Summary:

- McDonald’s recent stock decline presents a buying opportunity for investors, with a dividend yield of 2.59%.

- McDonald’s consistent taste and affordability make it a popular choice globally, with a higher value compared to competitors.

- McDonald’s resilient business model and track record of innovation make it a wise investment choice, despite potential risks.

Joe Raedle/Getty Images News

Thesis

McDonald’s stands as a robust company, commanding unparalleled prominence in the restaurant industry. The recent dip over the past three months presents a significant dip-buying opportunity for investors who may have overlooked its earlier retracements.

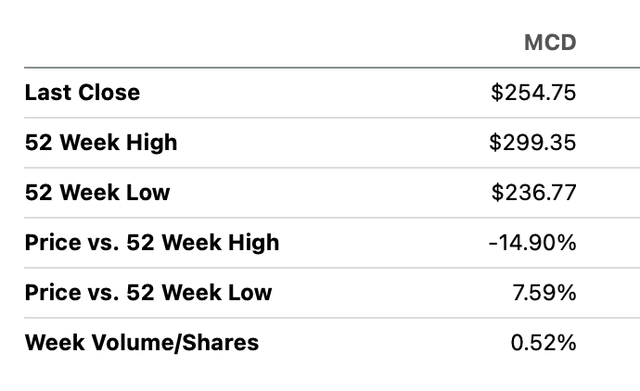

Although the stock has experienced a recent decline of approximately 15% from its all-time high, the current valuation still boasts a dividend yield of 2.59%. With the current surge in interest rates and a dip in people’s disposable income, I anticipate a possible boost in McDonald’s revenue. The reasoning behind this projection is that individuals tend to lean towards fast food consumption when faced with elevated interest rates, a phenomenon supported by information highlighted in a Morning Star article.

The affordability factor is positioned to heighten the allure of fast-food chains worldwide, and it’s worth noting that McDonald’s generates over 54% of its revenue on this global scale.

Now McDonald’s is trading only 7.6% higher than the 1 year low.

Mcdonald’s 52 Week High-Low (Seeking Alpha)

Company

McDonald’s is a behemoth in the fast food industry. In fact, when one thinks of burgers or fast food in general, McDonald’s is often the first name that comes to mind. Although I don’t reside in the US, my research suggests that regardless of the time or day of the week, there is consistently a lengthy queue in the drive-thru; McDonald’s is always bustling with activity. Additionally, if you ask a child about their preferred dining choice at any given moment, more often than not, the answer will be McDonald’s.

This is consistently the scenario across much of Europe, a region I frequently explore. Firstly, McDonald’s offerings are simply tastier than a considerable portion of their competition, at least in Europe. The second factor is the pricing; McDonald’s is notably more economical for the quantity of food you receive.

According to Uber Eats in New York, a Big Mac meal costs $15.79, whereas a Whopper will set you back $16.39. Though a minor difference, it still counts.

Now, in Europe, this price gap widens further. A Big Mac in London cost £5.49 with the Big Mac Large Meal costing £8.19 while a comparable burger at Burger King will cost £7.99 and the large meal will cost £11.29 – a 27% increase in price. This trend is consistent across much of Europe.

What I find most striking is that McDonald’s has mastered the consistency of their franchises. Wherever I try McDonald’s, the taste remains remarkably uniform (with the exception of a somewhat lackluster experience in Peru). On the contrary, Burger King, KFC, or Taco Bell vary significantly.

Another significant point for me is that McDonald’s maintains a nearly identical menu globally, with some regional additions as “guest stars,” whereas other chains have entirely different menus. This becomes especially challenging when trying to navigate unfamiliar offerings, particularly when presented in a language you don’t understand.

Valuation

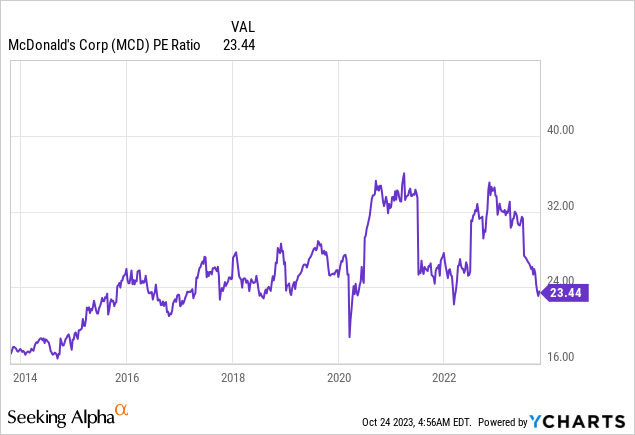

Observing McDonald’s current P/E ratio, it appears to be slightly below the 10-year average P/E of 24.78.

