Summary:

- Medtronic plc will announce its fiscal year 2024 Q2 earnings on Tuesday 21st November.

- Analysts expect Q2 revenues of ~$7.9bn, normalized EPS of $1.18, and GAAP EPS of $0.81.

- Key areas of focus include the impact of U.S.-China relations, supply chain improvements, and competition from GLP-1 therapies in the diabetes and cardiovascular markets.

- Medtronic management believes that pandemic pressures are easing and a return to BAU is stimulating growth, but new competitive threats are also emerging.

- This could be a tough set of earnings for Medtronic, with the market demanding faster improvement. This is still a globally significant business, however, and given time, matters can improve.

JHVEPhoto

Investment Overview

Medtronic plc (NYSE:MDT) will announce its fiscal year 2024 Q2 earnings premarket next Tuesday, 21st November. I last covered the company after its Q1 results were released, when shares traded ~$81. The share price has slipped somewhat since, trading at a value of $75 at the time of writing, while the medical device giant faces some significant challenges ahead of its latest quarterly update.

As I wrote in my previous note:

The headline news was that in Q1 2024 Medtronic was able to beat analyst consensus estimates, announcing revenues of $7.7bn for the quarter, and non-GAAP EPS of $1.2, whilst GAAP EPS of $0.59 represented a narrow miss.

The revenue figure represents annual growth of 6% on an organic basis (4.5% on a reported basis), while non-GAAP EPS also increased by 6% – in fact, all 4 of Medtronic’s major business divisions – Cardiovascular, Neuroscience, Medical Surgical and Diabetes – drove ~6% year-on-year growth.

Ahead of the Q2 2024 earnings release, analysts expect to see revenues of $7.9bn, normalised earnings per share (“EPS”) of $1.18, and GAAP EPS of $0.81.

In my previous note, I also made the following observations about Medtronic’s recent share price slump, and stagnant top and bottom line growth:

Between 2009 and mid 2021, Medtronic rewarded shareholders handsomely, its share price rising from ~$30, to ~$130, resulting in a 330% return on investment. The company is also a strong dividend payer – between 2010 and 2022, the payout increased from $0.86 per annum, to $2.67 per annum, for a current yield of ~3.3%.

Total revenues grew from $16.9bn in 2014 to $30.6bn in 2019 – a compound annual growth rate of ~13% – but since then, revenue growth has been broadly flat year-on-year, while operating profit has only once been higher the $6.7bn reported in 2019 – last year, it missed this high water mark by >$1bn.

The stagnant top and bottom line growth has exasperated the market, triggering a bear run on the stock price that lasted throughout 2022 and into 2023, with shares reaching their lowest value since the pandemic low in May this year.

That downward share price trend has continued – Medtronic stock is down >15% across the past 6 months – the only positive being the increase in the dividend yield, to 3.7% at the time of writing, after management hiked the quarterly payout by a single cent in May, to $0.69, maintaining the same value in September.

In summary, Medtronic heads into its latest quarterly earnings under some pressure, but management is insisting that post-pandemic, and with a return to “business as usual” (“BAU”) operating conditions, matters are improving and the long-term outlook is positive.

In this post, I will try to tease out whether that is a fair reflection of the current state of affairs at Medtronic, by looking at 4 key areas of the business that have been under scrutiny, what may have changed in the past quarter, how it may be reflected in next week’s earnings, and what that may do for the company’s valuation and share price.

In a recent fireside chat at the Bank of America Healthcare conference, Medtronic’s CEO Geoff Martha spoke candidly about several issues confronting the company, and I will quote extensively from that conversation in this earnings preview.

First Key Area Of Focus – China

Medtronic is a truly global player – the largest Medical Device company in the world, with a current market cap of $100bn, and nearly 100k employees. The company lists its 4 largest markets as the U.S., Western Europe, China, and Japan, in its 2022 annual report / 10K submission, stating that it accounts for ~7% of total revenues.

There are several issues related to business in China, the first is described by the company as follows:

The ongoing global economic competition and trade tensions between the U.S. and China present risk to Medtronic. Although we have been able to mitigate some of the impact on Medtronic from increased duties imposed by both sides (through petitioning both governments for tariff exclusions and other mitigations), the risk remains of additional tariffs and other kinds of restrictions.

