Summary:

- McDonald’s has maintained its reputation for convenience, affordability, and quality while adapting to diverse tastes and cultural nuances.

- Despite macroeconomic factors, McDonald’s has shown resilience and maintained high product demand and increasing comparable sales.

- The company has strong profitability metrics and appears attractive from a valuation perspective, leading to an upgrade in rating from “hold” to “buy”.

spflaum1/iStock Editorial via Getty Images

McDonald’s (NYSE:MCD), a global icon in the fast-food industry, has transcended culinary boundaries since its inception in 1955. Revered for its signature golden arches and iconic offerings, the brand has become synonymous with convenience, affordability, and consistent quality. Operating in over 100 countries, McDonald’s has evolved to cater to diverse tastes and cultural nuances while maintaining a steadfast commitment to innovation. Beyond its famed hamburgers and fries, the brand continually adapts to changing consumer preferences, embracing sustainability initiatives and fostering community engagement. McDonald’s enduring success lies in its ability to blend tradition with contemporary trends, offering a familiar yet ever-evolving dining experience.

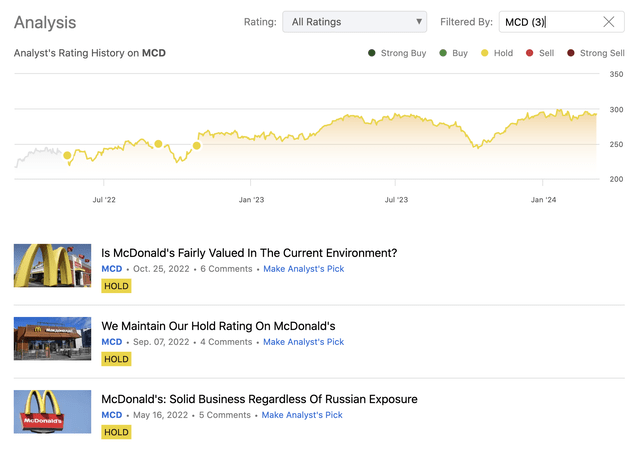

Since initiating coverage in May 2022, we’ve produced three articles consistently rating the company’s stock as “hold.” Despite acknowledging its high-quality business model, macroeconomic factors have hindered a bullish stance. Our primary reasons for maintaining a “hold” rating were the Russia-Ukraine conflict affecting a significant portion of MCD’s business and a relatively high valuation based on multiples and the Gordon Growth Model. We revisit MCD today to assess the validity of our previous arguments. The accompanying chart illustrates the stock’s performance since our coverage began.

To initiate our discussion, we will begin by examining the most recent quarterly results, which were disclosed in February. Subsequently, we will delve into a comprehensive analysis of the business, exploring metrics related to profitability, efficiency, and the firm’s valuation.

Earnings results

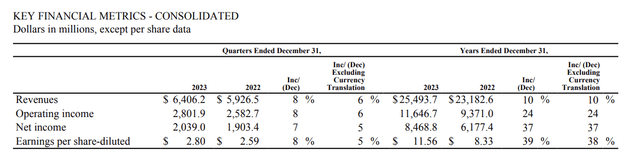

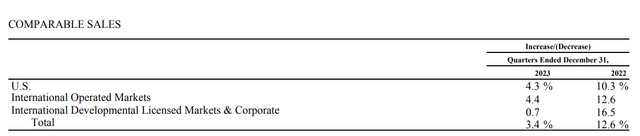

In Q4 2023, MCD exceeded EPS estimates but fell short of revenue and comparable sales estimates, despite a 3.4% YoY growth in comparable sales. Breakdown by geography reveals a 4.3% increase in the U.S., 4.4% in International Operated Markets, and 0.7% in International Developmental Licensed Markets (impacted by Middle East war).

Strong U.S. growth was driven by strategic menu price increases, while international markets like the U.K., Germany, and Canada excelled, offsetting negative sales in France.

Consolidated revenues rose by 8%, systemwide sales by 6%, and consolidated operating income by 8%, yielding a $2.8 per share (diluted) bottom line, an 8% YoY increase.

While these results might look attractive at first sight, we have to understand how the growth dynamics have been changing over the past year. The following table illustrates the comparable sales growth of different segments in 2022 and in 2023. A significant slowing can be recognised.

Despite slowed growth, these results underscore MCD’s business resilience amid macroeconomic challenges (poor consumer confidence, elevated inflation levels, geopolitical tensions across the globe), maintaining high product demand and increasing comparable sales across segments.

