Summary:

- McDonald’s Corporation is a consistent and reliable stock that has posted positive annual EPS growth in 17 out of the last 20 years.

- The company’s loyalty program has expanded to over 150 million members, indicating its success in creating sticky customers.

- Despite slowing growth, MCD’s Q4 results were impressive, with consolidated revenue and net income both up 8%.

NurPhoto/NurPhoto via Getty Images

McDonald’s Overview

I admit it, McDonald’s Corporation (NYSE:MCD) is a relatively boring stock. But oftentimes, I’ve found that boring is best in the stock market. This updates my previous article on McDonald’s.

There’s nothing wrong with slow and steady compounding, and MCD is a poster child for a mature compounder that offers fairly consistent top and bottom-line growth (and more importantly, generous shareholder returns).

MCD has posted positive annual EPS growth during 17 out of the last 20 years.

MCD has generated double digit earnings growth during 11 out of the last 20 years, including during 2023.

And right now Wall Street consensus points towards ongoing bottom-line growth in 2024, 2025, and 2026 as well.

This type of consistency is what has enabled McDonald’s to build a 48-year annual dividend growth streak.

This company currently yields 2.25% and is known for annual dividend raises well above the inflation rate (the company’s 5-year dividend growth rate is 8.3%).

Sure, that yield isn’t extraordinarily high; however, this is a dividend growth story, not a high-yield play.

At that 5-year average growth rate, the MCD’s dividend doubles every 8.7 years.

Someone who bought MCD shares a decade ago would be looking at a yield on cost of 6.9% today.

Someone who was lucky enough to buy and hold MCD 20 years ago would have a yield on cost of 41.4% today.

These are the types of results that “boring” blue chip compounders can generate for long-term investors and this is exactly why McDonald’s is a very easy stock for me to hold throughout market volatility and a high-priority buy for me during any pullback.

But, the question remains, is McDonald’s a buy right now?

Let’s find out.

McDonald’s Full Year Highlights

MCD reported Q4/full-year results yesterday and I thought the numbers were impressive.

Its global comparative sales were up 9% on the year.

Breaking down those results, the company noted that guest count increased by roughly 3% overall during the year, with positive growth in each of its operating regions.

Overall, MCD’s full-year consolidated revenues were up by 10% on a y/y basis (10% in constant currencies).

The company’s adjusted EPS came in at $11.94/share, up 18% on the year (up 18% in constant currencies).

MCD’s loyalty program expanded to 50 new markets around the world in 2023 and the company highlighted $20+ in loyalty program sales during the year.

MCD’s peers, such as Chipotle (CMG) and Starbucks (SBUX) have done well with digital loyalty programs in recent years, and it appears that MCD is really leaning into this trend as well in an attempt to create sticky customers (and therefore, predictable sales).

McDonald’s active loyalty program membership now exceeds 150m people.

In its most recent quarter, Starbucks boasted 34m U.S. loyalty members. Obviously MCD’s global count isn’t an apples to apples comparison, and I’m sure these companies get the higher ARPU’s (average revenue per user) in the U.S. market, but MCD didn’t specifically break out their U.S. figure in the Q4 conference call and 150m+ overall clearly gives them one of the most successful loyalty apps on the global stage.

I think the focus on MCD’s loyalty app combined with its very asset-light business model (remember, the majority of MCD’s sales/cash flows don’t come from selling burgers, but instead, collecting rent and licensee fees from its clients across the globe) separates this company from the rest when it comes to the quick-service-restaurant space. McDonald’s continued to adapt to changing consumer taste/demands during 2023.

For instance, the company highlighted its focus on chicken, with its McCrispy sandwich, which has become a huge success for the company (as it tries to compete with the likes to Chick-Fil-A, Canes, Zaxby’s, and other chicken-oriented quick service chains that are attempting to take market share).

MCD said that Chicken sales crossed the $25b annual mark in 2023, putting it on-par with the company’s beef results.

More recently, MCD generated a lot of media buzz with its CosMc’s brand (focused primarily on caffeine and new flavorful drinks that are all the rage of social media right now).

MCD is still in the very early stages of CosMc’s development, but the company has had very positive things to say about its 10-store brand trial and consumer surveys point toward a massive opportunity for the company if it can carve out meaningful market share in the caffeine/energy drink segment where sales of – literally addictive – products are skyrocketing (especially amongst the younger generations).

Companies like Starbucks and Monster Beverage (MNST) have built massive operations on the back on caffeine. I’m happy to see MCD try to take some of that market share away from them.

All in all, I thought 2023 was a solid year for the company, and I saw nothing in the recent McDonald’s results that changed my long-term bullish outlook.

