Summary:

- Franchising corporate strategy brings advantages to McDonald’s top and bottom line growth.

- However, its growing leverage, built up throughout the years, has reached some of its highest levels in historical terms.

- As cash flow is under pressure and costs/expenses rise, the company could be facing more vulnerability compared with the previous recession.

- Combined with consumer spending at the restaurants normalizing, the company has peaked in the near term.

jetcityimage

Investment Thesis

McDonald’s (NYSE:MCD) robust growth comes from its much-improved cost control and franchising strategy that is scalable globally. However, after analyzing its financial leverage and in relation to the restaurant inflation in the US, we consider McDonald’s has reached its near-term peak.

Company Overview

McDonald’s, founded in 1940 and headquartered in Chicago, Illinois, is an American fast food chain with 95% of its over 40,275 restaurants franchised across more than 100 countries. The company’s reportable segments are the US and International Operated Markets.

Strength

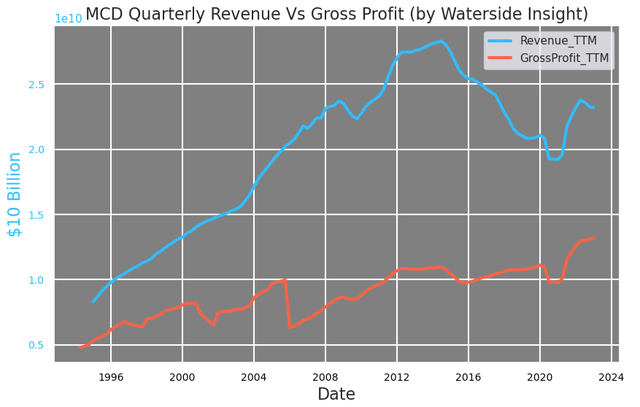

McDonald’s revenue has only seen strong growth since the depth of the pandemic. Its latest topline growth seems to have been bucking the downfall trend after reaching the high of 2014. While its revenue has been riding some volatility, its gross profit has steadily increased. Currently, its gross profit is at the highest since MCD stock’s IPO.

McDonald’s Net Cash Flow Breakdown (Calculated and Charted by Waterside Insight with data from the company)

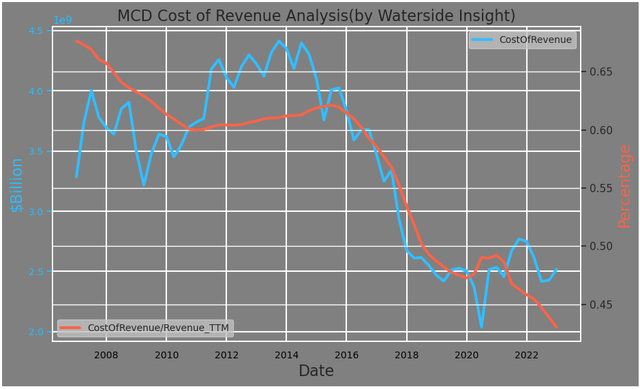

The rising gross profit is primarily due to the fast and continuous decline of the cost of revenue. Although at an absolute value term, its cost of revenue has been rising since 2008, it has staged a fast decline since 2016. This cost measurement has become a lesser part of revenue since 2008.

McDonald’s Cost of Revenue (Calculated and Charted by Waterside Insight with data from the company)

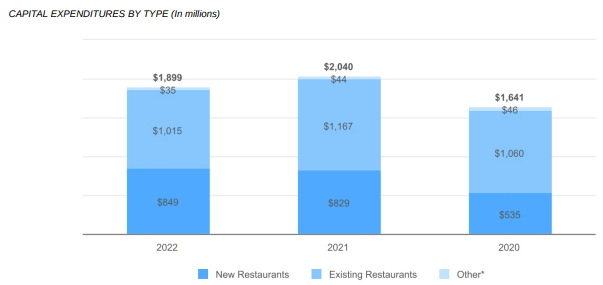

Moreover, its capital expenditure has only been flat to lower as of late.

