Summary:

- McDonald’s is one of the most successful businesses in the world.

- The company benefited from inflation as it is able to increase prices which resulted in higher growth.

- However, the tailwind is now gone and disinflation will be a headwind moving forward as it weighs on growth.

- The current valuation is also expensive with multiples near 10-year historical high levels.

- I rate the company as a sell.

Alexander Farnsworth

Investment Thesis

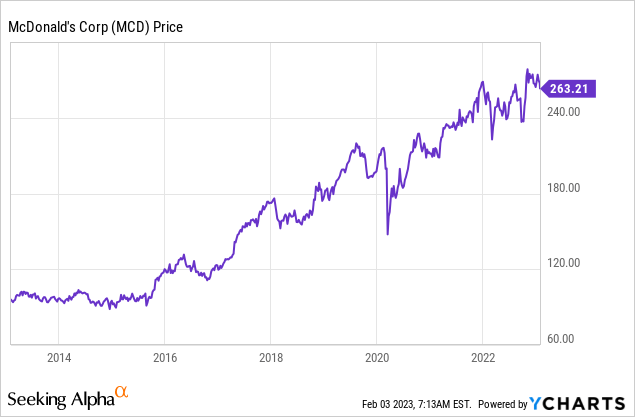

McDonald’s (NYSE:MCD) has been a fantastic dividend growth company. The US fast food giant has grown its dividend for 21 consecutive years and recorded a 177% gain over the past decade. Despite facing a tough macro backdrop, it still managed to close out the year basically flat, outperforming the S&P 500 Index which declined by over 19%.

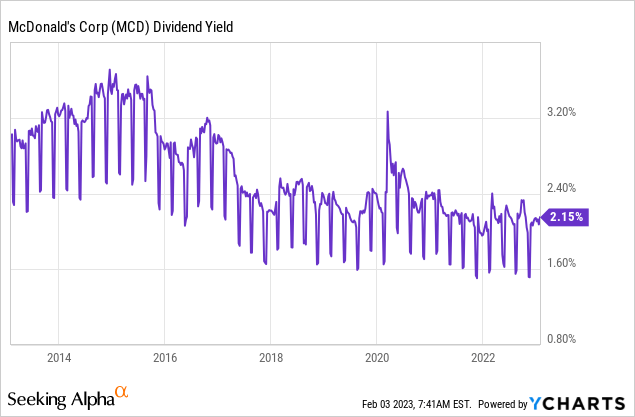

Unlike most companies, McDonald’s actually benefited from the soaring inflation rate as it is able to increase prices disproportionately due to its branding. However, this seems to be coming to an end as we enter the disinflation phase, which will weigh on growth. The current dividend and valuation also isn’t attractive, with the dividend yield near a 10-year low while multiples are near a 10-year high. Its forward growth rate is not strong enough to support the valuation either. If multiples were to re-rate we might see some potential downside from the current price. Therefore I rate the company as a sell at the current price.

Unsustainable Price Increases

As inflation soared in the past two years, companies have been jacking up prices to pass on customer costs. McDonald’s is not known for being a high-growth company but it has managed to grow comp sales by double digits in the latest quarter due to price increases.

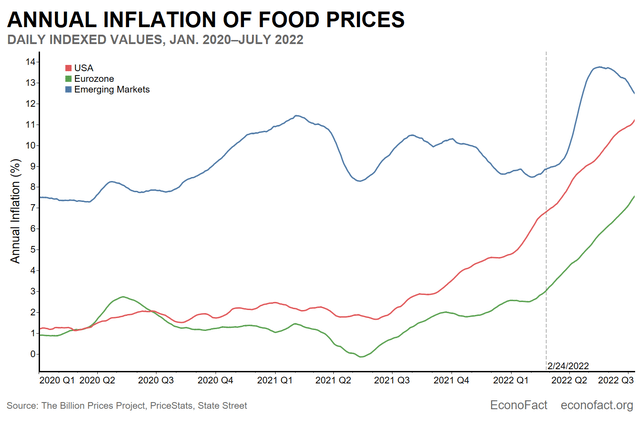

Food is one of the categories with the highest inflation rate. According to the USDA, the CPI (consumer price index) for food at home increased by 11.8% YoY (year over year) while CPI for food away from home increased by 8.3% YoY. This significantly outpaced to overall CPI increase of 6.5%. The price increase at McDonalds’ was even steeper as it is able to leverage its strong branding and customer loyalty. For example, McDonalds’ in Japan are now raising their prices for the third time in just ten months. A classic cheeseburger will soon be 55% more expensive than just a year ago.

