Summary:

- McDonald’s stock has had minimal growth in revenues over the past 5 years.

- Even if recent growth continues, the returns for investors will likely be average at best.

- My valuation approach estimates that MCD currently trades around fair value.

- Due to the factors above, I rate MCD a hold.

MichaelJay

Introduction

McDonald’s Corporation (NYSE:MCD) is relatively flat for the year so far with a slight gain of 1.95%. Over the past 5 years, revenues have struggled to grow with a CAGR of 0.32% for the period. My valuation approach estimates a fair value of $214.92 for MCD stock.

Minimal Upside Even If Growth Continues

McDonald’s delivered a solid Q3 earnings report with consolidated revenue up 14%. On top of the growth, management was able to keep costs under control with total operating costs and expenses growing 12% for the quarter. This operating leverage led to an increase in operating profit for the quarter of 16%. On top of that, MCD decided to increase its dividend and now trades at a 2.49% yield. This increased profitability and dividend income has many investors excited about MCD currently. However, I believe that even if the growth continues, the returns will be average at best at the current price. This is a situation where if everything goes right over the next 5 years, then the stock could generate a 10% CAGR. I prefer situations where, even if the worst case scenario plays out, there is not much risk to the downside. My scenario analysis below will demonstrate my assumptions that led to this conclusion.

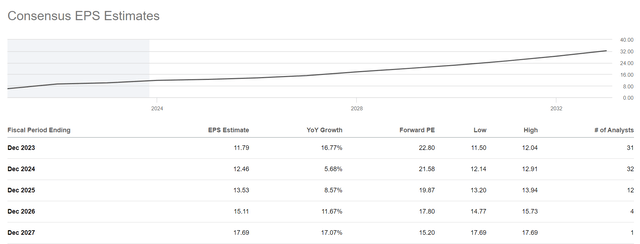

Earnings Expectations

Before I dive into my scenario analysis, I will use this section to explain how I chose my growth assumptions. As we can see from the chart above, consensus expectations are for EPS to increase substantially in 2023 and continue to grow from there. Overall, the implied EPS CAGR from 2022 to 2027 is 16.26%. I will use 16% as the growth rate in my best case scenario, which is only assigned a probability of 10%. I will use a growth rate of 12% for my base case to be slightly below consensus.

Valuation & Scenario Analysis

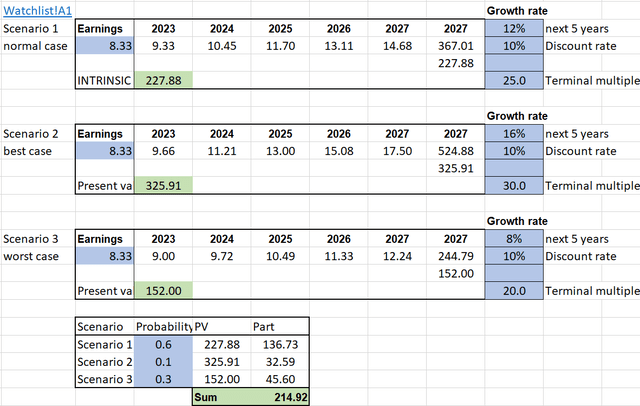

For all my calculations of value, I will be using a discount rate of 10%. 10% is my minimum required return because this has historically been the return you can expect if you decide to just put your money in an index fund that tracks the S&P 500. Lastly, keeping the discount rate the same allows for comparability between different investments.

Also, I assign a weight of 60% to my base case, 10% to the best case, and 30% to my worst-case scenario. With that out of the way, I will move to the individual scenarios.

Scenario 1 is my base case, which assumes 12% growth for the next 5 years with a terminal multiple of 25x. Discounting the 2027 sales price back to present value yields a fair value of $227.88 for an investor with a target return of 10%.

Scenario 2 is my best case, which assumes 16% growth for the next 5 years with a terminal multiple of 20x. Discounting the 2027 sales price back to present value yields a fair value of $325.91 for an investor with a target return of 10%.

Scenario 3 is my worst case, which assumes 8% growth for the next 5 years with a terminal multiple of 30x. Discounting the 2027 sales price back to present value yields a fair value of $152.00 for an investor with a target return of 10%.

The sum of the weighted PVs is $214.92, implying the stock is currently trading slightly above fair value. However, this does not take into account dividends. If dividends are included, then there is an argument to be made that MCD currently trades around fair value.

PEG Analysis

I like to use PEG analysis to compare what the market is pricing in and compare that to consensus estimates. Based on the chart from my earnings expectations section, the average EPS that MCD is expected to earn in the next five years is 14.12. Currently, MCD trades at 19.03x this number. However, consensus estimates imply that EPS will grow at ~16% over this same 5-year period. Based on these numbers, you could argue that MCD is overvalued due to the fact that its PEG ratio is above 1. However, with dividends included, I would conclude that this ratio also points to MCD being fairly valued.

Risks

Market Saturation

Consensus expectations are for MCD’s to continue to grow over the next 5 years. However, given the size of the company, management will have to be creative in how they drive this growth. There has been virtually no growth in revenues over the past 5 years.

Valuation

MCD currently trades at a 23.67 p/e ratio. This is on the low end of its recent range but by no means cheap compared to future prospects.

Changes in Consumer Preferences

If a greater percentage of the population decides to move toward healthier lifestyles over the next 5 years, McDonald’s will have to change their product offerings, which could result in lower revenues.

Conclusion

Overall, I expect MCD’s to achieve average returns in the long term as they provide a solid dividend with the opportunity to continue to increase profitability. The shares look fairly valued given the current multiple.

As a result, I rate MCD a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.