Summary:

- McDonald’s is a quality company, and quality companies do relatively well in a challenging macro-environment.

- As the S&P 500 ‘crashed’ by about 20% YTD, McDonald’s managed to outperform by approximately 15 percentage points.

- McDonald’s net-profit margin has been consistently above 25% during the past decade.

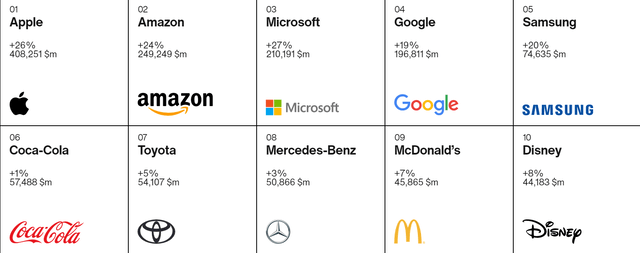

- According to Interbrand, McDonald’s is ranked as the world’s 9th most valuable brand, with $45.9 billion of brand equity.

- I think MCD stock is fairly valued, but given strong quality arguments, definitely worth a ‘Hold’.

Justin Sullivan

Thesis

McDonald’s (NYSE:MCD) is neither a growth stock, nor a value stock. But a quality stock – whereby I define quality as the ability to generate attractive profit margins, predictive and stable revenues, as well as a strong competitive moat. Quality stocks are often supported by a recognizable brand image and a non-cyclical industry. Accordingly, these stocks do very well in a recessionary macro-environment and in times when investors turn risk averse.

Given a highly challenging market environment – that arguably needs no further explanation – I like the relative risk/reward of investing in McDonald’s versus the broad market.

McDonald’s Company

McDonald’s is arguably the world’s most recognizable fast-food chain, selling food products and soft drinks since 1940. As of December 2021, the company branded more than 40,000 restaurants globally, of which more than 90% were operated under a franchise agreement.

McDonald’s operates globally in more than 140 countries and generates more than 50% of total sales outside the US.

What Quality Looks Like

Personally, I define a quality stock with three dimensions: (1) steady and stable revenue growth, (2) high profit margins on these revenues to generate attractive, and (3) a strong competitive moat to defend value accumulation. McDonald’s scores very well on all these characteristics.

Steady And Stable Revenue Growth

From 2018 to 2021, McDonald’s revenues expanded at a compounded annual growth rate of about 2 percent, which is approximately in line with nominal GDP growth. Accordingly, in the past 3 years, McDonald’s added about $1.8 billion of sales, reaching $22.8 billion in 2021.

Over the same period, however, the company managed to increase gross profit at a much faster pace: from $10.8 billion in 2018 to $12.6 billion in 2021. Notably, this is a CAGR of about 8%, and indicates that McDonald’s could expand profitability on the backdrop of bargaining power against suppliers and improved resource efficiency.

Perhaps the strongest argument to define McDonald’s business franchise as high quality is based on the observation that despite a very challenging macro-environment, the company managed to grow. For the trailing past twelve months, McDonald’s revenues stood at $23.2 billion and gross profit at $13 billion.

High Profit Margin

In my opinion, net-profit margins above 20% indicate a quality company. And McDonald’s net-profit margin has been consistently above 25% during the past decade.

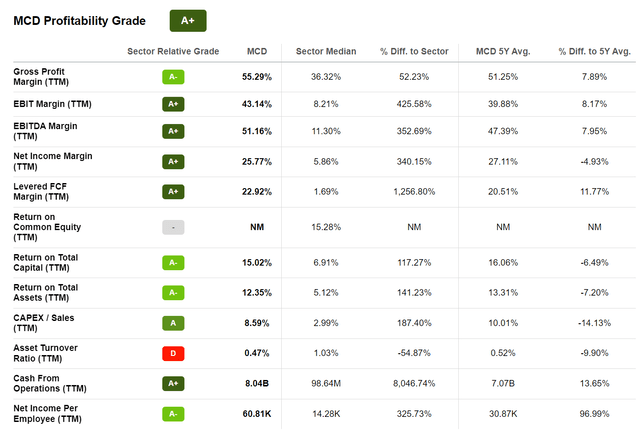

Notably, for the trailing twelve months, McDonald’s managed to claim a gross profit margin of 55.3%, which is more than 50% higher than the sector median of 36%. Moreover, the company’s EBIT margin is 43% and the net-income margin is 25.7%, which is a 425% premium to the sector median and a 340% premium respectively.

