Summary:

- McDonald’s is a global fast-food chain with over 40,000 restaurants and a strong brand image.

- The company’s business model relies heavily on franchisees, who pay royalties and fees to use the McDonald’s brand.

- MCD has a robustness ratio and bargaining power over its franchisees, allowing it to continue raising royalties without significantly affecting profitability.

M. Suhail/iStock Editorial via Getty Images

Founded in 1955, McDonald’s Corporation (NYSE:MCD) is arguably the most famous fast-food restaurant chain in the world. It boasts over 40,000 restaurants globally, which we’ll delve into further later. It enjoys a strong brand image as well as economies of scale, and despite being a mature company known to all, I believe it still has a trick up its sleeve for the future.

But first, let’s define the title of the article. The Robustness Ratio, as I understand it based on the definition provided by Nick Sleep, is the untapped pricing power over your customer. In the case of McDonald’s, the franchisees. We will understand it throughout the article.

Business Model

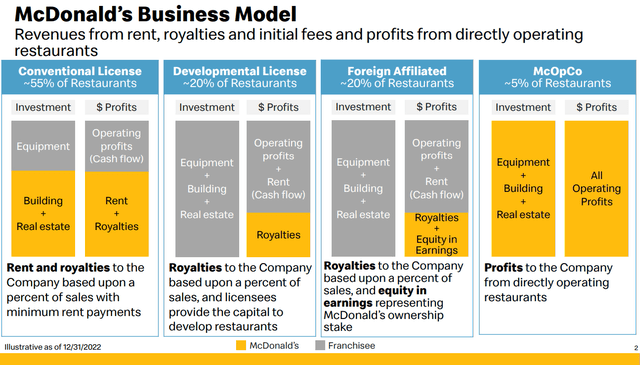

The company’s revenues consist of sales from restaurants operated by the company and fees from restaurants operated by franchisees, developmental licensees, and affiliates. Revenues from conventional franchised restaurants include rents and royalties based on a percentage of sales with minimum rent payments and initial fees. Revenues from licensed restaurants to developmental licensees and affiliates include a royalty based on a percentage of sales and typically include initial fees. Other company revenues consist of fees paid by franchisees to recover a portion of costs incurred by the company for various technology platforms, brand licensing agreement revenues to market and sell packaged consumer goods using the McDonald’s brand.

Source: 2023 Investor Update Fact Sheets

The company owns approximately 57% of the land and approximately 80% of the buildings for restaurants in its consolidated markets. These assets often serve as collateral for debt, and it is virtually the only player among franchisees that does something similar, thus obtaining very cheap debt in comparison. Property, plant, and equipment net assets and net right-of-use lease assets represented approximately 44% and approximately 24%, respectively, of total assets at the end of the year.

Franchise agreements initially last for 20 years. McDonald’s grants them permission to use its brand, technology, suppliers, and scale in any area. Franchisees are responsible for reinvesting capital in their businesses over time (though joint investments may occur). While the company employs 150,000 employees, over 2 million people work in its more than 40,000 restaurants globally. The menu options are highly standardized (with 65% of sales coming from the 3 essentials: Beef, Chicken, and Coffee), but MCD has the scale and expertise to adapt menus to any part of the world with some local gastronomy and decoration.

Source: https://internationalmarketingmix.wordpress.com/

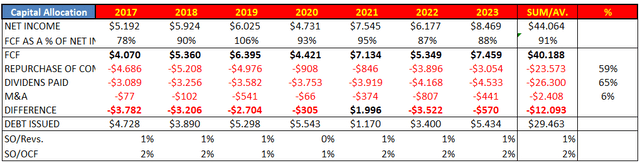

Capital Allocation

McDonald’s typically converts an average of 90% of its Net Income to Free Cash Flow. This FCF is allocated with 59% for share repurchases and 66% for dividends. Currently offering a Yield of 2.5% and having grown at an annual rate of 8% in recent years, MCD has been distributing a growing dividend for 47 years, soon to be considered a Dividend King. The remaining FCF is used for acquisitions, but this constitutes a very marginal portion (6%). The company’s Capex/Sales ratio stands at 9% ($2.26B), and they expect it to grow at rates of $300-500M annually to support the opening of new restaurants and to contribute to the significant investments in technology the company is undertaking.

