Summary:

- Medtronic is a global leader in medical therapies, with portfolios in cardiovascular, neuroscience, medical surgical, and diabetes segments.

- My investment thesis is based on market leadership, a robust pipeline, and a strong balance sheet for M&A, with a bullish outlook on future growth.

- MDT has underperformed in recent years, but with earnings growth and a strong pipeline, I consider shares to be cheap.

- With a view towards shareholder-friendly capital allocation through buybacks and dividends and a balance sheet that should support tuck-in acquisitions and accretive M&A, I rate shares as a ‘buy’.

shapecharge/E+ via Getty Images

Introduction

Medtronic (NYSE:MDT) has been an underperformer over the last few years. However, with the recent pullback while earnings have continued to climb higher, I think shares of Medtronic are cheap at the current price. My bullish investment thesis is driven by my optimistic outlook on the EPS growth long-term, which is sustained by growth in medtech markets and a huge pipeline of products. I rate shares as a ‘buy’ with a view towards shareholder friendly capital allocation through buybacks and dividends and a balance sheet that should support tuck-in acquisitions and accretive M&A, with FY’24 being a quiet year on that front.

Company Overview

Medtronic is a global manufacturer and developer of medical-based therapies that are used by doctors in hospitals for patients. As a $32 billion per year business, the company has several portfolios of products and treatments that are used around the world to improve health outcomes. These portfolios, which are also how the company classifies its revenue, include the Cardiovascular Portfolio, the Neuroscience Portfolio, the Medical Surgical Portfolio, and the Diabetes Operating Unit.

In the Cardiovascular Portfolio, the company’s largest segment, Medtronic is responsible for developing devices like pacemakers and defibrillators, among many other products that are designed to help heart function. They also make products for heart surgeries and treatments like stents and valves that help blood flow. The segment is responsible for 37% of revenues.

In the Neuroscience segment, here, Medtronic makes devices for the brain and nervous system. This includes implants to treat conditions like chronic pain or movement disorders. They also have tools for surgeons who work on the spine and brain. At 29% of revenues, the Neuroscience segment is Medtronic’s second-largest segment

Within the Medical Surgical segment, this part of the company provides tools for various surgeries and medical procedures. This includes staplers and tools to seal blood vessels, as well as instruments used in robotic-assisted surgery. Medtronic also offers products for treating hernias and conditions affecting the digestive system. The Medical Surgical segment accounts for 26% of total company sales.

Finally, in the Diabetes Operating Unit, Medtronic creates products for managing diabetes, such as insulin pumps and continuous glucose monitoring systems. These help people monitor and control their blood sugar levels. The segment accounts for the remaining 8% of total revenues.

Background

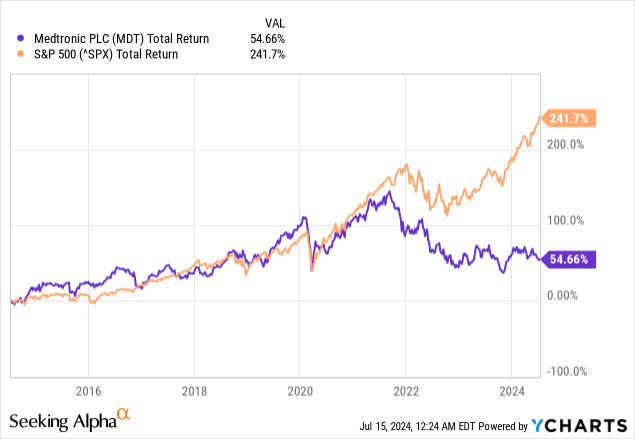

Shares of Medtronic closely tracked the S&P500 until late 2021, until a few years of underperformance led the company’s shares to lag the rest of the market. Over the last decade, while the S&P 500 has gone on to deliver a total return of 242%, shares of Medtronic have returned 55%, when including the company’s dividend. Without the company’s 3.6% dividend yield, Medtronic would only be up 25%. Not something you want to see as a long-term investor.

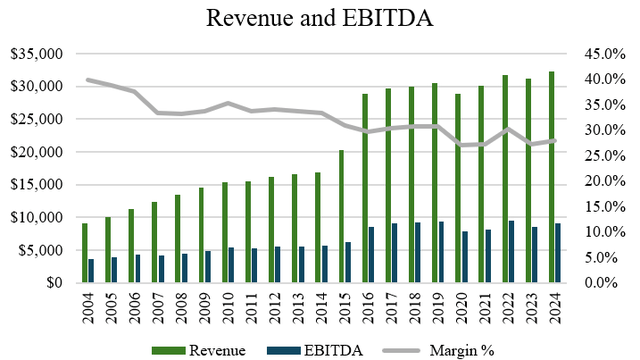

The financials tell a pretty similar story with respect to Medtronic’s performance. While the company has delivered ten-year CAGRs of 6.7% and 4.8% over the last decade, the company’s growth rate has declined, and margin contraction has occurred in recent years. This is highlighted by the fact that the five-year CAGR in revenues and EBITDA are only 1.2% and -0.7%, respectively (source: S&P Capital IQ). Over time, as shown by the decreasing grey line on the chart below, Medtronic’s profitability (showcased here through EBITDA) has been experiencing headwinds as margins decline.

