Summary:

- Sales are being affected by boycotts and I fear this could damage the global brand if it snowballs.

- The company’s Accelerate the Arches strategy has been successful, with a focus on marketing, core menu, and digital experience.

- Financials show strong growth and improved operating margins, making a case for buying the company’s stock in the long-term but near-term headwinds mean you might want to wait.

Wirestock/iStock Editorial via Getty Images

Investment Thesis

McDonald’s Corp (NYSE:MCD) reported results on the 5th, February. Factset analyst’s expected an increase of 4.7% in same store sales for the quarter but the company reported a gain of only 3.4%. The share price dropped 3.7% at the closing bell and has since retracted further to trade on the 200-day moving average. The miss on revenues is attributed to a decline in activity across the middle east as boycotters dent sales due to the company reportedly giving free meals to the Israeli military. I believe this is a good time to begin writing on the company and have initiated a Hold on the grounds that the Middle East conflict will continue to adversely affect revenues. But the long-term picture looks strong with the expansion of the Accelerate the Arches strategy driving growth over the long-term.

Accelerate The Arches Strategy

Since 2019 MCD has acted upon their Accelerate the Arches strategy to deliver exceptional performance, generating 5.3% CAGR growth since 2019. The strategy has 3 pillars that undermine the recent success of the company:

- Maximize Marketing

- Commit to Core

- Double Down on the 3Ds.

MCD continues to utilize their marketing expertise to engage with customers and build a world class brand. It was voted by Kantar as one of the top five most valuable brands, driven by culturally relevant campaigns that customers love to engage with. Their commitment to the core menu that represents 65% of systemwide sales is a proven success and MCD’s innovation in this crucial segment has allowed them to grow market share. Finally, MCD has focused on delivering an exceptional digital experience in their loyalty program. This is one of the largest of its kind had houses over 150 million active users, with plans to expand towards 250 million users by 2027. With this exceptional growth in active users MCD plan to have meals ready for arrival by 2025 further increasing efficiency across the organization.

On the 6th December in the investor update MCD announced new targets in relation to their Accelerate the Arches strategy. In summary it includes targeting an ambitious 50,000 restaurants by 2027, as well as adding 100 million active users to the membership plan by 2027 and integrating Google Cloud technology to improve operations. The improvements are expected to drive continued financial performance with the company targeting 2.5% Systemwide sales growth beyond 2024 and a continued expansion in operating margins.

Middle East Conflict

While I won’t touch on the actual situation due to Seeking Alpha guidelines, the Middle East conflict is affecting MCD revenues! According to data in 2021 MCD had 213 restaurants located in Israel and a further 1,650 located across the Middle East, with the impact of the war taking its toll. Revenues for the four months to December increased only 0.7% in the IDL segment and management aren’t very optimistic on the situation. It has been reported that MCD have been handing out free meals to Israeli militants and I fear this could snowball into a brand damaging disaster. It is estimated that 300,000 have taken to the streets of London alone in support of a Gaza ceasefire and the Israeli government have taken no such action. If the press gets ahold of this information more thoroughly, global boycotts could ensue striking further pressure on MCD sales.

Financials Point To Long-Term Buy

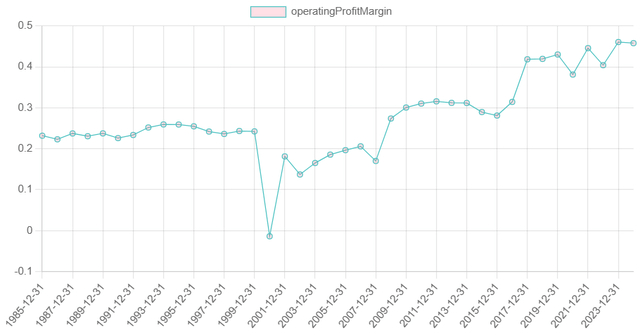

The financials look strong and definitely propose a buy case for the company. Full year revenues climbed 10% and EBIT Margins expanded 570 basis points. Traditionally MCD was a company in decline, with revenues falling -2.2% CAGR between 2010 and 2020 but since COVID there has been a notable increase in sales with a growth rate of 7.3% CAGR over the last 4 years. This growth is attributed to the Accelerate the Arches strategy that was formed in 2019 and I expect this strategy to continue driving success for the organization going forward.