MCD Q4 Highlights

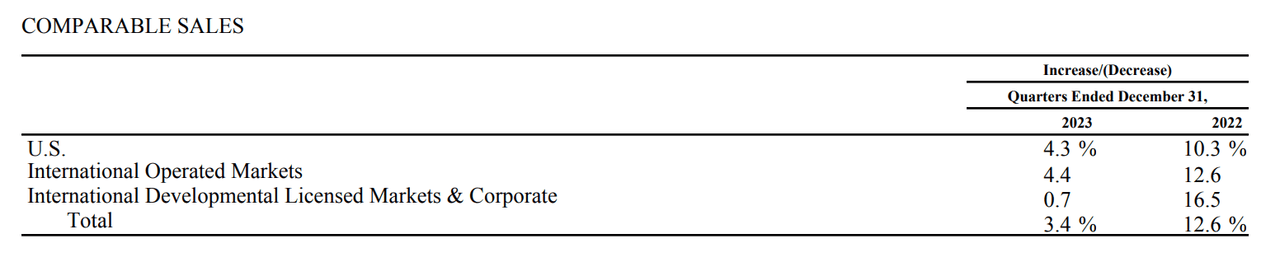

MDC’s Q4 comp sales slowed down a bit in Q4 (relative to the 2023 full-year result), coming in at 3.4% (U.S. comp sales increased by 4.3%, international operating markets increased by 4.4%, and international developmental markets increased by 0.7%).

As you can see below, this low-to-mid single digit growth is coming on the heels of very strong double-digit comp growth in 2022. To me, this makes MCD’s Q4 results even more impressive.

MCD Q4 Report

McDonald’s put a spotlight on struggles in the Middle East because of the war there, which brought down the developmental segment results.

Furthermore, MCD management was clear that inflationary pressures are hurting its low-income customers in developed markets across the world.

Honestly, that was a bit odd to hear. I own MCD, in part, because I view it was a hedge against recessions due to the fact that poor macroeconomic environments should drive up demand for MCD’s value-oriented menu (everyone has to eat, after all).

The company is attempting to offer cost savings with exclusive deals on its app (which also drives loyalty membership/sales); however, MCD was frank: in many markets, it’s simply cheaper to eat at home right now, and that’s a headwind for this value-oriented QSR (quick service restaurant).

That’s a problem that the company is going to have to continue to work on to solve, but management appears to be trying to tackle the issues head-on by simplifying its menu and point consumers towards higher margin products with its marketing arm.

Furthermore, I suspect that MCD is going to fare better than most in this sort of environment because of the low costs that come as a benefit of the size/scale of its operations and orders from suppliers.

Yet, despite ongoing inflationary headwinds, MCD produced solid growth in the fourth quarter.

At the end of the day here, we’re talking about slowing growth, not negative growth.

Overall, MCD’s Q4 consolidated revenue was up by 8% (6% in constant currencies).

The company’s net income was also up 8% (6% in constant currencies).

Adjusted earnings came in at $2.95, which beat Wall Street’s expectations by $0.12/share, representing 14% y/y growth (up 11% in constant currencies).

Now, investors have to ask themselves, with this slowing growth in mind, what are MCD shares worth?

MCD Stock Valuation

Remember, stock prices aren’t based upon what a company has done in the past, but instead, its future expectations.

As I said before, consensus estimates point towards ongoing growth for MCD in the coming years.

Right now, Wall Street’s consensus 2024 EPS growth estimate is 6%. In 2025, it’s 9%. And in 2026, it’s 10%.

I wouldn’t be surprised to see those numbers come down a bit in the coming weeks due to the relatively poor comp growth numbers during Q4; however, I think mid-single digit growth during 2024 and 2025 is likely here.

The problem is, that would be below-trend growth.

