Summary:

- McDonald’s stock is undervalued and offers a potential double-digit upside with a fair value estimate of $338 per share.

- The company is nearing dividend king status with 48 consecutive years of dividend increases.

- Despite challenges in the current economic environment, McDonald’s has shown strong sales growth and is pursuing new growth initiatives.

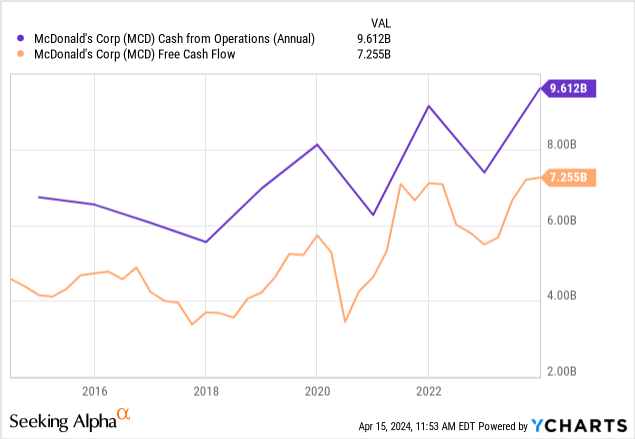

- Free cash flow levels have increased while money being allocated to capital expenditures has also increased.

M. Suhail

Overview

As a dividend investor, I love collecting income from companies whose products I personally consume. It adds a layer of authenticity to the concept of collecting passive income because you are able to physically see the company and people waiting in line to buy their products. In the case of McDonald’s (NYSE:MCD), they have grown to be one of the largest brands in the world with their recognizable golden arches.

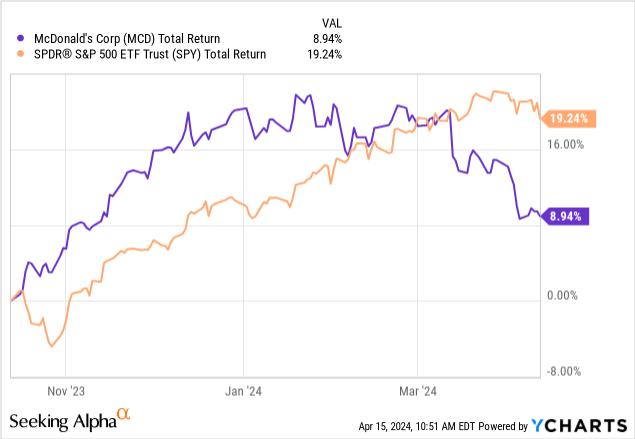

I believe that the company currently sits at an attractive valuation, touting a potential double-digit upside. I previously covered MCD in November of 2023, where I focused more on the reliability and consistency of their dividend growth. Now I would like to focus on the fact that the stock trades at a significant discount to fair value and discuss the strong growth metrics that will contribute to the upside. We can see that MCD has significantly underperformed the S&P 500 (SPY) and this can likely be attributed to the current economic environment; high interest rates, rising inflation levels, consumer spend is tightening, and lower profit margins are all likely factors.

The current dividend yield sits at 2.5% and still offers value here. For reference, the average dividend yield over the last 4 years has been closer to 2.2%, so we are trading at a more attractive yield level at the moment. The dividend growth metrics still offer sufficient levels of increases for someone considering MCD as part of a dividend growth strategy as well. When you take this dividend growth in consideration with the double-digit upside, I see a great opportunity to set yourself up for superior gains.

MCD has been able to deliver consistent sales growth, even in an environment that is unfavorable. High inflation, higher interest rates, and tighter consumer spend on food are all challenges that MCD has been able to overcome. Additionally, the company has increased the amount of money they are allocating to growth initiatives and partnerships. As a result, I believe that MCD is a great Buy opportunity here as we are likely to see the benefits of these efforts once market conditions improve.

Valuation

In terms of valuation, MCD currently trades at a price to earnings ratio of 21.57x in comparison to their 5-year average PE of 27.56x. The average Wall St price target sits at $324.60 per share and this represents a potential upside of over 21.23%. The highest price target goes as high as $357 per share and the lowest is currently $290 per share. It’s also nice to see that the lowest price target is still higher than the current price of a stock. This indicates to me that Wall St analysts see the potential and value here with MCD.

