Summary:

- McDonald’s remains a dominant player in the global fast-food industry, with more than 38,000 locations in 100-plus countries.

- Strategic focus areas include digital transformation, product enhancements, and store growth to sustain growth and shareholder value.

- Despite a strong market position, risks include rising labor costs, supply chain disruptions, and evolving consumer preferences impacting profit margins and growth.

- This analysis focuses on the real value of McDonald’s stock and if it’s a good investment at this time.

M. Suhail

As of mid-2024, McDonald’s Corporation (NYSE:MCD) continues to be one of the top fast food chain businesses in the world. Globally, it has more than 38,000 locations throughout more than 100 countries. The company continues to execute on its global strategic strategy to stay a step ahead of its competition.

McDonald’s has four key areas it’s trying to win in digital transformation, new product offerings, supply chain improvements, and store growth, including opening new locations and renovating existing ones. These initiatives should drive long-term strategic value for shareholders and lead to improvements in the stock price.

On the downside, McDonald’s faces rising labor costs and supply chain issues that directly impact profit margins. Other competition from fast-food chains such as Sweetgreen continues to increase as evolving consumer preferences toward healthier options. Lastly, digital transformation or new store expansion is very capital intensive, and any execution issues could hinder growth prospects, affecting long-term investor value.

When considering these current stories about McDonald’s, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Overall, McDonald’s continues to innovate, positioning itself to grow its market share vs competitors. The company’s strategic focus on digital transformation, menu innovation, operational efficiency, and global expansion showcases potential long-term growth and shareholder value.

Changing customer preferences and rising labor costs are eroding McDonald’s current profit and sales as healthy habits continue to change consumer lifestyles. Additionally, any setbacks in its digital transformation efforts or store openings could crater its return on investment. Monitoring these factors and any directional changes in these initiatives will be crucial for assessing the stock’s potential.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you determine if McDonald’s is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. McDonald’s shows a rating score of 45.375 out of 100. This is quite low, but also does not account for ROE and ROIC of McDonald’s, making the total score lower than expected. Part of the reason for the low score is because McDonald’s ROE and/or ROIC has been negative in the past five years. This special circumstance will be explained more in the ROE and ROIC sections further below.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer)

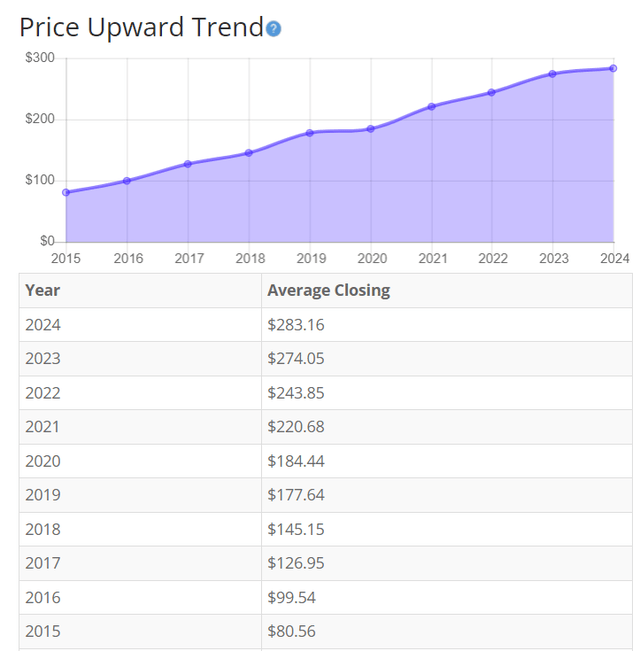

Fundamentals

McDonald’s share price has experienced significant growth because of its continued excellence in innovation. Starting around 2015, the stock rose due to implemented strategies, specifically menu innovations and digital transformations. Despite extreme market volatility and evolving consumer preferences, the share price trended upward with a new high in 2019, reaching new highs by 2019. The pandemic in 2020 introduced a short-term stock price reduction, but McDonald’s rebound was swift as the company changed with enhanced digital capabilities and operational adjustments. Overall, the long-term trend has been positive, highlighting the company’s resilience and ability to drive shareholder value. Overall, the share price average has grown by about 251.48% over the past 10 years, or a Compound Annual Growth Rate of 14.98%. This is an impressive and consistent long-term return.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Price Per Share History)