However, it’s crucial to note that over the past decade, McDonald’s operated with an average of 37 thousand franchisees, compared to the current 40 thousand. This increase in franchise count may contribute to the current valuation being on the lower side. Naturally, McDonald’s tends to command a premium in the market due to its stellar track record.

The Dividend Factor

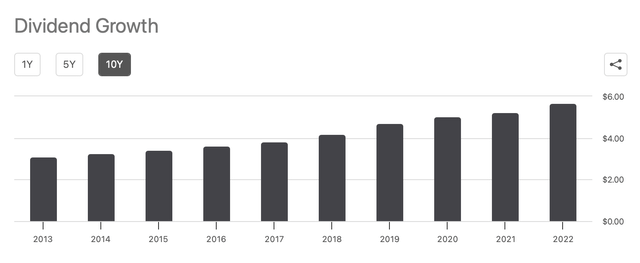

During the last recession, McDonald’s demonstrated remarkable resilience by boosting its dividend by 33%, elevating it from $0.375 to $0.50. This commitment to sustaining dividends was underscored earlier this month with another 10% increase, raising it from $1.52 to $1.67.

McDonald’s Dividend Growth (Seeking Alpha)

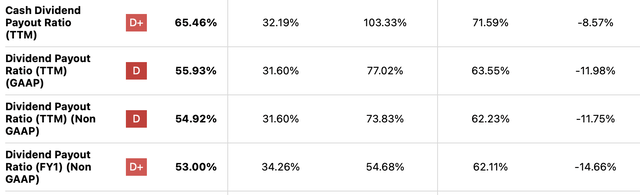

Notably, McDonald’s cash dividend payout ratio surpasses the sector median, prompting consideration for an optimal payout ratio within the 40% to 60% range by some stakeholders.

McDonald’s Dividend Safety (Seeking Alpha)

Upon reviewing the table depicting dividend statistics above, it becomes apparent that McDonald’s management excels at operating the company with greater efficiency than the industry average, enabling them to sustain a higher dividend ratio.

DCF

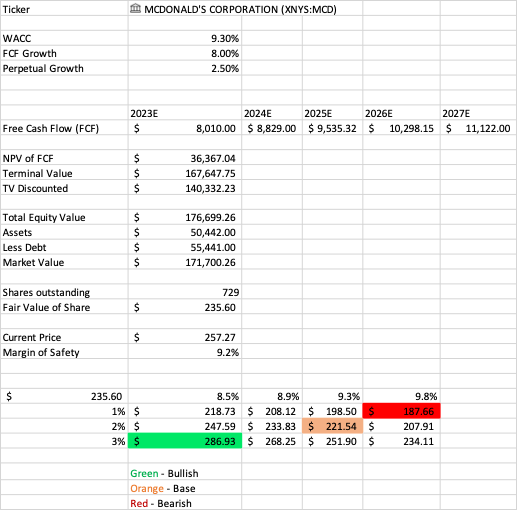

Conducting a Discounted Cash Flow analysis on McDonald’s Free Cash Flow yields a Fair Price of $235. Given the current market price of $256, it represents a modest premium, underscoring the company’s quality, particularly when factoring in dividends. A sensitivity analysis indicates a potential price of $287, while the average Wall Street projection for the next year sits at $314.

DCF Calculation (Author work)

Earnings Report

As per Zacks Estimates, McDonald’s is anticipated to announce a noteworthy 11.8% surge in revenues compared to the previous year. Coupled with the present decrease in stock price, this is likely to contribute to an overall increase in its value.

Risk

The company faces a clear risk from high-interest rates, and with the expectation of prolonged elevation in rates, this challenge is likely to persist in the foreseeable future. Concurrently, over the last two quarters, inflation has led to financial challenges for McDonald’s franchisees, particularly in Europe, necessitating assistance. Another risk is the potential structural shift in dining habits, especially at McDonald’s, it is currently too early to make a conclusive assessment.

Conclusion

In conclusion, McDonald’s emerges as a resilient giant in the fast-food industry, navigating recent market challenges with the potential for a significant upswing in revenue. The current dip in stock prices presents a notable buying opportunity, particularly as the company maintains a robust dividend strategy. McDonald’s maintains its global appeal through a combination of consistent taste and affordability, standing resilient in the face of diverse regional challenges. It’s crucial to recognize McDonald’s remarkable history of innovation and adaptability. This is underscored by its swift response to the challenges posed by COVID-19, successfully recovering 99% of its global revenue within just one quarter. As emphasized in a Harvard article, the company’s ability to navigate such crises is further exemplified by its commitment to technological breakthroughs. Betting against McDonald’s robust wide-moat business model seems unwise, and the recent apprehensions may not be entirely substantiated. Consequently, I see this period as an exceptional opportunity for investors to capitalize, given that McDonald’s is now more attractively priced relative to its historical metric.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.