Summary:

- I’ve long hated Facebook with the heat of 10,000 suns, waffled on Instagram, and didn’t know what to make of the other apps.

- But it’s never too late to learn and change… Instagram can be fun, and I’m now finding good stuff in Facebook.

- Even so, Meta is, ultimately, an advertising company.

- But I have to admit, Meta is darn good at advertising and is using AI to become even better at it.

- The stock isn’t on the bargain counter, but I think the fundamentals justify its price.

piola666

Mark Zuckerberg would probably appreciate an easy legal win.

Everybody seems to be filing some sort of legal thing against Facebook’s corporate parent, Meta Platforms (NASDAQ:META) (NEOE:META:CA).

Lawsuits, or even Congressional/Regulatory investigations are, sad to say, routine. And it’s not just META.

If I see a company for which the 10-K discloses nothing like that, I’d worry. Is it actually doing business? Does anybody care?

But META is unusual. The “Legal and Related Matters” section of its 2023 10-K is a sight to behold.

It’s a 3,493 word monstrosity. Its Flesch Reading Ease score is a terrible 17.8.

I sympathize. But I decided not to make Zuckerberg’s legal life easy.

I was tempted to screen-capture, crop and post a reproduction of my Facebook cover image. It wonderfully sums up my long-term feelings about the site.

But I’ll refrain. I don’t feel like hunting down and digging through the site’s Terms of Use. And I won’t expose Seeking Alpha or myself to a losing infringement case.

Instead, here’s verbal description… It’s a drawing of a sly kid urinating on a Facebook logo.

My feed had endless witticisms from an ex-colleague who was never as cool as he thought he was. I saw extreme political hate spewed by a cousin I regretted seeing this way.

My childhood best friend thought the world needed pictures featuring the step by step by step by step… renovation of his kitchen. (And sadder still, many others egged him on by liking all of it.) And he also long ago bored the daylights out of me with endless pictures of endless cruises he and his wife take.

Moreover, I couldn’t begin to name even a small fraction of family grandchildren and great-grandchildren whose smiling faces kept gracing my feed.

Yuk. Phooey. My choice of profile image was probably too kind!

I tried Instagram.

I’m not a selfie freak. And I refuse to post nonsense that could come back years later to destroy my reputation and career.

But I figured maybe I could post links to what I professionally write. Nah.

Even today, the best I can do is post a photo and a caption that says, “Seeking Alpha/Content link in bio.” I can be more interesting on X and LinkedIn.

Finally, I watched an on-line video in which Zuckerberg demonstrated an early incarnation of the Metaverse. When he entered a virtual world with a virtual table with some “friends,” one of whom kept flying around the room and another that was sort-of space robot …. Oh, good heavens!

Things Gradually (So It Seemed to Me) Changed

I eventually learned to rid my feed of things I didn’t want to see. That was a good start.

But I still lacked enjoyable content. Until…

Facebook started sending me e-mails inviting me to join various groups.

I didn’t pay much attention at first. But on one slow day for me, a picture that caught my eye. It was of the Polo Grounds.

That was the original home of the New York Mets when that baseball team formed in 1962. My father took me to a couple of games there. I even saw the New York Jets play football in that old dump in 1963.

The place was torn down when the teams moved to a new stadium in 1964.

But I’m a lot older now. And the picture of the Polo Grounds hit me in a nostalgic way. (Fortunately, it didn’t recreate the smell.)

Looking further, I saw it was a Facebook Group devoted to the old Polo Grounds. So, what the heck… It was free. I joined.

I started getting many more such Facebook group-promoting e-mails. And surprisingly, this barrage was not irritating. Most of those promotions were relevant to my interests.

I wound up joining many more groups. These touched on more sports, on history, on nostalgia, on trains (I’m a 70-something year-old child; I like those), etc.

Eventually, I noticed that my feed had become… cough, cough… interesting. I wound up checking it often.

Meanwhile, I came to terms with Instagram’s limitations. My work is verbal, not visual. So unlike, say, performers, or real estate agents promoting listings, it’s not going to move my professional needle.

But I could follow celebrities, athletes, etc. I have to admit I’m a sucker for low-class reality TV. (My favorites are 90-Day Fiancé, Seeking Sister Wife and Married at First Sight, especially the Australian and UK versions.) I could follow current and former cast members and laugh at the user comments.