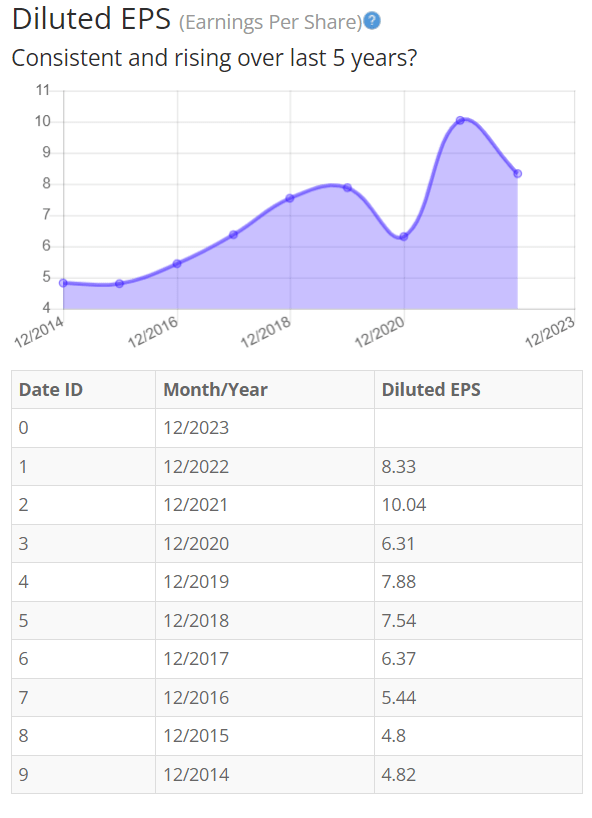

Earnings

McDonald’s earnings have generally shown a positive trajectory, showcasing the staying power of this company. COVID-19 represents the only blemish on McDonald’s EPS over the past nine years, and quickly showed it was an anomaly as EPS grew after. Over the most recent years, McDonald’s has reported stable and robust earnings, reflecting its ongoing strategic focus and resilience in the face of evolving market conditions. The recent downtrend is likely driven by market saturation and sales declines due to increased competition and changes in consumer preference.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – EPS History)

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

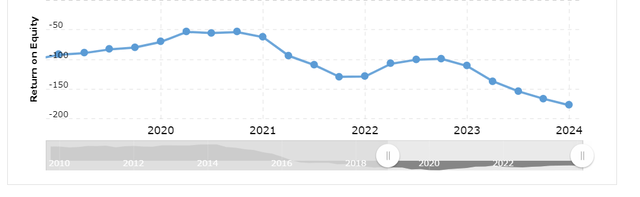

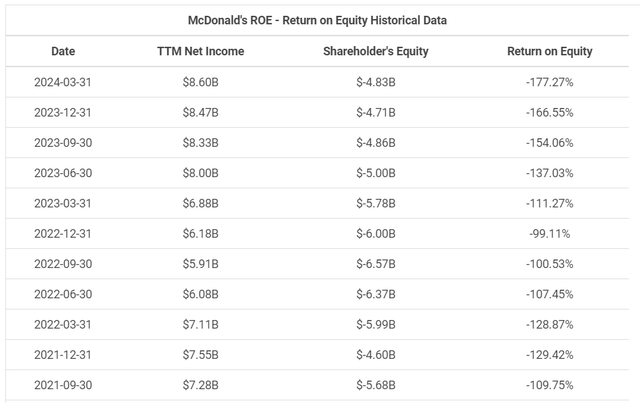

Return on Equity

The return on equity has remained negative over the last five years. A negative return on equity – ROE – may raise alarm bells for investors, but a closer look at the financials reveals explanations. McDonald’s focus on aggressive store growth and expansion has necessitated substantial long-term debt and capital leases. Due to these circumstances, a shareholders’ deficit is created, reflecting negative equity. Additionally, the company’s stock buybacks and dividends have further impacted ROE, as McDonald’s has used debt to repurchase shares, effectively reducing equity. Until recently, this negative ROE was not due to declining net income, but rather the result of financial strategies and balance sheet dynamics. However, recent quarters have seen a decline in both top and bottom lines, further affecting ROE. This complex financial scenario highlights the impact of McDonald’s growth strategies and capital allocation decisions on its overall financial metrics. For return on equity, I look for a five-year average of 16% or more. So, McDonald’s does not meet this requirement. The other drawback is that the ROE has been declining over the past three years.

