Summary:

- McDonald’s has shown strong financial performance in Q4 and full year 2023, with growth in total sales and expanding operating margins.

- I see this success as a result of their strategy of enhancing the customer experience, increasing operational efficiency, and innovating its menu offerings.

- Despite potential challenges in 2024, McDonald’s is expected to continue growing revenues at around 12% YoY and has opportunities to expand into new business segments.

- The firm still faces some risk from wage inflation and significant exposure to international markets, increasing the potential for operational and earnings disruptions.

- Buy rating reiterated.

Nathan Stirk/Getty Images News

Investment Thesis

McDonald’s Corporation (NYSE:MCD) continues be a highly profitable business with both great topline and bottom-line growth characterizing their FY23.

Despite a difficult macroeconomic backdrop, McDonald’s managed to grow sales and margins thanks to efficient cost control and a great understanding of what customers want from the menu.

When combined with a reasonable 8% undervaluation given a base-case scenario, I believe the firm’s stock still makes for a compelling long-term buy and hold GARP opportunity.

Therefore, I rate McDonald’s a Buy and see real upside potential over the next five years for the company and the stock.

Company Background

McDonald’s is perhaps the most iconic fast-food restaurant in existence.

Since their inception in 1940, McDonald’s has become the largest fast-food chain in the world serving over 69 million customers daily. The firm has over 1.7 million employees operating almost 45,000 outlets worldwide.

The firm’s classic menu items such as their iconic burgers, fries and chicken nuggets are complemented by a huge portfolio of products localized for each specific market they operate in.

McDonald’s Corporation primarily operates as a real-estate company and extracts their revenues from the rents paid by franchisees for operating their franchises on the land owned by the firm.

The corporation also receives royalty and franchise fees which serve as another important set of revenue streams.

Earnings Analysis – Q4 & Full Year 2023

I wrote a deep-dive analysis into McDonald’s overall financial profile and economic status in the autumn of 2023.

I strongly suggest you read that article: “McDonald’s Stock: Why I’m Lovin’ This Modern-Day Buffett Style Pick“, in order to gain a more holistic understanding of their economic moat and how the firm generates revenues.

In this update piece, I would like to discuss the firm’s most recent earnings release and the multiple qualitative factors influencing the firm in early 2024.

McDonald’s reported strong financial performance for the fourth quarter and the full year of 2023, despite multiple macroeconomic and geopolitical headwinds.

The company attributed its overall success to the execution of its Accelerating the Arches strategy, which focused on enhancing the customer experience, expanding its digital and delivery capabilities, and innovating its menu offerings.

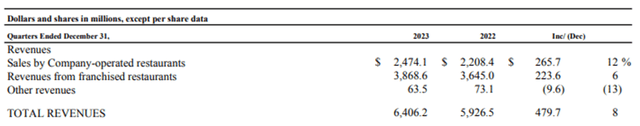

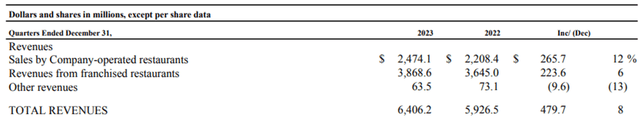

MCD Fy23 Q4 & Full Year Earnings Release

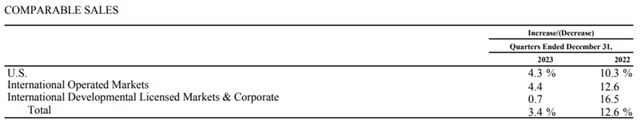

Global comparable sales increased 3.4% in Q4 and 9.0% for the full year, reflecting positive growth across all segments. This resulted in consolidated revenue growth of 8% YoY for the quarter which came thanks to surprisingly resilient consumer spending even among lower income earners.

MCD Fy23 Q4 & Full Year Earnings Release

Systemwide sales were increased 6% YoY for Q4 while consolidated operating income increased 8%.

This 8% growth came despite $72 million of pre-tax charges related to the write-off of impaired software no longer in use and $66 million of pre-tax charges related to the Company’s Accelerating the Arches growth strategy.

Without these charges, Q4 operating incomes actually increased 14% YoY.

Overall, Q4 was a massively successful quarter for McDonald’s with the firm managing to continue generating real topline and bottom-line growth even despite the inflationary macro environment and increasingly income restricted nature of most consumers.

MCD Fy23 Q4 & Full Year Earnings Release

For the full-year 2023, Global comparable sales increased 9.0% for the full year, reflecting positive growth across all segments.