McDonald’s Capex (Company 2022 10-K)

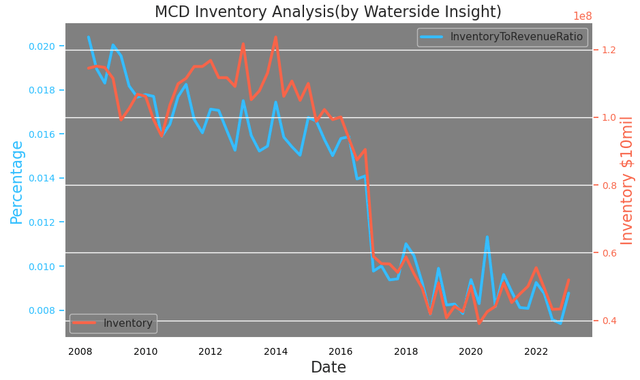

In addition, despite all the supply chain problems reported elsewhere, McDonald’s has done an excellent job at controlling its inventory and supply. As each franchised chain restaurant optimizes its supply and demand, this behavior replicated at a scale benefits the company as a whole. There is no sudden large spike or a gradual accumulation of its inventory on either an absolute or relative basis. They are basically at their average since 2016.

McDonald’s Cash Flow (Calculated and Charted by Waterside Insight with data from the company)

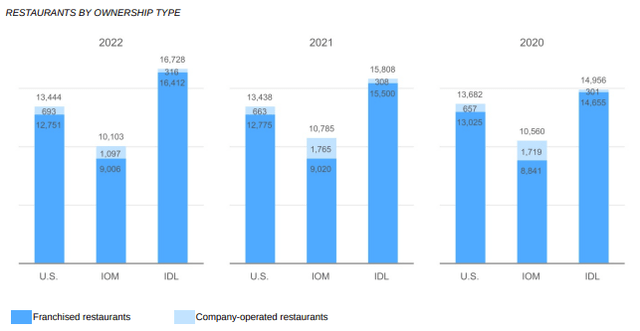

The company’s franchising setup has three forms: conventional franchises, development licenses, or affiliates, with the latter two, being primarily in foreign markets such as China and Japan. The majority of its ownership is from franchises.

McDonald’s Number of Restaurants by Ownership Type (Company 2022 10-K)

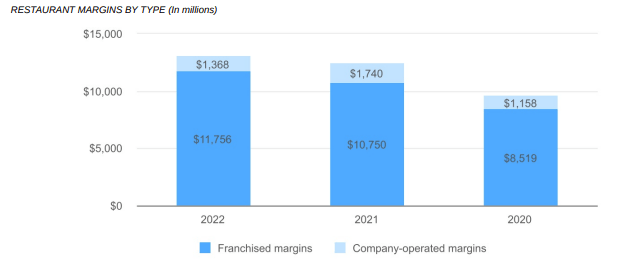

The company’s franchise margin growth has exceeded the company-operated restaurant’s margin. The stats all show how McDonald’s operating strategy of franchising at a global scale is working well in contributing to both the top and bottom lines.

McDonald’s Restaurant Margin by Type (Company 2022 10-K)

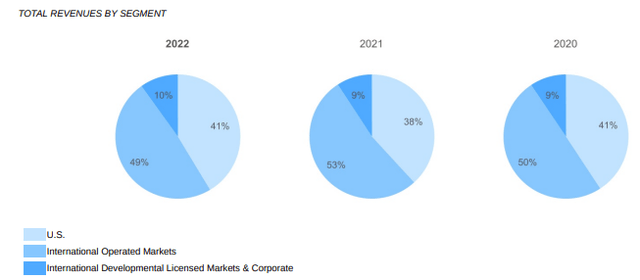

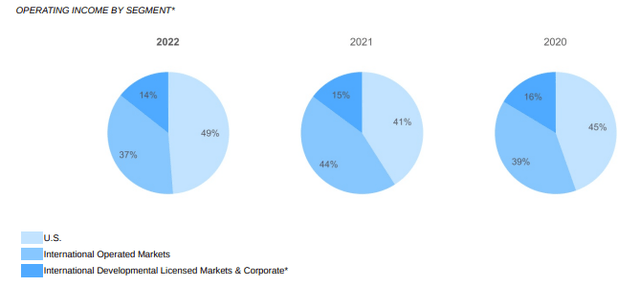

And as a global company, McDonald’s record half-and-half from both in the US and overseas. With their operating income also almost evenly split. In 2022, foreign currency translation negatively impacted $0.52 on diluted earnings per share. But with the US dollar’s strength reaching a peak in the next year or so, this could be an advantage to its near-term earnings. We are not too worried about it.