Macrotrends

Macrotrends

Return on Invested Capital

The return on invested capital shows an increasing trend over the last five years. The company has increased capital expenditure year-over-year. McDonald’s invests in digital transformations and remodels of its stores to capture market share and remain innovative. McDonald’s high ROIC is because of its efficient operations, strong brand, and capital investments in store growth and digital initiatives. Optimizing its capital expenditures and leveraging its robust franchise model has been instrumental to maintaining a healthy ROIC. Recent fluctuations in ROIC may be influenced by macroeconomic factors, investment strategies, and capital structure adjustments. But overall, McDonald’s continues to demonstrate a solid ability to generate returns on its invested capital.

For return on invested capital, I look for an average of 16% or more. MCD’s three-year ROIC is 15.31%, its five-year ROIC is 13.98%, it’s 10-year ROIC is 15.68%. So, even though McDonald’s past average ROIC is under the 16% mark, when we remove the anomaly of COVID years, and look at its increasing ROIC trend and its past 12 months ROIC of 17.32%, it’s on track to be above the 16% desired mark.

FinanceCharts

FinanceCharts

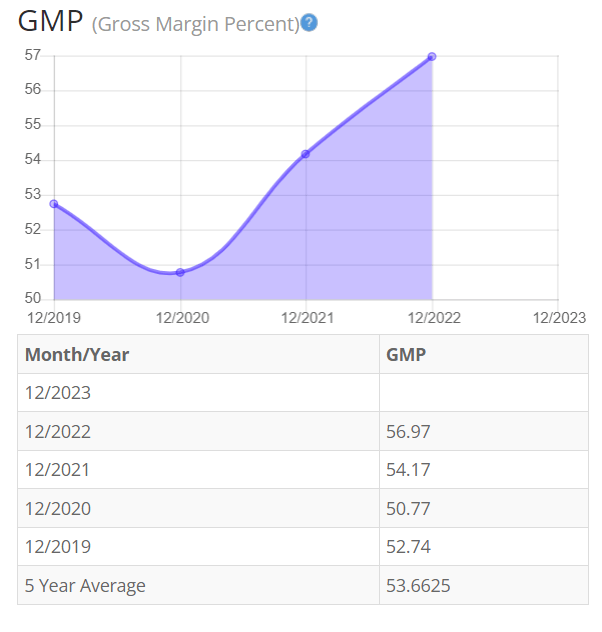

Gross Margin Percent

The gross margin percentage (GMP) has remained stable over the last five years, outside the recent cost improvements in optimizing the supply chain. McDonald’s has high gross margins due to its efficient supply chain driven by its economies of scale and strong brand pricing leverage. McDonald’s continues to maintain strong margins in a normally tough business industry. I expect continued excellence in margin over the short and long term.

I typically look for companies with gross margin percent consistently above 30%. So, McDonald’s is above this criterion.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Gross Margin Percent History)

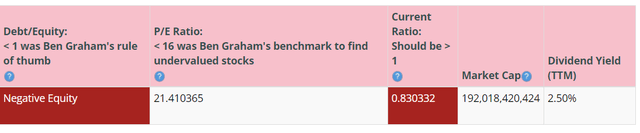

Financial Stability

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. The company continues to increase its long-term debt obligations while utilizing its retained earnings and cash to repurchase stocks and give investors dividends. This strategy works as long as the stock continues to grow and provides a level of liquidity for McDonald’s.

McDonald’s Current Ratio of 0.83 indicates it could struggle to pay off its short-term debt. The current ratio has improved in recent years bringing it back above one making it able to pay of short-term liabilities.

Ideally, we’d want to see a Current Ratio of more than 1, so McDonald’s exceeds this amount.

McDonald’s carries a large debt load, yet does show it’s capable of paying off its liabilities. Low debt interest rates allow it to leverage excess earnings for share repurchases rather than prioritizing debt repayment in the short term. This strategy is likely to persist if the stock price continues to rise and the interest rates on the debt remain favorable compared to the benefits of repurchasing shares. McDonald’s financial approach highlights its strong competency to manage debt while enhancing shareholder value through capital allocation.

