Summary:

- McDonald’s has successfully reintroduced its value offerings, improving traffic trends.

- It has made significant progress acquiring loyalty members while bolstering its digital offerings.

- MCD’s expensive valuation suggests investors must be careful about chasing the stock.

- I explain why MCD is likely nearing its tipping point, as its risk/reward is getting increasingly unattractive.

TonyBaggett

McDonald’s Stock’s Remarkable Recovery

McDonald’s (NYSE:MCD) stock has performed admirably, even as the company reported a tepid Q2 earnings scorecard in late July 2024. The company observed several challenging headwinds, impacted by a more discerning consumer across its main markets. As a result, intensified macroeconomic pressures have hurt its comparable store sales, spurring the reintroduction of value offerings. Hence, McDonald’s decision to “reset” expectations and realign the company with its core value-conscious consumer base has been received favorably by investors. Consequently, it likely led to markedly improved buying sentiment as it re-tested its previous highs.

In my April update on MCD, I urged investors to ignore the significant pessimism that led to sharp downside volatility in early 2024. The market was concerned over its geopolitical risks and the decline in comp sales. In addition, the uncertainties over the increased labor costs also added to the company’s tepid outlook, hitting investor enthusiasm.

McDonald’s: Value Offerings Have Demonstrated Success

Notwithstanding these challenges, McDonald’s has made notable progress in its value offerings, suggesting it has proved effective. In addition, the company has also observed a higher average check size for customers who opted for its $5 value meal. Hence, I assess that consumers likely perceive the value proposition of its revised menu favorably, improving its ability to up-sell and cross-sell.

Moreover, McDonald’s advanced in its overarching strategy, demonstrating the momentum with its execution prowess. Its digital initiatives have proved successful, as McDonald’s digital sales account for over 40% of its overall revenue in its leading markets. The company’s loyalty sales have also gained momentum, reaching 166M loyalty program members. Hence, it has likely lifted the market’s assessment of its ability to achieve its 250M member target as it reaches out to more non-digital customers.

In addition, the robust take-up rate (93%) from McDonald’s US franchisees on its $5 value meal indicates the close partnership and collaboration with MCD HQ in implementing critical adjustments to its marketing and pricing strategies. As a result, I assess that it has likely boosted the market’s confidence in the company’s ability to adjust to a more value-conscious landscape, even as we navigate the impact of the high inflation and interest rate headwinds.

McDonald’s decision to continue rolling out more outlets globally (10K new restaurants in the next four years) justifies the company’s confidence in its execution. The decision to extend its $5 value meal into December indicates its value proposition, potentially helping reverse its adverse pricing perception of its offerings against its competitors. Recent customer surveys corroborate my assessment, suggesting McDonald’s $5 value meal “has been a significant traffic driver.” As a result, it has also lifted the company’s traffic trends, suggesting it could report a healthier slate of comp same-store sales metrics in the second half.

Is MCD Stock A Buy, Sell, Or Hold?

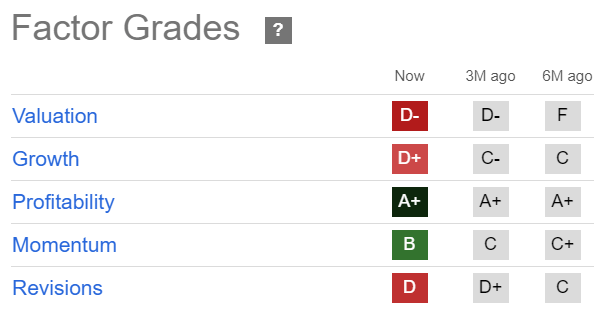

MCD Quant Grades (Seeking Alpha)

MCD’s “D-” valuation suggests the market continues to view the robustness of its fundamentally strong business model (“A+” profitability grade). However, its tepid “D+” growth grade underscores the potential risks of placing too much optimism on its bullish proposition. Despite that, its “B” momentum grade corroborates the improved buying sentiment, as investors reacted positively to the success of its revised value offerings.

However, I’m concerned with the significant premium baked into its outlook. Wall Street’s estimates on MCD have also been downgraded, potentially raising the execution risks for the company to justify its valuations. The forward-adjusted PEG ratio of 4.21 is almost 190% over its sector median, justifying my caution. In addition, the stock has also faced resistance under the $300 level since June 2023, suggesting caution.

While I’m satisfied that my buy thesis on MCD has played out well, I consider the current levels less attractive from a risk/reward perspective.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!