Summary:

- McDonald’s buys back shares in its China business, signaling optimism and control over operations in the Chinese market.

- The fast-food chain’s digital initiative, the MyMcDonald app, has led to significant sales growth in the US and is expected to expand into other markets.

- MCD is considered a blue chip stock, consistently paying dividends and showing positive prospects for long-term investors.

M. Suhail

Thesis

McDonald’s Corporation (NYSE:MCD) is a global American fast-food chain. It was founded in 1940 as a restaurant and is currently the world’s largest fast-food restaurant chain. The USA makes up the greatest source of revenue in terms of the number of stores present, followed by China.

The fast-food giant is also expanding into new markets. For example, it reacquired its stake in the China segment from the private equity firm Carlyle, signaling that it expects optimistic prospects for the Chinese market. Moreover, it is also expanding its digital initiative of the MyMcDonald app into other markets as well.

Added to this is the fact that MCD is currently considered a blue chip stock, and it has been consistently giving handsome dividends to its shareholders and is expected to continue to do so. The company thus presents investors with optimistic prospects.

Buyback of its Stake in the China Business from Carlyle

McDonald’s bought back its shares in its China segment from the private equity giant Carlyle, increasing its minority share from 20% to 48%. In collaboration with CITIC, a state-backed conglomerate, MCD now holds a 52% stake in the China business.

This move highlights the growing optimism and confidence among MCD’s top brass in the Chinese market. One of the statistics to note is that the number of stores in China has doubled to more than 5,500 since 2017. The business is aiming to open a total of 10,000 stores by the end of 2028. Moreover, the business in China has also made more than 30% growth in terms of sales since September 2019. Therefore, the buyback of shares from Carlyle is a positive outlook for the company, in my opinion, since it gives greater reins of control over its operations in China. This is given the fact that China is McDonald’s second-largest market (only behind the US) in terms of store count.

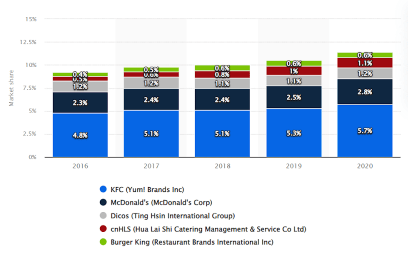

Statista

The table above shows the market share of each fast-food brand in China. The data was available only till FY20, which is why market share details have only been put here till that much has been put. As we can see, the market share of McDonald’s has grown from 2.3% to 2.8% in four years. The rest of the 85% of the market belongs to the independent fast food outlets in China, which provides a goldmine opportunity for McDonald’s. The figure below shows the future trend in the fast food market.

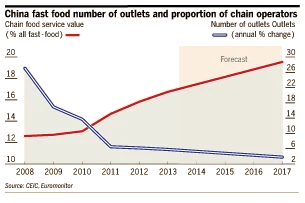

Financial Times

The chain fast food service as a proportion of all fast food is expected to continue to increase in the future. Therefore, I believe that there is tremendous potential for McDonald’s, and the decision to reacquire its shares in the China business from Carlyle comes at a crucial point in time, allowing MCD to gain greater control over the reins.

MyMcDonald’s

The digital initiative of McDonald’s in the form of the MyMcDonald app has paid off handsomely, as it has led to significant growth in the sales of McDonald’s products in the USA. Though there is no concrete data available pertaining to the US market about how many sales came from the digital segment, It is said that more than 25% of the sales in the top six markets came from the digital segment, which signifies a 60% increase over FY20. The McDonald’s app provides points to customers on certain orders, and by accumulating a certain number of points, the customers can unlock rewards. This initiative is set to enhance customer loyalty and McDonald’s profitability.

McDonald’s is also aiming to launch this initiative in the UK, which has already witnessed tremendous growth in the sales of McDonald’s products. With this optimistic prospect, I believe that McDonald’s is going to benefit from this tremendously with greater expansions in the UK market.