McDonald’s pays a regular dividend of around 2.5%.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Misc. Fundamentals)

This analysis wouldn’t be complete without considering the value of the company vs. share price.

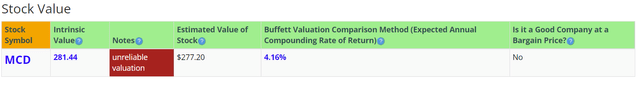

Value Vs. Price

The company’s price-earnings ratio of 21.41 indicates that McDonald’s is overpriced when comparing McDonald’s ratio to a long-term market average P/E Ratio of 15.

However, when compared to its trailing P/E ratio of 23.3 over the last 10 years, shows that McDonald’s could be currently selling at a slight bargain.

The 10-year and five-year average P/E ratio of MCD has typically been 26.2 and 28.3, respectively. This indicates that MCD could be currently trading at a low price when compared to its average historical P/E ratio range.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Stock Value)

The estimated value of the stock is $277.2, vs. the current stock price of about $277. This indicates that McDonald’s is currently selling at a fair price.

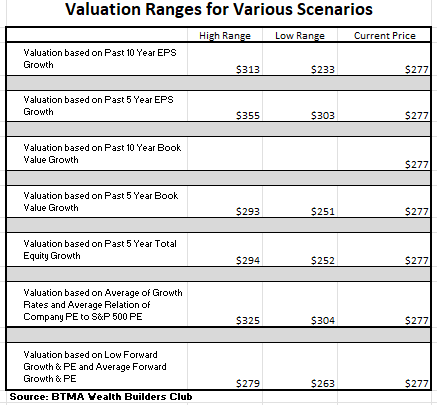

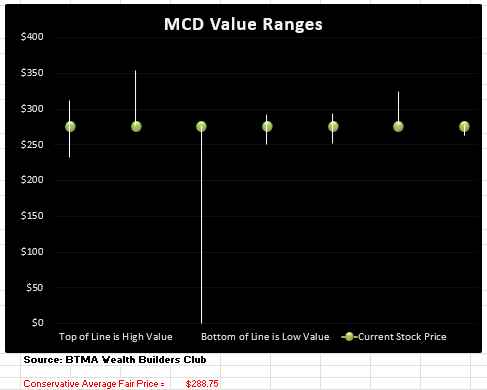

For more detailed valuation purposes, I will be using a conservative EPS of 11.56. I’ve used various past averages of growth rates and P/E ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare the growth rates of EPS, book value, and total equity.

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is toward the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club

BTMA Wealth Builders Club

(Source: BTMA Wealth Builders Club)

This analysis shows an average valuation of around $288 per share vs. its current price of about $277, this would indicate that McDonald’s is slightly undervalued.

Summarizing the Fundamentals

After analyzing McDonald’s fundamentals, I believe the company makes a case for potential inclusion in a portfolio. Over the past decade, the price per share and earnings have steadily increased, with only a brief anomaly during the COVID-19 pandemic. The company’s gross margin continues to improve, driven by its economies of scale and supply chain efficiency. Return on invested capital has also been adequate, despite increased spending on new store openings and digital innovations. While the negative return on equity might raise concerns, it’s largely attributed to stock repurchases rather than declining net income, which mitigates the concern. Overall, McDonald’s maintains robust fundamentals but will need to successfully navigate potential headwinds from increased competition and shifting consumer preferences to sustain its growth trajectory. In terms of valuation, my analysis shows that the stock is slightly undervalued.

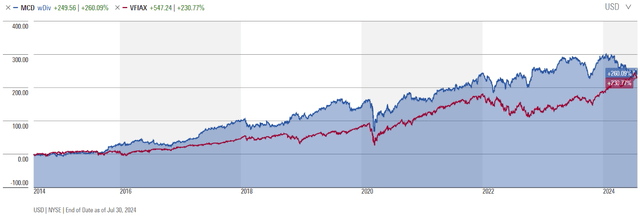

McDonald’s Vs. The S&P 500

Now, let’s see how McDonald’s compares vs. the US stock market benchmark S&P 500 over the past 10 years. From the chart below, McDonald’s consistently outperforms the S&P 500 over most of the chart’s history.

Morningstar

Forward-Looking Conclusion

Over the next five years, the analysts who follow this company are expecting it to grow earnings at an average annual rate of 4.44%.

