Summary:

- McDonald’s has benefited from its marketing strategies, such as the Grimace birthday celebration and shake.

- The company is focusing on improving its technology infrastructure to drive growth, with digital and loyalty initiatives playing a significant role.

- Despite the positive growth, MCD faces risks such as a slowdown in delivery, potential pullback on fast-food spending due to economic factors, and wage inflation impacting its franchisees.

Joe Raedle

McDonald’s (NYSE:MCD) has been a beneficiary of inflation, but quick service industry multiples have gotten pricey post-pandemic.

Company Profile

MCD owns and franchises its iconic namesake fast-food restaurants, which serve a staple of well-known food and beverage offerings such as Big Macs, chicken McNuggets, and shakes as well as locally relevant menu items. The company has locations in over 100 counties around the world.

Approximately 95% of MCD’s locations are franchised. The company uses three types of franchise arrangements. For conventional franchises, MCD owns or secures the lease for the land and building, while it generates revenue from rent, royalties based upon a percent of sales, and fees for opening new locations or granting a new franchise. Under developmental licenses or affiliate arrangements, the franchisee owns the land and building and MCD just collects royalties based upon a percent of sales and fees for opening new locations or granting a new franchise.

Opportunities and Risks

MCD is a marketing machine, and this continues to be a growth driver for the company. The latest example of this is the Grimace birthday celebration and shake. While MCD may not love the TikTok trend that has accompanied the push, which includes people pretending to die after consuming the purple beverage, it is driving sales and selling out quickly. MCD has even acknowledged the trend and played into it on social media. In addition, to get this much sought-after shake, consumers have to purchase an entire meal, not just the milkshake.

Outside of the Grimace shake phenomena, the company has continually done a great job of driving culturally relevant campaigns in local markets, as well as through sponsoring big events like the World Cup or Olympics. Being local, though, is another big part of MCD success. One of the keys to MCD success has long been the notion that if you order a Big Mac it will be the same if you order it in California, New York, Brazil, Paris, Beijing, or Tokyo. However, it was the company many years ago developing menu items specifically for local markets that really set it apart and helped lead to its huge success in international markets.

More recently, improving its technology infrastructure across its various markets to help drive growth has been a big focus for the company. Discussing this at UBS conference earlier this year, CFO Kevin Ozan said:

As you know, we’ve invested heavily in technology over the last several years now. Part of that was to get our infrastructure and our tech stack closer to where it needs to be. If I go back and think about how we grew up as an organization, we grew up pretty decentralized throughout the world and had organizations in each country and therefore, some different tech stacks in many of our countries. What we’ve needed to do is get on to a common tech stack, common platforms so that when we do introduce something like loyalty, for example, we can deploy it across markets in a much quicker way. Historically, it would have taken one by one in a long time to be able to deploy that because we had to go take loyalty, for example, and integrate it into a different tech stack in every country. Now that we’re on a relatively common platform in most of our major markets, we’re able to do something like loyalty and get it out to all of our big markets in a relatively short period of time. So getting that infrastructure and tech stack was really important for us to be able to move quicker and be more agile on new products that we want to be able to roll out more broadly. Having said that, I think we have found that investments in digital and technology are going to be ongoing investments. It isn’t a invest and then relax for years and years because the world continues to change. We need to keep upgrading things like our app and our tech. And so I think there’s going to be an ongoing investment that’s going to be required in our tech and digital space.”

Digital and loyalty are big initiatives for the company. Mobile, kiosks, and delivery orders made up about 30% of its sales last quarter, showing the importance of digital and tech on the business. However, the company is still just rolling out loyalty and rewards programs in many markets, including some large ones like the U.K. The company also believes that through the collection of data that it will be better able to service its customers with personalization.

Finally, the company is looking to help alleviate pain points in the ordering process, with better drive-thrus and delivery experiences being key. Delivery is still driving growth, but it is slowing down, as it is a more expensive way to access the brand.

Thus, when looking at risks, a slowdown in delivery is one thing to consider. Delivery has been a huge boost to many quick service restaurant chains, but it is expensive for the consumer, and it wouldn’t be surprising for it to continue to slow down if the economy weakens.

The economy is another risk, as consumers could pullback on fast-food spending, or the environment could become more promotional. So far, though, this has not happened, and while some chains have seen traffic declines, MCD was still able to see positive traffic growth in Q1.

Restaurant sales have also benefited from inflation, which as inflation slows should see less price increases. So I wouldn’t expect the same strong same-store growth once inflation comes back in.

Wage inflation is an issue that hurts many restaurants, but given its franchise model and large international presence, MCD is likely one of the least effected fast-food chains impacted by this. However, rising wages does hurt franchisees, who could always push back, as well.

Valuation

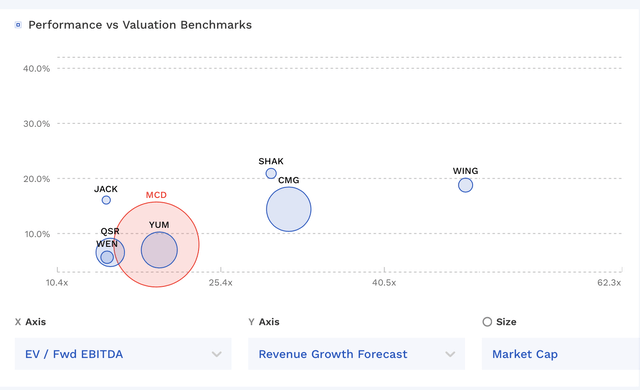

MCD stock currently trades at 19.6 the 2023 consensus EBITDA of $13.34 billion and 18.2x the 2024 consensus of $14.37 billion.

It trades at a forward P/E of 26.6x the 2023 consensus of $11.12 and 24.4x the 2024 consensus of $12.12.

Revenue growth is expected to grow 8% this year, and then grow over 6.5% the year after.

MCD trades towards the middle of its quick service restaurant peers.

MCD Valuation Vs Peers (FinBox)

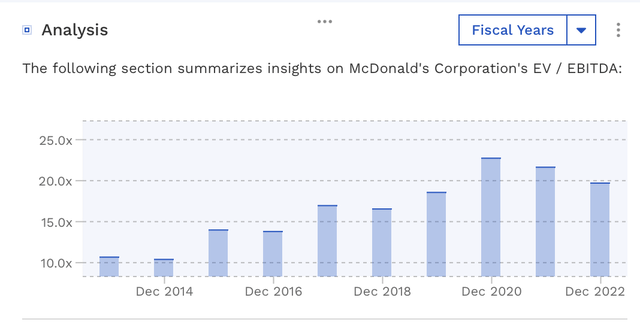

The multiple on the stock has been elevated in recent years compared to where it traded before the pandemic.

MCD Historical Valuation (FinBox)

Conclusion

MCD is one of the popular stocks on Twitter where certain investors question who eats there, similar to them saying who uses Facebook. The answer to both is millions and millions of people around the globe. At the end of the day, MCD’s one of the world’s biggest, and most recognizable brands and likely will continue to be for a very long time.

That said, MCD, as well as most of the quick service complex, has seen its valuation multiple jump post-pandemic. The industry has benefited from inflation, but I’m not sure that is a good enough reason to boost the multiple of the group to the levels we see today.

I view MCD as core type holding with an incredible track record of raising its dividend for 47 straight years. However, for new buy I’d prefer to be a buyer on a dip given the current valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.