Summary:

- McDonald’s is a global fast-food powerhouse with over 40,000 restaurants in 100 countries, and it continues to expand.

- Despite premium prices, McDonald’s revenue and cash flow are increasing, and it has a solid dividend growth rate.

- The rising cost of fast food may lead some consumers to choose healthier alternatives, but McDonald’s remains an attractive investment with potential upside.

- The data shows us that people are willing to pay premium prices for McDonald’s and that fast food consumption increases with income.

RiverNorthPhotography

Overview

McDonald’s Corporation (NYSE:MCD) has been around longer than sticky notes have. No seriously, that’s a true fact! Founded in 1940, MCD has been the go-to cheap spot to eat for a lot of our families. As you’ve probably noticed, McDonald’s isn’t so cheap anymore. Long gone are the days of the $1 McChicken and snack wraps. However, this shift in pricing is beneficial to us as investors.

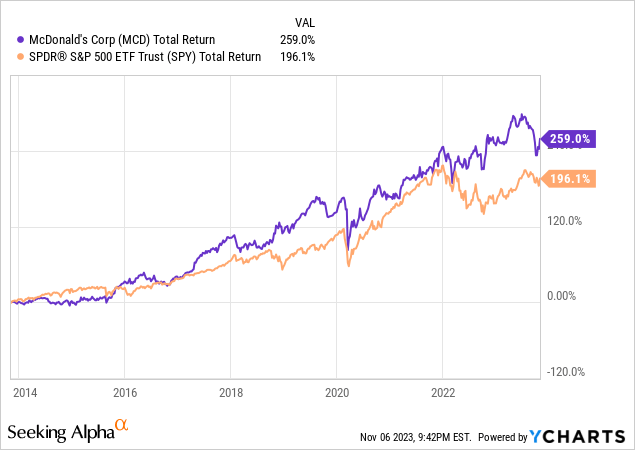

With over 40,000 restaurants spread throughout over 100 countries, the golden arches are more recognizable worldwide than the Christian cross. What a unique fun fact, right? There were over 1,000 new restaurants opened last year and McDonald’s has no plans of ever slowing that growth. MCD is still an attractive investment based on the outperformance of the SPDR S&P 500 ETF Trust (SPY).

People are still visiting McDonald’s and this is proven by the ever-increasing revenue and cash flow. The company has increased dividends for over 47 consecutive years and has grown the dividends at an attractive rate. These things aside, let’s dig into why I think MCD is still a compelling investment and where I think the company will be in the future.

Supported By The Market

I will attempt to sway you by painting a picture of why the typical family is even more accepting of fast food now compared to the past. There are several data points I will share that reinforce this perspective and confirm my buy rating. I will leave out any performance-related metrics of MCD in this section and instead focus on the macro environment data.

Not so surprisingly, people eat fast food on average 3 times a week. In addition, 83% of American families eat at fast food restaurants at least once a week. This data tells us that it’s safe to say the majority of people are still eating fast food and happily pay the premium prices for the convenience. A data point that I can confirm with my own life experience is that the higher the income, the more frequently people eat fast food. I notice that the further I progress in income bracket, the more comfortable I am spending money on overpriced chicken sandwiches and burgers. Coincidentally, the average American household has now crossed millionaire status.

“The percentage of adults who ate fast food rose with increasing income. About 32% of people who earn less than 130% of the federal poverty line – $32,630 a year for a family of four – ate fast food daily. 42% of people above 350% of the poverty line – $112,950 a year or more for that size family were daily consumers.” – CDC.gov

A study conducted found that people with lower incomes were less likely to eat fast food regularly than those in the middle class. However, in the study, lower-income individuals did eat a bit more fast food than those in the highest income brackets, though the difference was not very large. It turns out that people between the ages of 20 and 39 are the most likely to eat fast food on any given day. This demographic also happens to make up the largest portion of the U.S. workforce.

So, if it’s not because of a lack of money, what makes people consume fast food? One possible reason is the lack of time. The same study determined that the more hours a person worked, the more likely they were to eat fast food. This makes sense because fast food is, as the name suggests, quick and convenient. Think about it: how many times have you settled for fast food for dinner after a long day of work?