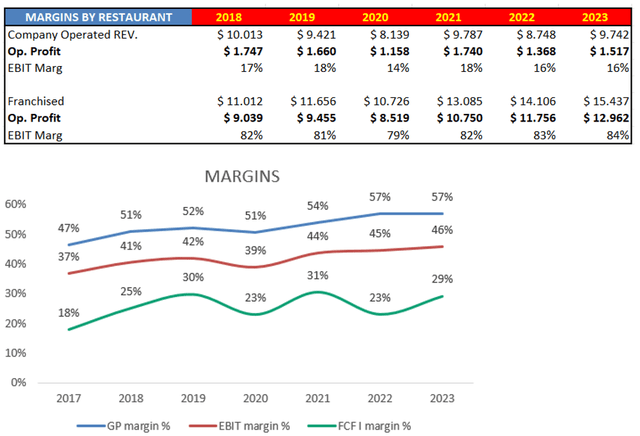

Source: Author’s representation

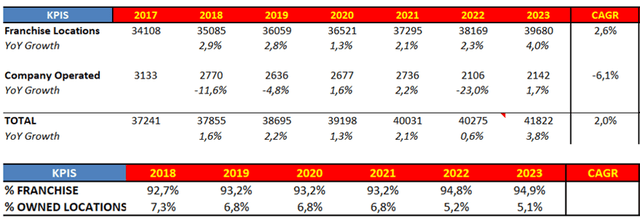

From the current almost 42,000 restaurants, the company aims to have 50,000 by 2027. This implies an annual opening rate of 4%-5%. Currently, 95% of these were franchises (compared to 80% in 2015), a fact that has been reflected in the company’s margins (29% EBIT Margin in 2015 vs. 46% today). The question we need to ask is what percentage of restaurants will be franchises in 2027, after the opening of the remaining 8,000. We’ll see that these are much more profitable for MCD than those operated by the company. In fact, MCD has been closing or converting many of its restaurants to franchises in recent years (which generate more revenue but are less profitable). This is why McDonald’s sales have been fairly flat in recent years (1.9% 6-year CAGR) compared to metrics like FCF/Share (12.6% 6-year CAGR).

Source: Author’s representation

Franchises have much better margins than company-operated restaurants. Additionally, with 20-year contracts based on royalties, MCD secures predictable and stable cash flows over the long term. Although it may not seem so at first glance, 61% of MCD’s sales have a very recurring profile.

Source: Author’s representation

Robustness Ratio

In addition to competitive advantages in the form of scale economies:

And I think the other part of that is about how we’ve been able to deliver a significant improvement in the return on the marketing investments we’re making. So, we’ve got the scale advantage. We invest more marketing dollars than anyone else in our industry by far, but we didn’t feel we were getting the return or as much return on that spend as we could get. So, that I would say are maybe a couple of the I think key progress points under the M”.

Ian Borden, Executive Vice President and Chief Financial Officer in the UBS Global Consumer and Retail Conference.

And the brand image, which makes it a very attractive restaurant for its franchisees, as the brand’s reach is global.

Our brand last year by Kantar was rated the fifth most valuable brand in the world. The other four companies ahead of us were all tech digital organization. So, I think that speaks to — and I think by increasing the value of the brand, you’ve also increased the appetite or the opportunity in terms of the accessibility of the brand to consumers”.

Ian Borden, Executive Vice President and Chief Financial Officer in the UBS Global Consumer and Retail Conference.

I think McDonald’s enjoys a good robustness ratio, which could be explained in another way, as shared economies of scale. That is, the larger you are, the more your costs decrease, and this effect is passed on to your customers in the form of lower prices. While MCD is not the best example of a company that does this, there are some details that speak very well of its corporate culture and support for franchisees, which I like. It is known that MCD forgave the rent for several of its franchisees during the pandemic, as many had to close their restaurants. It also supported the profitability of franchisees in Europe, following the increase in labor costs.

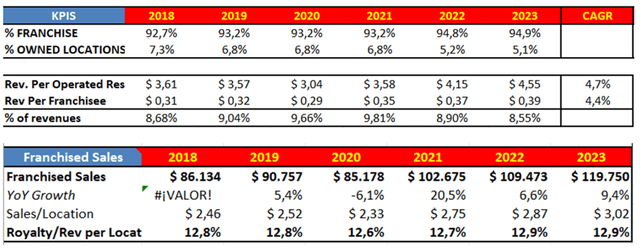

But there is another data point that can be calculated, and that is the pressure on the franchisees. As we know the total sales of franchises globally and their number, we can determine how much each franchise earns on average. Knowing the average payment each franchisee makes to MCD, we obtain the figures in the image. As we can see, franchise revenue for the parent company has grown more slowly than revenue from company-owned restaurants. The pressure on franchisees has remained virtually flat (12.8%-12.9%)

Source: Author’s representation

All of this indicates that MCD still has a lot of bargaining power over its franchisees. In the coming years, we will see an increase in sales and figures thanks to the expansion in the number of restaurants, but the company still has the option to continue raising royalties on its franchisees without their profitability being significantly affected. This would represent a considerable cash flow for the company, as around 90% of these royalties end up converted into cash for the parent company. With all of this, I believe that MCD still has many years of growth and profitability ahead.

