Summary:

- McDonald’s share price has dropped approx. 17% since the start of the year, with declining consumer sentiment impacting the quick-service-restaurant sector.

- Despite this, the Company’s future is promising, supported by a robust development pipeline and growing demand in China and India.

- The QSR sector often experiences challenges due to its exposure to commodity price fluctuations, labor cost inflation, and consumer sentiment. However, MCD’s long-term growth prospects remain strong.

- The current low P/E ratio of MCD’s shares presents a compelling buying opportunity.

Editor’s note: Seeking Alpha is proud to welcome Conor Casey as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

spflaum1

Investment Thesis

I rate McDonald’s Corporation (NYSE:MCD) a buy at its current price and a strong buy at or below $250. The softness in the QSR sector this year reflects a decline in consumer spending as we transition back to a more normalized inflationary environment. While MCD’s comparable sales growth will adjust downward compared to recent years, the Company’s development pipeline is stronger than ever, driven by increasing demand for fast food in emerging markets like China and India. In addition, MCD is well positioned to capitalize on challenges faced by its competitors. The Company has unrivalled digital and marketing capabilities, as well as a high-quality franchisee base with modern, digitalized restaurants. I believe MCD’s currently low P/E ratio reflects an overreaction to a temporary shift in consumer sentiment, and I expect a marked improvement in the share price before the end of the year and into 2025.

Revenue growth

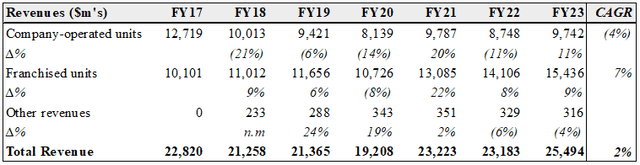

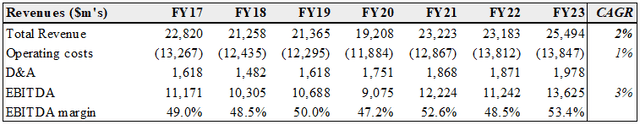

MCD achieved a 6-yr CAGR of 2% in total revenue through FY23, despite challenges such as a 10% YoY decline in FY20 due to Covid as well as the Company’s exit from Russia in FY22. Notably, the modest CAGR reflects a decrease in company-operated unit revenues, which experienced a 4% decline, and reduced from 56% of total revenue in FY17 to 38% in FY23. This movement reflects mgmt.’s strategic goal of increasing the higher margin franchised units revenues as a proportion of total revenues. Unlike company-operated units, franchised units generate revenues from fees paid by franchisees, without incurring restaurant operating costs, contributing less to total revenues per unit but delivering significantly higher margins.

In the above table, sourced from the Company’s 10-Ks, we can see the biggest driver of growth over the past 6 years was franchised units revenues, which as a proportion of total revenues increased from 44% in FY17 to 60% in FY23, positively impacting margins. Let’s take a closer look at revenues from franchised units.

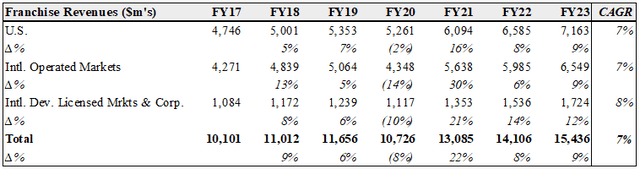

Historical Franchise Revenues (10K)

This segment achieved a robust 6-yr CAGR of 7% through FY23. Of note, its sub-segment International Operated Markets (“IOM”) was impacted by the sale of the Russian operations in FY22, but still grew 6% in that year. IOM encompasses 20+ markets incl. Australia, Canada, France, Germany and the UK. International Developmental Licensees & Corporate (“IDL”) had the strongest CAGR through the period at 8%. This segment covers 75+ markets, including Brazil, China, India and Japan.

The key drivers of total revenue growth have been (i) comparable sales (or same-store-sales) growth, and (ii) new unit growth. Comparable sales growth measures growth in sales from stores that have been operating for at least one year, thereby stripping out the impact of new units.

