Summary:

- McDonald’s shares are selling off, facing challenges from high commodity prices and consumer price index increases.

- The company’s shift to franchising has led to flat revenue growth but increased profitability, but now the company has an aggressive expansion plan in place to drive new revenue growth.

- Q2 earnings preview suggests a gloomy outlook, with a focus on value promotions impacting margins and potential post-earnings sell-off risk.

- In this article, I share my stance before a delicate report, sharing how I am positioning myself.

M. Suhail

A few months ago, I argued McDonald’s stock was an opportunity below $275. Currently, McDonald’s (NYSE:MCD) shares trade below $260. After all, it is not easy for many food companies, be they snack and chocolate producers such as Hershey (HSY) or the coffee shop giant Starbucks (SBUX). Let’s recap what is going on.

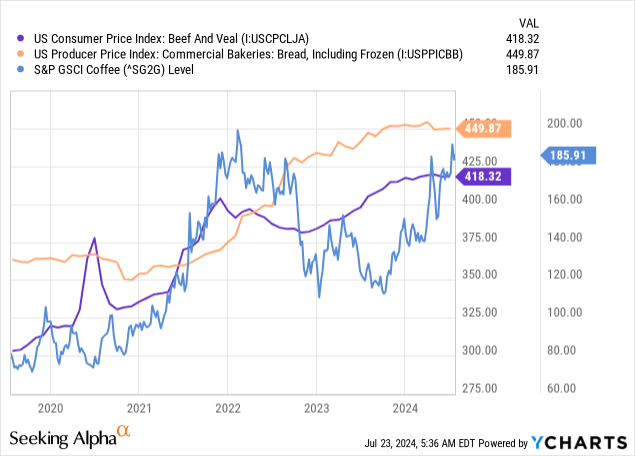

At first, commodity prices (corn and bread, beef and veal, coffee, etc.) soared, and have not truly deflated since the pandemic.

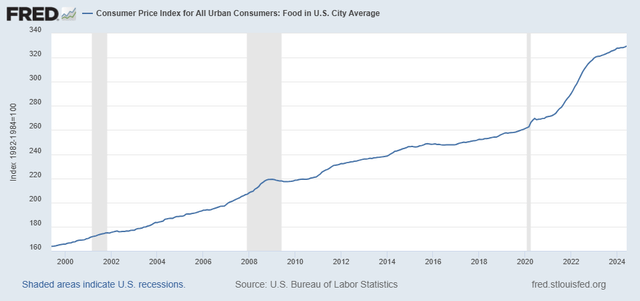

This puts pressure on costs for many restaurant companies. As a result, these companies had to increase their prices, adopting different strategies, but between 2022 and 2023, the consumer price index for food in American cities quickly moved upwards, diverging from the gradual increasing trajectory it had been following up until the pandemic.

FRED St. Louis

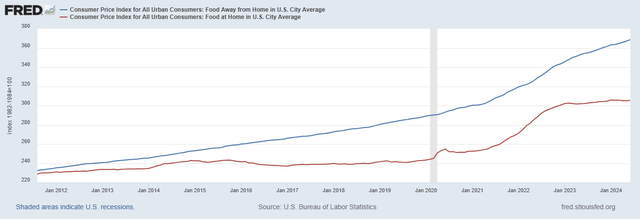

The consequences are now being seen: food away from home is rapidly increasing in price, while food at home has been relatively flat for more than a year.

FRED St. Louis

So, while right after the pandemic it seemed more convenient to eat away from home, things have rapidly reversed with consumers feeling the dent in their pockets when eating at restaurants.

This has been particularly true for fast food restaurants, which have all outpaced inflation over the last decade. As a matter of fact, recent studies show that McDonald’s has increased its prices by 100%, while actual inflation has been only 31% in the past ten years. This disconnect can’t last forever and, sooner or later, consumers will perceive their fast food experience as expensive.