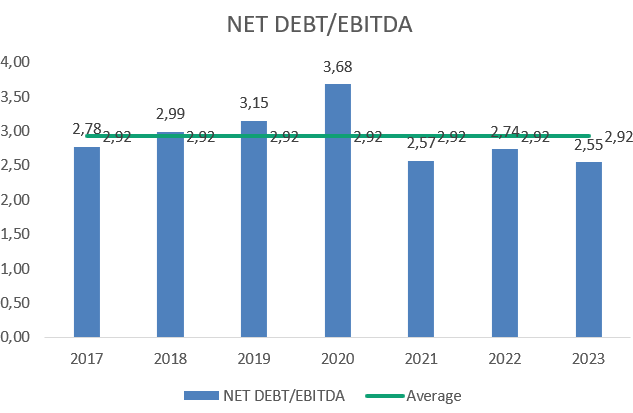

Debt

A section that people often worry about is the company’s debt. They usually focus on the total debt ($39B), but this data, without context, loses much of its value. MCD uses debt to purchase the locations and land on which it operates. With a large scale and predictability in its business, it obtains debt at very low rates (3.7%), and 96% of it is at fixed rates, so it is not affected by interest rate hikes in debt payments. On the other hand, the net debt to EBITDA ratio is the lowest in the past 7 years. The maturities it has in the coming years pose no problem (less than 30% of this year’s FCF). With all of this, I believe that the debt poses no danger, and MCD’s managers seem to me to be among the brightest in the sector, so this strategy is proving to be effective.

Source: Author’s representation

Valuation

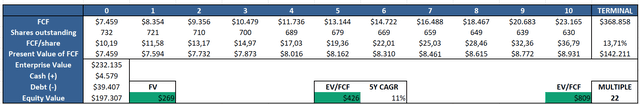

Between the opening rate of new restaurants (4%-5%) and organic growth of 3%-4%, I believe MCD can grow sales at rates of 6%-7% in the coming years. Depending on the percentage of franchises compared to total restaurants (95% nowadays), bottom-line growth should be even higher (around 10% Net Income). If we add to this a Dividend Yield of 2.5% and a repurchase rate of 1.5%, it is possible that MCD will end up offering shareholder returns of between 12%-14% with very low risk.

If we perform a reverse cash flow discounting, to determine what growth rate the market is discounting at today’s price ($266), we get a growth rate in FCF of 12%. In recent years, FCF/Share has grown at 12.6%, so these figures are achievable in my opinion. If we want to add some margin of safety, $250 is a level that I really like. However, thanks to the quality and the low operational risk of the business., I rate the stock as a buy.

Source: Author’s representation

Risks

Perhaps there will be a scenario of margin compression due to an increase in labor costs for the company (wages adjusted for inflation) along with greater pressure on its customers. Many of MCD’s customers are low-income individuals. MCD is aware of this and says they will focus less on premium products and more on larger, more satisfying ones, with a good quality/price equation.

Before delving deeper into the company, I thought there might be a risk of complacency. However, after discovering their plans to open new restaurants, their agreement with Google Cloud to optimize everything from the app to the operational systems of all restaurants, and their desire to continue improving in the chicken and coffee category by standardizing their machines (currently there are 100 different types of coffee machines, which can lead to differences in product quality and taste between locations), my perception has changed. Additionally, I really like the initiative of the 10 CosMc locations. With all this, I see that MCD remains obsessed with improving and satisfying customers, a fact that ensures the longevity of mature companies.

Other Important Graphs

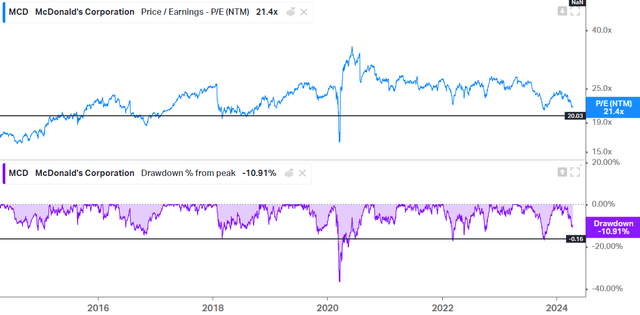

A drawdown of 16% from highs is already significant, and a multiple of 20 times earnings per share could be a very attractive entry price.

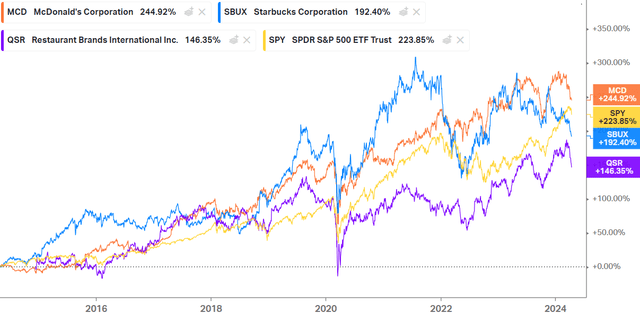

MCD has outperformed both, its rivals and the S&P 500 during the past 10 years.

Conclusion

I believe MCD is a great company with a defensive profile for any portfolio. I think the near future looks good, but in the long term, it will continue to shine. The combination of scale and brand power, combined with a management team that handles capital well and is obsessed with continuous improvement, gives me peace of mind. Additionally, I think the valuation may already be attractive, although personally, I will wait until $250; I hope not to miss out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.