Summary:

- Wage inflation and food costs are shrinking margins.

- So far, customers are absorbing price hikes: however, that could change if a recession hits.

- Despite the headwinds, Q4 results beat analysts’ estimates.

Popartic/iStock Editorial via Getty Images

McDonald’s Corporation (NYSE:MCD) is the world’s largest restaurant chain by revenue. With the recent announcement that the company is adding stores, that crown will not pass to a rival in the foreseeable future.

However, in spite of the advantages offered by the company’s scale, MCD is not immune to the current macroeconomic environment. Spiraling food costs and increasing wages are weighing on the company’s margins.

Despite these headwinds, this fast-food leader is posting higher comps and growing sales, and there is a reasonable argument that inflation will lead to consumers trading down to this leader in fast-food.

Q4 Results

MCD posted fourth-quarter earnings Tuesday morning. Results beat expectations, with adjusted EPS of $2.59 beating consensus by $0.13. Revenue of $5.93 billion also beat analysts estimates of $5.75 billion.

McDonald’s tallied $7 billion in digital sales in its top 6 markets, accounting for more than 35% of total sales.

Same-store sales were boosted by increased menu prices and store traffic: US same-store sales were up 10.3%, while international markets’ comparables sales increased by 12.6%.

While the growth in international sales may appear robust, that compares to 16.8% growth in international comps year-over-year.

For all of 2022, global comparable-store sales increased 10.9%, and U.S. comps were up by 5.9%.

The impact of foreign currency exchange rates weighed on results. While consolidated revenue dropped by 1%, revenue would have increased by 5% were it not for a strengthening dollar. Operating income rose 8% in the quarter, but the metric would have landed at 16% if not for Forex.

While customers spending more coupled with increased pricing resulted in a solid quarter, the market was not buying it: shares are down nearly 3% following the Q4 report.

Headwinds Abound

According to the U.S. Bureau of Labor Statistics, prices for food away from home increased by 6.4% in January. This marked the highest price increase since 1982. Unfortunately for the restaurant industry, that figure includes public school lunch programs. Limited-service restaurants have increased prices by 8%, and full-service restaurants by 7.1%.

Of course, the price hikes are spurred by the increased costs borne by restaurant operators. Federal data indicates restaurants are paying 13% more for food and paying 10% higher wages. While food and labor do not constitute all of the costs borne by restaurants, one must wonder how far restaurants’ price increases go towards offsetting increased costs.

I’ll add that as leases expire, restaurants are likely to see significant boosts in rents.

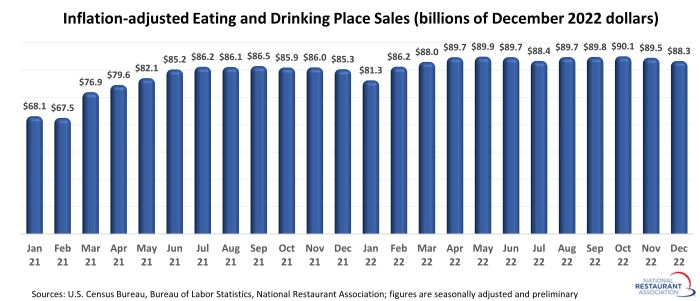

Additionally, according to the National Restaurant Association, restaurant sales trended lower as 2022 came to a close. Total sales of $88.3 billion in December were down by 0.9% compared to November.

Comparing current prices to those in 2019, Big Mac’s are selling for 7% more, the cost of Fries are up nearly 25%, and the price for a McChicken Sandwich has leaped by nearly 28%. One must question how long consumers can stomach the increased prices.

National Restaurant Association

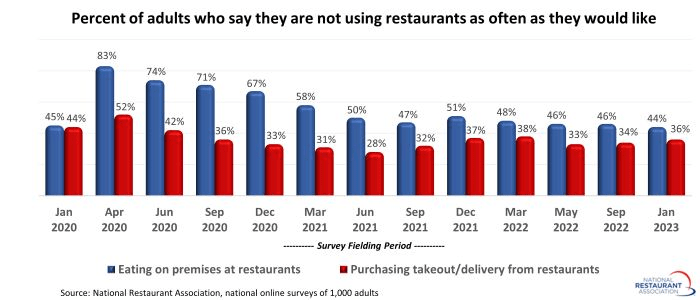

A study by the National Restaurant Association also revealed 44% of adults are not patronizing restaurants as often as they would prefer.