While the U.S. market generated 8.7% YoY revenue growth, International Operated Markets and Developmental Licensed Markets grew slightly faster at 9.2% and 9.4% respectively.

This great growth overseas illustrates how well McDonald’s combination of iconic meals and a geographically-tuned menu strategy is able to draw customers into their eateries.

Systemwide sales to loyalty members were over $20 billion for the full year across 50 loyalty markets, with full year growth of more than 45% over prior year. A significant increase in total franchises along with continued expansion in emerging economies helped boost systemwide sales.

I really like how well McDonald’s franchise model is working for both the firm and the franchisees. The current standard franchise agreement balances rewarding both the corporation and the franchisee effectively.

Such a well-tuned model allows McDonald’s to have a great stream of new franchisees looking to open restaurants with the corporation thus helping the firm to achieve their growth targets.

Overall, 2023 saw consolidated revenues increase 10% for the full year, driven primarily by topline growth in the form of higher sales and a slight expansion in franchise margins.

MCD Fy23 Q4 & Full Year Earnings Release

McDonald’s operating income for the full year 2023 was $11.428 billion, an increase of 24% compared to the prior year. This reflects the strong performance of the business across all segments and the execution of its growth strategy.

Operating margins expanded accordingly to 46% from 44% the previous year.

MCD Fy23 Q4 & Full Year Earnings Release

Net income for 2023 was up 37% YoY to a total of $8.5B as a result of the great revenue and margin expansion. This left net margins up massively at 33% from just 27% the year prior.

The company also returned $2.5 billion to shareholders through dividends and share repurchases in Q4 and $8.5 billion for the full year. Personally, I view this continued appreciation for shareholders as incredibly positive and an illustration of the confidence management has in their business.

The company’s CEO, Chris Kempczinski, expressed confidence in the resilience of the business and its ability to overcome the macro challenges that will persist in 2024.

He also stated that the company will continue to invest in its people, products, and platforms to deliver value to its customers, franchisees, and shareholders.

However, Kempczinski also highlighted the difficulties that the firm may face in 2024 with the CEO emphasizing the importance lower-income earners in particular are beginning to place on value and affordability.

While the firm has been working hard in recent years to expand their premium meal offerings, McDonald’s will most likely focus on developing their Dollar 1, 2, 3 platform and increase the number of new offerings at the value-end of their menu.

Despite these products generating slightly lower margins for the firm, I do believe McDonald’s will be able to continue growing in 2024 even if consumers begin looking for more affordable items on the menu.

Furthermore, I see McDonald’s experimental expansion into the specialty coffee and drinks segment with CosMc’s as a great opportunity for the firm to challenge the likes of Starbucks (SBUX) and Dunkin’.

Considering the entirety of 2023 for McDonald’s, I believe the firm is firing on all cylinders. Great quantitative results have been combined with excellent progress in their Accelerating the Arches strategic initiative.

Valuation – Q4 & Full Year 2023

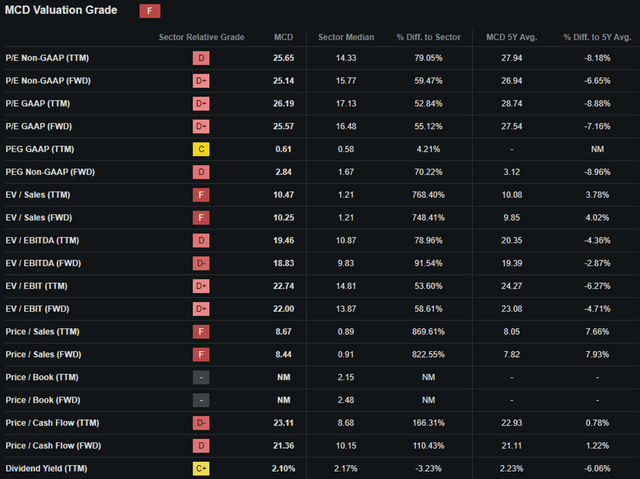

Seeking Alpha | MCD | Valuation

Seeking Alpha’s Quant assigns McDonald’s with an “F” Valuation rating. I find this pessimistic letter grade quite surprising given the stock’s valuation multiples are at relatively lower ratios especially compared to their running 5Y averages.

McDonald’s currently trades with a P/E GAAP TTM ratio of 26.19x which represents a 9% decrease relative to their running 5Y average.

While such a high P/E ratio places McDonald’s at a much higher multiple compared to other stocks in the consumer discretionary sector, the firm has continued to exhibit excellent growth and profits amid a difficult macroeconomic environment.

