Summary:

- McDonald’s Corporation has substantial branding advantages, global scale, and cost leadership, leading to best-in-class profitability.

- The company’s ability to leverage digitization and technology investments enhances its business model.

- Still, McDonald’s nearly fell into a bear market, crashing from its June 2023 highs. As such, McDonald’s stock has dropped to levels last seen in October 2022.

- Concerns about the impact of GLP-1 drugs on the restaurant industry and dining habits could affect McDonald’s, but its ability to innovate shouldn’t be underestimated.

- I argue why investors waiting for a golden buying opportunity shouldn’t miss buying the steep pullback. McDonald’s Corporation stock hasn’t been this cheap since March/April 2020.

M. Suhail

The McDonald’s Corporation’s (NYSE:MCD) investment thesis is pretty simple. It has strong branding advantages, global scale, and cost leadership. Bolstered by an unrivaled franchisee network, it has given the company significant pricing power, allowing it to maintain best-in-class profitability (“A+” grade) among its restaurant industry peers.

In addition, its ability to leverage digitization, technology investments, and omnichannel capabilities further enhances its wide-moat business model. As such, MCD is a resilient long-term uptrend stock that dip buyers have consistently defended on steep pullbacks.

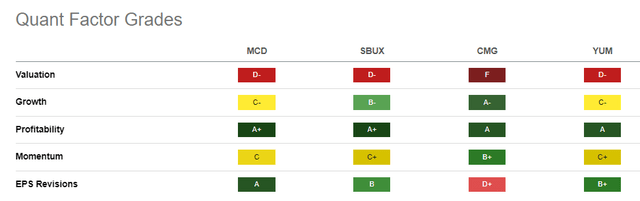

MCD Vs. Peers Quant Grades (Seeking Alpha)

With a “D-” valuation grade, MCD isn’t your cheap deal restaurant operator compared to its sector peers. However, like its closest industry peers listed above, wide-moat operators don’t come cheap, with Chipotle Mexican Grill (CMG) stock assigned an “F” valuation grade. As such, I believe what’s important for McDonald’s investors to consider is that MCD isn’t priced out of this world, requiring significant caution at the current levels.

While its “C-” growth grade could cause some investors to be more cautious, its “A” earnings revisions grade corroborates the company’s strong execution, which should support robust buying sentiments.

However, MCD was still battered recently, falling nearly 18% from its June 2023 highs through last week’s lows. As such, the $299 level, MCD’s critical resistance zone, has proved to be a selling opportunity for astute market operators, rejecting further upside since May 2023.

The recent success of GLP-1 drugs from Novo Nordisk (NVO) and Eli Lilly (LLY) has likely led to fears about the impact on the long-term prospects of the restaurant industry. These drugs initially used to treat Type-2 diabetes have gained tremendous success and exposure for weight management, anticipated to be a $100B market by 2030.

Wall Street analysts have also expressed concerns about their impact across several industries, including McDonald’s and its restaurant peers. Mizuho analysts cautioned that the effects of the GLP-1 drugs are “negative over the long term.” As a result, investors should anticipate “reduced spending on dining out.”

While these concerns are valid, McDonald’s is a value-conscious restaurant that has performed well through economic cycles. However, the imminent threat isn’t so much about weaker pricing power but a resurgence of a healthier population that could be more concerned about eating unhealthy fast food.

Could it lead to a structural change in dining habits, particularly at McDonald’s? I believe it’s still too early to assess. But, we shouldn’t rule out McDonald’s remarkable ability to innovate and keep itself relevant, as seen in its ability to achieve technological breakthroughs. I wouldn’t bet against MCD’s wide-moat business model and believe that the recent fear isn’t fully substantiated. As such, I assessed that it could represent a remarkable opportunity for investors to capitalize as MCD is no longer expensive relative to its historical metrics.

MCD last traded at a forward EBITDA multiple of 16.2x, above its 10Y average of 15.6x. However, the previous time MCD traded at a lower forward EBITDA multiple was during the early period of the COVID pandemic. In other words, MCD is much cheaper than ever since March/April 2020.

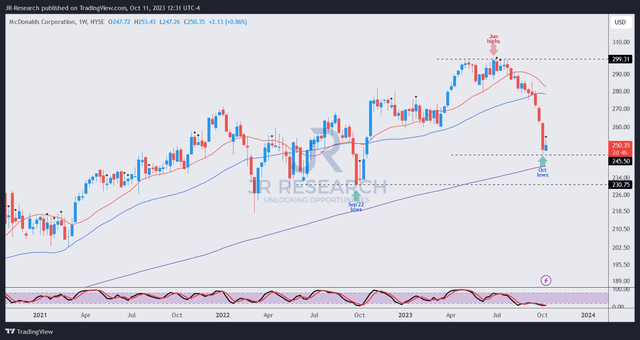

MCD price chart (weekly) (TradingView)

As seen above, for MCD to fall steeply, as it has since its June 2023 highs, isn’t a regular occurrence. The previous times it did so, it also bottomed out in March and September 2022, respectively.

Therefore, the decline over the past three months has set up a remarkable dip-buying opportunity for investors who missed buying its previous steep retracements. Accordingly, MCD has dropped back to lows last seen in October 2022, likely stunning investors who anticipated more stability from a resilient stock like MCD.

While I didn’t assess a robust price action signal from McDonald’s Corporation’s pullback, I’m satisfied that the worst selloff is likely over. As such, a more constructive consolidation is expected, with MCD’s September 2022 lows likely defended stoutly by buyers.

Rating: Upgraded To Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!