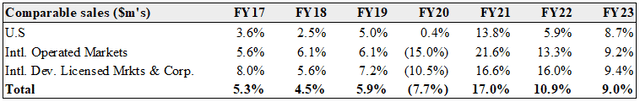

Historical Comparable Sales (10K)

Comparable sales have been consistently strong since FY20, with growth of 9% in FY23. While pricing actions across FY22-FY23 had little impact on demand, consumer sentiment has shifted in FY24 and comp sales were materially lower in Q1’24. I anticipate comp sales will shift back to more normalized rates, similar to those seen pre-Covid, following the next 2-3 quarters and a more tempered 2024. We will discuss the Q1 results in more detail later, but first, let’s look at the Company’s unit growth over recent years.

Unit Growth

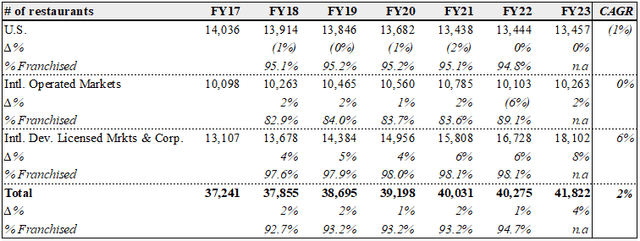

Net unit growth achieved a 6-yr CAGR of 2% through FY23, primarily driven by growth in the IDL segment, which experienced a 6% CAGR. Management project net new unit growth of 4% in FY24, with growth of 4-5% thereafter, and are targeting 50,000 units by FY27 (from 42,018 in Mar’24) with over half of those planned for China. Despite its economic woes, China’s QSR sector is thriving as demand for cheaper food options grows. Although mgmt.’s projections look somewhat aggressive when compared to the 1-2% annual growth rates across FY18-22, they are supported by the 4% growth achieved in FY23 and strong momentum in the IDL segment, which is expected to drive most of the development. On the Q1’24 earnings call, mgmt. reported that development for the year was off to a strong start and pacing on-track to plan.

Historical # of Restaurants (10K)

Trading Performance

Historical Trading Table (10K)

Despite fluctuations in margin due to Covid in FY20 and heightened inflation in FY22, increases in the proportion of franchised units helped drive margin expansion of 430bps from FY17-23. The continuation of this trend should drive further margin improvement, as MCD expands into untapped markets in the IDL segment. It’s also worth noting that as emerging market economies, like India, continue to grow, their currencies are likely to appreciate, potentially benefitting MCD’s top and bottom lines.

Relative to its peers, MCD’s margins are very strong at approx. 50%, a function of the Company’s franchise business model and rental income from its REIT-like property ownership. However, investors in MCD should be prepared for some margin volatility, given the Company’s exposure to commodities, energy, labor cost and consumer spending. That said, downside risk is mitigated here by a defensive franchise business model, diversified geographic footprint and franchisee base, and consumers’ tendency to trade down to fast food during economic downturns. While short-term fluctuations may persist, expect MCD’s growth trajectory to continue trending up and to the right as the Company’s franchise base expands in number (currently ~95% franchised) and revenue contribution (currently ~60% of revenues).

Cash flow is also very strong. In FY23, cash from operations was $9.6bn, with capex spend of $2.4bn (split equally across reinvestment in existing restaurants and new unit openings) and FCF of $7.3bn. Mgmt. have guided capex spend of $2.5bn-$2.7bn for FY24. MCD has ample cash available to fund its dividend payments and made $3.9bn and $3.0bn of share repurchases in FY22 and FY23, respectively, with $5.4bn remaining available under the existing share repurchase program.

Total debt was $39.3bn at FY23 (96% of which is on fixed rates), with total leverage of 2.9x based on the FY23 EBITDA shown above. This leverage is reasonable for a Company of MCD’s scale and cash flow, and is comfortably below the 4.0x leverage threshold considered reasonable for equity investments.