A Blue Chip Stock – Rising Trend of Dividend Payout

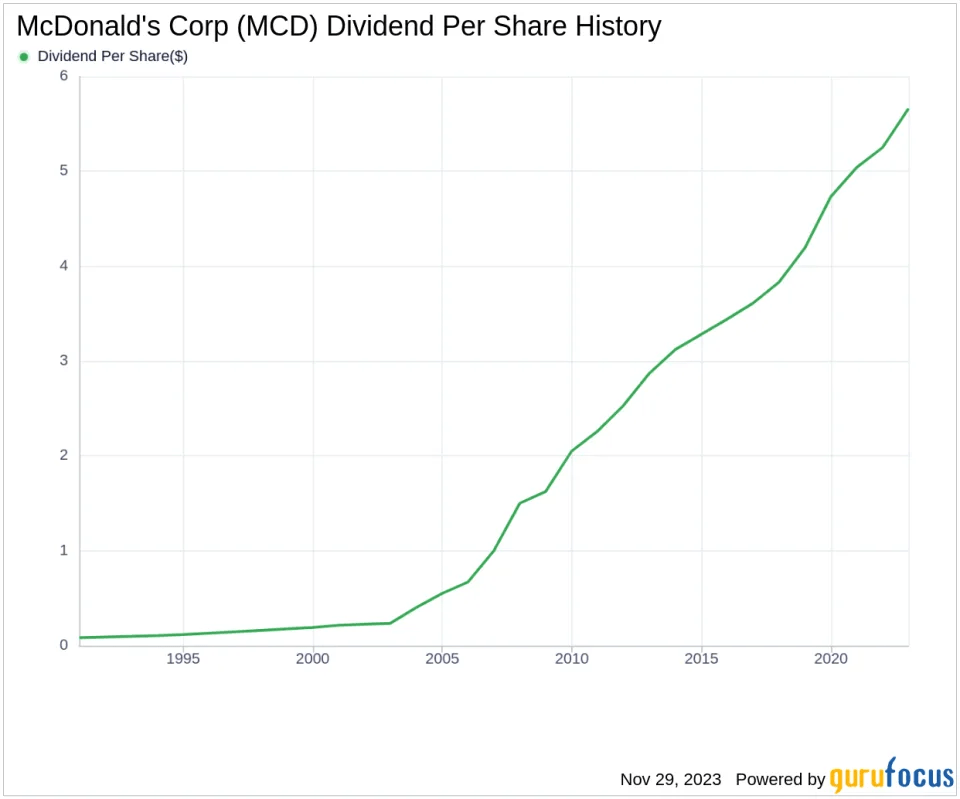

When we look at the graph given below, we can see that the dividend paid by MCD to its shareholders has been increasing consistently, indicating the positive prospects of the company and its optimistic outlook as signaled by the consistently rising dividends.

Yahoo Finance

Therefore, I believe that McDonald’s Corporation is a bargain, particularly for investors who are looking towards a more long-term income investment strategy, given it’s an established brand name with a global presence and is also paying a handsome dividend with a payout ratio of around 54%. When we analyze the dividend payout ratio, we also note that a major portion of the profit is being kept by the firm, which can indicate that the company is planning to invest in business growth.

Valuation

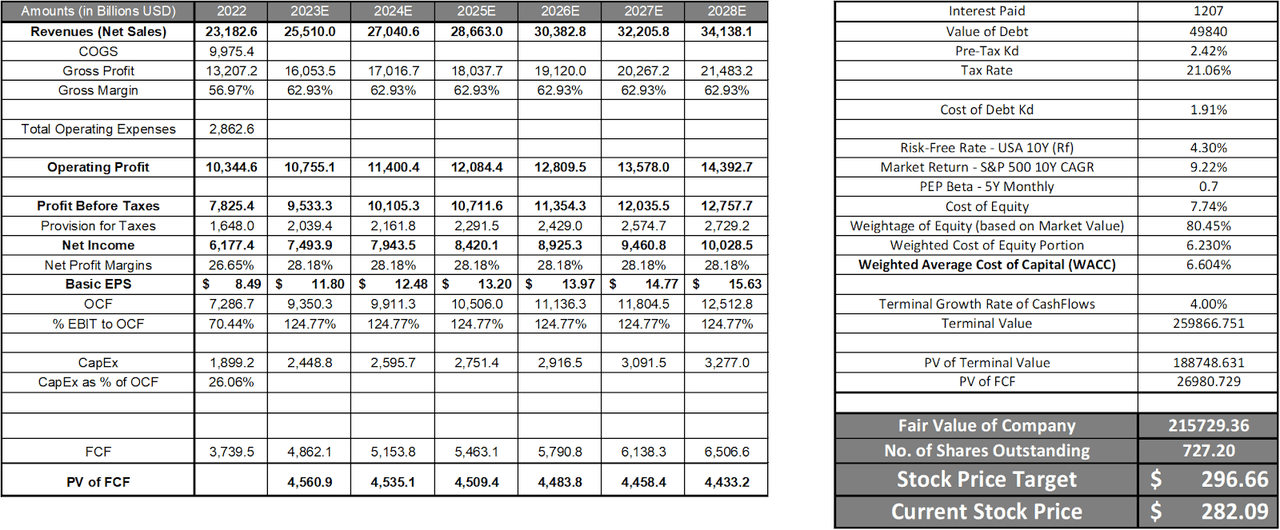

To assess the valuation of McDonald’s Corporation, I have undertaken both DCF Valuation. Below is an image of a DCF Valuation performed on MCD. I have assumed 6% revenue growth from 2023 to 2027, which is significantly more than the CAGR growth for the past four years. I believe that positive factors like a favorable Chinese market and a move towards digitization to retain customer loyalty will be crucial in speeding up the growth rate in the years FY23 and FY24, ranging around 10%, as also indicated by Seeking Alpha. However, after that, the growth rate is likely to level out at around the historical rate of growth. This is why I have taken an average growth rate of 6%. Given MCD’s optimistic prospects, I believe that this estimate is in line with its expected future growth. Based on the estimates, the valuation that was performed on McDonald’s is given below.

I assumed that MCD’s net profit margins would remain at 41.54% in 2023 and beyond. Ultimately, we get a Fair Value/ Price Target of $296.66 in the base case scenario. The DCF analysis gives us a value with an upside of 5.16%.

Conclusion

Overall, the stock is providing an optimistic picture. A closer look at the current fast food market scenario in China shows that McDonald’s is positioned to take advantage of much of the upcoming future growth in China, which is its second-largest market currently, which is likely to lead to greater sales and profits for the corporation. Apart from this, McDonald’s new digital initiative and its expansion into other markets will create a ripple effect, leading to greater sales. Moreover, a look at historical data shows that MCD has been handsomely paying out dividends to its shareholders and the dividend payment has not yet seen a downward trend, signalling that it is a bargain for investors who are also looking for long-term gains. So, overall, my recommendation for the stock would be a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.