McDonald’s also has a P/CF ratio TTM of 23.11x and an EV/Sales TTM of 10.47x. Both of these ratios are at roughly their 5Y averages. Neither of these metrics initially screams deep-value opportunity.

However, given the continuous growth of McDonald’s revenues and margins, I believe the stock should be considered more as a GARP opportunity than a fully mature enterprise.

Seeking Alpha | MCD | Advanced Chart 5Y

From an absolute perspective, McDonald’s stock has been slightly outperformed by the popular S&P 500 tracking index fund SPY (SPY).

Volatility for the stock has however been very low with a beta of just 0.73x. Such outstandingly consistent value generation by the stock should not be overlooked.

While the S&P 500 has in recent years seen explosive growth thanks to the magnificent seven stocks, I really like how well MCD has managed to keep up and only be outperformed by around 20% in a 5Y timeframe.

The Value Corner

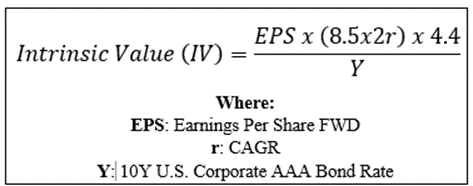

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Let’s start with a base-case valuation using McDonald’s current share price of $285.97, a conservative 2024 EPS estimate of $12.45, a realistic “r” value of 0.12 (12%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.87x, I derive a base-case IV of $308.30.

This represents an 8% undervaluation in shares given our base-case inputs.

When using a more pessimistic CAGR value for r of 0.07 (7%) to reflect a worst-case scenario where a recessionary environment causes McDonald’s to see muted revenue and margin growth, shares are valued at $260 representing a 10% overvaluation in shares.

This bear-case scenario illustrates how sensitive McDonald’s valuation is to any underachievement’s in their future growth prospects. While this is to be expected with a GARP opportunity like McDonald’s in my opinion, it is still important to note the reduced margin of safety on offer to investors.

In the short term (3-12 months), I find it difficult to predict a direction for the stock given their exposure to a highly sensitive consumer discretionary spending environment.

While the solid growth and profitability generate a positive outlook given a base-case scenario for 2024, a negative short-term catalyst that results in limited growth for the year could send shares down by around 15-20%.

In the long-term (2-10 years), I believe McDonald’s will continue to be one of the most influential fast-food franchises in existence. Their great range of both iconic and targeted products appear to still meet consumer expectations accurately while expansion with CosMc’s into the specialty coffee and drinks market could boost growth even further for the firm.

McDonald’s Risk Profile

McDonald’s faces a few risks that arise primarily from a tangible operational, currency and regulatory risks.

The firm may face increasing labor costs and operating expenses in 2024 as a result of the sticky inflation impacting economies across the globe raising pricing levels and wages accordingly. This may result in an erosion of systemwide sales and franchisee margins.

Such a scenario could result in slowing income growth and a potentially softer end consumer which could slow topline revenue growth too.

McDonald’s also earns a large portion of its revenues and profits from outside the US, which exposes it to fluctuations in exchange rates. A strong US dollar could reduce its foreign earnings or make its products less competitive in overseas markets.

McDonald’s ESG Impact Report 2022-2023

From an ESG perspective, McDonald’s faces some regulatory and social risk arising from their core restaurant operations.

McDonald’s operates in many countries with different laws and regulations, which could change or become more stringent over time.

Some of the areas that could affect McDonald’s are food safety, nutrition, taxation, marketing, environmental, and social responsibility. McDonald’s may have to comply with new or stricter nutrition rules that could increase its operating expenses or disrupt traditional operations.

The firm also faces the potential for many emerging markets to change taxation or operating regulations for the firm. This could result in McDonald’s having to change the operating structure of these international restaurants which could significantly decrease profitability.

While McDonald’s does face some ESG concerns, I believe it would still be a relatively suitable choice for any ESG conscious investor given the hypothetical nature of most of these concerns.

Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

McDonald’s has produced what I believe are excellent Q4 and full year 2023 results despite a difficult macro environment and the continued higher levels of inflation impacting both the U.S. and international economies.

Solid topline growth has been accompanied by real margin expansion thanks to solid operational efficiency improvements. Furthermore, management appears acutely aware of what consumers are looking for in 2024 while simultaneously continuing to experiment with expanding the brand into new business segments.

When combined with a slight undervaluation in shares give a base-case scenario, I rate McDonald’s a Buy at present time and believe the firm makes for a compelling long-term GARP opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.