Summary:

- McDonald’s second-quarter earnings report fell short of expectations, with weak comparable sales due to an industry traffic slowdown.

- MCD reported the first decline in comparable sales since the pandemic, with weakness seen in core markets like the U.S., Europe as well as emerging markets.

- The fast-food company retained a high level of operating income profitability, however.

- Risks have increased for McDonald’s, leading to a downgrade in shares to hold, with uncertainties surrounding future growth and stock performance.

TonyBaggett

McDonald’s (NYSE:MCD) reported second-quarter earnings on Monday which failed to meet expectations in a number of metrics, but especially with regard to comparable sales, which were especially weak due to a slowdown in industry traffic. With customers frequenting fast-food restaurants less often during the second-quarter, McDonald’s has seen a decline in comparable sales in its key markets, including in the U.S. and Europe. It was the first comparable sales decline for McDonald’s since FY 2020 and a continuation of this trend could be a major headwind for the fast-food company’s shares going forward. Because of new uncertainty created after Q2’24 earnings, I am down-grading shares to hold.

Previous rating

I pointed to McDonald’s’ 13-quarter streak of uninterrupted, comparable revenue growth as the foundation of my buy rating in June: A Top Dividend Growth Play. However, the comparable sales performance in Q2’24 disappointed greatly with McDonald’s seeing weakness in its core market, the U.S., as well as in Europe and in emerging markets. Because of softening comparable store sales, I believe risks have increased for McDonald’s, and I am changing my rating to hold.

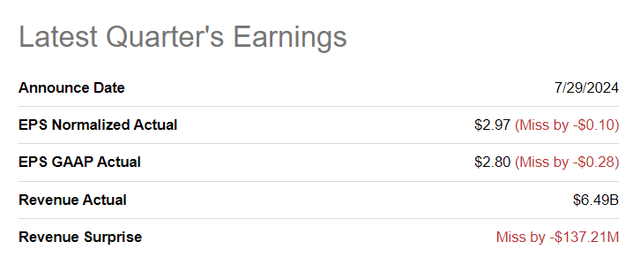

McDonald’s misses Q2 earnings estimates

It was an overall weak Q2 earnings scorecard for the fast-food chain on Monday, and it resulted in a double miss on earnings and revenues. Adjusted earnings came in at $2.97 per-share, missing the estimate by $0.10 per-share. The top line reached $6.49B, falling short of the consensus estimate by $137.2M.

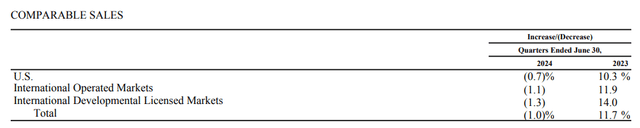

Weak comp performance across geographies

It was the first drop in comparable sales for the fast-food chain since the pandemic hit the U.S. economy in FY 2020. The U.S. market, which is by far the biggest operating market for McDonald’s, reported a 0.7% year over year decline in comparable system-wide sales. International Operated Markets, which includes countries like Australia, Canada, Germany, France and the U.K., saw the second-biggest comparable sales decline in Q2’24 of 1.1%. International Development Licensed Markets, which mostly represent emerging markets, suffered the biggest comparable sales drop of 1.3% year over year. Total comparable sales growth in Q2’24, on a consolidated basis, was 1.0% compared to 1.9% in Q1’24 and 11.7% in Q2’23.

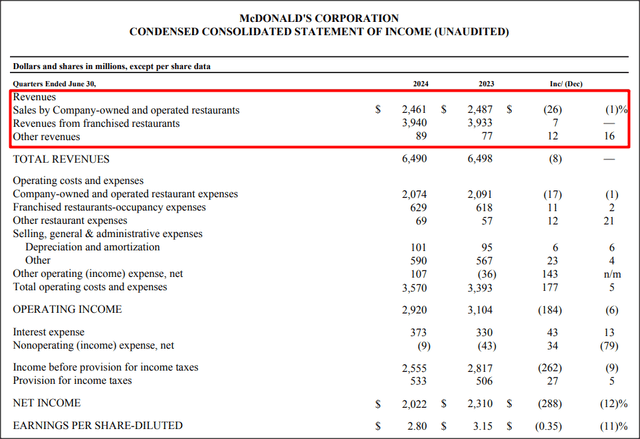

Total revenues were flat year over year at $6.5B due to customer traffic headwinds. Inflation has also been a key issue for McDonald’s lately, but with inflation moderating, however, as well as McDonald’s planning on improving its value offering — such as the return of the $5 value meal — there is a chance that McDonald’s could return to positive comp growth in the second half of the year. While it remains to be seen whether or not McDonald’s can lure more customers to its restaurants in a lower-inflation world, I believe it is safe to say that shares will have a hard time moving higher unless McDonald’s achieves a turnaround in comp sales.