The company reported its fourth-quarter earnings last week and it recorded a 12.6% increase in global comparable sales. The US increased by 10.3%, the international market increased by 12.6%, and the developmental markets increased by 16.5%. As you can see, growth rates are highly related to the market’s inflation rate (developing countries have higher inflation therefore higher growth). Traffic is actually not that strong as it only grew 5% YoY.

I do not believe this growth will be sustainable at all. The CPI is starting to fall as we enter the disinflation phase and companies now have less leverage and reason for price increases. Also, prices have got up so much that it is starting to impact demand. For instance, some customers are starting to shift to lower-priced meals. While some are going to other restaurants as McDonald’s is no longer cheap after all these price increases. I think there will not be much room for further price increases in the near term which will put pressure on future growth rates.

Christopher J. Kempczinski, CEO, on consumer behavior

We’ve talked about on prior calls, there is a little bit of a decrease in units per transaction that we’re seeing. We’re seeing a little bit of trade-down.

Too Expensive

McDonald’s is a reliant dividend growth stock with little volatility. It has increased the dividend for 21 consecutive years and recorded a solid 5-year dividend growth rate of 8.1%.

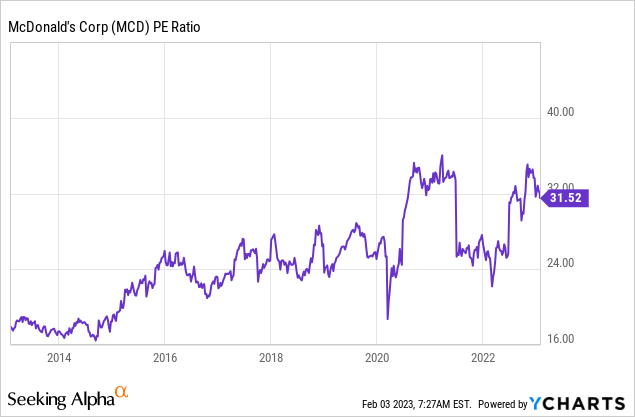

However, the price you pay for it matters a lot as well. In my opinion, the company is very expensive right now. From the chart below, you can see that it is currently trading a PE ratio of 31.5x, which is near the high of its 10-year PE ratio. The initial PE expansion that started in 2015 was due to margin expansion. The operating margin increased from 29% in 2014 to around 40% in 2017 as its investment in tech such as digital kiosks allows a reduction in “run the business” G&A expenses such as headcounts. This is no longer the catalyst as the operating margin has been essentially flat since 2018.

The recent expansion in the PE ratio is due to its pricing power and ability to pass on costs to customers, which translated to higher-than-normal growth rates. Investors are also willing to pay a premium for inflation-insulated companies. But this is unlikely to continue and growth should start to normalize. According to analysts’ estimates, the company is forecasted to grow EPS by 4.98% and revenue by 5.28%. This is definitely not enough to support the premium valuation it is trading at. From the chart below, you can also see that the current dividend yield is near a 10-year low at just 2.15%, despite ongoing dividend increases. I think as growth normalizes valuation should come back down to more reasonable levels as well.

Investor Takeaway

There is no doubt there that McDonald’s is a wonderful company with a resilient business. However, now is not the time to buy.

The company reported solid growth recently but the figure is not sustainable in my opinion. We are now in the disinflation phase as the CPI is coming down quickly. The inflationary tailwind that allows the company to raise prices is now gone and with elevated pricing, it is hard to increase traffic. Customers shifting to lower-valued meals will also reduce overall sales figures. I see this as a strong headwind that will weigh on growth in the near term. Valuation is another huge issue here.

The current multiples are very high and with normalized growth, I certainly do not think it is justified. The dividend yield is also not that attractive and lower than its 10-year historical average. With all these issues I think we may see a re-rating in valuation that will send the company lower. I will re-evaluate if prices come down meaningfully but right now I believe the company is a sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.