Summary:

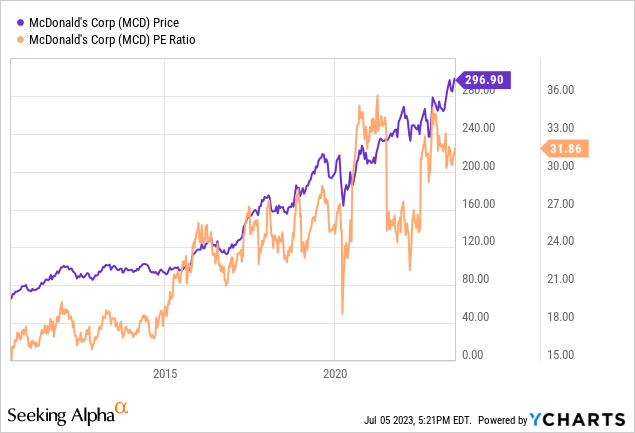

- McDonald’s has seen solid growth and strong margins over several decades, but elevated valuation is a concern for investors. Its P/E has risen from 15 to 31 in the last decade.

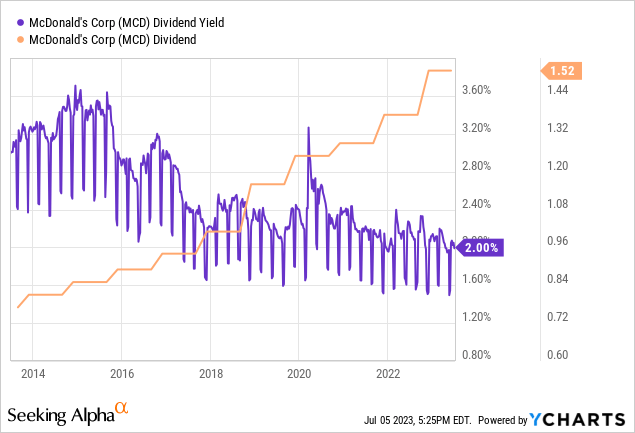

- Despite increasing its dividend from 72 cents to $1.52 in the last decade, McDonald’s dividend yield has dropped from 3.6% to 2.0%. This is less than half of the current treasury yield of 5.25%.

- We suggest a modified version of a covered call as a potential investment strategy, allowing for creating additional yield without giving up too much potential.

RiverNorthPhotography/iStock Unreleased via Getty Images

McDonald’s (NYSE:MCD) is one of those companies that many investors love to take bit of and I don’t blame them either. The company enjoys solid growth that spans several decades, strong margins, healthy pricing power and undying royalty of its customers. We saw an example of this last year when the company decided to raise its prices significantly in order to pass higher costs to customers and their sales volume didn’t even drop. The company even god rid of the Dollar Menu which has been around for decades and was one of its biggest attractions, and still it continued to post growth in sales.

While I am impressed by the company’s resilience and strength, I am also a bit worried about its elevated valuation. While customers might be fine with paying higher prices for MCD’s burgers and fries, investors might not be willing to keep paying a premium for the company’s stock in the same way. In the last decade and half, we’ve seen MCD’s P/E rise from 15 to 31, effectively doubling and rivaling valuations of tech companies.

While investors might continue to pay this multiple for a while longer, I don’t see much more room for multiple expansion either. It might have made sense for the stock to have a P/E of 30 (an earnings yield of 3.33%) when interest rates were near zero for much of the last decade but does it make sense now when treasuries yield a risk-free 5.25% after multiple rounds of rate hikes?

Speaking of yields, MCD’s yield has been dropping over the years even with the company hiking dividends every single year. In the last 10 years MCD hiked its dividend from 72 cents to $1.52 effectively more than doubling its dividend payments, yet curiously enough, the stock’s dividend yield dropped from 3.6% to 2.0% during the same period. Keep in mind that 10 years ago risk-free treasury yield was near zero but now it’s 5.25% now. In other words, 10 years ago MCD’s dividend yield was about 10x the short term treasury yield but now it’s less than half of the treasury yield (more like one third).

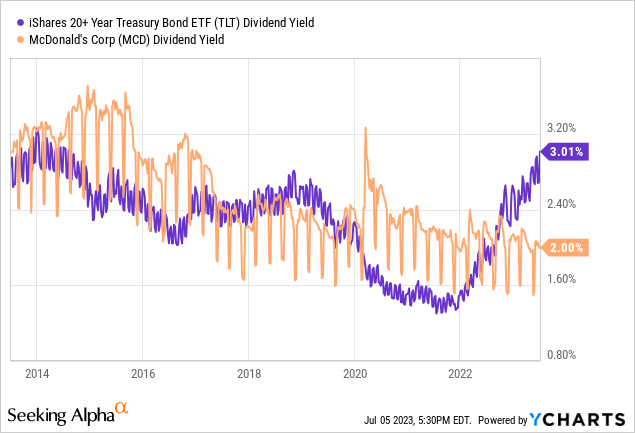

How about long term bond yields? Historically McDonald’s almost always had a dividend yield paralleling 10-year bond yield as you can see below. This year is one of the few instances where we are seeing such a large gap. It is possible that MCD’s investors are betting on a deep rate cut in treasuries but it is also possible that they are bidding up a stock a bit too fast.