Author, based on data from S&P Capital IQ

Investment Thesis

My investment thesis on Medtronic is built around 1) Medtronic is a market leader across its portfolios, 2) the company has a robust development pipeline, and 3) the company has a balance sheet that positions them well for M&A.

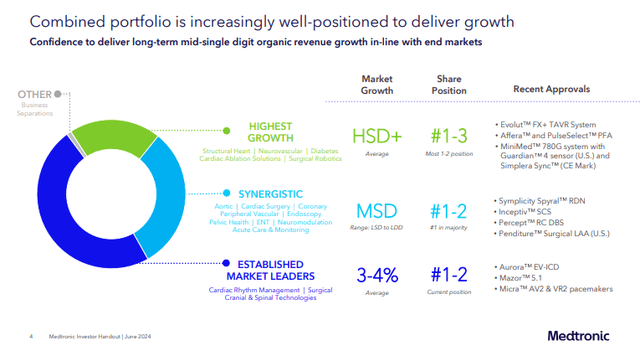

Medtronic is a market leader in several categories. According to management, in its highest growth markets of structural heart, neurovascular, diabetes, cardiac ablation solutions, and surgical robotics, the company maintains a #1, #2, or #3 in all of these markets. Typically, these markets are growing the high-single digits and would include things that the company’s Evolut FX+ TAVR System and Affera and PulseSelect PFA, among others.

In established markets like cardiac rhythm management and surgical, cranial and spinal technologies, the company is the #1 and #2 market positions within markets that are growing 3-4% per year on average. This includes things like the company’s Aurora EV-ICD and Mazor 5.1.

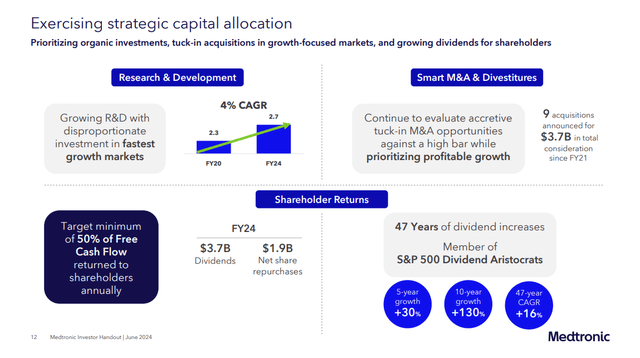

What’s important about this is that Medtronic can leverage its market position in different markets. By spending $2.74 billion a year on R&D, Medtronic is continuously at the forefront of developing an evergreen pipeline where the company always has something new coming out. This is great for investors as it means that risk is shared and diversified across a number of different projects. As such, in an industry where regulation is of utmost importance, Medtronic can sustain a hit if a few of its endeavors aren’t successful or make it out commercially.

In my view, Medtronic’s development pipeline should position the company for continued growth in the years to come. To give a sense of how big this pipeline is, of the company’s $32.3 billion of revenue for FY’24, about 8.6% of it was spent directly on investing in developing drugs and therapies to be used for medical treatments. During the fiscal year, the company received 130 regulatory approvals. On the latest earnings call, management commented that they are highly confident in the outlook for the pipeline, given the success they’ve had over the last year and a half. Importantly, much of it has already been approved by regulators, so that means a lot of it can start commercialization. Moreover, the company sees more opportunities to move therapies for limited market release to full market release in the near future.

In terms of profitability, Medtronic has strong gross margins of around 66%. Recently, this has been under pressure due to pricing and cost inflation mismatching, but now that costs have come down, gross margins should stabilize here. With better cost management while investing into R&D, EBITDA continues to grow year to year as EPS compounds in the mid-single digits. My view is that EBITDA and EPS growth could accelerate from here as the current pipeline generates sales for Medtronic in the coming quarters. During FY’24, Medtronic did $5.2 billion in free cash flow, of which $1.6 billion was spent on share repurchases and $3.7 billion was spent on dividends. I view the capital allocation to be very shareholder-friendly, given the strong return of capital to investors. As a long-term investor, this is what you want to see.

When it comes to the company’s balance sheet, Medtronic has $8.0 billion in cash and cash equivalents with $23.9 billion of long-term debt (source: S&P Capital IQ). With Net debt of $15.9 billion, the company has net leverage of 1.75x. In my view, the balance sheet seems to be in a good position compared to the 2.3x net leverage just three years ago. As such, given a healthier balance sheet, I believe that Medtronic should be in a good position to pursue M&A. With several potential targets, management has noted that they “evaluate tuck-in M&A opportunities against a high bar as [they] prioritize profitable growth”. In FY’24, the company only spent $211 million on acquisitions (compared to $1.87 billion in FY’23), so my view is that M&A could pick up again soon as the balance sheet continues to improve.