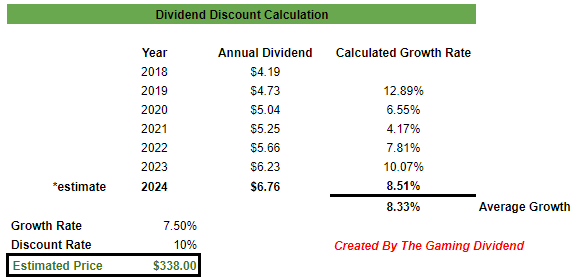

In an attempt to replicate these price targets, I decided to run a dividend discount model against MCD to get an estimated fair value. I first compiled all of the dividend data starting from 2018 to determine at what rate the dividend has grown. I then input the estimated annual dividend payout for 2024, which is $6.76 per share. We can see that over this period, the dividend averaged a CAGR (compound annual growth rate) of 8.33%. The current forward revenue growth rate sits at 7.12% while the full year results for 2023 showed us that MCD grew global sales at 9%. Based on these results, I feel that an estimated growth rate of 7.5% is achievable.

Author

As a result, I estimated a fair value of $338 per share. This shows a potential upside of 26.4% from the current price level. When you combine this potential upside with a growing dividend yield, you can get a clearer picture of the current value offered here. The price has really been held down by the shape of the economy with rising costs, high inflation, and shifting consumer spend in an effort to save money. At this moment in time, more people are making an effort to eat in and cut back on the food expenses.

Despite these challenges, MCD was still able to grow sales by increasing pricing and reducing expenses. Like most situations, the outlook here really depends on how well they continue performing and what the economic looks like at the latter half of the year. While the latest CPI report decreased the probability of rate cuts due to a rise in inflation, there is still a chance that rates can be cut by the end of the year. A rate cut would likely be the signaling of better times ahead within consumer spending.

In addition, MCD is still taking on new growth initiatives that can fuel further growth. They are still targeting a total of 50,000 restaurants by 2027 and actively working to expand their loyalty program from the current 150M users up to 250M users by 2027. They are aiming to achieve this growth by doubling down on the efficiency and speed of mobile orders since they expected nearly 30% of their orders to come through the mobile app by 2027. These growth initiatives are further supported by the strong financial growth that MCD continues to deliver, even in unfavorable market conditions.

Financials – Growth Opportunities

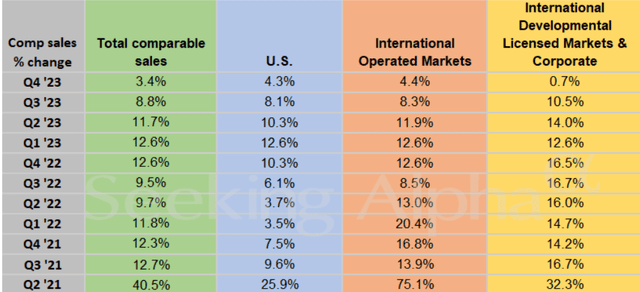

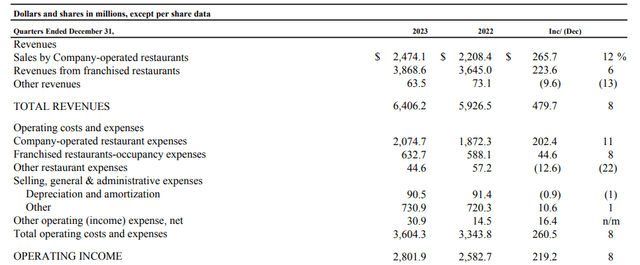

Revenues from franchised restaurants grew 6.1% year over year while sales by company operated restaurants increased 12% year over year. Something that stands out to me is that comparable sales across all market segments continue to see increases. Even if the increase is slowing down over the last couple of quarters, we are still seeing growth nonetheless. I think it’s totally acceptable that we see comparable sales amounts dip during a time of high inflation and tightening consumer spend. The fact that we still manage to see growth at all should be highlighted here, with international operated markets having the higher growth in Q4 of 4.4%.

Seeking Alpha – Niloofer Shaikh

The last reported Q4 earnings closed of MCD’s fiscal year and the results were strong. Comparable sales increased by 9% across all segments. Diluted EPS came in at $11.56, which was a huge 29% increase over the prior year. Each segment saw high single digit growth:

- US Markets: Experienced an 8.7% growth in sales. This can be attributed to the strategic price increases that were followed up with effective marketing and advertising campaigns.

- International Operated Markets: Experienced a 9.2% growth in sales due to more volume in the Europe markets, led by strong U.K and Germany sales.

