Summary:

- MCD now features a dividend yield that’s near peak levels in at least 5 years, indicating attractive valuation.

- But on the negative side, I am seeing high food price inflation as a key profit headwind.

- It is impacting both consumer spending and MCD’s menu prices, both could decrease customer flow.

- Valuation is not cheap either when growth outlook is factored in.

ermingut

MCD stock: dividend yields near peak levels in at least 5 years

McDonald’s (NYSE:MCD) caught my attention in my screening of dividend stocks. In these screens, I look for dividend stocks whose yields are noticeably above or below their historical averages. More specifically, the chart below shows MCD’s dividend yield compared to its historical average in the past 5 years. As you can see, McDonald’s current dividend yield of 2.58% is significantly above its 5-year historical average of 2.23%. Moreover, the current yield is also among the highest levels in at least 5 years. The only exception is the period right after the COVID-19 breakout, when the stock (together with the broader market) went through a fire sale.

Usually, such a high yield indicates an attractive entry point for dividend stocks (especially for a dividend champion like MCD). However, in this particular case, I am seeing a mixed picture. On the one hand, the yield certainly indicates an attractive valuation. But on the negative side, I am seeing persisting inflation, especially food price inflation pressure. As to be detailed in the remainder of this article, I am concerned that such pressure would dampen the growth outlook and thus the valuation may not be as attractive as it seems on the surface once growth is factored in.

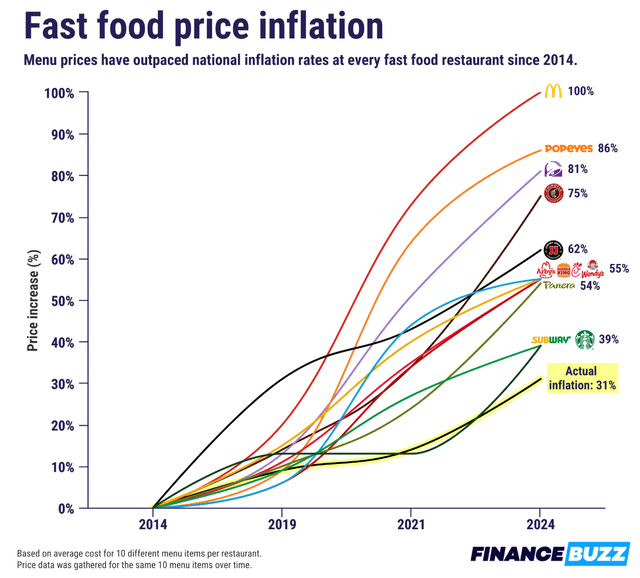

MCD, like other restaurants, faces rising costs for ingredients due to inflation. Despite its reputation for affordability, it had to raise menu prices to offset inflation. Actually, according to the following FinanceBuzz evaluation:

The worst offender for dramatic price increases is McDonald’s — a chain that recently went viral for all the wrong reasons. An $18 Big Mac combo garnered so much attention online that the McDonald’s CEO promised affordability on a recent earnings call. According to our data, prices at McDonald’s have doubled since 2014, with an average price increase of 100%. Overall, this rate is more than triple the national inflation rate during the same time. One illustrative example is the McChicken sandwich: once a staple of the chain’s $1 menu in 2014, the sandwich now costs $3 at some locations, a 200% increase.

Such large price increases could create many negative impacts. This could weaken its affordability thesis and alienate some customers. Furthermore, high inflation can lead to consumers cutting back on discretionary spending, including eating out and reducing demand for McDonald’s meals.

Next, I will explain I see such inflationary pressure to be persisting.

