Summary:

- A great company does not always mean the stock is great.

- McDonald’s Corporation stock is way too pricey any which way you cut it.

- The company’s debt level is to be monitored after a 15% increase in 5 years.

M. Suhail

McDonald’s Corporation (NYSE:MCD) has long been one of my favorite stocks, as part dividend growth investor. The company’s near 50-year-long dividend growth streak is impressive to say the least, operating in a highly competitive but many-a-times low margin business. That said, I am not afraid to call out a personal favorite if things don’t make sense.

I suggest investors not to read too much into this morning’s upgrade based on cost controls. On the back of a 7% run YTD (which is big for a low beta stock like MCD), I firmly believe this analyst upgrade is a cast of skating where the puck has been and not where it may go in the future.

I present a few reasons to not invest in MCD stock right here right now. Let us get into the details.

Not All Layoffs are Good

I welcome layoffs and cost cutting measures at bloated technology companies. For example, with a vast majority of the technical workforce working from home in the past and still a hefty number doing so, it makes sense for a company like Amazon.com, Inc. (AMZN) to pause the work on its second headquarters. It also makes sense for them to cut down on retail spaces and let go off some employees after having doubled their headcount in a short time. But a “staple” company like McDonald’s reportedly closing offices is a clear sign of just slowing demand and lowered expectations.

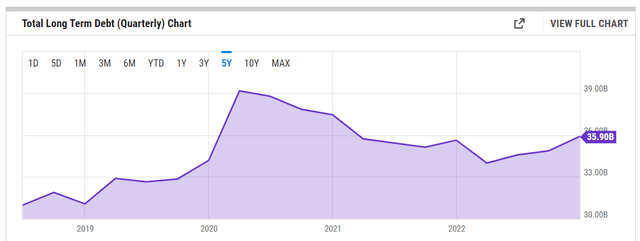

Debt Situation

I must admit this was one of the rare (if not first) times that I looked up McDonald’s debt situation. But I am surprised by the debt level, especially the fact that it has gone up 15% in the last 5 years. This is surprising for a company that you typically view as a stable, cash-flow generating machine. Once again, as a comparison, fellow stalwart The Coca-Cola Company’s (KO) debt has actually gone down an impressive 16% in the same time span.

Yield? What Yield?

A yield of about 2% means almost nothing in the current high interest rate environment. I am generally all for investing in stocks yielding lower than the savings accounts since stocks offer capital appreciation potential. But given how pricey McDonald’s stock looks right now, I don’t see any compelling reason to buy it here. As a comparison, even fellow dividend legend and “always pricey” Coca-Cola yields nearly 3% here.

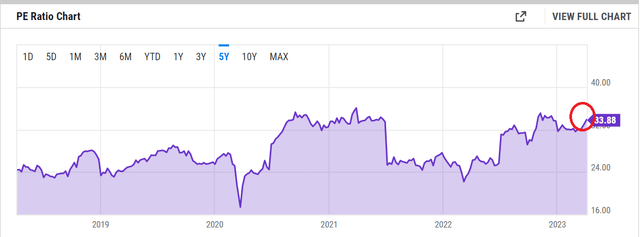

Overpriced Burger

The stock is trading near its 5 year highs in terms of P/E multiple as shown below. Based on the forward multiple of 27 and an expected earnings growth rate of 7.75%/yr, the stock has a Price-Earnings/Growth ratio (“PEG”) of almost 3.50, which is once again very expensive for a stock like McDonald’s. In addition, the median price target of $299 does not leave much room for error, and it is fair to say that MCD stock is priced for perfection here from every stand-point.

MCD Historical PE (YCharts.com)

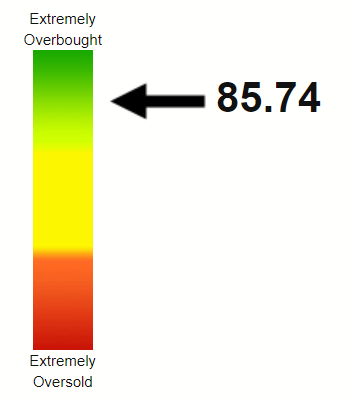

Overcooked Burger

Lastly, if you are still not convinced that the stock is overheated here, take a look at the Relative Strength Index (“RSI”) below. Before this morning’s upgrade, the stock already had an RSI of 86 and if the pre-market strength holds, the RSI may easily push beyond 90. In other words, the burger is not only getting pricey but is also getting overcooked by the minute.

MCD RSI (Stockrsi.com)

Conclusion

While I fully expect a 47th consecutive dividend increase from McDonald’s Corporation later this year, I suggest investors wait for a much better entry point. McDonald’s is a great company, and while I support buying great companies at fair price, I don’t believe the price is even fair here. If you hold MCD stock, I wouldn’t recommend selling it, but I am seriously considering trimming if the yield falls below 2%. If you do not hold McDonald’s Corporation stock, please stay away and wait for a much better entry point after a noticeable selloff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.