MCD Q4 Report

We can see how revenues increased alongside total operating income. Operating income grew by 8% YoY while ‘other restaurant expenses’ decreased by 22% YoY. The liquidity profile and balance sheet of MCD remains exceptionally strong with over $9.6B in cash from operations and an EBITDA growth totaling 12% YoY. Free cash flow totals continue to rise as well which can further fuel expansion opportunities, partnerships, and dividend growth. Free cash flow has grown to $7.2B, up from the $5.5B of the prior year. This is impressive considering that we also saw a rise in capital expenditure for the year, totaling $2.3B, up from $1.9B of the prior year.

There are active strides to continue these growth patterns as well with the recent announcement of a collaboration with Krispy Kreme (DNUT). The details of the agreement means that fresh donuts will be delivered to participating locations every single day. This is great for increasing sales volume as Krispy Kreme already has a high demand cult following because of their delicious donuts. I think the partnership will ultimately benefit MCD as it brings more people into their locations.

MCD has a ton of real estate all over the country, whereas Krispy Kreme does not in comparison. There are currently 356 Krispy Kreme locations in the US. Meanwhile, there are over 14,300 MCD locations, which means that it isn’t too difficult to believe that this opens the door to people visiting MCD for the sole purpose of getting a donut.

MCD has raised the dividend for over 48 consecutive years without a dividend cut, meaning they are nearing that golden milestone of reaching dividend king status. I don’t anticipate any cut as management is likely aiming for this milestone, but also because there is plenty of cash to cover the dividend at the moment. The current dividend payout ratio sits at 53.44%. While this is above the sector median of 33.6%, it is significantly below MCD’s 5-year average payout ratio of 62.12%. The payout ratio has substantially improved from the growing sales revenue.

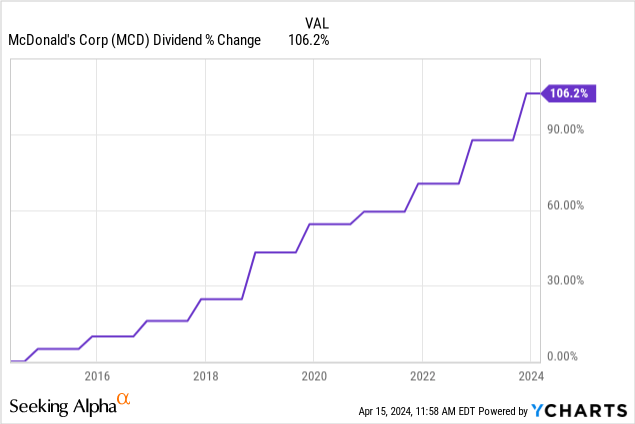

I do anticipate the continued growth of the dividend over the next decade. While growth metrics have slowed, I expect smaller raises due to the current macro environment. As things improve, however, I believe much higher levels of dividend growth can be achieved. For example, the dividend has grown at a CAGR of 8% over the last 5-year period. Zooming out to a longer horizon of 10 years, the dividend has grown at a CAGR of 7.28% which is a solid level of growth for a company in the restaurants sector. We can see that the dividend has grown by over 100% over the last decade.

Risks

As with any food-based business, MCD remains vulnerable to consumer spending. It’s a tough spot to be in because when costs rise, consumers tend to tighten their spending on dining out. This causes the sales volume to drop and the quick fix to counteract the lower sales volume is to increase pricing on menu items. This can actually lose customers if price raises are too substantially in short amounts of time. If the US were to go into a recession, tightening of consumer spend would likely be more dramatic.

In addition, MCD is also dealing with backlash from the conflict between Israel and Hamas. Sales have been impacted by the Israel-Gaza boycotts. They plan to acquire 225 restaurants from Alonyal Limited, who’s been in the business for over 30 years. While tensions rise in this region, we may see negative impacts on the international sales revenue over the remainder of the year. However, this problem is not unique to MCD and peer companies like Coca-Cola (KO) and Starbucks (SBUX) also face criticism and backlash for their operation in these territories.

Takeaway

McDonald’s (MCD) presents an attractive opportunity at the moment with an estimated fair value of $338 per share. This potential upside combined with a healthy dividend yield presents the chance to obtain double-digit upsides. I believe the growth initiatives and strong financial performance of the company have been overshadowed by the poor macro environment. High inflation levels and rising costs of food have caused consumers to be more cautious with their spending towards outside dining and restaurants.

Despite these challenges, MCD has been able to deliver consistent sales growth and dividend growth. MCD has also announced a strategic partnership with Krispy Kreme (DNUT) to get donuts into their locations. This is likely to lead to more traffic into their stores as customers have another menu item influencing their visit. Krispy Kreme locations aren’t as plentiful as MCD so I think this is a great partnership to help drive sales. I believe that once market conditions improve, we shall reap the rewards of all this strong performance. Therefore, I rate MCD a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.