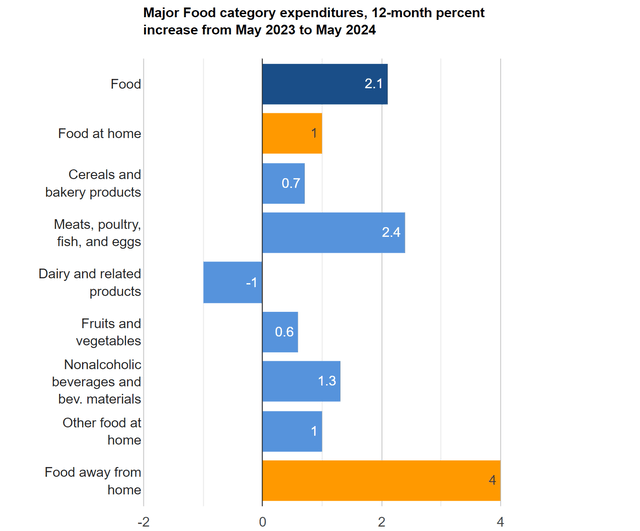

MCD stock: food inflation remains elevated

According to the latest CPI statistics (published on June 12, 2024, by the U.S. Labor Department’s Bureau of Labor, BLS), the good news is that inflation has shown some signs of cooling. For example, the average food price increased 2.1% in May YOY, compared to 2.2% in April. However, digging a bit deeper, the cooling is uneven among different categories as seen in the chart below. According to the data, the “Food away from home” index still increased by 4%, the highest among all different categories. The “Food away from home” category includes serviced meals and snacks (and MCD belongs in this category).

MCD is certainly aware of inflation stress on both its own margins and also on consumers’ wallets. In North America and overseas, MCD is seeing customers pull back on spending as inflation is pinching their budgets. The stress is more apparent in the United States, Spain, Poland, and the United Kingdom. Menus are being tweaked, with an emphasis on value offerings. Competition has intensified, and the MCD chain has to really focus on keeping its market share. The chain has upped its advertising spending and added tasty items on the menu (e.g., hotter, juicier burgers). Measures to improve and speed up service are also being taken as a response to competition.

However, in my mind, the menu price remains the key for a fast-food restaurant in the end. It remains to be seen if MCD can achieve all the above goals while keeping costs and menu prices under control.

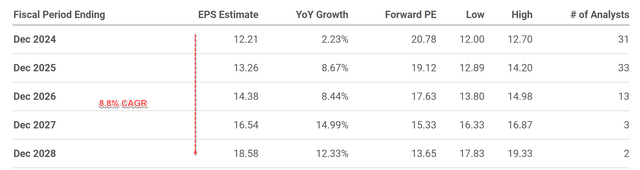

MCD stock: EPS outlook and valuation

In terms of the growth outlook, the chart below shows the MCD’s consensus EPS estimates for the next 5 years. Based on the chart, analysts expect its EPS to grow over the next five years. Although, the growth is a bit uneven. EPS is estimated to be $12.21 in FY 2024 and then increase to $13.26 in FY 2025, translating into an annual growth rate of 2.23% only, largely due to the inflation pressure in my view. Overall, the compound annual growth rate (“CAGR”) is 8.8% between 2024 and 2028 according to the consensus.

In my mind, a key assumption for such CAGR to materialize is for inflation to renormalize in the next 1 or 2 years, which is an uncertainty. Furthermore, even if such a growth projection does materialize, the stock is still not cheap when adjusted for its growth. As shown in the chart above, the forward P/E ratio for MCD is 20.78x currently. At a growth rate of 8.8%, the stock PEG (P/E growth) is about 2.4x, far higher than the 1x that most GARP investors (growth at a reasonable price) consider as the gold standard.

However, for a dividend champion like MCD, the PEGY ratio is a more appropriate metric for the following reasons Peter Lynch promoted :

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio below 1x.

For MCD, with a projected growth rate of 8.8% and yield of 2.58%, the PEGY works out to be about 1.84, still considerably above the 1x threshold.

Other risks and final thoughts

Besides the above issues, another concern involves the geopolitical conflicts in the Middle East. MCD’s sales were under pressure there, given the perception that MCD supported Israel over the Palestinians in their conflict. The company has taken a neutral stance, but a neutral stance carries its own risks (i.e., it could upset both sides).

On the positive side, MCD has a strong brand and loyal customer base. Many customers may be willing to pay a bit more for MCD, thanks to such a strong brand name (speaking from first-hand experience here) and its loyalty programs are quite effective. In the meantime, the company is using digital ordering, technology-enhanced processes, and improved store formats to increase productivity and efficiency. The measures could help MCD to better combat cost pressure (including commodity prices, energy prices, employee wages, etc.).

Given the mixed signs above, I see a hold case here. On the positive side, the stock offers a good balance of income and capital appreciation potential as analysts expect EPS growth of around 8.8% in the coming years, and its 2.58% dividend yield is among the highest levels in at least 5 years. However, the current P/E ratio of 21x is not cheap by any measure, either in absolute terms or in PEG (or PEGY) terms. Finally, I view the inflation and cost pressure to be a large uncertainty in the consensus growth projection. The growth could be slower than anticipated if inflation persists higher for longer, a quite likely scenario in my mind.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.