Voilà, I was enjoying Instagram.

And another thing hit me. I actually liked seeing the Instagram ads. They’re very well produced. And every darn one of them related to something interesting to me. I even bought some things!

I still haven’t figured out Messenger or WhatsApp. But that’s ok. Their existence doesn’t bother me. And who knows, maybe someday I’ll learn.

But guess what… I don’t hate Meta anymore.

In fact, something in me wishes Seeking Alpha could hide what’s next behind a few hundred very high-priced paywalls. But in the interest of candor, I’ll just put it out there: I don’t merely not-hate Meta. I enjoy it!

(But I’m still going to keep my profile image. It keeps me in touch with my inner rebel.)

None of this necessarily means I or anyone else should like the stock. But it does suggest an analytic theme worth exploring.

An Advertising Company, But a Darned Good One

As with Alphabet (GOOG) (GOOGL), which I covered on June 13, 2024), it’s about the “A” word — Advertising.

Both companies report numbers that make it clear this is where the money comes from. And both love to say “AI.”

As I previously wrote, GOOGL really, really wants to talk AI as much possible. META, on the other hand, embraces its existential role as an advertiser.

META isn’t shy about talking tech. But its focus is mainly on users and advertisers… and how its tech makes things better for both.

Essentially, that’s how META turned me, a one-time hater, into a fan.

And user attitudes are critical.

Consumers don’t really like advertising.

Consider how many old-time VCR and now-DVR users fast forward commercials. Consider how many folks have ad-blockers on web browsers. Consider, too, that streaming services running commercials let users buy higher-tier subscriptions that avoid them.

Advertisers always fight uphill battles.

So now, imagine you’re one of them.

How eager would you spend money pitching to audiences that hate you, and possibly by extension, the products or services that paid you to shove ads in viewers’ faces?

Wouldn’t you prefer to spend money pitching to audiences predisposed to like you, and possibly by extension, the products or services you represent?

META and GOOGL are both corporate geniuses for the way they cultivate the second option… pitch to favorably inclined audiences.

And both have achieved fundamental excellence by having done this.