Q1’24 Performance

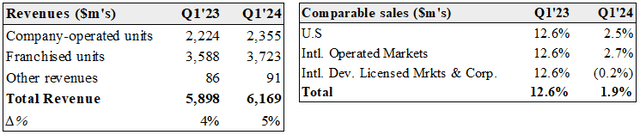

Q1 Revenues & Comparable Sales (10Q)

Mgmt. reported that traffic across all markets was flat or in decline in Q1’24 and this trend was continuing into Q2’24. As evident from the above tables, sourced from MCD’s Q1 10-Q, comparable sales in Q1 were lower than the 3-4% range of MCD’s mgmt. previously outlined for the U.S. and IOM, and are no longer expected to fall within that range for FY24. Macroeconomic headwinds facing the QSR sector in 2024 have caused MCD’s mgmt. to focus on value proposition, particularly in relation to aligning franchisees and utilizing the Company’s media scale to drive its value message.

The introduction of the new $5 meal deal (started 25 June in the U.S. for a limited time) is a prime example. This deal includes a cheeseburger or McChicken sandwich, small fries, 4-piece chicken nuggets and a small soft drink – offering real value to the lower income cohort who have been hit the hardest by inflation. Offers like these are about driving traffic through incremental visits while protecting pricing of core products, like the Big Mac, which ultimately improves market share. These offers are testament to the effectiveness of MCD’s mgmt. as they are not easy to implement with a franchisee base still reeling from the impacts of inflation (note, MCD’s franchisees are generally well capitalized). Along with its value proposition, competitive advantages include a fully modernized estate, best-in-class marketing engine, and system financial strength, placing the Company in a strong position to navigate a challenging macro environment.

Although, challenging macroeconomic conditions are not necessarily a bad thing for MCD in the longer-term. Smaller operators are more likely to struggle in downturns, providing opportunities for MCD to consolidate and grow market share. Many operators in the sector are already straining to catch up with MCD’s level of store modernization and digitalization, lower cash flows in a low growth economic environment will not help those operators catch up.

Risks

The main risks in the QSR sector include increased competition, economic downturns, and food safety/reputational issues. In addition, edge-type risks such as pandemics (Covid) and geopolitical conflict (Russia and the Middle East) have had significant impacts in recent years. Country-specific and geopolitical risks remain pertinent for MCD. In Oct ’23, a franchisee in Israel promoted free meals to Israeli Defense Forces personnel, sparking boycotts in several territories with large Muslim populations. This has negatively impacted revenues over the past two quarters. As indicated in the table above, comparable sales in the IDL segment, which includes countries in the Middle East, declined by 0.2% in Q1. Mgmt. are increasingly focused on aligning franchisees with its global strategies and plan to acquire all franchised units in Israel, while franchisees in Muslim-majority countries have disavowed the actions of the Israeli franchise. Mgmt. expects revenues in the IDL segment to remain affected while the conflict persists, though they noted seeing signs of improvement during the Q1 earnings call.

Country-specific risks aside, a return to higher rates of inflation poses perhaps the highest risk to MCD. I deem this unlikely, however. Food inflation has moderated significantly since its June 2022 highs, and even core inflation (which excludes food and energy) is trending down towards more normalized levels. With U.S. inflation largely controlled by the Fed’s restrictive monetary policy, I don’t expect a substantial increase in labor costs over the next year. While reduced consumer spending in 2024 poses challenges to franchisees, this development was anticipated. The depletion of Covid savings and the impact of higher pricing are affecting consumers. Therefore, management are focusing on marketing and value offerings for the rest of the year, which are expected to boost short-term traffic and enhance long-term customer loyalty.

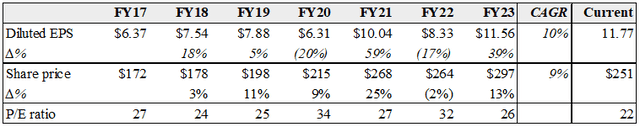

Share Price

Now, let’s review how all of this translates into the Company’s share price.

