Summary:

- McDonald’s Corporation remains well-positioned amidst macroeconomic pressures.

- Its adequate liquidity and viability are one of its cornerstones.

- Its cash levels are lower but enough to cover its dividends and financial leverage.

- The stock price uptrend is consistent with its fundamentals, but the actual value is not enticing.

Alexander Farnsworth

In the face of macroeconomic volatility, McDonald’s Corporation (NYSE:MCD) continues to perform with ease and prudence. It remains on solid footing with sustained market dominance, although growth has been hampered. In addition, its ideal liquidity position makes it a durable company. It remains capable of covering dividends, CapEx, and current borrowings. Indeed, it is a secure company with sound fundamentals and consistent payouts. However, its quality comes at a high price. The stock price uptrend is reasonable but comes with overvaluation.

Company Performance

McDonald’s Corporation has endured external pressures in the last two years. Being a company with brick-and-mortar stores, it had to withstand the toll of pandemic restrictions. It had to handle limited physical transactions and supply chain disruptions with prudence. Thankfully, its efforts and strategies paid off in no time. Today, it sees more potential potholes as it operates amidst economic volatility. Nevertheless, it remains one of the leading and most durable traded QSRs globally.

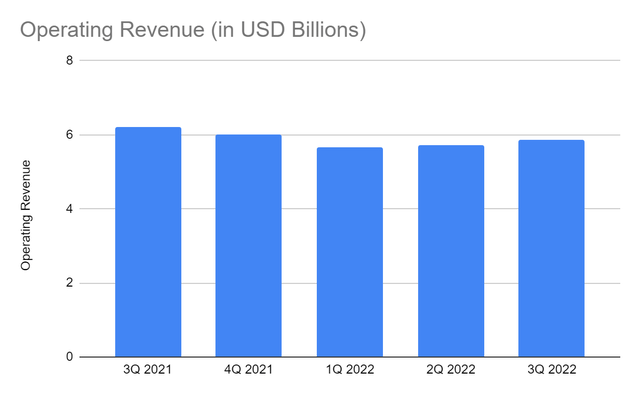

The impact of skyrocketing prices has been evident in the last three quarters. The geopolitical tension between Ukraine and Russia is another challenge it faces. Revenues are relatively lower, although a slight rebound can be seen this quarter. Despite this, its excellent business model cushions inflationary blows while remaining efficient. The operating revenue of $5.87 billion is a 5.3% year-over-year decrease but better than in the first half.

Operating Revenue (MarketWatch)

Company-operated restaurant revenues are lower than in the comparative period. It can be attributed to lower demand for its products due to higher prices. Yet, the primary trigger comes from its contraction to cope with inflation. With a lower operating capacity, sales are undoubtedly lower. Meanwhile, franchised restaurants, the largest revenue component, remain its primary growth driver. It is a more flexible and secure revenue stream since franchise fees are fixed. Hence, its growth partially offsets the revenue decrease in company-operated restaurants.