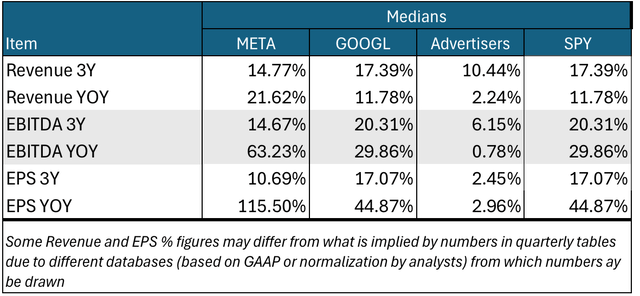

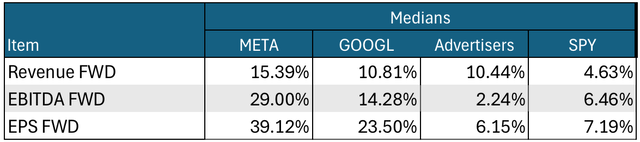

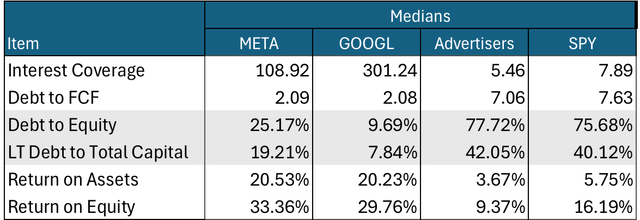

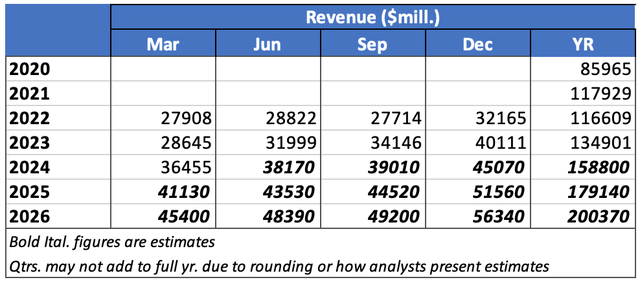

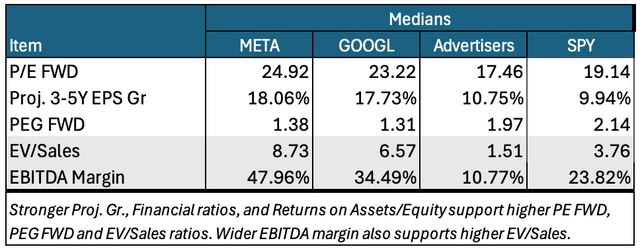

The following tables compare META, GOOGL, companies I drew (using the Seeking Alpha Equity Screener) from among those in Consumer Discretionary and Staples sectors. I chose those I think likely to advertise heavily to consumers. I also show the companies in the SPDR S&P 500 ETF (SPY).

(I prefer medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Both META and GOOGL have been doing great. Yet, they differ in how they achieve advertising success.

GOOGL wins audience favor by tying its ads to information the consumer actively wants. We know this because the consumers choose to initiate the searches.

META succeeds, but in a different way. It ties ads to users’ positive emotions. Better still, these are emotions the consumer actively sought out… by opening their feed, by watching a long- or short-form video, by looking at Instagram stories, by looking at Reels, etc.

In sum, GOOGL is search-based advertising. META is social media advertising.

Which is better?

Ask again in 10 to 20 years. For now, judging by available evidence, both are leaders in their respective fields.

I discussed GOOGL’s search dominance on June 13th. That same article also covered the dominance and growth of digital advertising in general (something the benefits of both META and GOOGL)

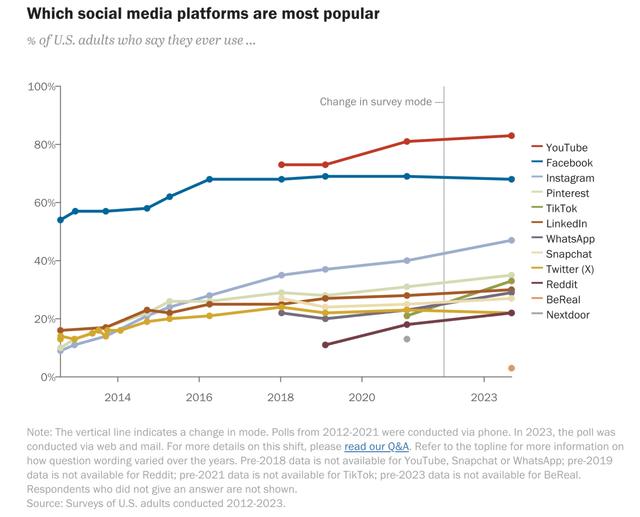

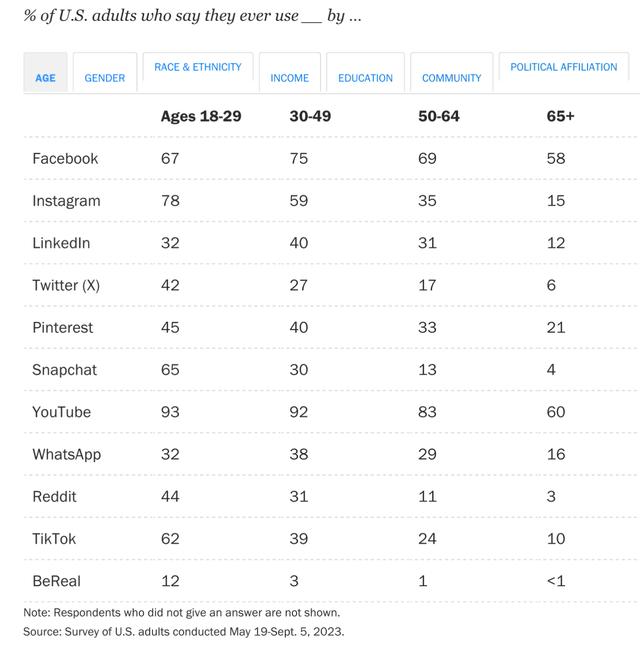

As to META, the following from Pew Research Center confirms META’s stature as a power player.

Pew Research Center

Of course, you couldn’t help but notice that GOOGL’s YouTube is number one.

If our context weren’t investing, I’d stop here and hand the trophy to GOOGL. But we are looking here as investors. So, we need to consider monetization.

YouTube isn’t impressing.

