Summary:

- I’m initiating McDonald’s with a sell rating. The world’s largest fast-food chain has dramatically underperformed both the S&P 500 and fast-casual rivals over the past few years.

- The company’s “Accelerating the Arches” plan is insufficient to revive sales growth, with Q3 trending at a -1.5% same-store sales decline. In the long run, health trends may steepen decay.

- Its plan to make promotions and $5 Meal Deals more prominent is also helping to contribute to an operating margin decline, on top of rising labor costs.

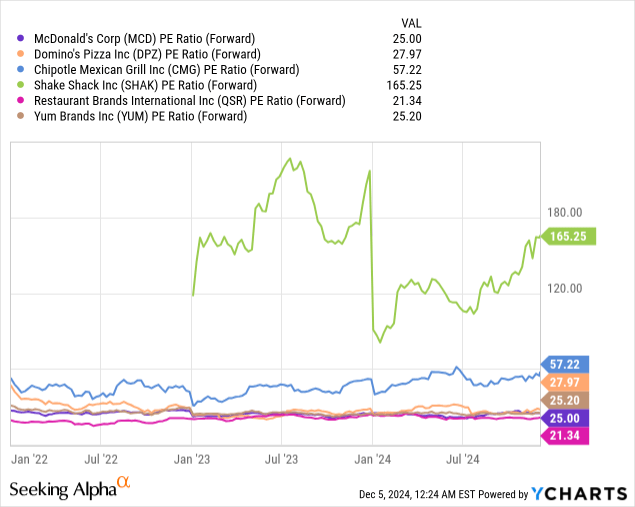

- MCD stock has an unattractive valuation at ~25x forward P/E despite near-zero growth in the near term, with uncertain drivers to resurrect growth in the long run.

Jay Mize/iStock Editorial via Getty Images

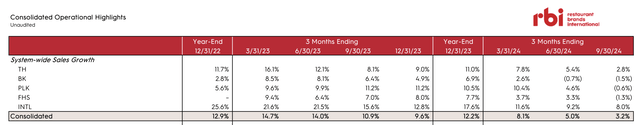

It’s been a great year for U.S. stocks, but one of America’s most iconic global brands has not been a participant in this year’s rally. McDonald’s (NYSE:MCD), the quintessential purveyor of Big Macs and Happy Meals, has not only seen ~flat share price action year to date, but the stock has also dramatically underperformed the S&P 500 and other major restaurant group peers over the past 5-year period (shown below). The question for investors here is: can the Golden Arches make a swift comeback?

At least from a stock market perspective, we can see where the wind is blowing among restaurant peers. Big fast food brands are ceding gains to smaller, fast-casual, more health oriented chains like CAVA Group (CAVA) and Sweetgreen (SG). Amid this rise, McDonald’s is doubling down on its core and reaffirming its commitment to providing value meals in an inflation-weary environment.

But can this strategy succeed? For a number of reasons that I’ll elaborate in this article, I believe not. I’m initiating McDonald’s at a sell rating, and in my view, further pain is ahead for this once-dominant stalwart.

McDonald’s Strategic Plan: not meaty enough to turn sales trends around

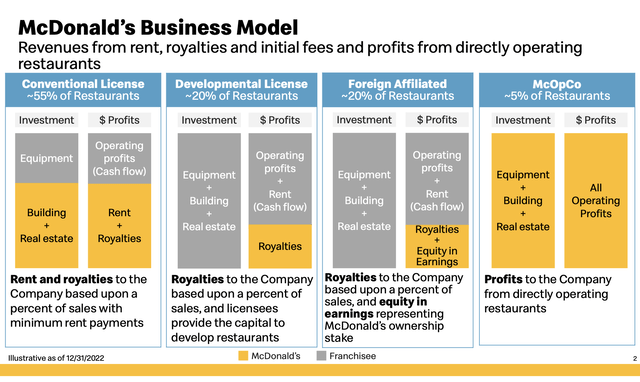

For investors who are newer to McDonald’s, let’s first get grounded on the company’s segmentation. The company’s primary source of revenue (60% of its Q3 actuals) comes from royalty fees from its thousands of franchisees, consisting of startup fees, ongoing cuts of sales, and in some cases rent payments as well. The company does also operate its own restaurants, but this represents only ~5% of the company’s portfolio of 40k+ restaurants.