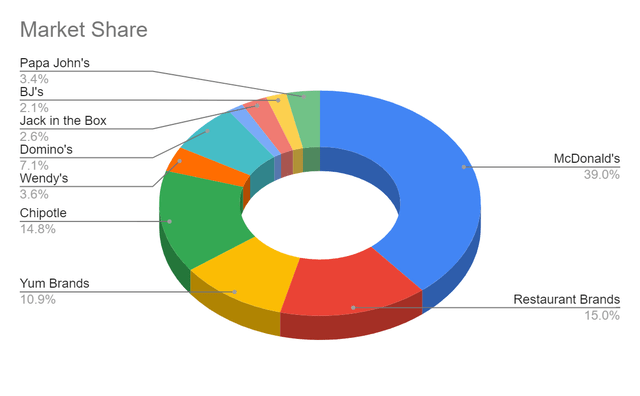

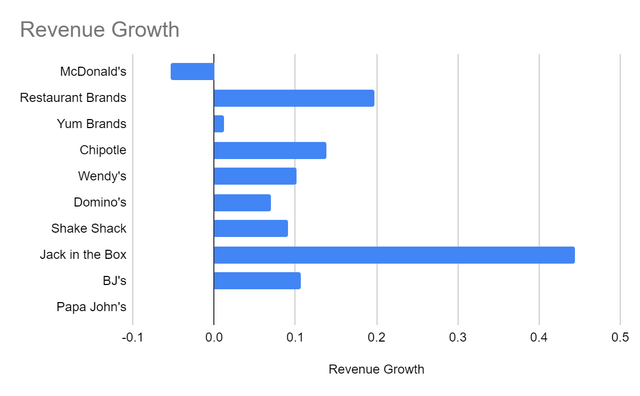

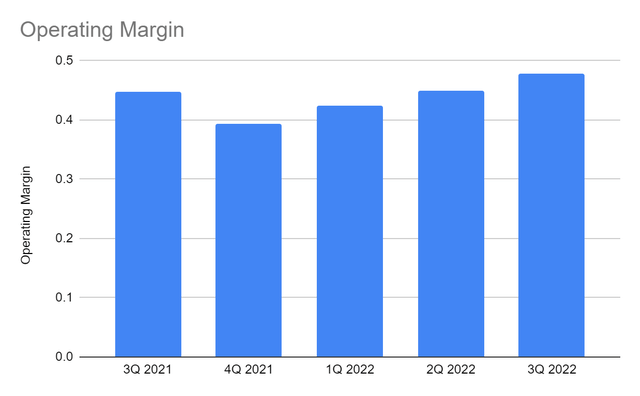

With regard to many of its competitors, McDonald’s continues to dominate the market. Despite the revenue decrease, it still holds a massive portion of the market share at 39%. It notably decreased from 42% in the comparative quarter, but MCD remains unparalleled. Even better, it appears to be the most efficient among its peers on the list. Indeed, it benefits from its cost-reduction strategy and still solid customer base to sustain its viability. Costs and expenses are stable, so its operating margin is high at 48% compared to 44% in 3Q 2021. Large peers, such as Restaurant Brands International Inc. (QSR) and Yum! Brands, Inc. (YUM) are also impressive, with 32% and 34%, respectively. So McDonald’s is still far more massive and efficient than most of its peers.

Operating Margin (MarketWatch)

Another growth driver is its digital adoption and unit development acceleration. Its faster digital shift is timely and efficient in the advent of digital transformation. Indeed, it has already realized how to capitalize on the drastic changes in the market landscape. For instance, digital transactions in delivery and drive-thru rose as an alternative to physical transactions. Its online app allows customers to order and pay using Visa (V), Mastercard (MA), Discover (DFS), American Express (AXP), and the like. In other markets, especially Asia, Gcash is the most popular means, and McDonald’s has already adapted to it. Digital adoption will continue as cashless transactions dominate the globe. In the US alone, cash transactions have plummeted to 22% in the last two years. More studies adhere to the increased preference for cashless transactions. Indeed, McDonald’s stays consistent with the market landscape changes.

External Challenges And How McDonald’s Can Stay Afloat

Amidst inflation, MCD remains a secure and durable company. Even so, it has to ensure its sustainability. It also has to be flexible to market changes, especially now that volatility remains disruptive. Thankfully, inflation has appeared to be cooling down in recent months. It had a continued downtrend to 7.7% from 9.1% in June. It also helps MCD to regain its momentum in the company-operated restaurant segment. It also makes the stabilization of costs and expenses easier. Lower prices mean lower production costs and expenses. In turn, prices are more strategic with higher purchasing power, leading to more demand and revenues.

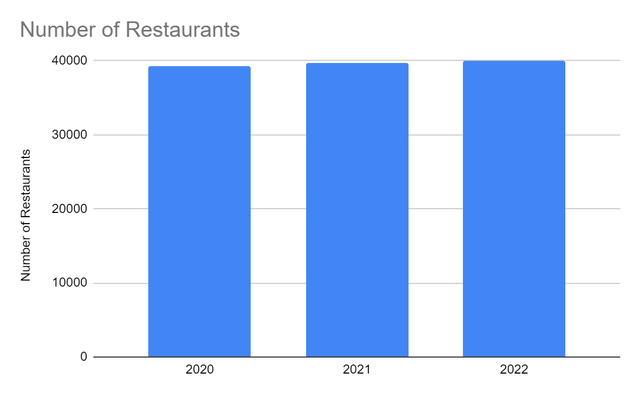

McDonald’s is now taking advantage of the situation. It capitalizes on its current expansion and digital adoption. It now has 39,980 stores compared to 39,676 in the comparative quarter. Its average operating revenue remains high at $146,824 compared to $144,095 in 2Q 2022. It shows that as it expands, it continues to generate more revenues. Even better, it becomes more viable despite the increased stores and prices. It has an average operating income of $70,035 compared to $65,673 in 2Q 2022. It is also higher than in 3Q 2021, with $70,032. So even with lower operating revenues and more restaurants, McDonald’s becomes more efficient. This attribute is what will help it get through this stormy market landscape. Its efficiency is fueled by digital transformation, which proved to increase customer engagement. Aside from that, it continues to implement its loyalty programs across its 50 markets globally. With about 43 million active loyalty members, 25 million are from the US. It can increase its presence in its current markets and penetrate new ones. With its solid customer base and digital innovation, it is geared toward attractive growth prospects.

