Summary:

- MCD and ARCO offer different yet compelling investment avenues: MCD for those seeking long-term stability and consistent dividend growth and ARCO for those looking for growth potential in emerging markets.

- The true potential of ARCO’s growth engine is beginning to become visible as the currency situation in Latin America shows signs of stability.

- Although the shift towards franchising has led to declining revenue for MCD, this strategic transition has also resulted in higher profitability.

Joa_Souza/iStock Unreleased via Getty Images

Investment Thesis

Investment objectives come in all shapes and forms. These varying goals sometimes cause debates on a stock’s intrinsic value or appeal. You need only to look at the vast range of opinions here on Seeking Alpha to see this in action. Although, in many cases, these arguments mirror different perspectives over operational fundamentals, such as market position or competitive dynamics, in other instances, it’s a simple matter of different strategies. What is considered a worthy stock for a passive income strategy may not make the cut in a growth-oriented portfolio.

Interestingly, the globally renowned McDonald’s brand presents itself as a multifaceted investment opportunity fitting both a dividend-driven strategy and a growth-focused one through two separate entities: McDonald’s Corporation (NYSE:MCD) and Arcos Dorados (NYSE:ARCO)

For investors seeking to harness the power of the iconic Golden Arches brand for a steady income and long-term stability, MCD presents a compelling option, with its solid history of dividend growth, making it a perfect fit for retirement-planning strategies. The company’s critics often argue that its valuation is high, and maybe it is. However, this debate fades amid the diversity of investment objectives. For example, ten years ago, MCD investors had to settle for a modest 3% dividend, paying price multiples similar to today. Those very investors now reap a 6.5% yield-on-cost on an investment-grade stock. It is true that during this ten-year period, MCD might not have beaten the Dow Jones (DJI) or the S&P 500 (SP500) indexes and thus, in the eyes of some, is an underperformer. However, in my view, long-term investors have successfully leveraged MCD’s investment characteristics to sidestep conventional market truths, manifested in the correlation between risk and dividend yield, turning a high-quality, low-yield position into a retirement income bless.

This shows that planning for retirement isn’t solely an act of future prediction but also incorporates strategic decisions made today. For individuals eyeing retirement in the next 10 to 15 years and searching for a dependable dividend stock for post-retirement income, MCD is a solid contender. It is a core holding in my portfolio, and my strategy revolves around dollar-value averaging, periodically buying the ticker to accumulate a sizable position for retirement income.

However, MCD may not appeal to younger investors seeking to leverage the strength of the McDonald’s brand while aiming for faster capital appreciation. This is where ARCO comes into the picture. As the largest franchise holder of McDonald’s in Latin America and the Caribbean, it represents a tangible link to the McDonald’s brand while also offering exposure to a fast-growing region ripe with opportunity.

Growth Profiles

The common perception that MCD, as a traditional fast-food chain, is directly involved in daily operations such as serving customers at the counter or managing kitchen staff is only partially accurate. In reality, MCD acts as an overseer, dictating guidelines that are followed by third-party franchisees who handle the daily details.

ARCO is the largest player in this franchisee network. With over 2,312 restaurants in 20 countries across Latin America and the Caribbean, it leverages the McDonald’s brand to capture growth in one of the world’s most vibrant emerging economies, with ripe growth opportunities.

In contrast, MCD is a mature business, focusing on slow but steady dividend growth. One might wonder how this stability is achieved. Interestingly, it is primarily attributed to MCD’s unique position as a property owner of many of the real estate operated by its franchisees, collecting rent while also reaping growth opportunities via revenue-based royalties. Its role as a landlord also provides a degree of protection against inflation since real estate is often an effective hedge against inflationary trends. Out of MCD’s 40,275 restaurants, 95% are franchised as of March 2023. ARCO represents 6% of MCD’s franchised base, with 2,312 restaurants. Out of these, ARCO owns the underlying property of 500 outlets while leasing the remaining, at least partly from MCD.