Presidents Biden and Xi Jinping met this week in San Francisco to iron out issues between the two countries, and there were signs that tensions are gradually being defused, which the market may take as a positive sign.

Nevertheless, the volatile nature of U.S. / China relations is a continual thorn in the side of a company such as Medtronic, which is vulnerable to sudden changes in policy. During a recent Fireside Chat at the Bank of America (BAC) Global Healthcare Conference. Medtronic’s Chairman and CEO Geoff Martha commented on the situation as follows:

On the ultimate geopolitics, look, clearly, the U.S. government and the U.S.-China relations are – I don’t know that they’re at a low point, but they’re lower than the past.

Both governments have told me directly at the various highest levels that they’re looking for places to cooperate. And health care is one of those places. I don’t think the U.S. government is too worried about our technology. We may be, but the government is open to letting us cooperate with China. And China is very active in trying to draw on foreign direct investment and match it with their own investment.

More specifically, a resurgence of COVID-19 in China, supply chain challenges, and the impact of volume-based procurement (“VBP”) tenders has seen Medtronic struggle in China, but as with geopolitics, Martha sees the situation improving:

Last quarter, we grew 4% (in China). I mean that’s down quite a bit from pre-COVID where it was growing like 12%, 15%. We used to call it an independent growth vector for the company. Where it was, it’s a good memory.

80% of our portfolio (in China) has been repriced through VBP, and now we have a smaller business, but the procedures are still strong, and it will get back to that high single digit, double-digit growth, we believe.

And you’re starting to see it was minus 6% for us last year, minus 6%. This last quarter, it was +4%. And we believe as the VBP anniversaries and the procedures continue to be strong, it will get back…to that high single or low double-digit, somewhere in that area of growth.

Clearly, a return to the historic double-digit growth in China would be a welcome change for Medtronic after a challenging few years in its third-largest market and could make the difference between a mediocre quarter in Q2 2024, or a strong one.

Second Key Area Of Focus – Supply Chain

In March 2021, Medtronic appointed the former Executive Vice President of U.S. Supply Chain for Walmart, Greg Smith, as EVP of global operations and supply chain.

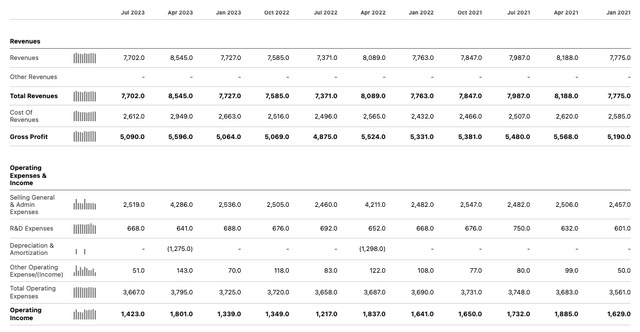

Medtronic quarterly earnings (Seeking Alpha)

As we can see above, Medtronic’s 2021/22 revenues did not grow sequentially, rather they followed a pattern where revenues were highest in the first quarter of the year, then decreased in each quarter. Through 2022/23 that trend was bucked ever so slightly, with revenues growing sequentially in Oct 2022, and Jan 2023, with Jan 2023 revenues very nearly matching Jan 2022, unlike July and October.

In summary, although you have to look closely for signs of overall improvement, some positives can be found, and there is a distinct improvement in operating margin between July 2022, 16.5%, and July 2023, 18.5%. Could the introduction of an industry outsider charged with making the supply chain more efficient impact the bottom line positively? CEO Martha believes that is the case. During his recent fireside chat, Martha discussed the matter as follows:

Supplier consolidation is probably the biggest one that’s helping us with resiliency and costs. We had too many suppliers even though Medtronic is a big company. We’re small to these suppliers when you spread it out.

We were buying metals, various types of metals from 150 companies. And now we’re going through a process of bringing that down to 10 or 12 companies. We get better pricing. We’ve got significant savings coming out of that exercise. And that’s just one anecdote, we’re taking that across all areas of spend.

