Summary:

- McDonald’s is an extremely high-quality business showing long-term growth.

- The management team of McDonald’s has proven to be great at execution, and the growth opportunities are intact.

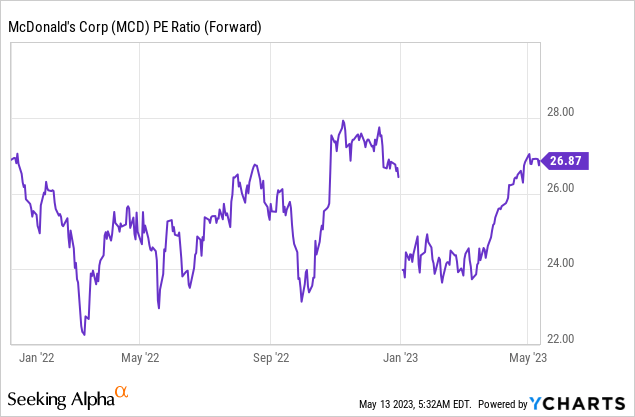

- However, at 26 times forward earnings, there is not enough margin of safety for investors in McDonald’s.

M. Suhail

Introduction

As a dividend growth investor, I look to add to my positions in undervalued companies with a history of increasing dividends. I buy and hold these companies long-term, using market volatility to my advantage as I consider new companies to diversify further. This strategy helps me achieve my financial goals and diversify my income stream.

Consumer discretionary is an exciting sector nowadays. Companies in the industry may suffer from a lousy sentiment as the fears of a recession may hurt discretionary spending. Investors in companies seek stability and a growth path, and it is harder to find in this environment. Therefore, investors flock to safer investments within the sector. One is McDonald’s (NYSE:MCD), the second-largest position in my portfolio.

I will analyze McDonald’s using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

McDonald’s operates and franchises McDonald’s restaurants in the United States and internationally. The company’s restaurants offer hamburgers and cheeseburgers, chicken sandwiches and nuggets, fries, salads, shakes, frozen desserts, sundaes, soft serve cones, bakery items, soft drinks, coffee, and beverages and other beverages, as well as a breakfast menu, including muffins, Sausages, biscuit and bagel sandwiches, oatmeal, hash browns, breakfast burritos, and hotcakes. McDonald’s Corporation was founded in 1940 and is headquartered in Chicago, Illinois.

Fundamentals

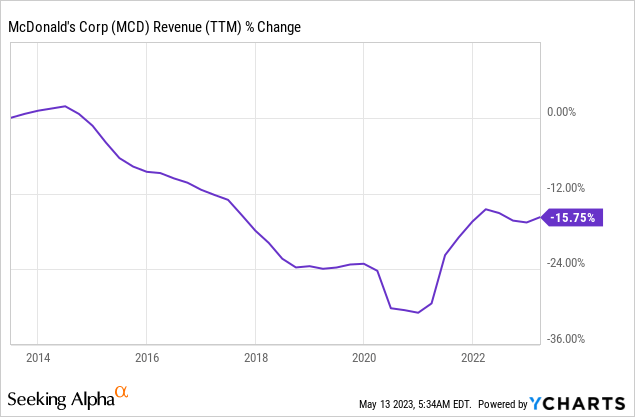

The revenues of McDonald’s have decreased over the last decade. Over these ten years, sales have increased by almost 16%, yet they have started climbing following the pandemic. The decrease in sales results from a business model change as the company shifts towards the less company-operated restaurant. Therefore, revenues are lower, but the margins are higher. Operating margins are at 45% compared to 30% a decade ago. In the future, as seen on Seeking Alpha, the analyst consensus expects McDonald’s to keep growing sales at an annual rate of ~6.5% in the medium term.

