Summary:

- McDonald’s Corporation has now beaten EPS estimates for 8 consecutive quarters, while also showing a 10% YoY increase in revenue.

- The company reports a 25% YoY jump in operating income and a reduction in shares outstanding, saving $55 million annually.

- Free Cash Flow jumps 32% YoY, providing a comfortable payout ratio of 67%, but comparable sales in developing international markets lag behind.

- I rate McDonald’s stock a “Weak Buy” and would warn against going all-in right now.

Nathan Stirk/Getty Images News

McDonald’s Corporation (NYSE:MCD) has just released its Q4 and FY 2023 earnings, as Seeking Alpha has covered here. EPS beat estimates, while revenue missed. The market hasn’t made up its mind how to react yet, as the stock was initially up 1% but is now down about 1% as I write this.

My most recent coverage on McDonald’s was after the company’s annual dividend increase in October. I had rated the stock a “Buy,” and since then, MCD has gained 18.50% (including dividends) against the market’s 16.50% gain. With that background out of the way, let us now review The Good, The Bad, and The Ugly from MCD’s Q4 and FY 2023.

The Good

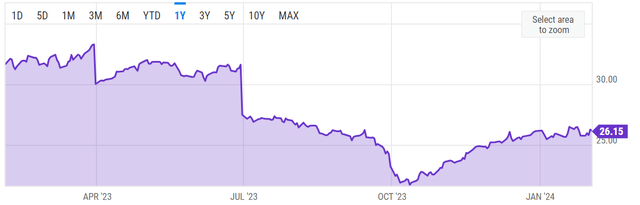

- McDonald’s has now beaten EPS estimates in 8 consecutive quarters. This is especially impressive considering that 15/21 EPS revisions for Q4 were to the upside. Even though Q4 revenue missed expectations by a hair ($40 million), it was still up more than 8% YoY. On an annualized basis, revenue showed an impressive 10% jump YoY.

MCD Rev (corporate.mcdonalds.com)

- Sticking with revenue, although McDonald’s showed only a 10% YoY increase in revenue, it reported nearly 25% YoY jump in operating income. This suggests extremely efficient and disciplined operations throughout the year, as operating costs and expenses were basically flat for the year.

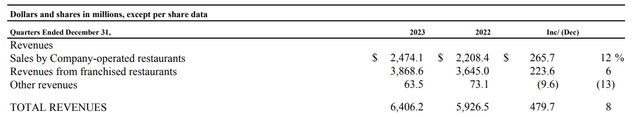

- McDonald’s reported a 1.11% YoY reduction in shares outstanding (page 6) at the end of Q4, 2023. That is, 8.2 million shares were retired in 2023 to finish the year with 727.8 million shares outstanding. Those 8.2 million shares are good enough for the company to save nearly $55 million every year in the form of dividends, considering the $6.68/share dividend. It should come as no surprise that over the last 5 years, the company has retired nearly 5% of its shares.

MCD Shares Outstanding (YCharts.com)

- 2023’s Free Cash Flow [FCF] came in at $7.25 billion, page 9. That’s an impressive 32% YoY jump compared to the $5.48 billion reported in 2022. Based on the shares outstanding reported above (727.8 million), the company needs $4.86 billion in annual FCF to meet its dividend commitment. 2023’s FCF of $7.25 billion gives MCD a comfortable FCF-based payout ratio of 67%. That should make investors feel better compared to the 86% we had using the then 5-year average FCF during my October review.

The Bad and The Ugly

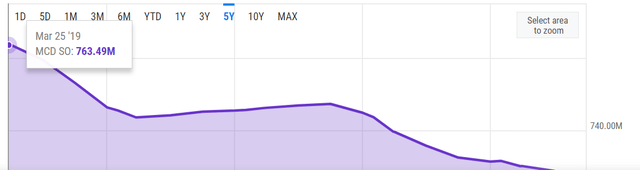

- While comparable sales in the U.S. and developed international markets went up more than 4% YoY, developing international markets’ comparable sales went up only 0.70%. These numbers pale in comparison to 2022 numbers, as shown below. 2022 perhaps had a bit of post-COVID induced demand that definitely went out of the picture in 2023, and the company has alluded (page 1) to macro challenges impacting its operations in 2024.

MCD Comparable Sales (corporate.mcdonalds.com)

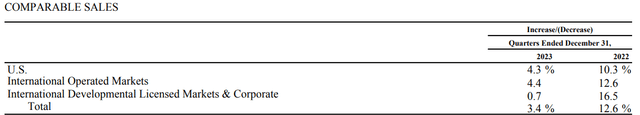

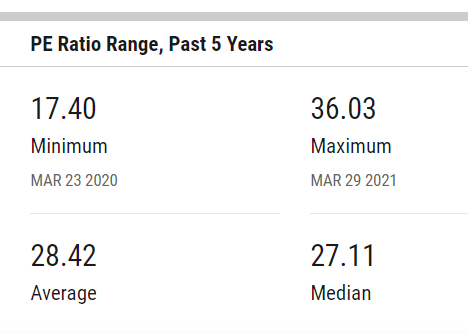

- While I’ve always acknowledged that quality rarely comes cheap, I am also against buying at any price for quality. MCD’s stock is right now trading at a trailing multiple of 26 and a forward multiple of 25, basically suggesting not much of an earnings jump is to be expected. The 5-year average multiple of 28 is not far off, and I’d be wary of jumping all in at this point, especially as the yield is barely hanging onto its 5-year average.

- Long-term debt went up 3.50% YoY to reach $37.1 billion (page 8) and this resulted in interest expense of $360 million. Interest expense has been going up every single quarter since March 2022, going from $287 million to $360 million, a 25% jump. While MCD has no imminent danger of being under too much pressure due to debt, this is something to be watched carefully.

Conclusion

Q4 was business as usual for McDonald’s. For now, it appears like the comparable sales boom in 2022 is unlikely to be repeated in 2024 and 2024 is likely to be another 2023 at best. However, I am sticking with my “Buy” rating on the stock for now but am acknowledging that it is a “weak” buy. If the stock breaches $330 (multiple of 28), I’d consider trimming and will definitely downgrade my rating to a “Hold.”

My preferred sweet spot is to buy MCD when its forward multiple is in the early 20s. Bear in mind, even at the height of COVID selloff, MCD had a minimal multiple of 17.40, which if using the current forward estimates gives the stock a price tag of $205. Barring another COVID type scenario, I don’t expect to see that price tag, and will be glad to go buy aggressively at around $260.

MCD PE (Ycharts.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.