McDonald’s segmentation (McDonald’s Sep 2024 investor presentation)

As seen in the chart above, most of the company’s franchisees are on what it calls a “conventional license,” where McDonald’s undertakes the location development and real estate acquisition portion of the new store opening, while franchisees are responsible only for financing the equipment for the new restaurant. These franchisees pay McDonald’s rent. Meanwhile, some other larger franchisees and overseas entities are fully responsible for the build costs, while McDonald’s only receives ongoing royalties without rent in return. On a geographic basis, the U.S. represents just over 40% of the company’s corporate revenue as well as systemwide sales (revenue of total restaurants including those owned by franchisees), while developed overseas markets are ~50% of corporate revenue and developing markets the remaining ~10%.

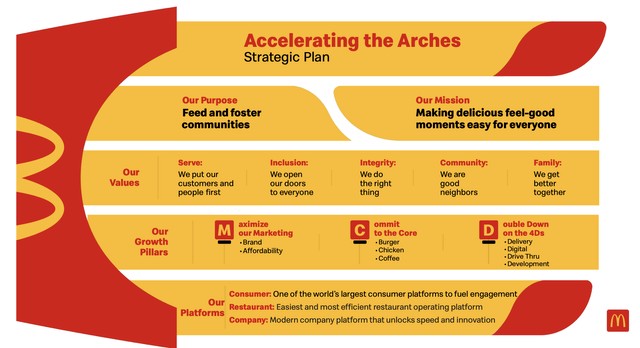

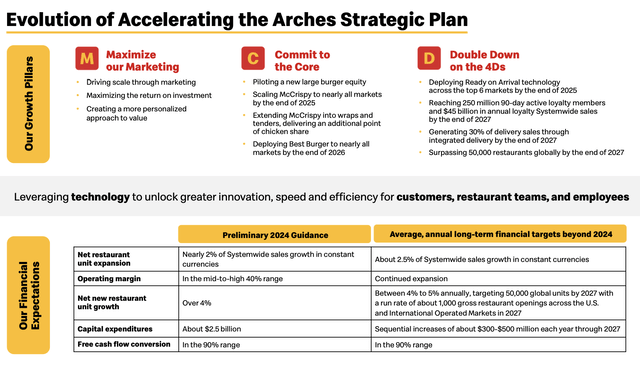

Now let’s dig into the company’s strategic pillars over the short to medium term. In an investor day in 2023, McDonald’s laid out its operating plan, which it labeled “Accelerating the Arches.” The broad strokes of the plan are shown in the chart below:

McDonald’s’s strategic plan (McDonald’s 2023 investor update)

In a nutshell, the company is aiming to achieve greater scale in its marketing network, committing to its core menu, and improving overall operations through technology.

Before digging into numbers, let’s offer a qualitative assessment first of how McDonald’s is faring. Where I think the company deserves the most praise is its commitment to operational excellence. In particular, McDonald’s was a clear first-mover in the restaurant industry in introducing digital order panes, both in the U.S. and overseas.

The benefits of this technology investment have been multifold. The most obvious win is that leaving the ordering process to a digital screen and freeing McDonald’s labor from this task has helped the company (and its franchisees, whose success ultimately ends up fueling McDonald’s hefty franchise fees) streamline its labor costs in a heavily inflationary environment, especially for low wage labor. It has also streamlined both restaurant operations and the use of real estate space (much of the “entry foyer” in a McDonald’s restaurant is now occupied by 4-6 ordering screens). And, digital screens have also been able to natively upsell customers with add-ons more effectively than human cashiers can.

Rivals like Burger King have followed suit in many of their locations, but rivals where customization is key to the menu offering, such as Chipotle (CMG) or Starbucks (SBUX), can’t benefit from the same wins.

However, counterbalancing the strength of the company’s operational improvements is the weakness in overall sales, which is a threat to the company’s “commit to the core” initiative.

The company is challenged by two equally powerful headwinds. The first is ongoing health trends. Social media has been an especially powerful force in stimulating healthy eating and healthy lifestyles (for example, sober and “sober-curious” movements have picked up in popularity). McDonald’s brand retains a connotation of unhealthiness that, despite menu additions like salads and lower-calorie offerings to try to combat that image, can’t entirely reverse the brand perception of the Golden Arches. And the second is menu price inflation: amid an inflation-weary consumer, especially in the U.S., many consumers have traded down to cheaper alternatives and increased meals at home instead of going out, a trend that has been reported as a major risk to the restaurant industry by Yelp (YELP) for several quarters.