On the positive side, McDonald’s reported solid operating income profitability. The fast-food chain achieved $2.9B in operating income, showing a decline of 6% year over year.

Catalysts for FY 2024 and beyond

The main challenge for McDonald’s will be to increase customer traffic and system-wide sales. Factors that could support growth in the top line and a turnaround in comparable sales include:

- Menu optimization and inclusion of promotional offers

- The return of limited-time value offers such as the $5 value meal

- Continually moderating inflation

- Acceleration of new store openings in underserved markets (McDonald’s plans to grow its restaurant footprint by approximately 25% to 50k units by FY 2027.

In addition to these operational catalysts, McDonald’s could continue to raise its dividend and decide to return more cash to shareholders via stock buybacks.

McDonald’s valuation

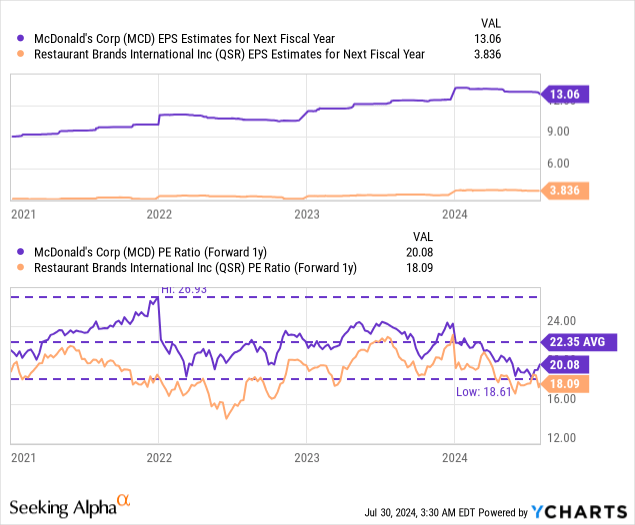

McDonald’s is currently trading at a 20.1X P/E ratio, which compares to an 18.1X price-to-earnings ratio for the company’s biggest rival, Restaurant Brands International (QSR). McDonald’s projected earnings growth next year is 9.5% compared to 13.5% for Restaurant Brand International, which owns the Burger King and Popeye franchises and therefore directly competes with McDonald’s in the low-price fast-food segment.

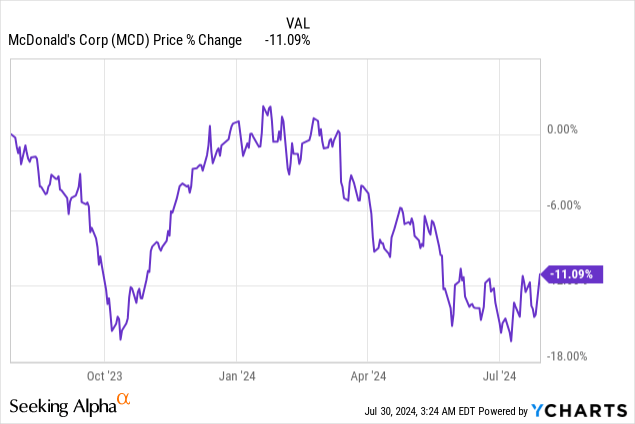

Given that McDonald’s just had its weakest comparable sales growth since the pandemic, I believe the fast-food company has created significant uncertainty, which could be a headwind for the stock in the months ahead. In my last work on the fast-food franchise I said that I can see McDonald’s revalue to its 3-year average P/E ratio which implied a fair value of ~$300.

However, uncertainty about comparable sales headwinds could be a considerable weight on McDonald’s shares going forward, and I am taking a more cautious stance here after the firm’s Q2’24 report. For shares to revalue to my long-term fair value estimate of $300, the company would likely have to return to positive top line and comp growth. If McDonald’s continues to report negative comp growth rates for its core markets, I believe it may take a lot longer for the fast-food company to reach my fair value target.

Risks with McDonald’s

I believe the risks here are quite obvious: the biggest one is a continual decline in comparable store sales in the coming quarters and continual top-line pressure amid weak industry traffic. Since comparable sales are a key performance metric for investors, weakness in this KPIs going forward are likely to determine the direction of McDonald’s shares. A countermeasure here could be moderating inflation, which could take financial pressure off of consumers and be a catalyst that drives more customers to McDonald’s fast-food restaurants.

Final thoughts

McDonald’s second-quarter earnings release was not good, and the drop-off in comparable sales in Q2 — which was the first time since the beginning of the pandemic that comps turning negative — is a major warning signal for investors. A continuation of this weak growth trend could prevent a re-pricing to the upside and remain a considerable headwind for the company’s financial performance. What was especially concerning to me is that McDonald’s comp weakness applied to all major reporting geographies. While McDonald’s is still obviously very profitable on an operating and net income basis, I believe the risk profile has deteriorated here, and I feel a downgrade to hold reflects the changed risk matrix after the company’s Q2 report!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.