McDonald’s Revenue by Segment (Company 2022 10-K) McDonald’s Operating Income by Segment (Company 2022 10-K)

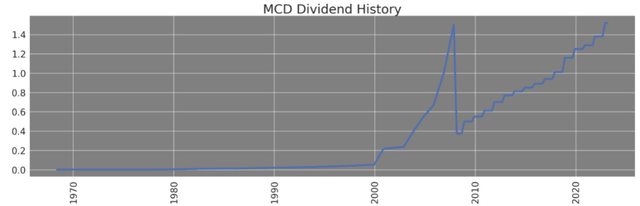

Its strong dividend growth and the household name brand make McDonald’s a highly relatable stock in the average Joe’s investment portfolio. And it is rightly so. Its current dividend built back up to its level before the last recession in 2008.

McDonald’s Dividend History (Calculated and Charted by Waterside Insight with data from the company)

Overall, McDonald’s is currently at one of its strongest footings in terms of growth and efficiency.

Weakness/Risks

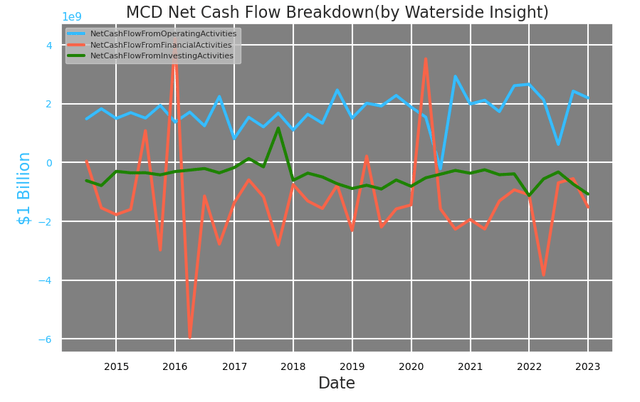

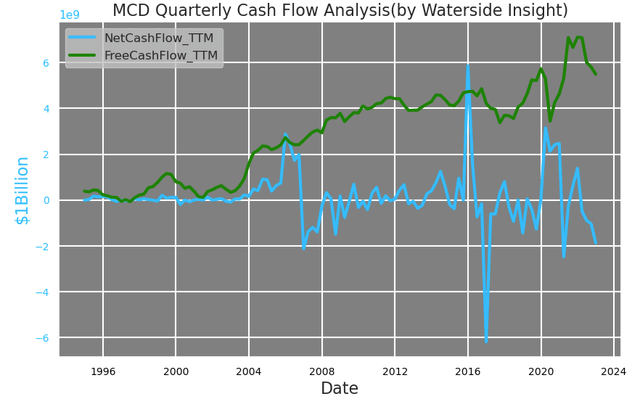

The breakdown of its net cash flow’s history shows that the financing leverage McDonald’s built up is through a continuous process. Its cash flow from financing activities has mostly been negative, while its operating cash flow growth has been flat and stable.

McDonald’s Net Cash Flow Breakdown (Calculated and Charted by Waterside Insight with data from the company)

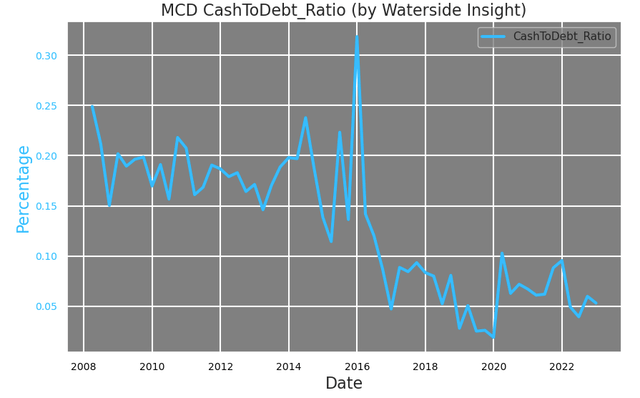

This build-up has led it to one of its lowest cash-to-debt ratios. McDonald’s highly leveraged balance sheet didn’t seem to be a problem for a long time, as the company started aggressively increasing its leverage since at least 2016. Its cash-to-debt ratio is currently at its low point of just 5%, about one-fifth of where it was before 2008.