Secondly, this environment requires the company to execute perfectly, both in terms of cost management and in their marketing efforts. Strategies may differ, but the consumer, in the end, is the one who shows which is better. Companies that tried to flex their pricing power, believing that by offering premium services, customers would always be willing to buy, no matter the price, have been severely punished. Starbucks is the perfect example, with its CEO still going on TV stating that its disastrous quarter with negative comp sales and traffic was to blame on the consumers who didn’t fully understand the value proposition the company was offering.

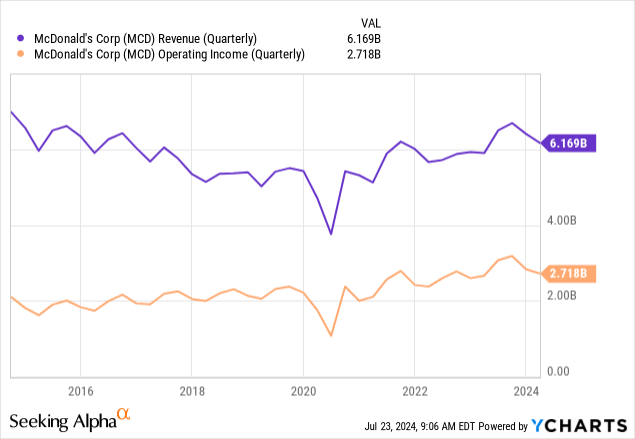

McDonald’s, another consumer favorite, has been reporting some problems for a while: no revenue growth over the past 10 years, and challenges in Arab countries, to which we need to assess the recent news of consumers disgruntled by the now-perceived-weak value proposition.

Third, let’s address one of the reasons why McDonald’s revenue has been flat for many years. Between 2014 and 2016, the company switched gears and decided to become an almost wholly franchised business. As a result, franchised restaurants are now almost 95% of the total, while in 2014 the percentage was just above 81%. This has an impact on sales because McDonald’s sales are made up of the sum of the company-run restaurants – whose sales are fully accounted for – and the fees and royalties coming from franchised restaurants. By converting company-operated restaurants into franchised ones, we have less overall sales. But, on the other hand, we have increasing profits.

McDonald’s reported a 27% increase in operating income over the past decade, while its revenues decreased a bit. So, overall, this change helped McDonald’s become a more profitable company.

At the same time, restaurants have increased and the company wants to reach 50,000 locations by 2027. Currently, the company has a little over 42,000. So, the expansion plan is aggressive, though, given the current environment, it is yet to prove that this target will be feasible.

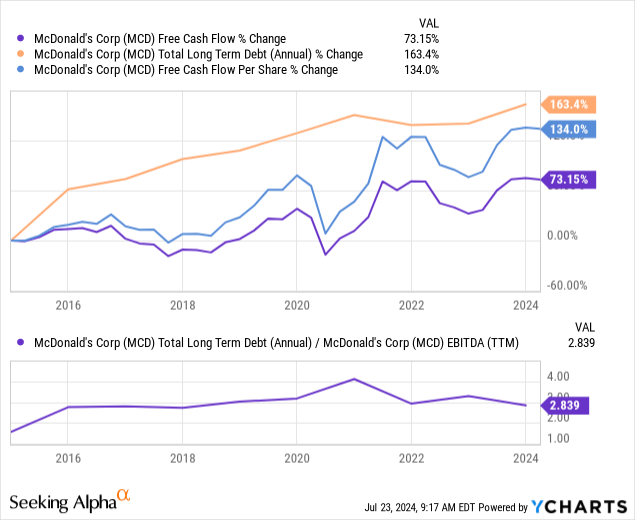

Though the picture of this company is still mixed, we should all be aware of one of the main reasons why this stock keeps on being an investors’ favorite. By focusing on its profitability, the company can grow its free cash flow each year. As Seeking Alpha analyst Marcel Knoop has brilliantly outlined in his analysis of McDonald’s, the company has been able to increase its debt, while keeping its debt/EBITDA ratio usually below 3x. This was because the company focused on efficiency and became more profitable. As its EBITDA expanded, McDonald’s was able to take on new debt (up to $3 for each extra $1 in EBITDA). What has the company done with this debt? It bought back shares, with the consequence of increasing its FCF/share by 134%, while its FCF only increased by 73%.