Profitability

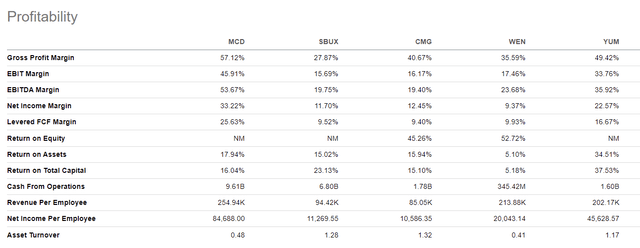

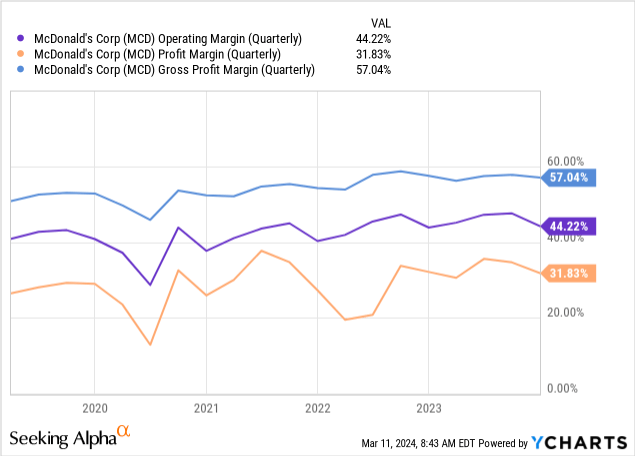

When evaluating firms for profitability, we typically consider three metrics: gross profit margin, operating margin, and net profit margin. The accompanying chart illustrates these ratios for MCD.

Generally, we favour stable or improving profitability metrics. While there has been some volatility, especially in the net profit margin in early 2022, driven by the outbreak of the tension between Russia and Ukraine, MCD has managed to keep its profitability metrics relatively stable over the past 5 years, even slightly improving them.

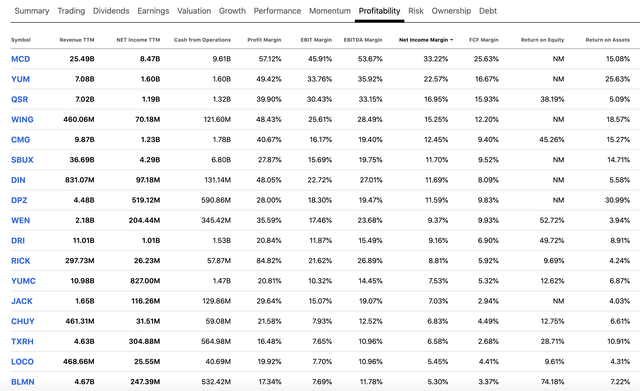

To put these metrics in perspective, the following table compares MCD’s figures with those of its closest peers and competitors.

If we extend our coverage to the entire restaurant industry, MCD still appears to be one of the best, if not the best company, from a profitability point of view.

For these reasons, we believe that MCD’s business is attractive from a fundamental point of view, and we expect it to remain so in the coming quarters.

