Summary:

- McDonald’s was a great investment during the last decade and rewarded shareholders with strong dividend growth.

- Although, when digging under the surface, this was aided significantly by their unhealthy diet of debt-funded share buybacks.

- These totaled over $38b and thus, as a result, saw their net debt almost triple, which obviously sent their leverage much higher.

- This cannot continue forever, and I feel the limit is nearby, especially with the era of cheap money ending and rising geopolitical risks.

- Without these share buybacks, their dividend growth would have been low single-digits, and given their near-record share price, I believe that a sell rating is appropriate.

wildpixel/iStock via Getty Images

Introduction

The last decade was very profitable for the shareholders of McDonald’s (NYSE:MCD) who have not only been rewarded by a soaring share price but also, a steady and strong stream of dividend growth that in turn also helped push up their shares thanks to boosting their appeal. Whilst their shares have been healthy for portfolios, the same cannot be said under the surface at the company level as they are now bloated from an unhealthy diet across the last decade, metaphorically speaking that similar to a person, leaves lasting implications for the next decade.

Their Unhealthy Diet

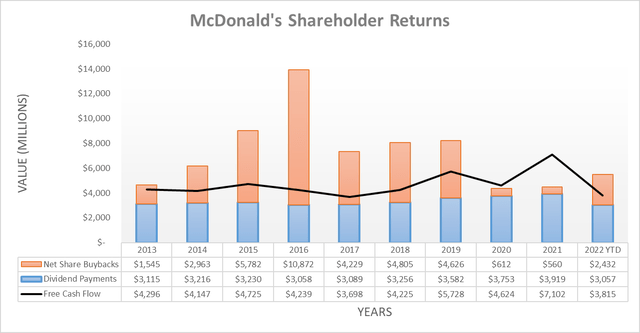

When looking back at the last decade, they have consistently rewarded shareholders with a steady and strong stream of dividend growth, plus share further buybacks. If aggregating the former from the beginning of 2013 until their most recent quarterly results from the third quarter of 2022, it sees a total of $33.274b. Although this is already a massive amount of money, they were also accompanied by an even more massive sum of share buybacks that, if aggregated, totals $38.424b across this same period of time, net of their relatively minor equity issuances for employee stock options.

Quite unsurprisingly, their dividend payments were always covered by free cash flow but alas, this did not extend to their share buybacks during the majority of years, especially back in 2016 that saw a record-setting amount of $10.872b. In fact, their share buybacks have overwhelmingly exceeded their excess free cash flow after dividend payments, which itself only totaled $13.324b since the beginning of 2013 through the third quarter of 2022, thereby leaving them reliant upon debt-funded.

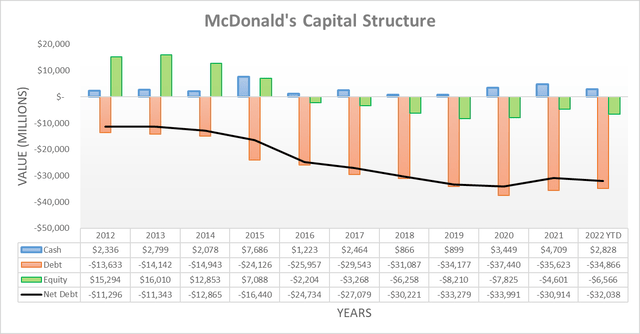

On the surface, shareholders have enjoyed seeing their pockets filled, but I suspect that not everyone stepped back to consider the costs across the last decade, namely the additional debt. If looking at their capital structure, it shows that 2012 ended with net debt of $11.296b but after this massive sum of share buybacks, their most recent results from the third quarter of 2022 ended with net debt of $32.038b. Yes, that is right, their net debt is now almost three times higher, primarily as a result of their debt-funded share buybacks, which in my eyes, makes for an unhealthy diet.

Interestingly, their balance sheet equity is also now negative $6.566b following the third quarter of 2022, unlike following the end of 2012 when it was a positive $15.294b. This results from their assets being less than their liabilities and whilst this sounds scary and is obviously not considered good, it does not automatically indicate any solvency issues because their debt relative to earnings is far more important, which is subsequently discussed.

The Lasting Implications

There are very few instances whereby a company can almost triple their net debt via funding shareholder returns without seeing lasting implications that, more often than not, inhibit their future mobility. Although, before moving into these negative considerations, there are still a few positive ones to mention. The first relates to their outstanding share count, which ended 2012 at 990.4m before most recently ending the third quarter of 2022 at 732.4m, thereby falling a very impressive circa 26%. Naturally, this helped support their quarterly dividend growth at the per-share level, which in turn increased from $0.77 per share to $1.52 per share across these same two points in time and thus represents compounded annual growth of 7.04%, which is solid for a long length of time that saw various operating conditions.

