Summary:

- Dividend Aristocrats have underperformed in 2023 after a stellar year relative to the S&P 500.

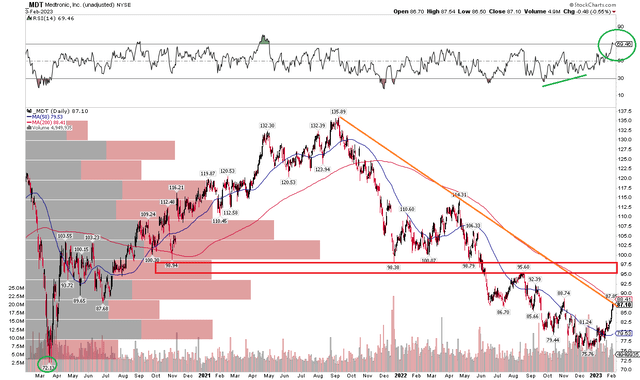

- With an earnings date ahead, shares appear reasonably priced while the chart shows a potential trend change.

- I outline key price levels to watch on this turnaround name.

Moussa81

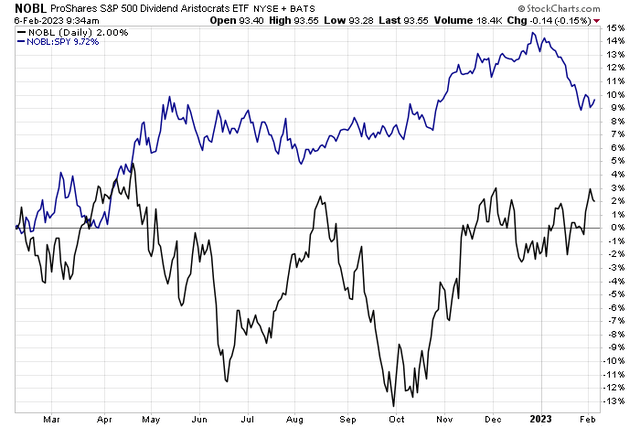

Dividend Aristocrats were big 2022 relative winners. Investors flocked to firms that had at least a 25-year history of increasing payouts. This year has been a bit of a different story so far. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is up about 4% total return YTD, but that lags the S&P 500’s return by about 5% as the long-duration trade returns.

One aristocrat reports earnings later this month, and the firm is aiming for a turnaround story after a major drawdown from a 2020 high. Is there a value case for Medtronic (NYSE:MDT)? Let’s read the vital signs.

Dividend Aristocrats Give Back Some Relative Gains

Stockcharts.com

According to Bank of America Global Research, Medtronic is a medical technology firm that develops, manufactures, and markets medical devices and technologies to hospitals, physicians, clinicians, and patients. The company operates in four business segments: Cardiac & Vascular Group, Medical Surgical, Neuroscience, and Diabetes.

The Dublin-based $116 billion market cap Health Care Equipment & Supplies industry company within the Health Care Sector trades at a high 27.1 trailing 12-month GAAP price-to-earnings ratio and pays an above-average 3.1% dividend yield, according to The Wall Street Journal.

MDT reported an earnings beat back in November while it missed on the top line. Shares dropped, though, as a result of a guide below consensus, setting the bar low for the balance of its 2023. Medtronic is aiming for a turnaround here with a spinoff of its Patient Monitoring and Respiratory Interventions businesses.

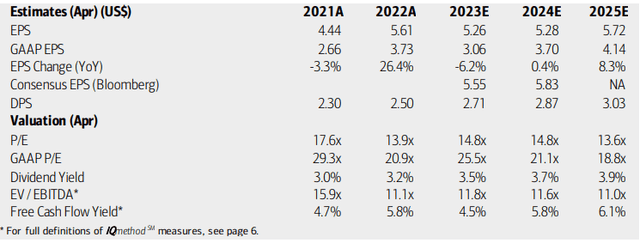

On valuation, analysts at BofA see earnings falling back 6% in its FY 2023, which is currently ongoing. Per-share profits are seen as recovering, though, with growth being decent by 2024. The Bloomberg consensus outlook is more sanguine than what BofA sees. Dividends, meanwhile, are seen as rising at a steadier clip compared to up and down EPS.