It’s contribution to the advertising portion of GOOGL’s revenue has been stuck at around 13% since 2021. And its contribution to total revenue has slipped from about 11% in 2021 to about 10% in 2023. GOOGL doesn’t disclose YouTube’s contribution, if any, to operating profits.

And I can understand how YouTube ads might be unproductive for advertisers.

If you’re watching something on YouTube, how well disposed are you to an ad that cuts off a video in somebody’s mid-sentence! The platform does this shamelessly.

I don’t remember the product or service of a single YouTube ad shown to me. I always zero in on the lower-right corner, counting down the five seconds until I can “Skip Ad.” Is your experience different?

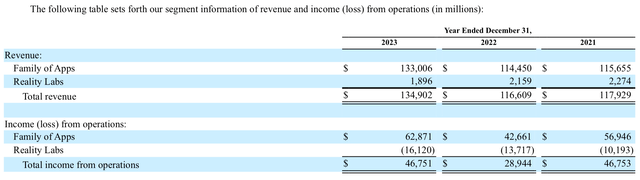

Meanwhile, advertising brings in the lion’s share of META’s revenues and more than 100% of its operating profits.

META 10-K

“Family of Apps” is where the advertising happens. “Reality Labs” is for META’s R&D. It’s where META develops visionary things not yet on the market. It does, however, sell things like Virtual Reality Headsets and Meta Quest hardware.

In terms of social media prowess, YouTube is the tail that can’t really wag the GOOGL dog. But the powerful META dog easily wags its Reality Labs tail.

So as far as I’m concerned, META, through Facebook and Instagram, dominates social media.

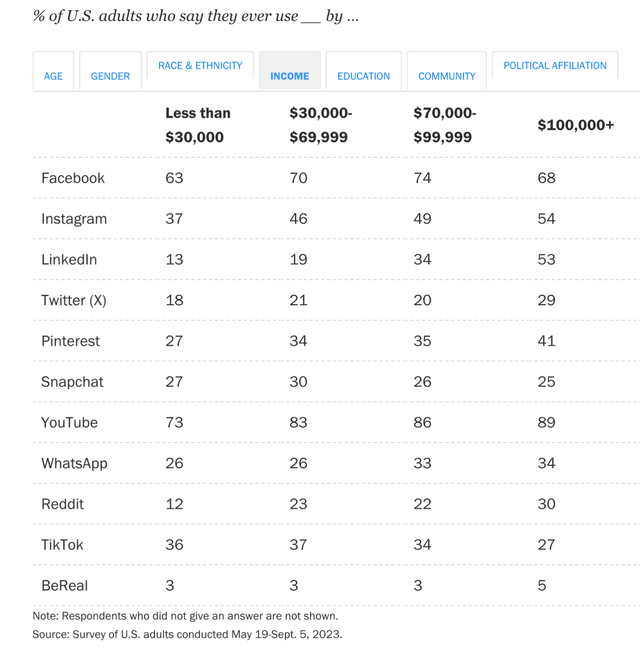

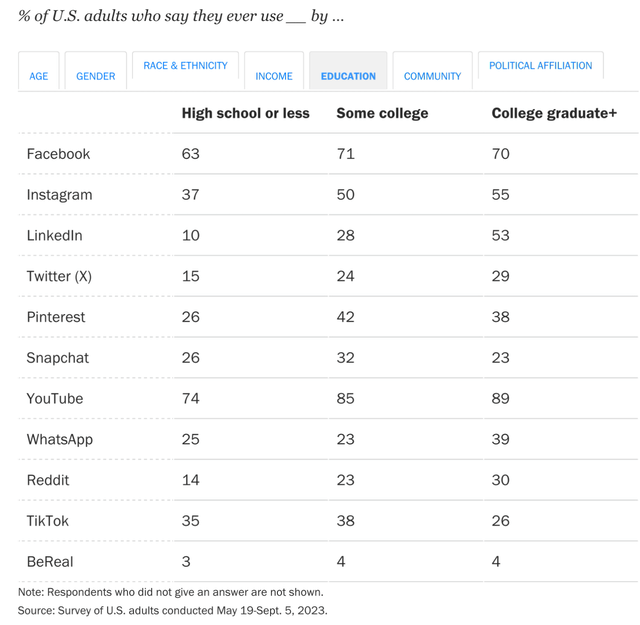

Here’s its stature how in key demographic areas.