As Marcel Knoop showed, when we consider McDonald’s we have to factor in its ability to return to its shareholders around 125% of its yearly FCF.

McDonald’s Q2 Earnings Preview

As I have sometimes pointed out, McDonald’s has chosen to keep the quarterly traffic metrics to themselves, which are quite an important KPI for a restaurant.

However, when we see its lack of top-line growth and its pricing in the past ten years, it is immediately understandable that traffic is not doing so well. If both traffic and pricing increased together, we would have seen a different trajectory of the company’s revenues, net of its shift towards franchised restaurants.

Coming to what McDonald’s earnings may look like, the picture we have painted so far looks a bit gloomy.

And no wonder, McDonald’s had to take action and promote its $5 value meal to drive guests back to its restaurants. Recently, we heard the news that this promotion should be expected in more than 90% of the company’s restaurants. While this may increase traffic, I doubt it will move the needle in Q2. In fact, McDonald’s sales are going to decrease because of the lower ticket meals that will be sold. In addition, profits will be lower on such deals, and I hardly think McDonald’s will be able to earn a +55% gross margin and a 45% operating margin. True, the mix won’t be cannibalized by the value meal, but surely this promotion won’t provide further thrust to McDonald’s margin expansion.

This means McDonald’s finds itself in a tight spot. While striving to resume growth, it has to give up a bit of its margins. However, the stock has been mostly valued based on its earnings per share and its FCF per share, which have compounded well thanks to increasing buybacks.

Q2 reports from similar restaurants, such as Domino’s (DPZ), were not encouraging either. While its revenue increased, the mix offset part of the growth. But when the company lowered its store growth target “due to franchisee challenges” a warning bell rang and investors fled from the stock, making it plunge 10%.

I think a similar scenario may hit McDonald’s. As I said, I have doubts the company will grow its restaurant count by 8,000 units in three years, given the current environment that doesn’t make franchisees willing to invest (on top of this, McDonald’s recently increased its franchise royalty fees to 5%).

During the Q1 earnings call, McDonald’s management already informed investors that Q2 had started flat from a comp sales perspective. Chris Kempczinski, the CEO, acknowledged the issue in the U.S.:

But I think the issue that we have in the U.S. is in an environment where everybody is out there with a value message there’s an opportunity for us to drive better awareness of what our value platform is. And one of the things that’s going on in the U.S. right now is the value message that I was talking about, we’re doing it in 50 different ways with local value. And what we don’t have in the U.S. right now is a national value platform at the same time that our competitors are out there with the national value platform.

So, no wonder earnings revisions have headed south this time, with 25 downward revisions and only one upward revision in the last three months. Currently, the EPS estimate is $3.07, with a 3.2% decrease YoY. At the same time, revenues are expected to increase by 2% to $6.63 billion.

As far as I see it, I believe McDonald’s revenue won’t be an issue, as long as it is in the positive or, at least, flat YoY.

However, the EPS decrease may be larger than anticipated if the value bundles the company has promoted will take the lion’s share of the sales mix.

But what will matter even more will be the outlook for the remainder of the year. Seeing what is happening in the industry, I doubt McDonald’s will revise its outlook upward. I actually expect it to lower its guidance. As a result, the risk of a post-earnings sell-off is higher than usual this time.

Therefore, we have to be able to distinguish the overall long-term thesis from the probable stock movement we are going to see.

Long-term, I keep my buy rating as I see a company that should be able to weather the situation and remain the market leader. Short-term, I expect some volatility. This creates an opportunity for those, like me, who are still sitting on the sidelines waiting for a good entry point. If the stock dips to $240, then we would have one of the most established blue chips trading at a fwd PE below 20. At the same time, we have seen how McDonald’s can grow its EPS at high-single-digits. Adding its dividends and its buybacks, we have a stock whose returns should be low-double-digits for years to come. As a result, the risk/reward ratio starts getting interesting, especially after a possible dip. Therefore, I give my buy rating, but I suggest waiting after earnings to initiate a position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.