Growth

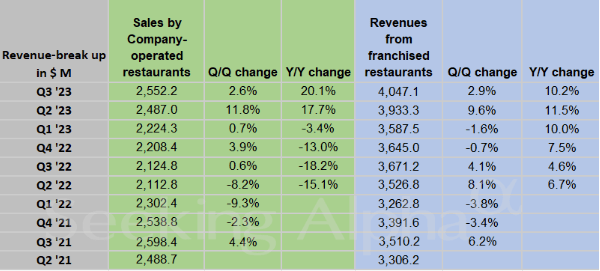

Sales at company operated locations rise 20% (Seeking Alpha)

Referencing some of the tables provided by Seeking Alpha, we can see that sales at company-operated locations have risen 20%. In addition, the latest earnings report was strong as their non-GAAP earnings per share of $3.19 exceeded expectations by $0.20. Revenue for the quarter amounted to $6.69 billion, marking a 14.0% year-over-year increase and surpassing expectations by $140 million. The company’s focus on digitalization was also apparent, with Digital Systemwide sales in their top six markets reaching nearly $9 billion for the quarter, accounting for over 40% of their Systemwide sales.

However, these results and growth are not surprising to me whatsoever. It’s basic math: revenues are up because the cost of McDonald’s is up! McDonald’s expects prices to increase 10% for the full year going into 2024. A Big Mac meal now runs you $13. I see some reports of Big Macs going for a whopping $18 in some areas of California! Maybe my mind is stuck in 2013 but I swear I remember Big Macs costing about $7 for a meal. In fact, I looked back to confirm my suspicions and a Big Mac cost only $7.89 for a combo as short as 3 years ago in 2020. As previously mentioned though, it seems that people are willingly paying a premium to get their MCD fix. As inflation weakens the dollar and causes people to work longer hours, I suspect this cycle will continue into the future.

Lastly, it’s worth mentioning that a lot of McDonald’s growth comes from the way the business is structured. 55% of their revenue comes from conventional licenses while the remaining half comes from developmental licenses, foreign affiliates, and McOpCo (which is just an abbreviation for MCD’s operating company). A lot of the revenue comes from the rent and royalties MCD receives from their franchisees and this structure has proven successful over time.

Financials

As mentioned above, McDonald’s has demonstrated their strong financial standing in the third quarter of the year, exceeding expectations. The company reported a non-GAAP earnings per share of $3.19, surpassing estimates by $0.20. Moreover, their revenue reached $6.7 billion, reflecting a significant 14.0% year-over-year increase.

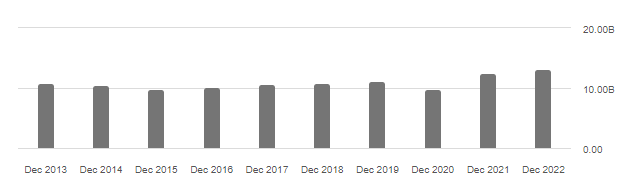

A noteworthy highlight from their Q3 results is the impressive 8.8% increase in global comparable sales, indicating strong performance across all segments. Specifically, revenue in franchised restaurants amounted to around $4 billion in Q3, a noticeable improvement from the roughly $3.7 billion in Q3 2022. For company-owned restaurants, revenue reached around $2.6 billion, compared to $2.1 billion in the same period the previous year. This recent earnings contributes to ending the flat revenue streak over the last decade. As previously mentioned, the prices are expected to be raised by 10% so I anticipate continued revenue growth. It’s worth also pointing out that MCD currently trades with P/E ratio of 23x compared to the 5-year average P/E of 27.4x. This will later tie into the valuation discussion.

Seeking Alpha

Lastly, the culmination of these results led McDonald’s to take the step of increasing its dividend by 10% to $1.67 per share, showcasing their confidence in their financial stability and future growth prospects. We will dig deeper into the sustainability of the dividend next.