How it’s going: 2024 trends have been especially weak for McDonald’s

Now let’s dig into more of the raw financials. Alongside the company’s “Accelerate the Arches” qualitative plans that it issued last year, it also offered preliminary 2024 guidance that banked on 2% systemwide sales growth (including contribution from new locations) and a mid-to-high 40s operating margin.

McDonald’s financial targets (McDonald’s 2023 investor update)

The company is falling short of both the top and bottom-line targets, with trends worsening in its most recent quarter.

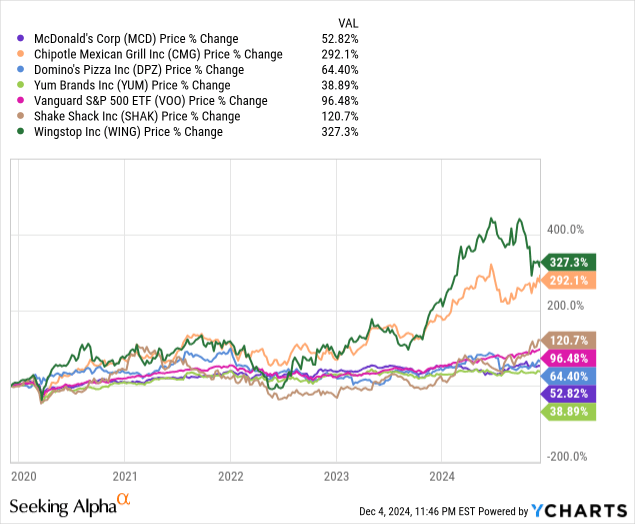

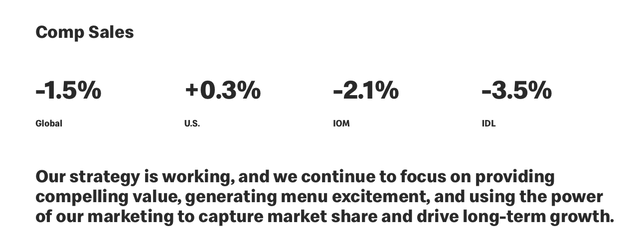

In Q3, systemwide sales were flat y/y: falling short of the company’s “nearly 2% system sales growth” target. In fact, McDonald’s net store count expansion has been offset by declining same-store sales growth, which measures the sales growth of locations that already existed in the base-year compare and eliminates the noise from the timing of new restaurant openings.

While the U.S. held on to roughly flat trends, overseas markets (both the developed IOM segment and the developing IDL segment) saw low single-digit declines, dragging down systemwide sales as a whole. Note as well that this is the second consecutive quarter of declining SSS, with the company worsening from a -1.0% decline in Q2.

McDonald’s’ Q3 comp sales (McDonald’s’ Q3 earnings release )

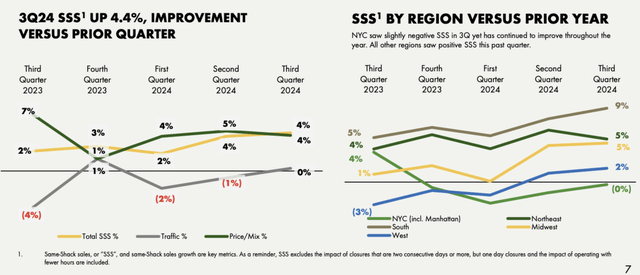

This is where we can make the most jarring compares against direct peers, particularly amid the more upscale “fast casual” segment. Shake Shack (SHAK), the burger chain founded by chef Danny Meyer that is now expanding rapidly both in the U.S. and overseas, grew same-store sales by ~4% in the same quarter, with growth in particular led by the Southern U.S. market.