Taking reference from the table below, readers can see that McDonald’s TTM profit margin is in line with the 5-year average, indicating that the company is able to maintain high-margins against competition.

Strong Competitive Moat

What is protecting McDonald’s high margin against the competition? As for every successful company, it is the strong competitive moat. A moat can be supported by many different qualities, such as best-in-class technology and human capital. But for McDonald’s, I argue it is the globally recognized and loved brand (I’m lovin’ it).

According to Interbrand, McDonald’s is ranked as the world’s 9th most valuable brand, with $45.9 billion of brand equity.

In addition, investors should also consider that McDonald’s operates restaurants at prime locations, usually well-arranged around the city center. This makes the franchise exposed to high traction and easily accessible for a ‘fast’ meal. And from a competitive standpoint, this real-estate advantage is hard to replicate for new entrants, given the enormous capital intensity.

Valuation

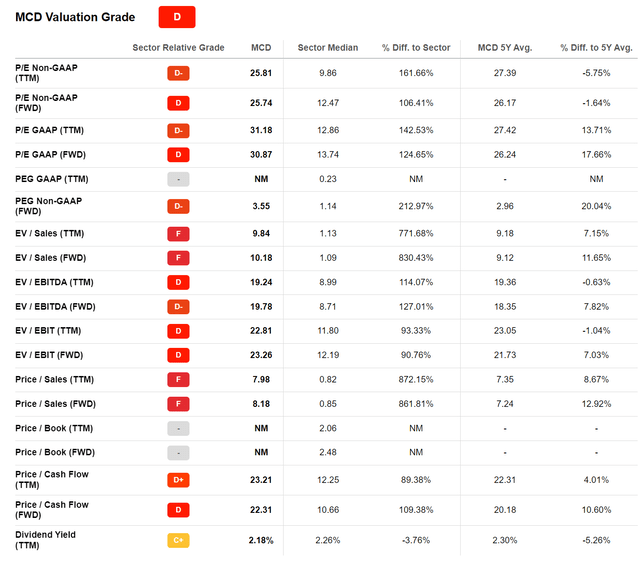

McDonald’s stock is not trading cheap. Of course not, given the company’s well-noted quality aspects. According to data compiled by Seeking Alpha, investors are required to pay approximately 100% premium versus competitors. For reference, McDonald’s one-year forward P/E ratio stands at x31, versus about x14 for the sector median. Respectively, EV/EBITDA is x20 versus x9.

But I argue the premium is justified, and the risk reward for investors still attractive. For example, another way to think about McDonald’s P/E is to argue that ‘1 divided by x31’ gives the annual shareholder return, which is 3.2%. And given McDonald’s competitive moat, this return could be viewed as safe.

But why not invest in US Treasuries that now yield almost 4%. Because McDonald’s also gives exposure to growth, and accordingly yield expansion. (Remember that McDonald’s managed to increase gross profit at a CAGR of about 8% during the past 3 years).

Going forward, on the backdrop of a booming market for food-delivery, I believe McDonald’s could expand its business at a 3% – 5% CAGR through 2025. The argument is simple: with restaurants in prime real estate locations as well as significant bargaining power against delivery firms, McDonald’s is poised to claim a leading position in this emerging market opportunity.

Quality Outperforms

Despite a rich valuation, quality companies (such as McDonald’s) generally do very well in a recessionary environment and in times when risk-aversion dominates investors’ sentiment — given the quality arguments presented above.

Consequently, as the market (S&P 500 reference) ‘crashed’ by about 20% YTD, McDonald’s managed to outperform by approximately 15 percentage points, losing only 5% of equity value.

Conclusion

Given a highly challenging macro-environment, I am confident to recommend the holding of quality stocks with strong brand image and steady non-cyclical cash flows. McDonald’s fits the screen perfectly.

In my opinion, McDonald’s is likely to outperform money market securities such as treasury notes and the general stock market. Money market securities yield less than inflation, and the stock market appears very vulnerable to a recessionary environment and EPS contraction.

McDonald’s should manage to provide a stable yield — given the quality arguments mentioned in this article — while also protecting investors relatively well from a continuing market selloff. I think MCD stock is fairly valued, but given strong quality arguments, definitely worth a ‘Hold’.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advise