Dividends

MCD has increased their dividend payouts for 47 consecutive years. With a 5-year dividend CAGR of 8.5% and an upfront yield of 2.5%, this makes an attractive dividend growth stock! While the low starting yield may not seem attractive, the growth certainly is! They recently increased their dividend by 10% and declared a payout of $1.67/share. The current payout ratio sits at 52%. This payout ratio is a large premium to the sector average of 34%, however, McDonald’s still has the largest market share worldwide in fast food sales and operates with a much better growth rate so this makes the payout ratio sustainable and nothing to worry about in my opinion.

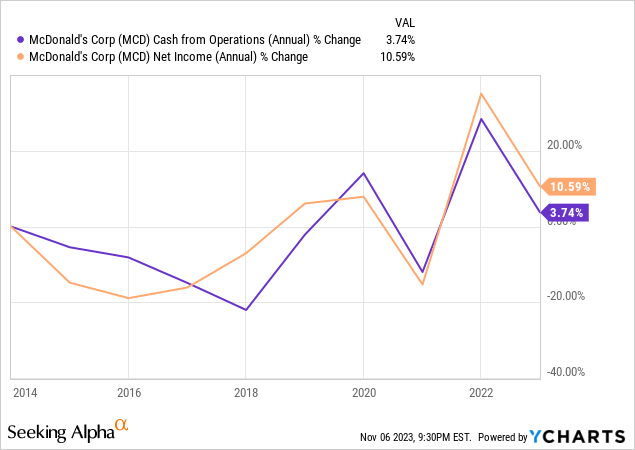

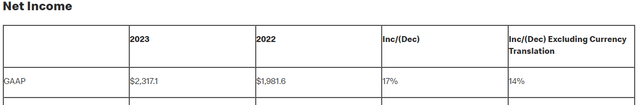

The dividend is well supported by the company’s net income margin and free cash flow. MCD’s leveraged free cash flow sits at 25% compared to the sector median of 5.34% which shows the company’s brilliance in operating in uncertain economic times. Their net income increased 17% YoY and with the future price increases, I fully expect this to continue into the future.

McDonald’s Earnings

Valuation

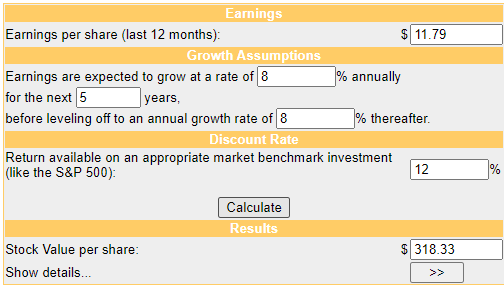

While the average Wall St. price target for MCD sits at $307.27/share, this would represent a potential upside of 14%. However, we will use a discounted cash flow calculation to come up with our own fair value for the stock. Using the EPS estimate for year-end of 11.79, we can combine this with the estimated growth rate of 8-10%. For the sake of being conservative, we will estimate growth at only 8% annually, despite prices increasing by 10%.

Money Chimp

Using these metrics, we calculate that a fair value estimate for MCD comes to $318/share. From the current price level, this would represent a potential upside of about 18% which closely aligns to the average Wall St. price target. It’s also worth mentioning that the highest price target for MCD comes in at a whopping $383/share. This would represent a huge upside potential of 42%. As previously mentioned, MCD currently trades with P/E ratio of 23x compared to the 5-year average P/E of 27.4x. This P/E difference represents a 19% potential upside which further reinforces our valuation.

I believe that adding to your current position or starting a new position here would prove beneficial in the long term. With expected price increases of 10% going forward and increasing free cash flow, we can expect upside potential combined with a steadily increasing batch of dividend payments.