McDonald’s Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

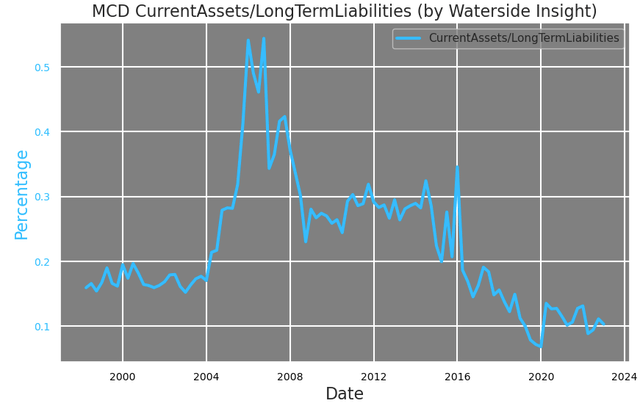

And from a broader perspective, its current assets are about 10% of its long-term liabilities, about one-third of where it was before 2008.

McDonald’s Current Assets over Long Term Liabilities (Calculated and Charted by Waterside Insight with data from the company)

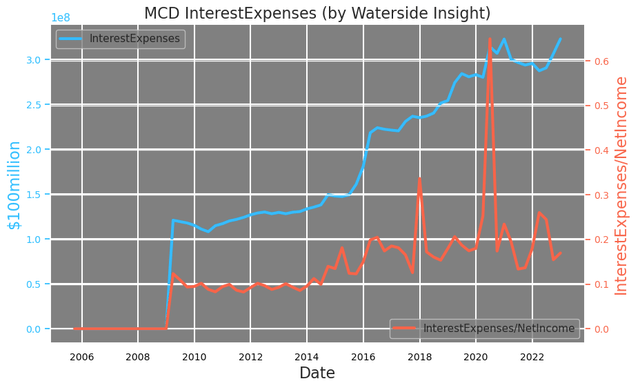

But this could become an increasing burden now. Its interest expenses have reached the highest level ever. On a relative basis to net income, its interest expenses are far above its level post-2008, which is close to zero. Keep in mind that its net income has more than doubled since 2008, so this increase is more substantial than this ratio shows. McDonald’s could now be more vulnerable to macro challenges and rising rate environments.

McDonald’s Interest Expenses (Calculated and Charted by Waterside Insight with data from the company)

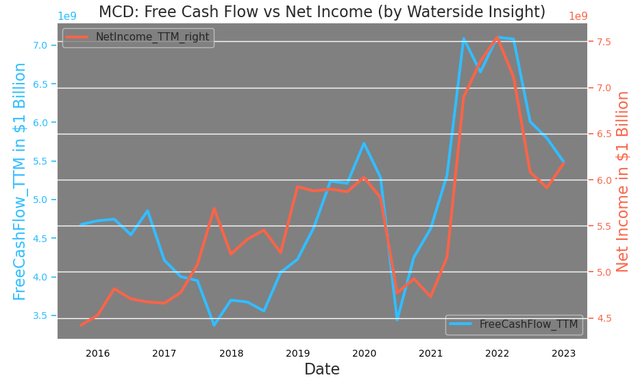

And these challenges have been gradually creeping in. Both its free cash flow and net income, albeit still healthy and robust, have come back down to close to their average levels since 2016.

McDonald’s Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from the company)

On a TTM basis, its free cash flow is still elevated, but its net cash flow is as low as its level before 2008. We think it has more room to fall. Assuming its operating cash flow sustains at the current level, and its investing pace is marching ahead (the company plans to continue expanding its global presence), it then has steeper financial obligations to fulfill, as the interest expenses indicate.

McDonald’s Cash Flow (Calculated and Charted by Waterside Insight with data from the company)

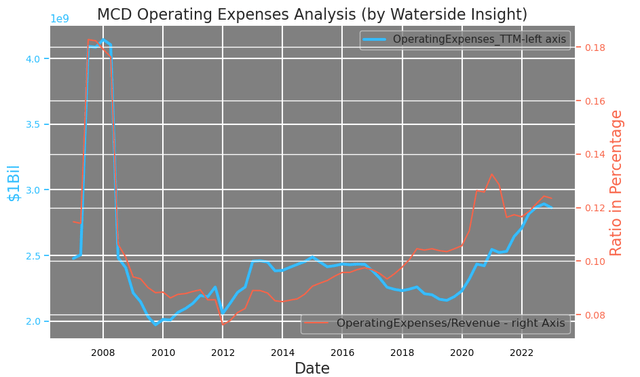

Although McDonald’s has better control over the cost of revenue, its operating expenses have been rising. It is still a far cry from its highs before 2008, but the trend is increasing.