In addition, the average one-year price target for this stock is $299.03, which is about an 7.9% increase in a year.

The Expected Annual Compounding Rate of Return is 4.16%.

If you invest today, with analysts’ forecasts, you might expect about 4% (low growth) to 15% (high growth) per year.

Here’s an alternative scenario based on MCD’s past earnings growth. During the past 10 and five-year periods, the average EPS growth rate was about 9.1% and 7.9%, respectively.

But when considering cash flow growth over the past 10 and five years, the average growth has been 8.3% and 7.7%, respectively.

Therefore, when considering all of these return possibilities, our average annual return could likely be around 7%-8%.

If considering the actual past results of McDonald’s, the story is a bit different. Here are the actual 10 and five-year return results.

______________

10 Year Return Results if Invested in MCD:

Initial Investment Date: 8/3/2014

End Date: 8/31/2024

Cost per Share: $94.30

End Date Price: $276.69

Total Return: 243.23%

Compound Annualized Growth Rate: 13%

_______________

5 Year Return Results if Invested in MCD:

Initial Investment Date: 8/3/2019

End Date: 8/3/2024

Cost per Share: $214.48

End Date Price: $276.69

Total Return: 42.03%

Compound Annualized Growth Rate: 7%

_________________

From these scenarios, we have produced results ranging from 7% to 13%. I feel that if you’re a long-term patient investor and believer in MCD, and its existing business model (hamburger franchises and real estate leases), you could expect MCD to provide you with around 7%-13% annual return over the long haul.

As a comparison, the S&P 500’s average return from 1928-2014 is about 10%. So, in a typical scenario with MCD, you could expect to earn a similar or slightly higher long-term return as compared with an S&P 500 index fund. The individual MCD stock obviously doesn’t offer the diversification that the index fund does, but MCD has proven that it’s a consistent performer over the long run.

Does McDonald’s Pass My Checklist?

- Company Rating 70+ out of 100? No (45.37)

- Share Price Compound Annual Growth Rate > 12%? Yes (14.98%)

- Earnings history mostly increasing? Yes

- ROE (5-year average 16% or greater)? No (-105.59%)

- ROIC (average 16% or greater)? Yes (if removing the COVID anomaly years)

- Gross Margin % (5-year average > 30%)? Yes (53.66%)

- Debt-to-Equity (less than 1)? No

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? Yes

- Do I think this company will continue to successfully sell the same main product/service for the next 10 years? Yes

McDonald’s scored 7/10 or 70%. Therefore, McDonald’s could be a good potential investment.

Is McDonald’s currently selling at a bargain price?

- Price Earnings less than 16? No (21)

- Detailed Valuation greater than the Current Stock Price? Yes (Value $288 >$277 Stock Price)

In conclusion, McDonald’s stock presents a compelling investment opportunity based on its strong fundamentals and continued innovative mindset. The company has demonstrated consistent growth in share price and earnings over the past decade that continue to drive shareholder value. Additional improvements in gross margin and ROIC reflect its operational efficiency and effective use of capital that should encourage investors that its senior executives have a clear vision. Even with a negative return on equity, this is mainly due to stock repurchases rather than declining profitability. McDonald’s commitment to expanding its stores and enhancing digital capabilities, showcasing its constant growth mindset and positioning it well for continued (but possibly slower) growth. While the company must tackle potential challenges from increased competition and changing consumer preferences, its consistent financial performance makes it a worthy candidate for consideration in a long-term investment portfolio. One drawback is that McDonald’s has approached market saturation. Future growth is likely to be slower and competition will continue to challenge McDonald’s market share.

Investing in McDonald’s could provide a return similar to the S&P 500, but the S&P 500 is a more diversified investment. In my opinion, the main benefit of investing in McDonald’s is the consistency and stability of the investment. This is due to McDonald’s investment in real estate and the stability that is provided through its property appreciation, property lease payments, and franchise fees. In addition, McDonald’s is one of the most recognizable fast-food brands, which should continue to do well in all economic situations since it aims to provide good value for all classes of society.

Since McDonald’s likely won’t be a huge growth stock moving forward, it will be more of a defensive, stable investment. Therefore, I would consider investing in MCD only if I could purchase it at a deep discount to its estimated value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.