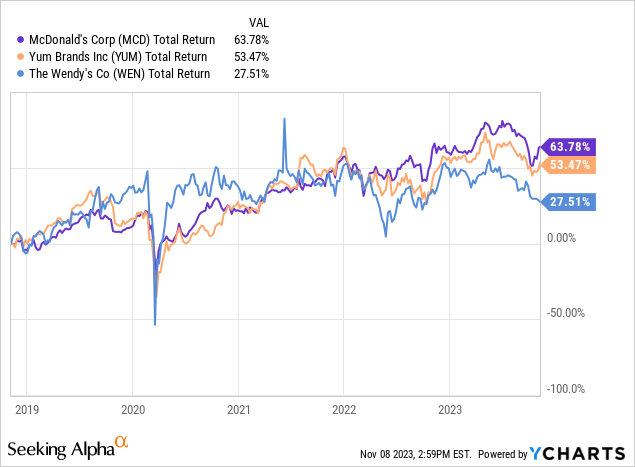

Comparison

I believe The Wendy’s Company (WEN) and Yum! Brands, Inc. (YUM) to be the closest competitors to MCD. Wendy’s is well known and self-explanatory but Yum Brands operates similar fast food service restaurants such as Taco Bell, KFC, Habit Burger, and Pizza Hut. As we can see, MCD remains the outperformer of the bunch. YUM also trades at a similar PE discount as MCD but only slightly lower at 14%. WEN trades at a much larger PE discount of 35% but this can be attributed to a much more drastic price drop as WEN is currently down 14.6% YTD as opposed to MCD being up slightly up 1.3% YTD.

MCD remains my choice over competitors because of 3 main drivers:

- Longest Dividend Increase Streak (47 Years).

- MCD has more global recognition.

- Strong Cash Position.

WEN does have a higher starting dividend yield over 5% but their dividend payout ratio remains too high for my liking, sitting above 80%. YUM has a dividend yield that sits below 2% which is also on the lower end of the spectrum. In addition, MCD has outlined clear plans to intentionally raise prices to increase revenue and profitability. In comparison, YUM has confirmed they do not intend to follow the same route. MCD continues to dominate the market in terms of the number of locations worldwide and the brand recognition. I just don’t think the competitors are doing anything to close the gap on market share. Maybe if WEN or YUM were making these large pushes in marketing campaigns I would feel differently. Until then, I plan to remain invested in MCD above all else.

Lastly, MCD has over $1 billion in cash on hand. The strong cash position and better margins of MCD give me a better sense of peace knowing that they will be better suited to reinvest back into the business, build upon expansion efforts, and manage through rough economic conditions.

Risks

Healthy eating has become more and more of a preference for people’s daily lives. Despite the data proving people still eat fast food, that could easily change into the future. There is a large portion of consumers that are becoming more health conscious as the rising cost of eating out gets worse. In fact, the rising costs of fast food can be the main motivator to help a portion of the population choose healthy eating alternatives or shift to being more motivated to prepare their own meals.

We are seeing more consumers prioritize plant-based meals and meals that contribute to general wellness. Affordability plays a big part of this impact as “eating healthy” usually has the stigma of being more expensive. However, when the cost of eating fast food starts to approach the same cost as these healthy alternatives, there may be a crossroad where habits shift.

Takeaway

McDonald’s Corporation (MCD) has stood the test of time, evolving from its humble beginnings into a global fast-food powerhouse. With over 40,000 restaurants in more than 100 countries, McDonald’s is a recognizable global icon. The company continues its expansion, opening over 1,000 new restaurants in the past year, with no signs of slowing down. Despite its premium prices, people still flock to McDonald’s, as evidenced by their increasing revenue and cash flow. With over 47 years of consecutive dividend increases and a solid dividend growth rate, MCD remains an attractive investment.

Despite the rising prices, which can now reach $13 for a Big Mac meal, people are willing to pay a premium for the convenience and familiarity of McDonald’s. As inflation persists and the need for time-saving options continues, it’s likely that this trend will endure. McDonald’s unique business structure, relying on franchisees for a significant portion of its revenue, has contributed to its success. It has also maintained an impressive streak of dividend increases, with a sustainable payout ratio.

From a valuation perspective, McDonald’s appears to have upside potential, with the current price aligned with Wall Street targets. Using conservative estimates and a discounted cash flow calculation, we find a fair value estimate of $318 per share, indicating the potential for an 18% increase. The highest price target of $383 per share suggests an even greater upside potential of 42%.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.