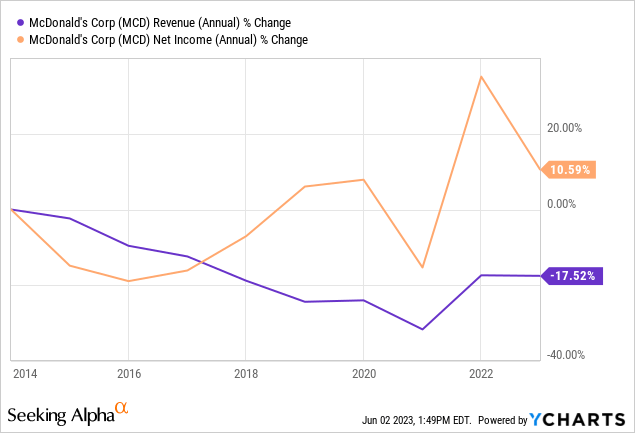

Looking closer at the numbers for the past decade, MCD demonstrated relatively consistent profitability, despite declining revenue. This revenue decline is attributed to MCD’s strategic shift from company-operated restaurants to a franchise-based model, a strategy characterized by higher margins and reduced operational risks.

For example, nine years ago, in 2014, franchised outlets constituted roughly 70% of the total number of restaurants under the McDonald’s umbrella. Now MCD predominantly runs a franchised business. This strategic shift led to less realized revenue but higher profits, as shown in the graph above.

Going forward, I believe we should now see some stability on the revenue front now that MCD has reached its target franchise-outlet ratio of 95%, not that this would have a material impact on profitability metric and dividend distribution. The reported 1.47% sales dip in FY 2022 is primarily attributed to the sale/suspension of its Russian operations starting in March 2022. Going forward, we’re moving into a more normalized YoY comparison as we step away from the shadow of the Russian exit.

Wall Street consensus estimates indicate a positive trajectory for MCD, projecting a solid 11% increase in EPS for 2023. MCD has a track record of closely aligning with these estimates, and even when it falls short, the deviation tends to be minor.

That being said, some uncertainty clouds the horizon. Word on the ground is that certain ranches in the US are questioning the current value proposition of raising cattle. With inflation eating away their profits and drought conditions adding to the burden, these ranchers are reportedly reconsidering their investments in herd expansion.

Given that it takes about three years for a calf to mature for the market, choices that ranchers market today could have a ripple effect for years into the future. Consequently, any trends in herd size could have a significant impact on the broader industry and the markets, by extension, stretching into 2025 and beyond. Thus, it is critical to keep an eye on how this situation evolves, as it may carry broader implications for MCD.

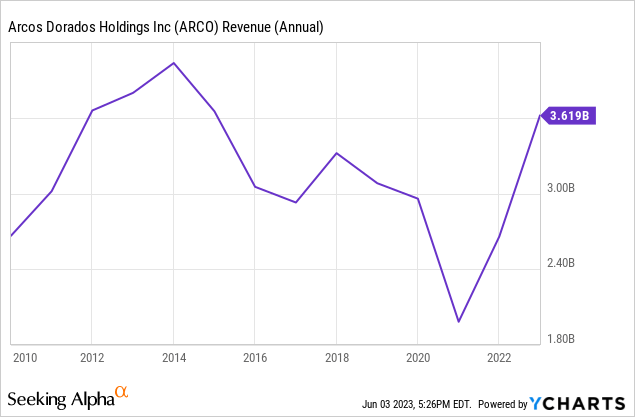

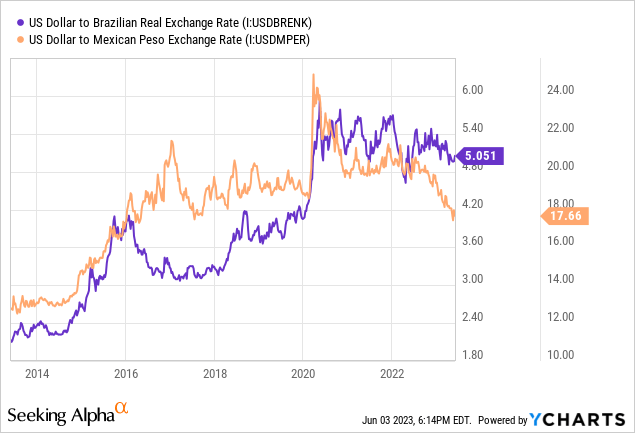

ARCO has a more aggressive growth profile. However, in light of the currency fluctuations in Latin America, the company’s GAAP revenue hasn’t fully reflected the brand’s growing market share, customer traffic, and broader market penetration in the region. Over the past few years, even though GAAP revenue was subject to volatility due to these currency shifts, the underlying business consistently expanded (notwithstanding COVID disruptions.) This is evidenced by a steady rise in constant currency comparable sales figures.

