Summary:

- McDonald’s has strong branding advantages, global scale, cost leadership, and an unrivaled franchisee network.

- The company has outperformed the S&P 500, with a 19% total return compared to the index’s 8% gain since my previous update, urging investors to ignore the pessimism.

- McDonald’s focuses on growth through its “fourth ‘D’ in the Accelerating the Arches strategy” and plans to challenge Starbucks in customized beverages.

- My Buy thesis in early October has played out nicely. I explain why it’s time for investors to tone down the FOMO surge.

z1b

I highlighted in my previous article that the investment thesis in McDonald’s Corporation (NYSE:MCD) is straightforward: “strong branding advantages, global scale, cost leadership, and unrivaled franchisee network.” With such significant advantages over its QSR peers, investors shouldn’t be surprised by MCD’s solid performance over the past ten years.

Accordingly, MCD posted a 5Y and 10Y total return CAGR of 13.7% and 14.8%, respectively. In addition, MCD posted a 1Y total return of 14.9%. However, if you bought MCD between May and July 2023 close to the $300 level, you are still nursing losses (albeit slightly). As a result, I often remind my readers and subscribers that risk/reward matters for consistent outperformance, even for MCD.

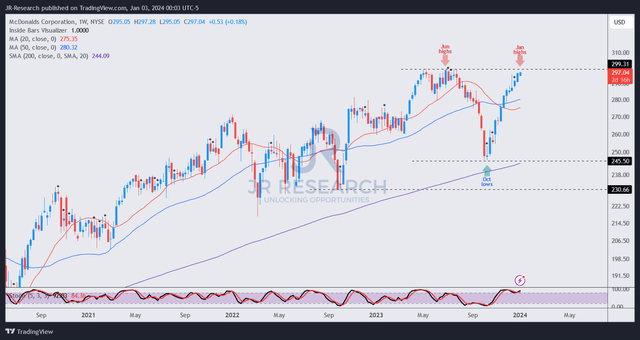

MCD has significantly outperformed the S&P 500 (SPX) (SPY) since my early October 2023 update. It’s up by nearly 19% on a total return basis, compared to the SPX’s 8% gain over the same period. I highlighted that the previous plunge in MCD likely bottomed out, suggesting the “worst selloff is likely over.” As a result, it set up a “remarkable dip-buying opportunity for investors who missed buying its previous steep retracements.” MCD investors who capitalized on that opportunity should pat themselves on the back for spotting the fantastic setup. Based on MCD’s 1Y total return, it should be clear that significant upside was captured over the last three months. Therefore, it strongly suggests that knowing how to assess investor psychology/buying sentiments appropriately is foundational to consistent market outperformance (beyond fundamental or financial statement analysis).

While MCD pays a decent forward dividend yield (10Y average: 2.7%), its total return CAGR should inform investors that it’s not your “typical” income stock. Therefore, I assessed that MCD is still expected to be a growth play based on capital appreciation, driving shareholder value in the medium- to long term.

Therefore, I believe McDonald’s recent Investor Day in early December was instrumental in emphasizing that growth-oriented thesis. The company’s adoption of its “fourth ‘D’ in the Accelerating the Arches strategy” in 2023 suggests the ongoing evolution of its consumer strategy. As a result, the central thesis of McDonald’s Investor Day indicates it’s ready to challenge Starbucks (SBUX) and its peers in customized beverages. However, its current restaurant format presented operational challenges in “integrating complex, customized beverages.” As a result, the recent launch of its CosMc concept is intended to overcome these issues, allowing McDonald’s to present “a unique and compelling product or experience to customers.” In addition, McDonald’s emphasizes that the concept must be scalable across its global franchise, “aligning with McDonald’s global brand strategy.”

With that in mind, McDonald’s is going on the offensive to gain share in the $100B specialty beverages and coffee market. Management stressed that it’s “growing rapidly with high margins.” In addition, to demonstrate the company’s sense of scale, management communicated that “McDonald’s is the second-largest coffee player globally, selling nearly 8M cups of coffee per day.” As a result, I believe McDonald’s is ready to take its brand leadership further by pursuing a faster growth opportunity against Starbucks, just as it gained share through its chicken offerings. McDonald’s accentuated that chicken “represents $25B in annual system-wide sales, matching the beef business, and is growing faster.” As a result, McDonald’s chicken strategy remains “central to McDonald’s growth strategy” and continues to expand.

In other words, while CosMc may not provide earnings accretion to McDonald’s in the near term, I believe the company has the wherewithal, branding advantages, and massive global scale to make it viable. The company has upped the ante, announcing its target to reach 50,000 restaurants by 2027, demonstrating its volume-based growth outlook. Given that new restaurant openings are expected to be focused on international markets, I believe CosMc is expected to be launched globally, which could impact Starbucks’s global strategy. It’s still too early for us to assess McDonald’s success. However, it has proved its ability to continue innovating and leveraging its advantages to compete effectively against smaller peers. My thesis is also supported by MCD’s best-in-class “A+” profitability grade and “A-” earnings revisions grade, justifying robust the market’s confidence, as seen in its long-term total return CAGR.

However, with MCD close to re-testing its 2023 highs attributed to its surge from its early October lows, should investors who missed buying when it bottomed out chase now? With a forward EBITDA multiple of 18.1x, it has surged above its 10Y average of 15.8x as it bottomed out. Therefore, its valuation is much less attractive if you missed buying when it previously fell to the $245 level.

MCD price chart (weekly) (TradingView)

In addition, I gleaned that the near-vertical surge in MCD shouldn’t be expected to be sustainable without a welcomed pullback. Despite that, it’s still possible for MCD to grind higher and re-test its $300 level before a consolidation. However, the risk/reward of maintaining my Buy rating isn’t attractive enough. While I didn’t assess a sell signal suggesting investors should consider cutting exposure, caution should be heeded if you consider buying now after the recent surge.

Investors who want to outperform the market consistently should consider taking advantage of steep pullbacks on quality plays like MCD and buying aggressively, loading up toward your full allocation. While the news and sentiments might seem highly pessimistic then, MCD bottomed out resoundingly. Therefore, I believe you shouldn’t consider joining the ride now (likely late) just when the crowd could have gone FOMO.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!