Pew Research Center

Pew Research Center

Pew Research Center

Facebook and Instagram don’t just have a lot of users. They have good-quality users.

Are you impressed that I got this far without discussing AI? But fear not. I won’t disappoint. Let’s now go there…

The Obligatory AI Discussion

Starting with the obvious, AI (Artificial Intelligence) is for real. And it’s going to do a lot of great things for a lot of companies. So investors are right to care about the topic.

But right now, it’s being wildly over-hyped. If a candidate named, say, Alice Isaacson (fictional name) were to suddenly jump into the Presidential race, she’d probably win because her initials are A.I.

On June 13th, I wondered in print how much monetary benefit GOOGL would ultimately get from AI. I feel much better about META’s prospects.

I’m not going to try to judge how META’s generative AI offering compares to others pushed by GOOGL and OpenAI.

They’re all evolving and have a long ways to go. That said, I was surprised (given my former hatred for META) to find its offering right up there with those of its rivals.

If a serious techie says otherwise, I’d react with an Oscars or Pulitzer Prize analogy. Criteria that motivate insiders to award such prizes are often irrelevant to average movie watchers or readers.

The main issue was summed up by Mark Zuckerberg on the latest Earnings Call:

AI is already helping us improve app engagement, which naturally leads to seeing more ads and improving ads directly to deliver more value. So if the technology and products evolve in the way that we hope, each of those will unlock massive amounts of value for people and business for us over time.

We are seeing good progress on some of these efforts already. Right now, about 30% of the posts on Facebook feed are delivered by our AI recommendation system. That’s up 2x over the last couple of years and for the first time ever, more than 50% of the content that people see on Instagram is now AI recommended.

AI has also been a huge part of how we create value for advertisers by showing people more relevant ads. And if you look at our two end-to- end AI powered tools, Advantage+ shopping and Advantage+ app campaigns, revenue flowing through those has more than doubled since last year.

That pretty much explains what turned me from hating to loving META’s apps.

That’s how META learned to stop showing me stuff that bored or annoyed me, and to start showing me more and more things I like. And that’s how I became more receptive to what its advertisers are pushing.

There’s more development work to be done. For example, I clicked on a Facebook ad yesterday and ordered something. That satiated my need for that product category. Yet, it took a long time for META to recognize this and move onto other things.

That’s ok.

I think (hope) I got better with experience. Don’t we all!

I can comfortably assume META and its use of AI will do likewise.

But it’s not just me. Imagine META gaining ground with countless other users. That’s the prescription for serious growth going forward.

Risks

META is social media. Accordingly, it connects people. Some may know, respect and care about one another. Others who may not, or even be actively malicious.

That presents an ever-present risk of harm. And as disclosed in the 10-K, that’s keeping META’s legal team very busy.

It’s impossible to know how ongoing matters will resolve. Nor can we know what legal or regulatory matters may arise in the future.

Apple (AAPL) already got involved by implementing App Tracking Transparency (ATT). That hinders META’s ability to gather information about users.

Advertising is cyclical. So, when interest rates rose in 2022, that scared some advertisers away from spending as much as they might otherwise have done.

And many investors don’t love Mark Zuckerberg’s spending tendencies. Building the future takes time and costs a lot of money. But Wall Street culture demands immediate results.

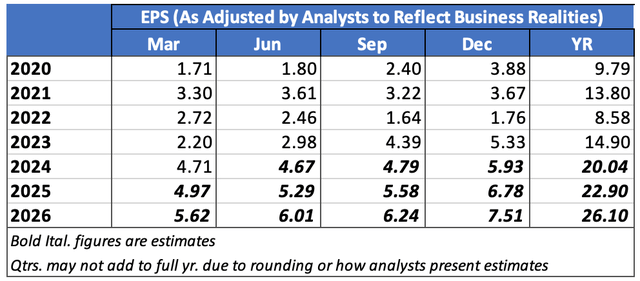

So, we see, in 2022, an example of a lackluster Revenue year and a down EPS year.

Seeking Alpha Estimates Presentation

Seeking Alpha Estimates Presentation

Worse still for a company like META, it’s often not so much how good or bad the results are as how they look compared to prior expectations.

So, every earnings season will raise the risk of disappointments.

Investors who don’t want to deal with this sort of volatility shouldn’t have real money invested here.