Shake Shack SSS (Shake Shack Q3 shareholder letter)

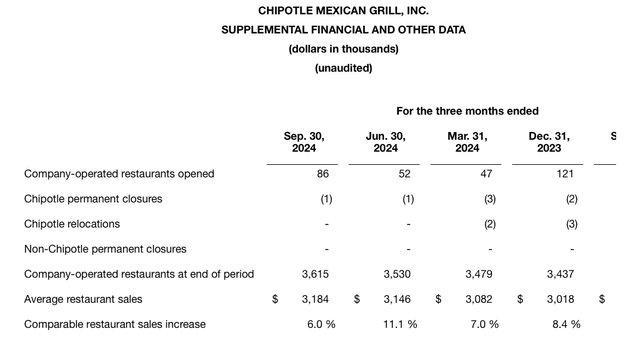

Chipotle, meanwhile, notched 6% SSS growth in Q3:

Chipotle SSS (Chipotle Q3 earnings release)

Direct fast-food rival Restaurant Brands International (QSR), parent company to Burger King, meanwhile, also posted 3% SSS growth, though we note that Burger King itself also shed -1.5%:

Amid the deterioration in sales, McDonald’s key action, as previously noted, is to “commit to its core,” which it is doing in two ways. The first is by doubling down on key menu items. It’s looking to expand its McCrispy chicken sandwich to all markets, especially amid the rising popularity of chicken-based sandwich items; and in addition, the company is also rolling out a reinvented formula for its burgers, which it has named Best Burger. In a nutshell, the company is cooking fewer burgers at a time on a single grill (though keeping the patties the same), while also adding more sauce and upgrading the buns.

The second core strategy is to try to combat market share pressure by making $5 Meal Deals more prominent. Initially launched as a summer deal, now the company is experimenting with keeping the nostalgic $5 price point around until the end of 2024 or potentially longer. It’s also adding the ability to order customized add-ons such as small fries or 6-piece nuggets for $1 (smoothly executed by the company’s order kiosks, as previously mentioned).

We’ll acknowledge here that the company has potentially seen success with this move. Though overall SSS declined sequentially from Q2 to Q3, the U.S. (where the $5 Meal Deal is offered) improved from a -0.7% decline in Q2 to a 0.3% gain. But whether this slim improvement in U.S. results is enough to combat a global decline in sales trends, as well as prove worthwhile to margins, remains to be seen.

Speaking of margin, it’s worth checking in on the company’s progress toward its bottom-line goals as well. Heading into 2024, the preliminary guidance plan called for “mid to high 40s” operating margins, implying a 45-49% target.

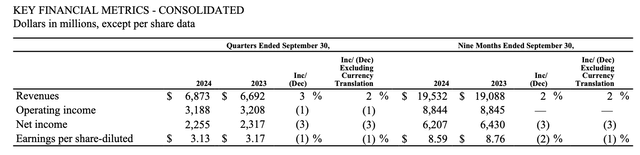

In Q3, the company actually saw a -1% y/y decline in operating income to $3.19 billion, or a 46.3% margin (-160bps y/y). YTD 2024 margins are worse, at 45.3% (-100bps y/y). Both Q3 and YTD actuals are below the implied 47% midpoint of the company’s “mid to high 40s” target.

McDonald’s Q3 highlights (McDonald’s Q3 earnings release )

The company’s target of appealing to more value-conscious consumers is evidently having an impact on its margin progression. EPS, too, is down single digits for both Q3 and YTD. On top of heavier promotional activity, rising labor costs are another key risk. The company doesn’t break this expense out separately, but total company-owned operating costs rose 5% y/y in this quarter.

Valuation and key takeaways

Amid weakening same-store sales as well as margin declines, we have to ask ourselves: does McDonald’s deserve to trade at a premium to the S&P 500? We note as well that consensus is currently calling for McDonald’s to hit 4% sales growth and 7% earnings growth next year to $12.61 in pro forma EPS: both representing an acceleration from YTD actual sales growth of 2% and YTD earnings growth of -2%. Needless to say, acceleration is far from guaranteed, especially if global macro conditions tighten.

Now, valuation is a bit trickier here. Despite the fact that McDonald’s trades at a slightly richer multiple than the S&P 500’s ~22x forward P/E ratio, direct peers are also trading at rich premiums and McDonald’s is on the lower end of the spectrum, in-line with other fast food names but substantially below fast-casual rivals.

In other words, the whole market (and especially the restaurant sector) seems bloated for underwhelming growth and fundamental performance.

With this in mind, it’s best to sell this stock and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.