Summary:

- I am downgrading McDonald’s Corporation to a “Sell” rating due to overvaluation and an E. coli outbreak linked to their Quarter Pounders.

- The E. coli outbreak is expected to reduce store traffic and same-store sales growth, mirroring Chipotle’s 2015 incident’s impact.

- I project McDonald’s comparable sales growth to be -3% in FY24 and 2% in FY25, with a fair value of $240 per share.

- Upside risks include potential accelerated stock buybacks and a faster-than-anticipated investigation conclusion, which could mitigate financial impacts.

luismmolina/E+ via Getty Images

I assigned a “Hold” rating to McDonald’s Corporation (NYSE:MCD) in December 2023, highlighting their overvalued stock price. Since the publication, the stock price has been significantly underperformed the S&P 500 index (SP500, SPX). On October 22nd, the U.S. Centers For Disease Control and Prevention (CDC) reported an E. coli outbreak linked to McDonald’s Quarter Pounders. I think the incidence would pose a near-term headwind from McDonald’s, and the stock price is overvalued. I am downgrading to a “Sell” rating with a fair value of $240 per share.

E. coli Outbreak Linked to McDonald’s Quarter Pounders

According to CDC, multiple states are investigating an outbreak of E. coli O157:H7 infections, with most cases in this outbreak linked to Quarter Pounder hamburger at McDonald’s. McDonald’s has temporarily suspended using fresh slivered onions and quarter pound beef patties in several states while the investigation is still ongoing. It is evident that McDonald’s has pinpointed the food safety issue at their supplier level. I think several issues should be considered:

- Due to the incident, Quarter Pounder hamburgers will not be available in some states currently, and I argue most people will not order Quarter Pounder hamburgers until the investigation concludes. As a result, McDonald’s might have reduced store traffic in the near term, which will hurt their same store sales growth.

- Historically, Chipotle Mexican Grill (CMG) had an E. coli outbreak in 2015. In February 2016, CDC declared the outbreak over, but it sickened 60 people and took Chipotle Mexican Grill more than one year to investigate, overhaul its supply chain and resolve related litigations. In April 2020, Chipotle Mexican Grill agreed to pay $25 million to resolve criminal charges related to foodborne illness outbreaks from 2015 through 2018. During the investigation period, Chipotle’s sales growth declined significantly, with revenue declining by 13.3% in 2016.

- The E. coli Outbreak linked to McDonald’s Quarter Pounders suggests that McDonald’s has an internal control issue with their supply chains. I presume some high-level management will likely be responsible for this incident, which could cause near-term disruptions to the global restaurant chain.

Outlook & Valuation Revision

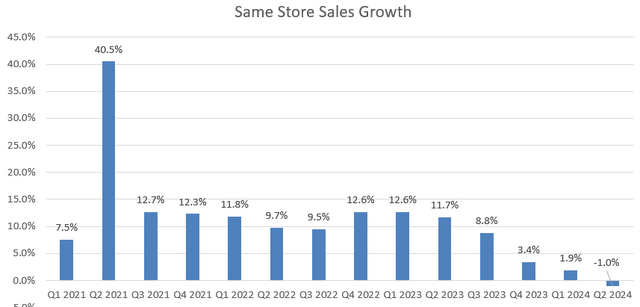

McDonald’s reported their Q2 result on July 29th, delivering a 1% decline in the same store sales growth, as depicted in the chart below. The comparable sales growth in the U.S. declined by 0.7% year-over-year. The weak growth was primarily caused by the high-interest rate environment and soft consumer spendings. While the company increased menu price, it has experienced declining traffic growth in recent quarters.

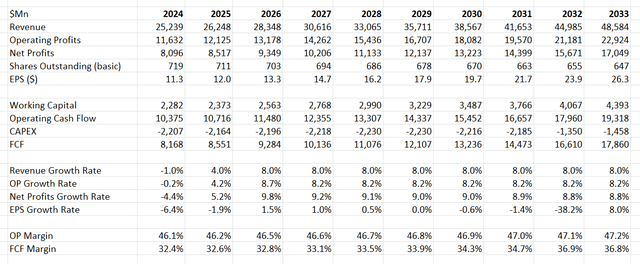

Due to the E. coli outbreak, I am making several changes to my outlook and valuation model:

- I assume McDonald’s comparable sales growth will be significantly impacted in FY24 and FY25, as consumers may have lingering concerns about food safety. Chipotle Mexican Grill’s past incident also showed that the financial impact could last for more than one year. As such, I project McDonald’s to deliver -3% and 2% same store sales growth in FY24 and FY25, respectively.

- I estimate $100 million in total provisions for FY24 and FY25 to cover investigation expenses, internal policy changes, as well as potential penalties from regulators.

- Starting in FY26, I assume McDonald’s to recover from the food safety issue, with the SSS returning to 6%, aligned with their historical trend.

- I continue to forecast the new store opening will contribute 2% to the overall topline growth.

- I project 10bps annual margin expansion driven by price increase, digital marketing initiatives, store efficiency improvements, and franchisee growth.

- I revised the WACC to 7% assuming: risk-free rate 4%; beta 0.5; cost of debt 5%; equity risk premium 7%; equity $220 billion; debt $37 billion; tax rate 21%.

With these assumptions, the discounted cash flow (“DCF”) can be summarized as follows:

Discounting all the future FCF, the fair value is calculated to be $240 per share, as per my estimates.

Upside Risks

As I assign a “Sell” rating, I am considering the potential catalyst that could support the stock price:

- McDonald’s has a quite strong balance sheet, allowing them to repurchase their shares. Over the past six years, they repurchased more than $18 billion of own stocks in total. The management might choose to accelerate stock buyback in the near future, which might provide some support to the stock price.

- As McDonald’s has already temporarily stopped their product, the investigation may conclude faster than anticipated. In that case, the financial impact might be less severe than I anticipated.

Conclusion

The E. coli outbreak is likely to create near-term growth pressures for McDonald’s Corporation, and it might take several quarters for McDonald’s to return to their normal growth trajectory. I am downgrading to a “Sell” rating with a fair value of $240 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.