National Restaurant Association

Another trend that’s not Ronald McDonald’s friend is a move to increase fast-food workers’ wages. Last September, Governor Newsom of California signed The Fast Food Accountability and Standards Recovery (FAST) Act. The bill requires fast-food restaurants to pay employees a minimum wage of $22 an hour. While the bill is on hold until November of 2024, FAST apparently inspired proposals for similar legislation. Those became in the form of HB 2478 in Virginia and the fast food franchisor accountability act, S3155, in New York.

FAST also prompted a response in an open letter from McDonald’s USA President Joe Erlinger.

One reason Erlinger criticized the bill is because it only applies to fast-food restaurants which would give fine-dining establishments a competitive advantage. The bill also doesn’t increase wages for fast-food restaurants with less than 100 locations nationwide.

Erlinger claimed the bill would increase prices at quick service restaurants by 20%.

Last but far from least is a troubling trend regarding the firm’s revenues and debt. McDonald’s peak revenues were recorded in 2013. In that year, the company garnered about $28.1 billion in revenue. Since then, revenue has fallen each year, and by 2019, MCD posted less than $21.4 billion in annual revenue.

While revenue has climbed since the economy was reopened post-COVID, 2022 revenue is still lower than in 2016.

To push EPS higher in the face of falling revenues, MCD bought back shares; however, that has come at the price of rising debt loads. I will not pursue this concern further, as there is a recent in depth article on the topic on Seeking Alpha.

Trends That Are Investors’ Friends

During the earnings call, it was revealed that McDonald’s plans to open 1,900 new locations in 2023.

Of those stores, 400 will be in the US or in the firm’s internationally operated markets, and 1,500 will be located in the developmental licensee and affiliate markets, including 900 in China. Net store openings in the US should number around 80.

Management guides for 4% unit growth from new store additions in 2023. Coupled with the new locations opened in 2022, they expect nearly 1.5% to system-wide sales growth.

Same store sales have increased for ten consecutive quarters, and customer traffic has grown for two straight quarters. US visits are up 26% from pre pandemic levels.

Debt, Dividend, And Valuation

The credit agencies rate McDonald’s debt at the lower end of investment grade. In 4Q22, cash and cash equivalents were $2.6 billion, down from $4.2 billion at the end of 2022. Long-term debt rose to $35.9 billion, up marginally from $35.6 billion.

McDonald’s has increased the dividend for 46 straight years. In October, the payout was increased by 10% to $1.52.

The current yield is 2.31%, the payout ratio is 56.04%, and the 5-year dividend growth rate is 8.12%.

MCD currently trades for $263.55 per share. The one-year average price target of the 26 analysts rating the stock is $288.41. The price target of the 7 analysts that rated the stock following Q4 results is $285.57.

McDonald’s forward P/E is 24.89x, a bit below the 5-year average for the P/E ratio of 26.85x. The 5-year PEG ratio is 3.4X, significantly above the average PEG ratio for McDonald’s over the last five years of 3.04x.

Is McDonald’s A Buy, Sell, Or Hold?

With inflation at a four-decade high and prospects of a recession on the horizon, the immediate outlook for McDonald’s may appear daunting; however, an argument can be made that the company’s low prices might attract consumers willing to trade down to less-expensive meals. Furthermore, the firm’s investments in automated drive-through lanes and mobile apps could take some of the sting out of inflation.

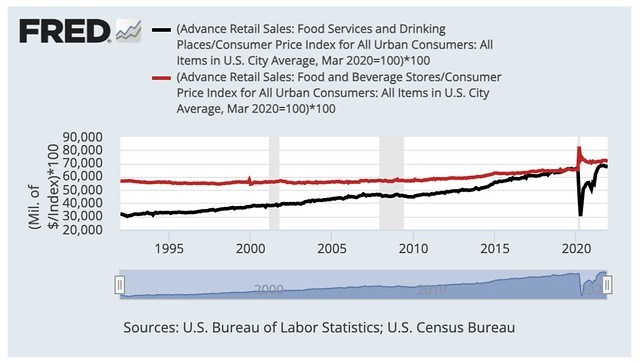

Additionally, Americans have shifted to eating out versus preparing food at home: more money is spent in restaurants today than in preparing food at home, and my guess is that once that habit is established, it will be hard to break.

20 Something Finance

My assessment of McDonald’s leans less on inflation, wage pressures, and a possible recession than on the stock’s valuation.

McDonald’s trades for a P/E ratio that is akin to those sported by growth stocks. Growth is no longer a hallmark of McDonald’s: as I noted earlier in this piece, the company’s revenues have trended lower for a decade.

I’ll add that I seldom invest in companies with PEG ratios above 2.0x. When I make an exception, it is for high-yield stocks that have reasonably strong moats.

Therefore, I rate MCD as a HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.