Outlook

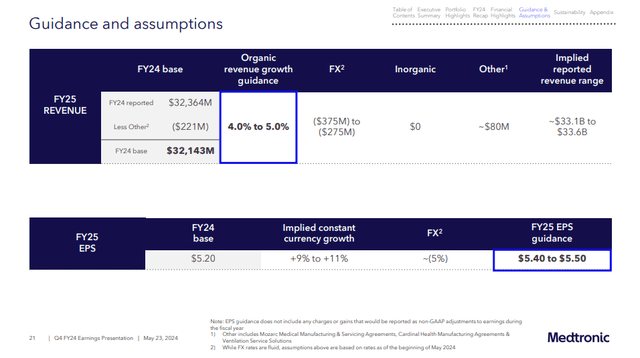

MDT will report its Q1’25 results before the market open on Tuesday, August 20. Previously, the company was guiding for organic revenue growth guidance of between 4.0% and 5.0% with EPS for FY’25 to be between $5.40 and $5.50. This guidance was reaffirmed on June 26th when the company announced her departure from Medtronic to move to HP Inc (HP).

While the news came as a surprise, I view the announcement of guidance reaffirmation as somewhat of a de-risking event to a negative surprise for next quarter, given that this reiteration came nearly two-thirds of the way through the quarter. Last year, post-Q1’23, Medtronic raised guidance subsequent to the quarter given strong results. Given my bullish view that Q1’24 could be better than expected, I think there’s a good chance this could happen again.

In terms of the pipeline discussed earlier, Medtronic is experiencing a recovery the U.S. Diabetes business and has multiple high-growth opportunities in areas such as PFA (PulseSelect and Affera), leadless CRM (Micra and the EV-ICD), renal denervation (Symplicity Spyral) and TAVR (Evolut FX and FX+). In addition, Medtronic continues to advance the US development of Hugo, with the robot’s urology study nearing completion and trial enrollments recently started in two new indications, hernia and gynecology.

Affera had favorable US IDE data in May, showing non-inferior results for safety and effectiveness compared to the control arm and superior outcomes for procedural time and efficiency. With approval expected sometime this year, I think this could be a catalyst to watch for next quarter. In addition, with Simplera having just gotten approval in Europe, the likelihood of FDA approval in the U.S. has become more likely, in my view.

In terms of the risks to the investment thesis, the main risks would be GLP-1 competitive headwinds and pending FDA clearance of potential high-growth products such as Symplicity Renal Denervation device. More stringent FDA regulations would also pose a risk to the company. As mentioned, because Medtronic has so many different treatments in its portfolio, the risk is somewhat de-risked as it is shared across hundreds of medical therapies in the portfolio.

Valuation

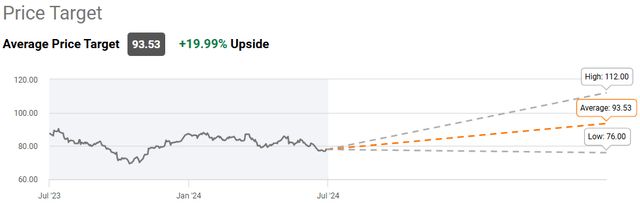

Based on the 33 sell-side analysts who cover Medtronic’s stock, there are 16 ‘buy’ ratings, 14 ‘hold’ ratings, and 3 ‘sell’ ratings. Collectively, the analysts have an average price target of $93.53, with a high target of $112.00 and a low target of $76.00. Given 20.0% upside from the current price to the average price target one year out, it seems that analysts are pretty bullish on the company’s near-term outlook.

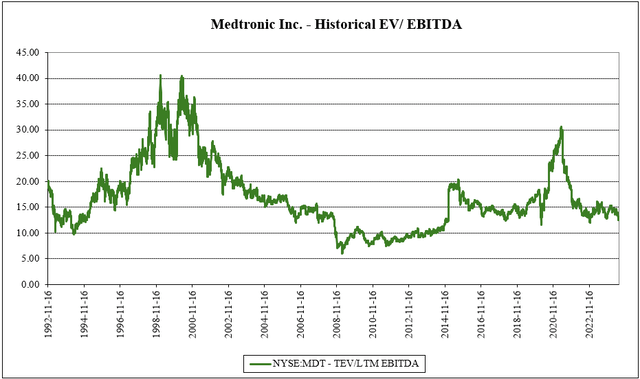

Medtronic has traded at an average valuation multiple of 16.8x EV/EBITDA. Historically, it’s traded in a wide range between 6.0x and 40.6x EV/EBITDA across varying economic environments (source: S&P Capital IQ). More recently, the company has traded very closely to the 15.0x level, which in my view seems to be the right price to pay for a company of Medtronic’s quality. Compared to the current multiple of 12.7x EV/EBITDA, I’d say that shares of Medtronic look attractive relative to their historical average multiple.

Author, based on data from S&P Capital IQ

Even though Medtronic has been somewhat of a sleepy stock for long-term shareholders, I view the valuation today as being quite attractive. At 15.0x P/E and 12.7x EV/EBITDA, the valuation seems compelling for a company that can likely grow its bottom line in the mid-single digits over the long-run. Right now, shares of Medtronic are out of favor, which is usually when you want to start buying great dividend companies such as this one. As a market leader within its verticals, a robust and diversified pipeline, and a steady balance sheet that supports the company’s capital allocation plans, I rate shares of Medtronic as a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.