Efficiency

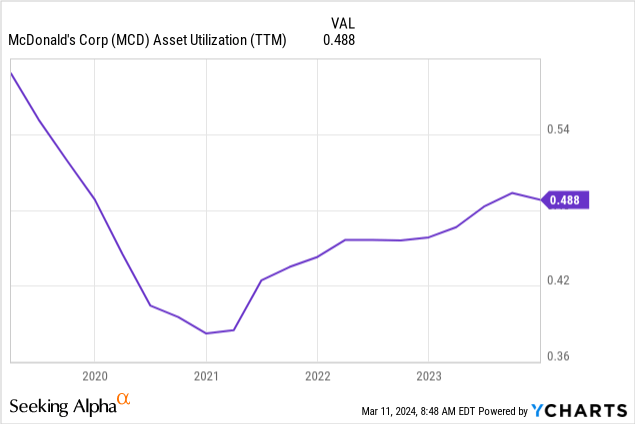

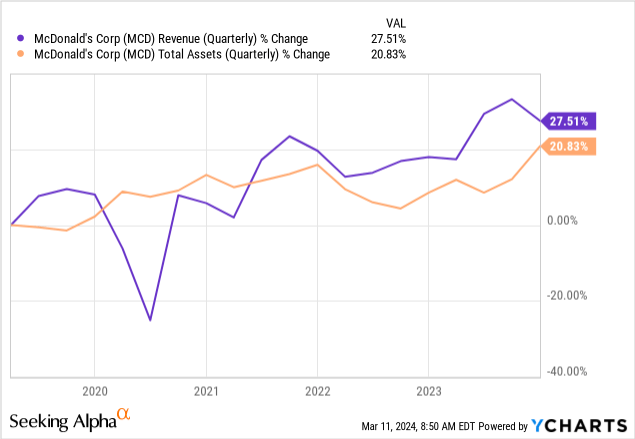

When assessing a company’s efficiency, the central ratio under consideration is typically the asset turnover, or asset utilization. This metric gauges the relationship between sales and total assets, revealing the effectiveness of the firm in utilizing its assets to generate revenue. Similar to our approach with profitability metrics, we prefer stable or improving levels in this regard. The provided chart illustrates MCD’s asset utilization.

Until 2021, there has been a declining trend in MCD’s efficiency. This trend has been driven by slow, and even declining sales, through some periods, while total assets have been increasing. From 2021 onwards, revenue once again started to grow at a faster pace than total assets, leading to an improved asset utilization.

Despite the improvement in recent years, MCD’s efficiency still compared relatively poorly to that of its peers. In the coming quarters and years, we would like to see MCD address this topic and see further improvement.

Valuation

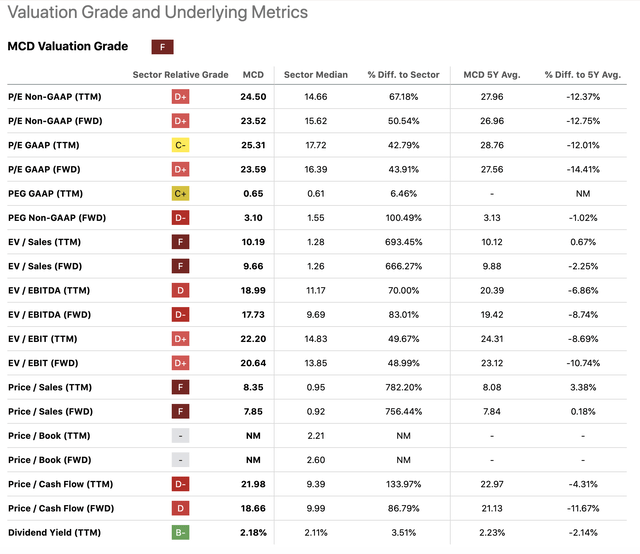

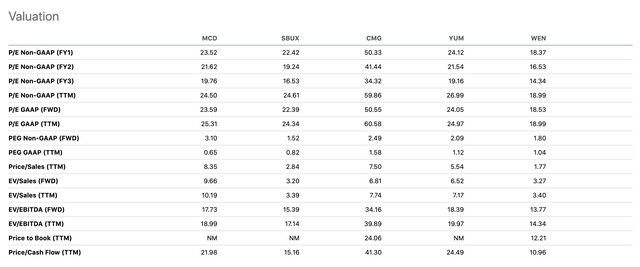

As with most things in life, you have to pay a higher price for quality. The same is true for MCD. The firm’s stock is trading at a significant premium compared to the consumer discretionary sector median, based on a set of traditional price multiples.

If we narrow down the peers group once again to MCD’s closest peers and competitors – to make sure that we are comparing similar companies, in similar industries, with similar business models – we can see that MCD does not appear to be that extremely expensive.

Furthermore, if we compare MCD’s multiples to its own 5YR averages, it even appears to be trading at a discount.

All in all, we believe that the current share price is justified. For a variety of reasons.

- MCD is one of the most well-known brands in the world

- The firm has managed to keep its profitability relatively stable despite the challenging macroeconomic circumstances, including poor consumer sentiment, elevated inflation and geopolitical tensions around the globe.

- The firm is committed to paying dividends and buying its shares back

- The demand for MCD’s products appears robust

We believe that at this price point, MCD’s stock can be an attractive option for investors looking for both growth and income.

Conclusions

While McDonald’s growth has significantly slowed in the fourth quarter of 2023 compared to the same period in the prior year, the firm has still managed to increase its comparable sales across all segments.

The company has one of the best set of profitability metrics in the restaurant industry, making MCD’s stock an attractive pick for investors focusing on fundamentals.

The firm also appears to be attractive from a valuation point of view.

For these reasons, we upgrade our rating from “hold” to “buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.