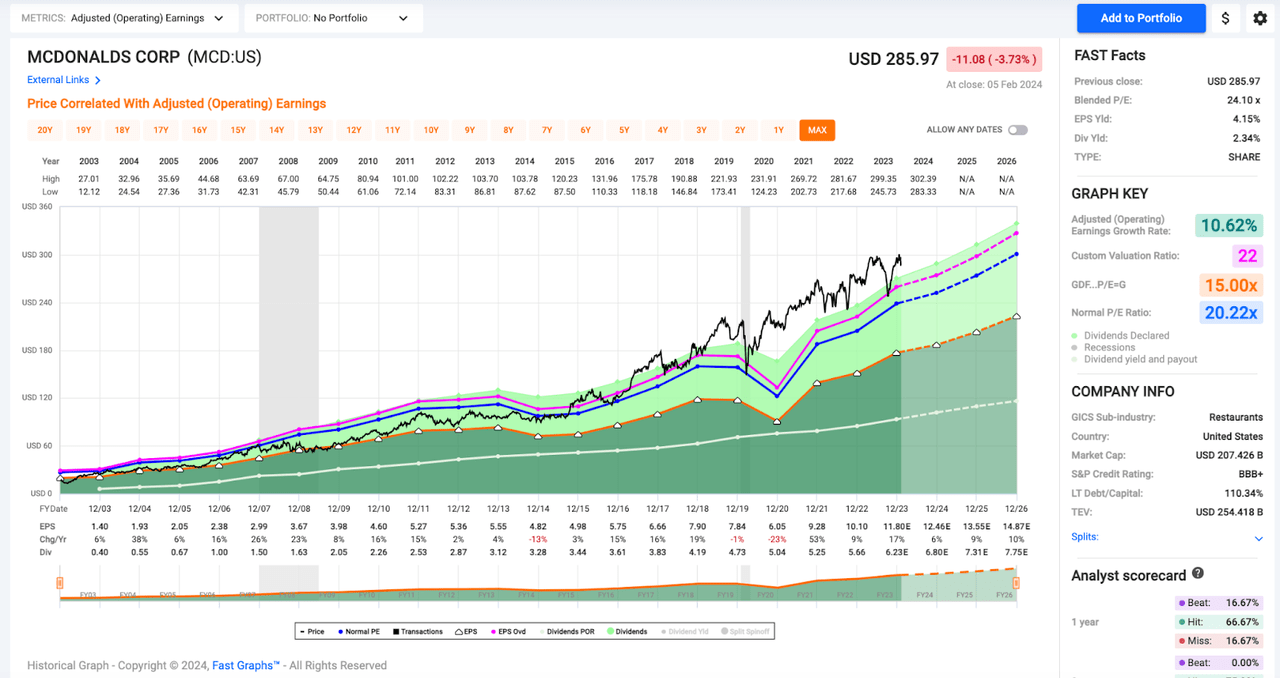

During the last decade, MCD’s EPS CAGR has been 8.0%.

MCD’s average P/E ratio during this period of time was 24.1x.

MCD is always going to trade with a high premium because of its safe dividend, strong profits, and asset-light/compounding model.

However, because of my forward-looking growth expectations in the 4-6% range, I don’t believe that shares deserve that 24x multiple right now.

To me, I think the ~22x level makes more sense as a fair value multiple.

That’s a ~8% discount to MCD’s trailing 10-year historical average and a 17.6% discount to MCD’s trailing 5-year average P/E of 26.7x.

It’s above the stock’s 20-year average P/E of 20.2x; however, looking at MCD’s stock price since the start of 2014 that 20x level has served as extremely strong support and therefore, I don’t think it makes sense to call the bottom of the trough fair value.

Obviously I’d love to buy MCD shares trading for 20x.

I’d feel extremely comfortable doing so.

20x forward would represent a ~$250 share price.

But I don’t think a dip that far is likely given MCD’s reliable growth and therefore, I’d be content to start adding to my position in the $275 area (22x my current 2024 EPS estimate of $12.50), which is where I think fair value lies.

FAST Graphs

Looking at the chart above, you’ll see the strong 20x support (blue line). You’ll also notice that MCD has bounced off of the 22x level several times since 2018 (it has only dipped below that threshold once – during the depths of the COVID crash in the spring of 2020).

Finding support levels like this give me peace of mind – especially when they line up with acceptable PEG ratios relative to future growth expectations.

McDonald’s Stock Dividend

MCD hasn’t dipped down to that $275 level yet, but I’m still happy to hold my position because of the stock’s growing dividend.

As I said before, MCD yields 2.25% right now.

For me to feel really good about a stock at that sort of yield level, it has to post 7.75% annual dividend growth (I want to see yield + growth = at least 10%).

Well, in 2022 and 2023 MCD posted raises of 10.1% and 9.9%, respectively, exceeding my expectations.

I expect to see a lower raise in 2024, but I still believe the 7-9% is likely.

MCD’s forward payout ratio is currently 53.4%.

Historically, this company has largely maintained its payout ratio in the 50-60% range. This means there’s some wiggle room for management here, and I believe that a dividend raise above its EPS growth rate would be sustainable in 2024.

Conclusion

McDonald’s isn’t exciting, but it has printed a lot of wealth for its shareholders over the years.

This company has outperformed the market over the long-term – with dividends reinvested, it’s 10-year total return CAGR is 14.3%, beating out the S&P 500’s (SP500) 12.3% returns. Over the last 20 years, this outperformance is even wider.

MCD’s 20-year total return CAGR (with dividends reinvested) is 17.65%, which beats the pants off of the S&P 500’s 9.8% result.

What’s more, MCD shares offer investors a low beta, defensive anchor with a nearly 50-year annual dividend increase streak.

This is a stock that has performed well historically during bear markets and I suspect that will continue to be the case moving forward.

In short, it’s the definition of a SWAN (sleep well at night) stock.

And, therefore, I’m watching McDonald’s Corporation shares closely as they sell off towards my $275 fair value estimate.

This is an easy company for me to own, and I’m always happy to buy shares of blue chip dividend growers when they’re trading with attractive valuations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CME, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, ECL, ELV, ENB, ESS, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, MA, MAIN, MCD, MCO, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.