Historical Share Price (Yahoo Finance)

At their current price of $251, MCD’s shares are trading at a P/E ratio of 21, lower than their 10-yr historical average of 25 (with a peak of 34 in Dec’20). Comparatively speaking, MCD looks undervalued relative to the likes of Yum Brands’ (YUM) P/E of 27 and Domino’s (DPZ) P/E of 34. The Company’s dividend yield of 2.66% is also attractive, especially given its history of consistently increasing dividends. While further downside is possible, MCD’s P/E is already well below its average levels and the Company is widely seen as a safe haven stock. The $5.3bn remaining under the existing share repurchase program should also provide some comfort, with mgmt. likely to ramp up buybacks if there is a further price deterioration.

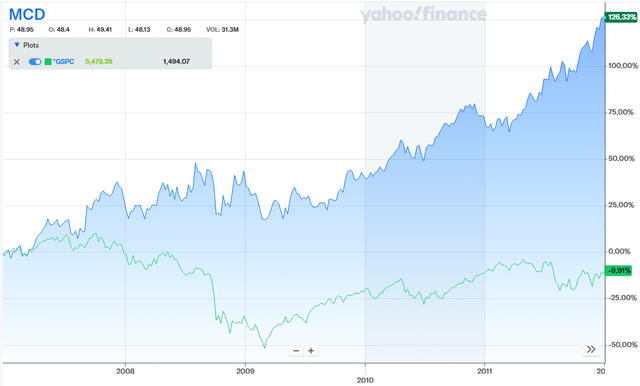

The below line graph from Yahoo Finance compares MCD’s share price (blue line) to the S&P 500 (green line) during the 5-yr period from Jan’07 to Dec’11, which includes the Great Financial Crisis. As shown, MCD’s share price grew 126% during this period, while the S&P 500 index declined by 10%.

Share Price Performance 2007-2011 (Yahoo Finance)

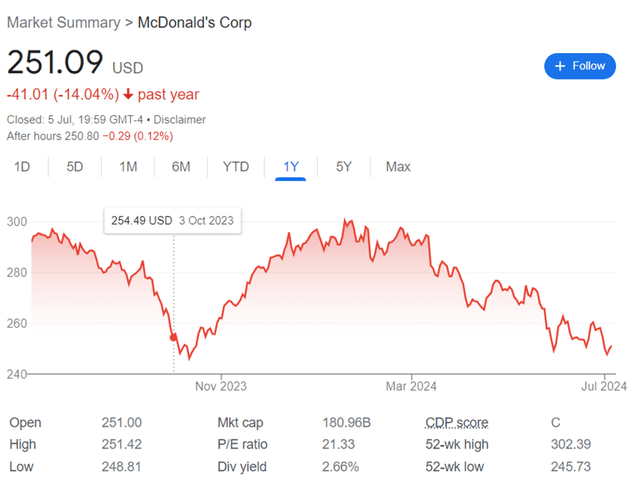

Over the past year, the share price has fluctuated, trading above $280 for much of that time, as can be seen from the below price chart. When it briefly dipped below $250 in Oct’23 it quickly recovered, and thereafter breached $300 in Jan’24.

1-yr Share Price Chart (Google)

Volatility like this in a bluechip company of MCD’s quality presents opportunities. Short-term fluctuations aside, the trend in MCD’s trading is towards continued secular growth, driven by increasing demand in emerging markets. I expect the share price to break through the $300 threshold, where its met resistance so far, potentially before 2025, with interest rate cuts being a possible catalyst. In the longer-term, McDonald’s market leading position and strong growth opportunities in emerging markets support a positive outlook and make the Company an attractive investment at its current share price.

Conclusion

In conclusion, MCD’s fundamentals remain robust despite the recent decline in consumer spending in the sector, which I expect to stabilize as normalized inflation takes effect. The key driver of the company’s sustainable growth will be net new unit growth, especially in the IDL segment. Although short-term volatility in the share price is possible, the downside risk appears limited at its current level. With a strong development pipeline and increasing demand in emerging markets, MCD is positioned well for future growth. I believe the potential upside far outweighs any downside risk, and I rate MCD a buy at its current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.