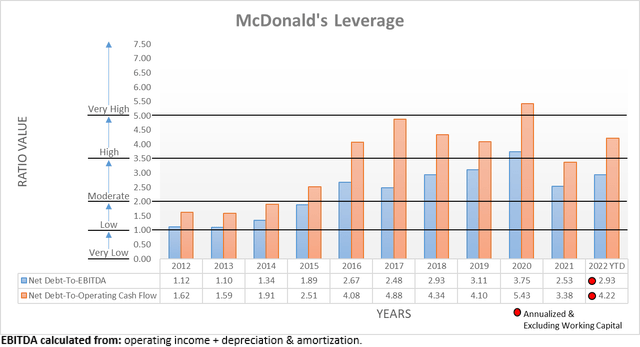

Unfortunately, the positive implications from their debt-funded share buybacks are accompanied by negative ones too. Since their net debt almost tripled, it should not come as a surprise to see their leverage surge, as their financial performance obviously could not keep pace. As a result, their net debt-to-EBITDA is now 2.93 following the third quarter of 2022, whereas its previous result was only 1.12 at the end of 2012. Concurrently, their net debt-to-operating cash flow saw an even greater increase, thereby rising to 2.93 versus its previous result of 1.62 across these same two points in time.

To be clear, this does not mean their current leverage is dangerous nor poses risks to their dividends as they stand right now. More so, it means they cannot continue down this same path forever because no matter if we are talking about a person, a company or a government, leverage cannot grow infinitely high. Since they are very mature and generate ample free cash flow, these latest leverage ratios do not pose any material risks but nevertheless, they cannot more than double once again in the coming decade. If this were the case, their net debt-to-operating cash flow would be pushing towards 10.00, which is seldom seen and when observed, it results from severe financial distress.

I feel their leverage cannot keep increasing much higher as the limit is nearby with their net debt-to-operating cash flow of 4.22 well into the high territory, especially as the era of cheap money appears to be over with central banks rapidly tightening monetary policy. I also suspect management may also feel similarly given they kept share buybacks much lower during 2021 despite their very strong free cash flow, as per the first graph. Regardless of this latter thought, I still feel that it would be prudent for investors to adjust their expectations accordingly for the decade ahead to exclude any benefit from share buybacks. If they keep pushing leverage higher via share buybacks, it would raise the risk profile of their shares and therefore see their shares trade at a lower valuation relative to earnings, which in turn would eliminate the value created by these share buybacks.

No one can necessarily see the future but given the headwinds they face in this uncertain and volatile geopolitical backdrop, it is difficult to see the next decade seeing stronger fundamental growth than the last decade. Apart from the pressure of keeping on top of offers by competitors and consumer preferences, they are also facing limits to their growth from rising geopolitical risks. As everyone knows, they are a truly global brand and company with stores in many countries, ranging from their home in the United States throughout Europe, Asia and until recently, even their former cold-war adversary, Russia. After benefitting from decades of globalization and warming international business relations, this trend appears to be retreating after the Russia-Ukraine war that ultimately saw them abandon the country. Plus, the rise of China as a second economic superpower is also creating new geopolitical risks and thus by extension, hurdles for international trade and business relations.

If utilizing their growth from the last decade as a basis point, if not for their share buybacks reducing their outstanding share count by circa 26%, their current quarterly dividends per share would also be circa 26% lower. Therefore, if subtracting this from their current quarterly dividends of $1.52 per share, it equals $1.12 per share and thus, it would only represent compounded annual growth of only 3.82%, which is obviously a much slower pace than the 7.04% per annum from the last decade. This highlights the dividend growth that was afforded by their actual financial performance and thus could be replicated in the future is only in the low single-digits, assuming the aforementioned geopolitical risks do not cause further headaches as seen in Russia.

Apart from taking shares off the market via share buybacks, their solid dividend growth is clearly an important factor that attracts investors and ultimately, helped drive their share price towards its current almost record-setting level. As they face the lasting implications of their unhealthy diet of debt-funded share buybacks in the next decade, their dividend growth will almost certainly slow down significantly and thus as a result, hurt the appeal of their shares because their current yield of 2.30% is not going to attract many investors without steady and strong growth.

Conclusion

Two rules of thumb for investors, the first being that increasing leverage cannot continue forever with the second being, what is accomplished by increasing leverage cannot be replicated in the future without increasing leverage. Whilst the last decade was very profitable for shareholders, I fear the same cannot be said for the next decade. Apart from rising geopolitical risks, almost half of their dividend growth only resulted from an unhealthy diet of share buybacks that were overwhelming debt-funded. Naturally, this cannot continue forever and given the era of cheap money appears to be over, I suspect they are near their limit. When everything is said and done, I feel their shares and accompanying low dividend yield are overrated in light of this lower growth outlook and thus, whilst not necessarily a popular stance, I nevertheless believe that a sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from McDonald’s SEC filings, all calculated figures were performed by the author.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.