What to do About META Stock

META is, however, very interesting for those who want a stake in the future… and are willing to ride out sentiment-induced hits the stock is likely to suffer from time to time.

I’m well aware of the stock’s vigorous rally off its late-2022 low. Steven Cress, Head of Seeking Alpha’s Quant Team, addressed that sort of thing at Seeking Alpha’s June 18th New York Investor Summit. He told attendees not to concern themselves with that.

Only two things matter, he said. What is the stock’s valuation today? And what are the company’s fundamental prospects, as we assess them today?

Before we get to that, I’d like to add one more thing. High valuation ratios, even very high ratios, are not automatically bad.

They are OK, or not OK, only in light of fundamentals, especially future growth potential. (I discuss this principle more fully here.)

So now, let’s look at META’s valuations.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

As with GOOGL, META is aggressively valued.

But these earnings, based valuations are acceptable. The strong growth expectations support the P/E ratios. We see that reflected in PEG ratios that come in below the benchmarks.

The EV/Sales ratios are way up there.

Sales-based valuations got a bad reputation during the circa-2000 internet bubble. These were the only metrics available for companies losing money hand over fist. And hype-masters took advantage of that.

That’s unfortunate. Sales-based valuation, besides helping for money-losing companies, is very legit in all cases.

Earnings are sales multiplied by net margin. So, a P/E ratio is the same as P/(S*M).

We know the reasonableness of P/E is tied to growth of E. Fiddling with some algebra, we could also say the reasonableness of a P/S ratio is tied to growth of sales and/or the size of the margin, and prospects for future margin improvement.

To wrap my mind around forward-looking analysis, I prefer EV/S.

Swapping EV for P lets me easily compare companies with different debt-equity balance sheet structures.

And also focusing on the EBITDA margin helps me think more clearly about the future. Net margin trends can get messed up by non-operating things.

Keeping all that in mind, META’s strong growth prospects and wide margins allow me to accept its high EV/S ratio.

The main question here is how comfortable we are with the future-oriented assumptions.

Digital advertising, particularly when viewed together with social media, remains in uncharted territory. So, growth forecasting is hard.

That’s why I’ll call on the behavioral finance Keynesian Beauty Contest framework.

This casts you as a beauty-contest judge. But you aren’t picking your favorite contestant. You’re choosing the contestant you think a majority of other judges will prefer.

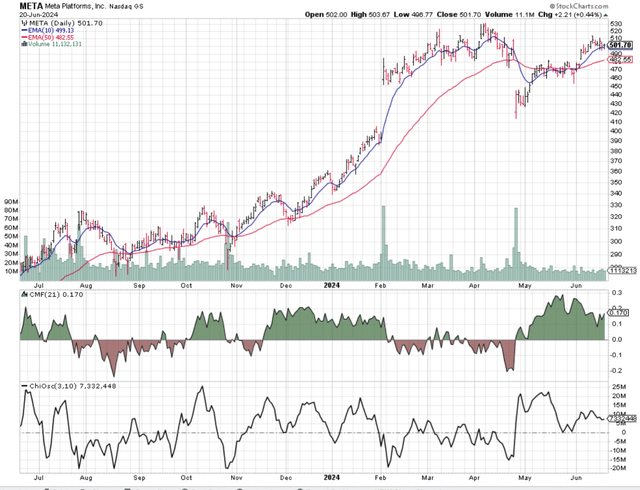

Similarly, I’m going to look at META’s chart to help me discern how most market participants feel about META, and by implication, whether they believe the future-oriented assumptions.

StockCharts.com

As the recent plunge suggests, the Street hated META’s most recent results, particularly it’s continuing to spend heavily.

On the last earning call, management spoke of “operating the business in a very efficiency oriented way …. (and) being very disciplined with allocation of new resources.”

But it’s still not going to abandon its big plans.

Actually, the Street gets it. The stock recovered from earnings day better than many who obsess over quarterly numbers might have expected.

The 10-day exponential moving average (EMA) dipped modestly below the 50-day EMA. And then, the 10 quickly crossed back above the 50. And now, the 10 is starting a new upward path.

The Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO) both have good news. These indicators measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both indicators are solidly positive, especially the CMF. Stronger buyer motivation exerts upward pressure on stock prices.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market, but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market, but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating META as a “Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.