Despite the aneamic sales growth in the past, the company has successfully expanded operating margins due to excellent operating leverage driven by impressive cost reductions. This has resulted in EBIT Margins ranking 7th out of 525 companies in the Consumer Discretionary sector.

After subtracting interest expense and other income net margins show a similar picture, with a major expansion in profitability between early 2000s and 2024. The increasing net margins and well managed working capital has expanded free cash flow margins which currently stand at 25%. The company uses its $15 billion share repurchase program announced in 2019 to return money to shareholders and also pays a dividend yield of 2.1%.

More recently, sales increased 3.4% in Q4, coming in just under estimates driven by robust growth in North America offset by anemic growth in the IDL segment. Net Margins contracted -28 basis points but after adjustments expanded 136 basis points to 33.5%. The company missed on top line numbers because of the conflict in the Middle East.

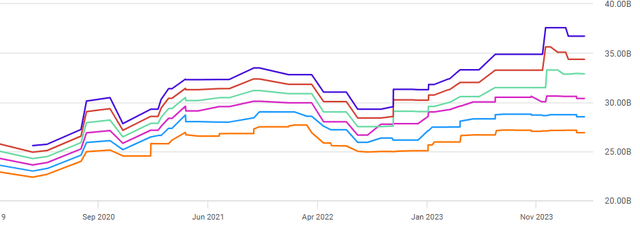

Revisions

Since the results revisions have fallen back as expected. Further out revenue estimates fell immediately following the results and in the proceeding weeks the more recent years estimates have also marginally declined. This decrease in revisions is due to the miss on same store sale in Q4 that was driven by poor performance across the IDL segment. That poor performance is being driven by conflict in the Middle East and certain customers boycotting MCD due to them delivering free meals to Israeli militants. The conflict is a clear near-term headwind and MCD management are expressing concerns:

As long as the war is going on… we’re not expecting to see any significant improvements [in these markets]

Valuation

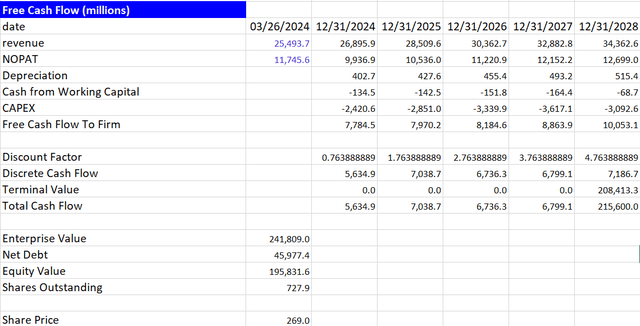

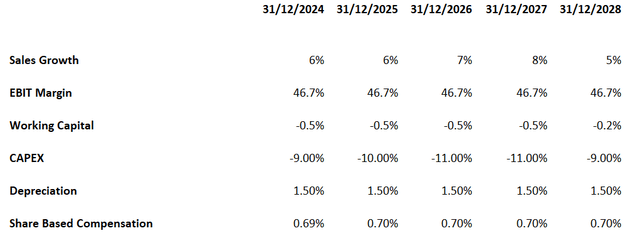

When valuing MCD I have used a multiple of 29x to get a share price target of $269 and a downside of -4.6% from today’s price. The median multiple over the last 5-years is 30x but due to the ongoing conflict and recent negative press I have used a slightly lower multiple to account for this.

Over the last 6-years MCD has invested heavily into working capital and I have the investments reducing going forward as I don’t think the current level can be sustained so have rolled out a -0.5% incremental change. In terms of CAPEX the company has a reasonably strong expansion project planned so I have CAPEX increasing towards 11% by 2027 to account for the 55,000 new stores planned.

Risks

The major challenge to my thesis is the conflict in the Middle East. So far the UN Security Council has ordered an immediate ceasefire but Israel responded with more attacks. If a ceasefire does occur that would warrant a change in my recommendation as other MCD markets are growing, and adjusted profit metrics are expanding.

Conclusion

The long-term outlook for MCD remains strong, the financials are excellent, and the company maintains its status of having a strong moat but the current conflict in the middle east could result in bad press and further boycotts. That is why I am initiating a Hold on the company with a share price target of $269. I imagine MCD will tackle the problem in the coming quarters but for now the very near term outlook doesn’t look promising.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.