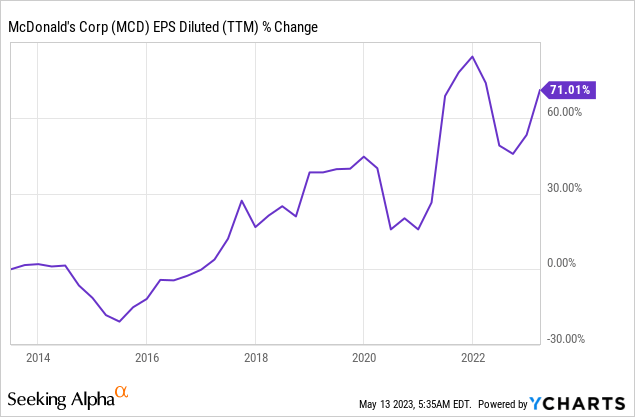

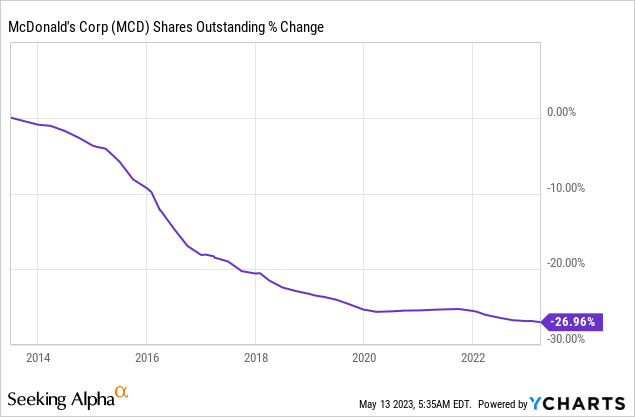

The EPS (earnings per share) has increased over the same period as the change in the business model resulted in more profits coming from every dollar in sales. In addition, EPS has also increased as the company cut its costs and bought back shares aggressively to support additional EPS increases. In the future, as seen on Seeking Alpha, the analyst consensus expects McDonald’s to keep growing EPS at an annual rate of ~9% in the medium term.

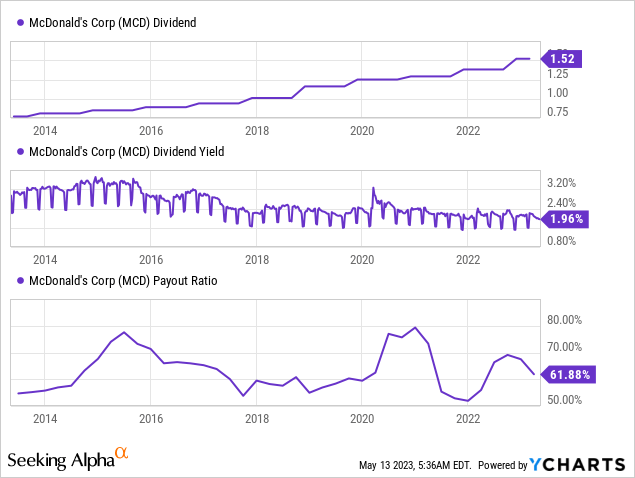

McDonald’s is a dividend aristocrat on its way to becoming a dividend king with a streak of 46 annual dividend increases. The company has increased the dividend by 10% in October. The dividend seems safe with a 62% payout ratio, yet I’d prefer it to be a bit lower, and the company does lower the payout slowly from the 80% payout ratio we have seen in 2021 and 2015. The current yield is 2%, and I believe it will grow at a high single-digit rate as the company keeps increasing the dividend without further stretching the payout ratio.

In addition to dividends, McDonald’s returns capital to shareholders via buybacks. Over the last decade, the company has repurchased its shares aggressively and decreased the number of shares by 27%. Buybacks support EPS growth by lowering the number of shares outstanding. Buybacks are very efficient when the share price is low, and therefore it would be wise for the company to wait for a better valuation for more aggressive buybacks.

Valuation

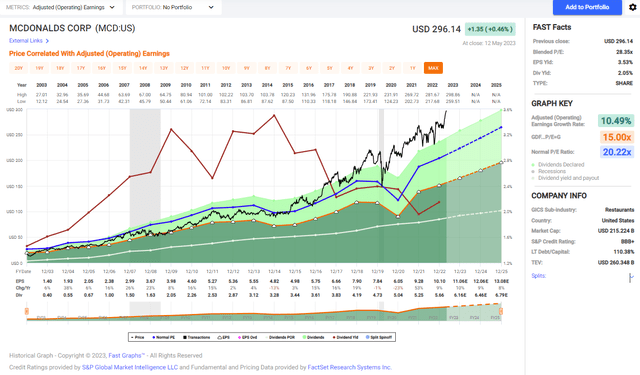

The company’s P/E (price to earnings) ratio stands at 26.9 when using the EPS forecast for 2023. This is a high P/E ratio despite a decent 9% growth rate. In addition, it is close to the highest valuation we have seen over the last eighteen months. Therefore, it seems like the shares of McDonald’s are trading for an unattractive valuation. Following the great Q1 report, the share price skyrocketed, and so did the valuation.

The graph below from Fast Graphs shows how overvalued the shares of McDonald’s have become. The average P/E ratio over the last two decades was 20, and the current P/E ratio is almost 27. The growth rate over that decade was 10% annually, which aligns with the current forecasts. Therefore, it is hard to justify such a premium. A similar growth rate, yet a much higher valuation, means less margin of safety.