Number of Restaurants (3Q Financial Report)

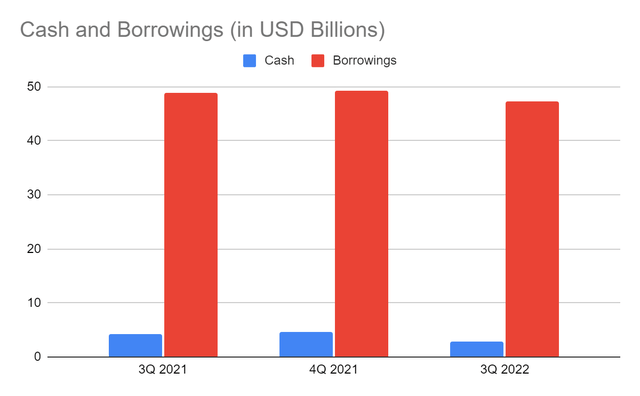

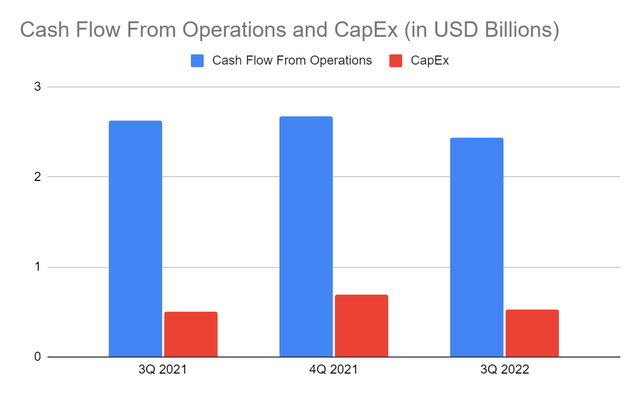

What makes it a sustainable company is its impressive liquidity position. It has a quick ratio of 1.64, showing it can cover its current liabilities. And even if cash dropped, it was able to lower its borrowings. It is an excellent move to cope with interest rate hikes. Cash can cover all its current borrowings and accounts payable, even in a single payment. Even better, it has an impressive Net Debt/EBITDA Ratio of 3.8x. It shows that even if the total borrowings are high, MCD generates enough income to cover borrowings. This impressive ratio is important to note since MCD is capital-intensive, given its high concentration on PPE. The ratio also demonstrates the consistency between viability and liquidity, making it sustainable. Moreover, its operating cash flow remains stable and adequate to cover CapEx. Its FCF of $1.9 billion remains high to distribute dividends and repay borrowings. Its FCF/Sales Ratio of 32% is impressive for a capital-intensive company. So MCD shows a high capacity to turn revenues into free cash after taking its operating transactions and CapEx into account. After deducting dividends, it still has a FCF of $789 million to be added to cash and cover other payables.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

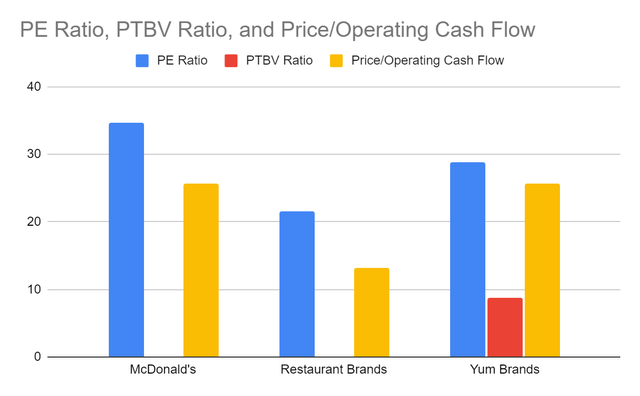

The stock price has been moving sideways, in general, in the last year. But the uptrend is more visible, especially in the last two months. At $272-274, the stock price is 4% higher. The good thing is that the stock price movement adheres to its fundamental trend. However, the impressive financial quality does not justify the stock price. It is now traded at a 34x price-earnings multiple, far higher than in 2021. If we plot the current price to its earnings, it will be at 27x. Although the current multiple is lower than the five-year average of 36x, the reasonable growth upside should be within 26x-30x. QSR with 22x and YUM with 29x appear to be better alternatives. Their fundamentals are also sound, making their stock price more reasonable.

Despite this, MCD makes up for its expensive stock price with its consistent dividends over the years. It has an average dividend growth of 8% with a dividend payout ratio of 57%. MCD can cover dividends without having to borrow. Also, it has a dividend yield of 2.05%, which is better than the S&P 500 average of 1.82%. To assess the stock price better, we can use the DCF Model.

FCFF $7,429,000,000

Cash $2,830,000,000

Payable Borrowings $650,000,000

Perpetual Growth Rate 5%

WACC 9.2%

Common Shares Outstanding 732,424,000

Stock Price $273.84

Derived value $244.51

The derived value agrees with our supposition of overvaluation. The stock price may have a 12% downside in the next twelve months. I think investors should wait for a better entry point or use this opportunity to get out with impressive gains.

Bottomline

McDonald’s Corporation is an impressive company with solid and intact fundamentals. Margins are expanding despite the hampered revenue growth. It has adequate capacity to sustain its operations, expand, and cover dividends. Even more, MCD has a lot of capacity to expand and stimulate growth. Its solid customer base and digitalization can help it achieve its goals. It is an excellent company with secure and well-covered payouts to its investors. But, the stock price does not appear reasonable. The recommendation, for now, is that McDonald’s Corporation is a hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.