McDonald’s Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

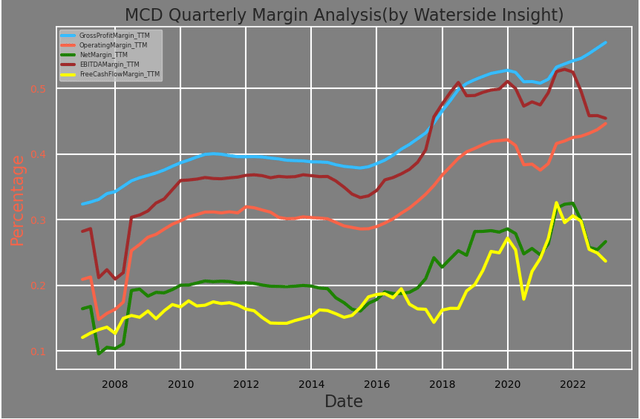

What’s at stake is the margin. As we mentioned before, its cost of revenue contributed strongly to its overall high margin. Its gross profit margin and operating margin are still inching higher, but net margin, free cash flow margin, and EBITDA margin are trending lower, although they are still at a high historical level. In relation to its operating margin, the company stated it was hit with a $1.28 billion pre-tax charge from its sale of Russian business, but saved $141 million from capex due to lower reinvestment from it. Overall, the operating margin remains robust on a TTM basis, as the impact of the Russia-Ukraine war should have been reflected by Q2 2022’s result already. Although recorded a 24% decline from 2021 partly due to this event, its internationally operated markets margin is still 22% higher than in 2020. We consider the event as a dent instead of an ongoing drag. So the longer the downward trends last, the more other adverse factors are at play.

McDonald’s Margins (Calculated and Charted by Waterside Insight with data from the company)

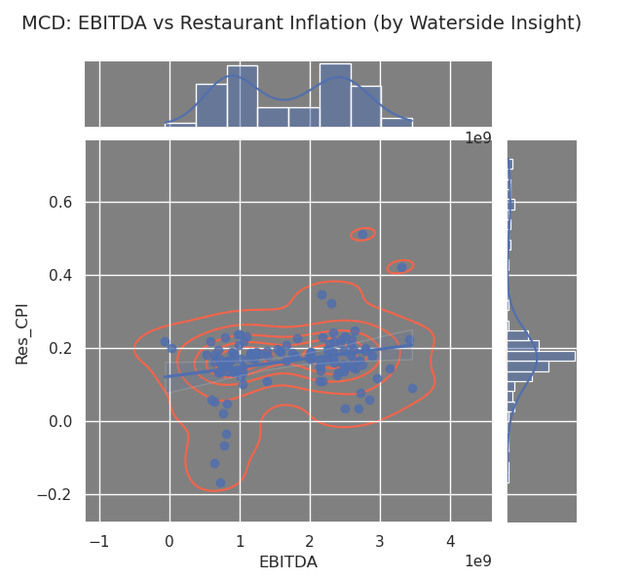

From a macro perspective, higher restaurant inflation means more money consumers spend when eating out. McDonald’s earnings could have large fluctuations when the restaurant inflation in the US is at average levels, but respond positively when restaurant inflation is exceptionally high, and vice versa.

McDonald’s EBITDA vs US Restaurant Inflation (Calculated and Charted by Waterside Insight with data from the company)

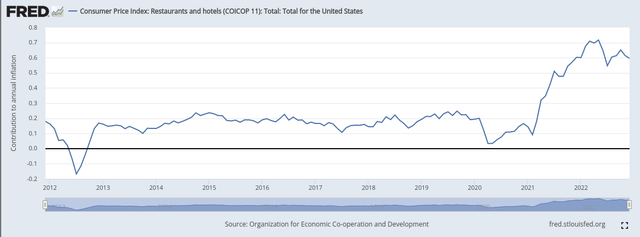

The current level of restaurant inflation in the US can be considered exceptionally high compared to its history. We don’t expect this to become a new trend as the Fed aims at bringing down the overall inflation in the economy. The dividend from the pandemic recovery could be normalizing in the near term for the company.

US Restaurant Inflation (FRED)

ESG Footprints

As a long-term investor, when looking at McDonald’s, it’s hard not to see its impact from an ESG perspective. To give some examples, McDonald’s footprints in two of the categories are of elephant size.