With an operating P/E ratio below that of the market, shares appear to be a decent value here while the EV/EBITDA ratio is not too cheap. Still, with solid free cash flow, the firm’s valuation could rise if the pipeline indeed turns more accretive. If we assign a market multiple to Medtronic, shares would be near $100 if we take a mid-point between BofA and the Bloomberg consensus.

Medtronic: Earnings, Valuation, Dividend Forecasts

BofA Global Research

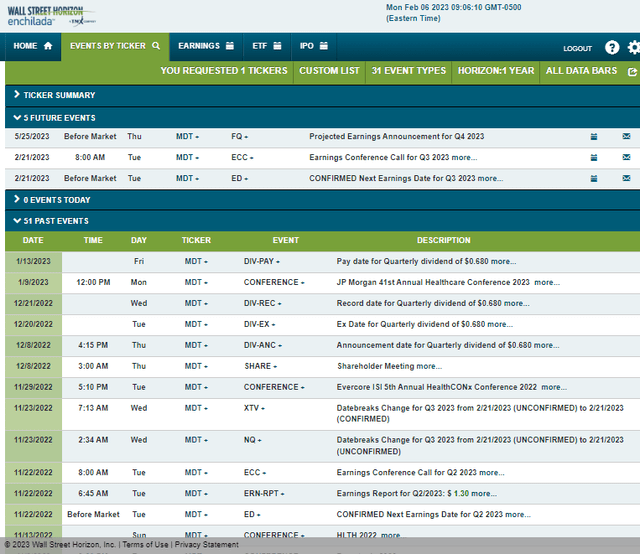

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2022 earnings date of Tuesday, February 21, before the open with a conference call immediately after results cross the wires. You can listen live here. The calendar is light on volatility catalysts aside from the upcoming Q3 report.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

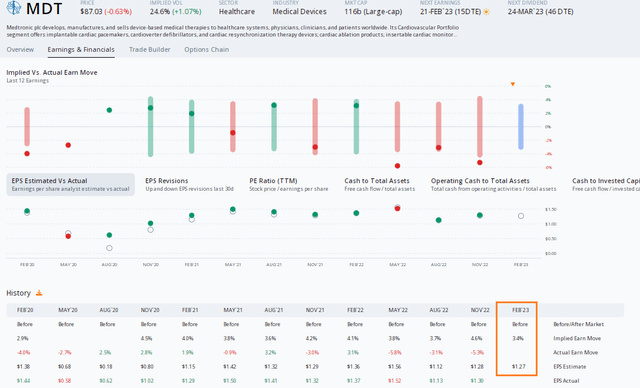

Digging into the earnings expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.27 which would be a 7.3% decline from $1.37 of per-share profits earned in the same quarter a year ago. MDT has a strong earnings beat rate history, topping analysts’ forecasts in nine of the last 10 reports, though shares generally range from –6% to +4% post-earnings with three consecutive drops the day after results are released.

Options traders have priced in a small 3.4% earnings-related stock price swing after the upcoming Q3 report, which could be somewhat on the cheap side despite no monster moves in the recent past.

MDT: Cheap Straddle Ahead of Earnings

ORATS

The Technical Take

With solid free cash flow, good yield, and a reasonable valuation, how’s the chart shape up? Notice in the graph below that shares are at a key spot. There’s a downtrend resistance line in play off the 2020 high near $136 while the falling 200-day moving average is now within 2% of the most recent closing price. That is also where the November high was struck. A rally above $90 could set the stage for a thrust to the $96 to $99 range was an important pivot point in the last three years.

What I like here is that RSI momentum printed a positive divergence while volume was high around the lows under $80 – perhaps indicating some capitulation by the bears. MDT also held its March 2020 low late last year. Overall, shares are near a trend reversal signature, but some work needs to be done still.

MDT: Shares Rally To Resistance With Bullish Divergence

Stockcharts.com

The Bottom Line

I like the mid-teens valuation on MDT and its yield. The chart suggests we are not quite in a bullish mode yet, but we’re getting closer. I rate it a buy ahead of earnings later this month.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.