To me, this is a significant point – what is the point of being the 800-pound gorilla in the medical device markets if you are not throwing your weight around, and using your economies of scale to reduce your raw materials, and other costs?

This is especially important in an inflationary market where costs of materials, labour etc. are growing by the month. Martha concluded this discussion by suggesting that fixing supply chain issues will result in a higher gross margin.

So we’ve got to stabilize the gross margin first by getting all this inflation off our books and FX, and these cost programs will start to show in our balance. So that’s a big piece.

And then the other piece, pricing COGS, and another piece would be G&A. We had a fairly significant reduction in G&A last year. And as we move forward, we’re going to be growing that G&A significantly lower than revenue. So all those things together are getting us in the gross margin.

Having made this promise, Medtronic naturally needs to deliver on it, therefore gross margin and operating margin ought to be an interesting number to consider when earnings are released next week.

The CEO also made the point that growing revenues is a key factor in growing gross margins, however, I would be pessimistic about Medtronic beating that demanding metric in Q2. Analyst’s EPS expectations also look quite demanding when we consider Q2 2023 performance – GAAP EPS came in at $0.32. In summary, top and bottom-line growth may not be arriving fast enough to satisfy a pessimistic market.

Third Key Area Of Focus – Diabetes, Cardiovascular, & Rise Of GLP-1 Therapies

As I noted in my last note covering Medtronic’s Q1 2024 earnings:

Cardiovascular was Medtronic’s largest division by revenue in Q124, recording $2.85bn of revenues, followed by Neuroscience – $2.2bn, Medical Surgical, $2bn, and finally Diabetes – $578m. Every one of Medtronic’s divisions posted >3% annual growth

A major potential threat appearing on Medtronic’s horizon is coming not from a rival medical device company, but from a class of drugs known as GLP-1 agonists, developed by Pharma giants Eli Lilly (LLY), and Novo Nordisk (NVO) respectively.

Lilly’s tirzepatide – approved to treat Type 2 diabetes under the brand name Mounjaro, and obesity under the brand name Zepbound, and Novo Nordisk’s semaglutide, approved in the same indications as Ozempic and Wegovy, are being hailed as “miracle” drugs that can help patients shed weight by as much as 15-20% over a short period and could even secure approvals in cardiovascular indications.

As such, could these drugs – which are forecast to share a ~$100bn annual peak revenue opportunity between them – impact sales of key Medtronic products in its cardiovascular and diabetes divisions?

One of Medtronic’s key products is its integrated continuous glucose monitoring system (“iCGM”), the MiniMed 780G, which is a body-worn sensor that can take blood glucose readings, which can also be combined with an insulin pump, to help avoid hypo and hyper glycemic episodes.

iCGM manufacturers, which include DexCom (DXCM) and Abbott Laboratories (ABT), have strenuously denied that GLP-1 agonists will impact their sales, and even claimed that their devices can dovetail with the drugs and help them grow revenues, but the astonishing rise in the valuations of Lilly and Novo Nordisk may suggest otherwise. When questioned, Medtronic’s CEO firmly rejected the idea the new drugs would impact iCGM sales, in the Type 1 indication, at least:

And on diabetes, what we keep hearing from endocrinologists and others that are familiar in the space and understand GLP-1s is that this will not impact our business. We’re mainly type 1s. And unfortunately, these drugs won’t – aren’t a cure for type 1, and type 1 is still growing. These autoimmune causes of type 1 or unfortunately growing and this will not affect our business.

And I know there was an England Journal article that came out a couple of days ago that caused me to circle back with my team and a number of endocrinologists, they held firm. They had a number of, I think, context around that article that I think wasn’t clear.

The wider problem here is that in an ideal world, Medtronic, Abbot and Dexcom would all like to target the Type 2 markets with its products. In theory, an iCGM or CGM only could work in tandem with GLP-1 agonists, but if we consider the recent share price performance of insulin pump providers – Tandem Diabetes Care (TNDM), down 39% over a 6-month period, and Insulet (PODD), down 46%, and even Dexcom, down >10%, and compare with Eli Lilly, +35%, and Novo Nordisk, +20.5%, it seems to be clear which product the market favours.