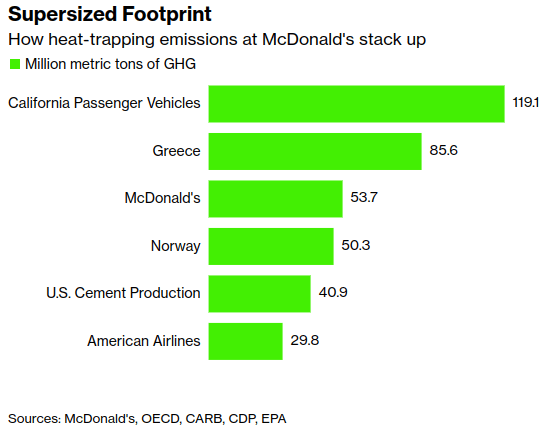

Greenhouse gas emission: Burger is made primarily with beef, and will continue to be so, even though other substitutes are to be introduced in the future. So counting that and the company’s other emissions from fossil fuels consumption, if we treat McDonald’s as a country, its emission can stack up in comparison against Greece and Norway, and far exceeded the emission from the US cement production.

McDonald’s Emission (Bloomberg )

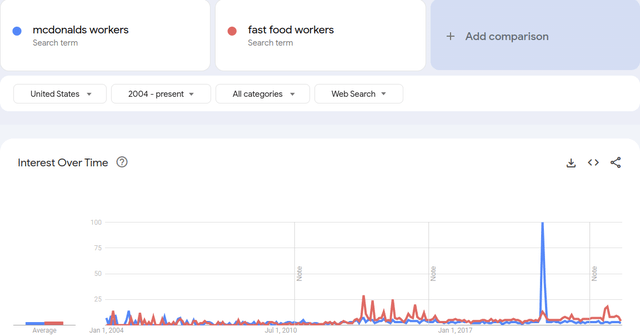

Labor: sometimes more or sometimes less, but McDonald’s workers seem almost synonymous with fast food workers in google search trends. It is symbolic, but also due to the sheer number of workers it has there. A rough estimate: if half of its workers are from US restaurants, there are at least 20,000 of them. As the number one fast food chain restaurant by size in the US, McDonald’s attracts particular attention to its work conditions, benefits, and salary.

Search Frequency of McDonald’s Workers (Google Trend)

Due to its significant social and climate impacts, investors can expect an increasing focus on McDonald’s ESG matters to be part of the ever-fluid discussion. The company is right to spend its efforts growing and transitioning with the broader society. Shareholders should also take this into consideration.

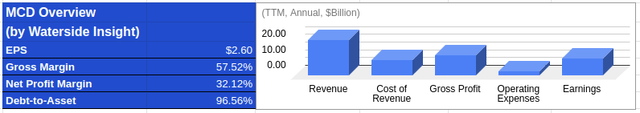

Financial Overview

McDonald’s Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

Valuation

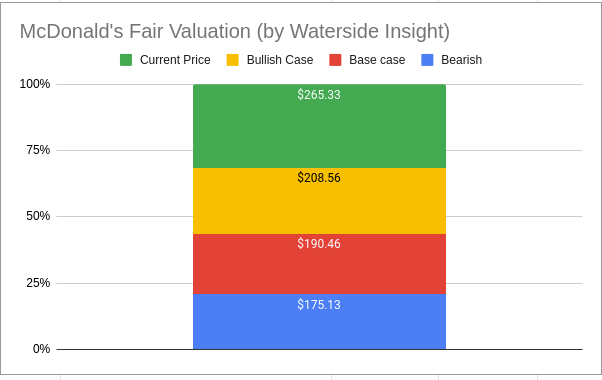

We take into account all our analysis above, using our proprietary models to assess McDonald’s fair value with a ten-year projection forward. In our bullish case, McDonald’s experienced a mild decline in 2023, but resumes steady growth going forward; it is priced at $208.56. In our bearish case, the decline lasts into 2024, rebounding back to robust growth; it is priced at $175.13. In our base case, we priced in mild decline in both ’23 and ’24, and the company continued to strengthen its growth afterward; it is priced at $190.46. The current price is above our top estimate.

McDonald’s Fair Valuation (Calculated and Charted by Waterside Insight with data from the company)

Conclusion

McDonald’s has a scalable franchising growth strategy on a global level, and the company has become more efficient in controlling costs while expanding. The company’s topline momentum could continue, given its expansionary strategy announced lately. However, its balance sheets are highly leveraged, with its margin facing some decline. On top of this, the macro environment could be normalizing with less consumer spending boost to it. And in the long term, the company still has more transitions to make to improve its ESG impact. We think the current high margin will transition to a lower level, with the company’s robust performance reaching a near-term peak. The current market price is rich for its fair value. We would recommend a sell and look to participate at a more reasonable price.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.