Opportunities

McDonald’s keeps focusing its strategy on customer centricity. If the company thought it knew what the client needed in the past, today, it works hard to understand what he wants. It does it by listening more to the franchisees and by becoming a more agile, faster-responding organization. The company intends to focus even more on such initiatives, as it aims to answer client needs quickly so it can keep growing comparable sales and open new restaurants.

This year, we’re focused on determining the best path forward to meet customer demand… The second newer element of our strategy is fundamentally rethinking how we as a company can work better together to become faster, more innovative, and more efficient. We’re calling this Accelerating the Organization.

(Chris Kempczinski – President and CEO, Q1 Conference Call)

Another growth opportunity for McDonald’s is the digital channels. The company has built a rewards program on its app, and it is trying to increase the loyalty of its consumers. So far, it has been a success, and the company intends to keep investing in these channels for the sales and marketing of its products. Digital sales now account for almost 40% of the company’s largest market, and the continuous growth is promising.

MyMcDonald’s Rewards is another example of how we’ve tapped into our marketing engine to deploy our loyalty platform throughout the system. In 50 markets, loyalty is building even stronger relationships with our customers, and the results continue to shine. In our top six markets, digital sales now represent almost 40% of system-wide sales or nearly $7.5 billion growth of more than 30% over the last year.

(Chris Kempczinski – President and CEO, Q1 Conference Call)

McDonald’s has seen increasing comparable sales across the board. In fact, in Q1, there was a double digits growth in every geography. Therefore, the company is not only investing in digital channels as well as its restaurants, but it will also open new restaurants. It will do so faster than first anticipated as the demand is high, as can be seen by the double-digit growth rate.

The first is accelerating restaurant development. Our strong performance has earned us the right to open new restaurants faster than we have historically.

(Chris Kempczinski – President and CEO, Q1 Conference Call)

Risks

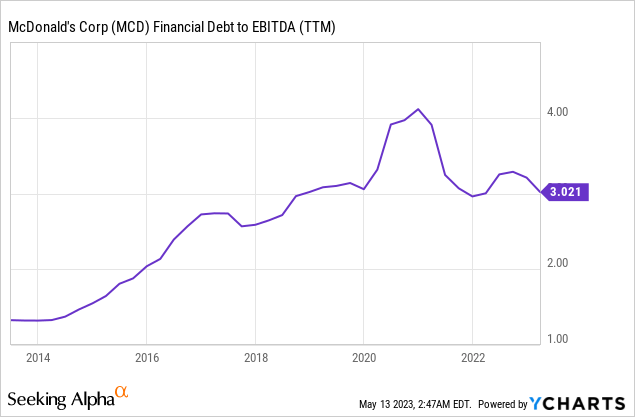

A medium-term risk that should be addressed is McDonald’s debt. The company has invested heavily as it changed its business model and kept investing in new restaurants. Moreover, the company allocated most of its free cash flow for buybacks and dividends. Therefore, it has used debt to grow. The debt to EBITDA ratio has increased significantly over the last decade. While it is not as high as during the pandemic, it is still high and limits the company’s ability to grow, invest and return capital as the interest rates are higher today.

Another risk for McDonald’s is competition. The restaurant world has changed dramatically over the last decades. More competitors are offering all kinds of hamburgers and meat products of various qualities. Also, the market is more segmented, with clients seeking healthier options where other chains like Chipotle excel. McDonald’s must be very prudent with its innovation and adaptation because there will be no vacuum in the market.

In my opinion, the most significant long-term risk is the lack of margin of safety. Investments have to consider prices and returns and not just the quality of the business. McDonald’s is priced for perfection at the current valuation. Every negative change to the business may cause significant losses to investors. However, even if the company does perform and its valuation returns to average, investors may face a 25% price decline that may take several years to recover.

Conclusions

To conclude, McDonald’s is probably one of the best companies in the world—an influential and well-known brand that is leveraged wisely. McDonald’s offers investors solid fundamentals with steady growth in sales and EPS. The growth leads to higher dividends and buybacks to reward shareholders. The company also has a solid strategy to continue to grow as it plans to be even more client-centric and open more stores around the globe.

However, even the best businesses should be acquired for the right price. Now, investors are afraid that the economy is not as strong and therefore seek refuge in companies with a long track record of execution, like McDonald’s. The current valuation is too high and leaves investors with no margin of safety in case the bullish thesis is wrong. I believe an attractive forward P/E ratio should be between 18 and 20. Until then, I think that shares of McDonald’s are a “Hold”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.