Even without the threat of new drugs, Medtronic has been struggling somewhat in the iCGM market. The company has received warning letters from the FDA questioning if its product is safe – the matter has since been resolved – and annual growth of 6%, to $578m in fiscal year 2023 was likely below the company’s internal expectations. Nevertheless, during the recent fireside chat, CEO Martha spoke as follows:

In the U.S., now that we’ve got the warning letter lifted and we’re launching this technology in the U.S., you’ve seen – I think we, in our last call, we talked about a 30% growth in pumps overall. And you’re seeing – but still the U.S. is shrinking from a revenue perspective. That’s because that will turn around.

That’s because we’re now seeding the market with these systems, the razors. And now we’ll be – once we are able to start selling razor blades, the infusion sets and the sensors, you’ll see the revenue grow. So in the next couple of quarters, you’ll see the U.S. start to flip to growth. And we expect our diabetes business went from shrinking to flat to growing 3% for a couple of quarters.

The “razor and blade” business model ought to work well in theory, but in practice, as the declining fortunes of insulin pump providers seem to suggest, in practice, it may be struggling. As such, diabetes segment numbers will be worth taking a close look at next week, to see if the CEO is right and growth is returning in the U.S. and buoyant ex-US, or whether the razor and blade business model is failing.

It should also be noted that cardiovascular is Medtronic’s largest business. I would not expect to see signs of that business beginning to struggle in the face of better treatment of obesity just yet, but long term, Medtronic will be conscious that there is a potentially major new player in town that wants to ease patients’ reliance on medical devices.

There has been some good news recently, with Medtronic’s share price rising in the past few days, in response to recent data shared by Novo Nordisk from a five-year study of semaglutide. According to Seeking Alpha:

Five-year data from the Danish drugmaker’s SELECT trial indicated that the GLP-1 receptor agonist at 2.4 mg led to a 20% risk reduction from major adverse cardiovascular events with a statistically significant effect.

However, findings about Wegovy’s potential to reduce risks related to non-fatal strokes and cardiovascular deaths were not statistically significant.

It may be the case that the moat around most of Medtronic’s medical device products is resistant to the GLP-1 agonist revolution, but equally, Medtronic must be prepared for many more studies and data readouts over the next few years, from Lilly, Novo, and other major Pharmas now developing similar drugs, i.e., Amgen (AMGN), Pfizer (PFE), as the true potential of these drugs becomes better understood. In short, watch this space!

Concluding Thoughts – Earnings May Not Provide Easy Route Out Of Current Share Price Slump

Announcing Q1 2024 earnings, Medtronic upgraded its FY guidance, forecasting growth of 4.5% – the higher end of former guidance – and EPS of $5.08 – $5.16. As I wrote in the previous note, “the implied full-year revenue figure is ~$32bn, which if achieved, would represent Medtronic’s best-ever year, although only narrowly.”

The market’s response was initially positive, but prior to last week, Medtronic stock had hit 5-year lows of $70. Whilst optimists will consider such a low as a buying opportunity – forward price to sales of ~3x, forward price to earnings of ~20x on a GAAP basis, my suspicion is that even ~6% top-line growth may not be considered satisfactory, and as I have discussed above, a lot needs to go right that has previously been going wrong – performance in China, margin expansion, and better performance from flagship products such as the iCGM – for Medtronic to be able to hit that figure.

The demands placed upon Medtronic by the market in terms of earnings metrics are significant, and my conclusion would be that Medtronic may need more time to guide the company successfully through the post-pandemic era, where it ought to have a better chance of improving performance once inflation and interest rates dampen, and BAU practices are restored.

The fact that there are new emerging threats to the business, in cardiovascular and diabetes, key markets for Medtronic, only adds to management’s headache. I’d make Medtronic plc stock a “hold” for now, given an objective assessment of business risk. However, management’s determination to turn things around and candid assessment of what needs to be done means that, should the share price drop into the $60’s, I’d be tempted to buy shares, as there are multiple opportunities to improve business performance in play, and a reasonably generous dividend.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.