With the region’s currency situation showing signs of stabilization, ARCO’s financial performance is gaining traction. The significant 25% YoY GAAP revenue growth in Q1 2023 is a clear testament to this trend. Although this figure includes the impact of YoY currency weakness, they are less severe than before, but more importantly, the environment carries signs of FX stability, especially Brazil and Mexico, which represents the majority of ARCO’s adjusted EBITDA.

Thus, despite the inherent risks of investing in these markets, ARCO’s strong growth figures and the backing of the globally recognized McDonald’s brand make it an attractive proposition for growth-oriented investors.

Dividends

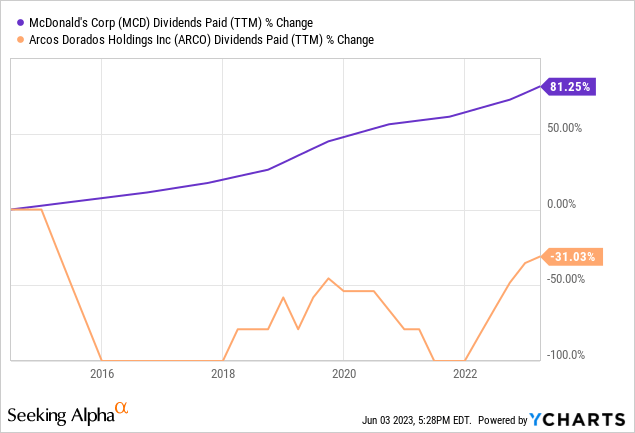

MCD has maintained an average payout ratio of around 60% in the past five years, highlighting its commitment to returning a substantial portion of its earnings to its shareholders. Its focus on consistent dividend growth has allowed it to bolster its image as a reliable dividend stock, with an impressive annual dividend growth of 6.36%.

In contrast, ARCO, with a payout ratio of 26%, appears to adopt a different capital allocation philosophy. ARCO’s strategy centers more on operational performance, increasing customer traffic, and enhancing brand metrics within its market. Consequently, its dividend distribution policy reflects this operational emphasis.

This is evident in ARCO’s annual dividend growth rate in the past three years, which at 0.92%, is significantly lower than MCD’s despite its much higher growth rates. This lower rate and its somewhat sporadic dividend history underscore the company’s differing strategic focus. Rather than focusing on consistent dividend growth, ARCO aims to capitalize on the growth potential within its operational markets, thereby offering greater potential for capital appreciation.

Thus, while the dividend rate of both MCD and ARCO is comparable, 2.1% vs 2.3%, respectively, their contrasting capital allocation strategies appeal to different investors.

Summary

MCD and ARCO offer different yet compelling options to leverage the McDonald’s brand to meet different investment objectives. MCD, a high-quality stock, appeals to long-term investors focused on retirement planning, capitalizing on its consistent dividend growth and stable returns. While the challenges, such as diminishing beef supply in the US, might appear alarming, it is essential for investors to maintain a long-term perspective. MCD has historically shown the ability to weather such supply-demand fluctuations, and these scenarios often smooth out over the long term, providing stability to MCD’s profit margins.

On the other hand, ARCO offers an alternative investment strategy to those seeking higher capital appreciation potential. Recent trends have been encouraging in terms of currency stability in the region. While it is not perfect, one can see a slowdown in the deterioration rate compared to previous years. For example, in recent quarters, the decline in FX rates has been slower than ARCO’s revenue growth. Given these developments, ARCO’s investment proposition becomes more compelling.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.