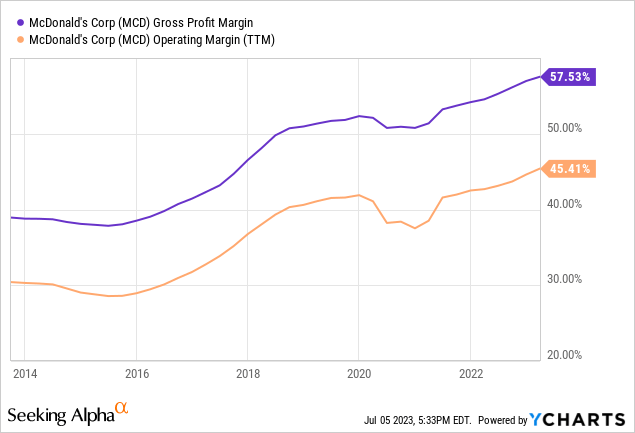

Apart from its valuation, the company is actually a great investment for several reasons. One of those reasons is MCD’s pricing power and strong margins. In the last decade, MCD’s gross margins and operating margins rose significantly, partly due to the company’s new franchise model and partly due to its incredible pricing power I mentioned above. It’s actually very rare for restaurants to see these types of margins unless they are owner-operated. The company’s long term goal of converting 95% of its restaurants into franchise-owned restaurant seems to be paying off so far. We are basically looking at a fast-food restaurant with that enjoys margins of a premium fine-dining restaurant.

Our population is becoming more health-conscious and people are more careful about what they consume. We are seeing declining numbers in smoking, soda consumption, alcohol consumption overall, just to give a few examples. It was thought that this trend would actually hurt demand for McDonald’s products but we’ve yet to see any evidence of that. The company’s profits and revenues keep growing year after year despite its reputation as being “unhealthy food” not to mention company raising its prices. I must also add that the company has been adding healthier items to its menu such as salads, vegan burgers and low calorie drinks. At this point it’s safe to say that demand for McDonald’s products is here to stay.

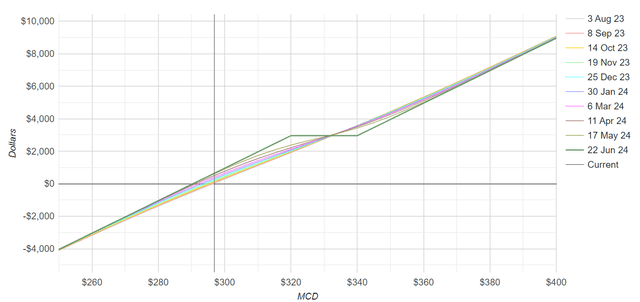

So what do I do with all this information knowing that McDonald’s is a great company with great prospects but also too pricey for my liking? I am doing a modified version of a covered call. I am buying 100 shares of McDonald’s, selling $320 June 2024 calls and buying $340 June 2024 calls with a $20 spread. It gives me a credit of $6.52 which gives an additional yield of 2.2% on top of the stock’s existing dividend yield of 2%, bringing my total yield to 4.2% but this is not the end of the story either. Since I also bought $340 calls, I am not giving up all of upside either. For example, if the stock were to climb to $360 in the next year, I’d participate in $40 of that upside in addition to the $6.20 I’ve already collected so my total return would be $46.20. If the stock were to stay flat or stay in a range, I’d collect my $6.20, plus any dividends and keep my stocks as well. Below is how my profitability would look like in different scenarios.

MCD covered call spread risk profile (optionsprofitcalculator.com)

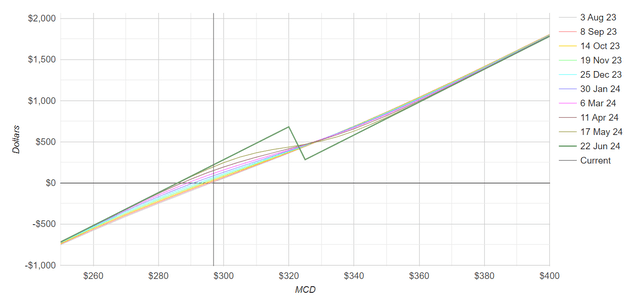

Here is something interesting though. Buying 100 shares of MCD costs $30,000 and not everyone have that kind of money to put into one stock and investors are always told that they have to buy 100 shares of a stock to do a covered call on it. Can I buy 20 shares instead and do the same options play? Actually you can. You just need to keep your option spread tighter. So instead of doing a $320-340 spread with a width of $20, you would do a $320-325 spread with a width of $5. Now you are getting a credit of $2.20 instead of the original $6.20 but you only own 20 stocks instead of 100 stocks and you are risking a lot less money with a similar risk-profit profile. This is something not many people even know about.

MCD covered call spread risk profile (optionsprofitcalculator.com)

With these plays, I can actually create myself additional dividends without giving up all upside like how a lot of people do with their covered calls. I don’t think the stock will rise much higher with its current valuation but I would rather be prepared in case it does and not miss out on gains if my neutral prediction turns out to be the wrong one. Investing is all about being prepared for different scenarios and options give us many options (no pun intended) in order to accomplish this.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.