However, 95% of its restaurants were franchised restaurants in Mar 2023. The franchised business model can generate more stable and predictable revenue with less volatility. It is less sensitive to changes in restaurant-level operating costs.

Thus, the company had an aggressive growth strategy to sustain its top-line growth to increase its operating margin.

We think the company can sustain its growth as the company maintained competitive pricing in comparison to its peers. Also, the company can grow through the consumer trade-down. There is room for TAM expansion by appealing to a wider range of customers who are looking for good value.

Restaurant-level margins under pressure near-term

There are several uncertainties and headwinds to navigate. The company expected a mild recession in the US and a more challenging environment in Europe compared to the US in 2023.

The company expected the food and paper commodity inflation in the US to decline from the mid-teens rise in 2022 to mid- to high-single digits in 2023. However, the situation in Europe is expected to be different. The company expected the food and paper commodity inflation to remain in the mid-teens in 2023.

In an effort to support its franchisees amidst the challenging business landscape, the company provided substantial aid amounting to $100-150 million in rental abatement to franchisees located in Europe. The aim of this financial assistance was to enable the franchisees to maintain their focus on executing the company’s strategic plans and to explore growth opportunities that align with their business objectives.

Based on the cadence of the inflation trend provided by the management, its US restaurant-level margins can be improved in the second half. Also, the company had seen a sequential improvement in restaurant-level margins in both franchised and company-operated stores.

Initiatives to increase company-level margins

The company took steps to leverage its SG&A expenses by focusing on higher revenue growth. This can further improve its company-level margins.

Moreover, the company launched an internal initiative called “Accelerating the Organization“. The company invested in marketing, digital channels, and delivery to improve customer experience and maintain its competitive advantage.

The company generated 40% of its revenues through digital channels. By focusing on the growth of its digital channels, the company can improve the convenience and accessibility of its services. Enhancing the customer experience can have a positive impact on customer loyalty, leading to lower marketing costs for the company and ultimately improving the company’s profit margin.

Delivery services can enhance the overall customer experience but at costs. The associated costs may limit the affordability for some customers. So, we think that adding a delivery service can only boost the company’s profit margin if it is advertised to more affluent customers who are willing to pay for the extra convenience.

Valuation and Catalysts

The company repurchased $3.9 billion of its stock in 2022. As of Mar 2023, the availability of share repurchase was $8.8 billion. The size of its share repurchase program is not large. Hence, the majority of stock return is from dividends (dividend yield 2.07%) and stock price appreciation.

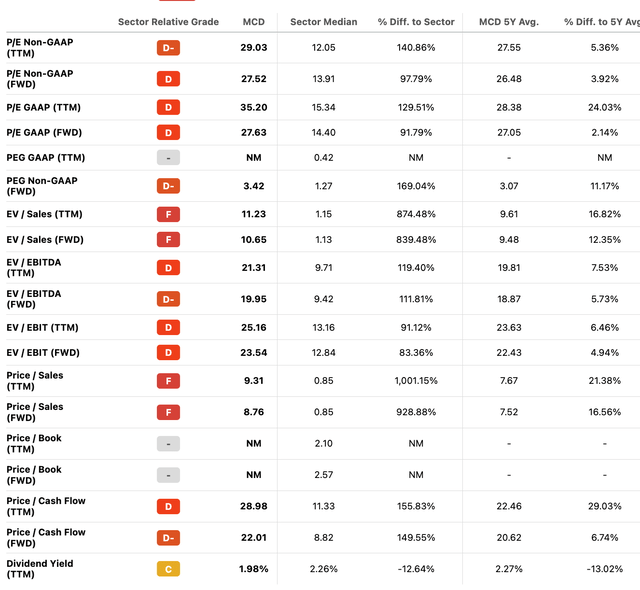

Most of its valuation multiples trade above its 5-year average and sector median. MCD stock’s 1-year return was 15%, roughly equal to its operating income growth.

The upside potential from multiple expansions can be driven by two key factors: an increased Total Addressable Market (“TAM”) due to consumer trade-down, and operating margin improvement resulting from the leverage of its franchise model.

Valuation Multiples (Seeking Alpha)

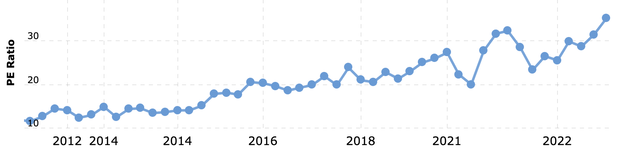

The below charts showed that its P/E ratio of 29x is relatively high compared to its historical P/E ratio.

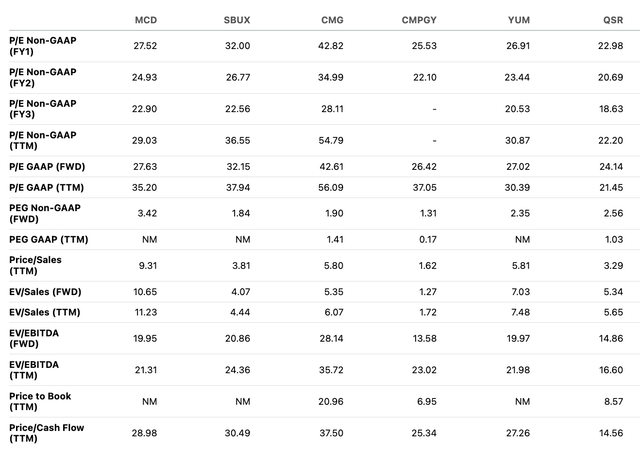

Its 2024 and 2025 FWD P/E ratios are 24.9x and 22.9x. This indicates that the market expected the company grows earnings rapidly over the next three years. Upon analysis, it has been observed that the majority of competing restaurants in the market have 2025 FWD P/E ratios exceeding 20x. This indicates that investors have high growth expectations for these companies.

Historical P/E ratio (Macrotrend)

Valuation multiples of its peers (Seeking Alpha)

One of the high growth scenarios in this context of inflation is the ongoing price rises in restaurants. Investors looking for a hedge against inflation risk may consider investing in MCD stock.

In an environment of inflation, companies with cost advantage may win the race. McDonald’s cost leadership position allows it to maintain its comparatively cheap menu prices. Its cost leadership position and franchised business model provide better downside protection compared to other peers. Under the franchised model, the company receives fees as a percentage of sales and is less sensitive to changes in restaurant-level operating costs.

In addition, for investors seeking to hedge against inflation, we suggest adding a position when the stock pulls back by 20%, a technical buy level.

Summary

The company is focused on revenue growth in the midst of macro uncertainty to enhance its company-level operating margins. Margin expansion and increased TAM from consumer trade-down can boost valuation multiples.

Investors have high growth expectations for restaurant stocks. McDonald’s franchise business model provides investors with better downside protection compared to other restaurant stocks.

However, its valuation is not cheap at the moment. For investors seeking to hedge against inflation, we suggest adding a position when the stock pulls back.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.